Date Issued – 27th August 2024

Asian Stocks Slip as Geopolitical Fears Sap Confidence

Asian Markets Slide as Geopolitical Tensions and Rate Cut Speculation Weigh on Investor Confidence. Asian stock markets took a hit on Tuesday, with investor sentiment dampened by rising geopolitical tensions in the Middle East and concerns over U.S. interest rate cuts. The anticipation of upcoming earnings from AI giant Nvidia (NASDAQ: NVDA) added to the cautious mood, as any disappointment could unsettle the recent AI-driven rally.

Gold prices hovered near record highs as investors sought safe havens, while the U.S. dollar remained stable and the yen held close to a three-week peak, reflecting heightened risk aversion amid the ongoing conflict between Israel and Lebanon’s Hezbollah. Meanwhile, crude oil prices were bolstered by supply concerns following Libya’s shutdown of all oil fields, disrupting production and exports. The MSCI’s broadest index of Asia-Pacific shares outside Japan dropped 0.48%, retreating from a one-month high reached in the previous session. China’s CSI300 index declined 0.61%, and Hong Kong’s Hang Seng index fell 0.27%, pressured by weaker-than-expected earnings from PDD Holdings, the parent company of Temu, amid reduced consumer spending.

Adding to the market’s woes, Canada joined the U.S. and the EU in imposing a 100% tariff on Chinese electric vehicle imports and a 25% tariff on Chinese steel and aluminum, further straining trade relations. Investors are now turning their attention to a pivotal speech by Federal Reserve Chair Jerome Powell, who on Friday signaled the possibility of imminent interest rate cuts, shifting focus to the Fed’s upcoming September meeting. The market is fully pricing in a 25-basis-point cut, with expectations of 100 bps of easing by year-end. However, Powell’s cautious tone left the door open for adjustments based on economic data.

Looking ahead, all eyes are on the U.S. personal consumption expenditure (PCE) price index, the Fed’s preferred inflation measure, due on Friday, followed by the August payrolls report next week. These data points will be critical in shaping expectations for the Fed’s next move. In currency markets, the yen softened to 144.645 per dollar after hitting a three-week high of 143.45 in the previous session. The U.S. dollar index remained steady at 100.84, near a 13-month low.

Oil prices paused after a strong 3% rise on Monday, driven by supply disruptions and Middle East tensions. Brent crude futures edged down 0.21% to $81.26 per barrel, while U.S. crude futures dipped 0.32% to $77.17 per barrel, both close to recent highs. Gold prices eased 0.39% to $2,507.12 per ounce, slightly below the record high of $2,531.60 reached earlier this month.

These stocks ‘are all expected to prosper’ if Trump wins election: Navellier

In his latest market commentary, Louis Navellier highlighted several stocks poised to benefit significantly if Donald Trump wins the upcoming U.S. Presidential election. According to Navellier, Trump’s expected focus on doubling U.S. electricity generation particularly through the use of inexpensive natural gas would boost industries tied to cloud computing and AI infrastructure.

Here are the key stocks Navellier identified:

- Crowdstrike Holdings: As AI technology expands, so does the need for secure cloud environments, making Crowdstrike a potential winner in the cybersecurity space.

- Eaton (NYSE): With the expansion of data centers to support AI, Eaton’s expertise in power management technologies could see increased demand.

- Emcor (NYSE): The growth in cloud computing infrastructure will drive the need for extensive electrical and mechanical construction services, positioning Emcor for growth.

- Nutanix (NASDAQ): Nutanix’s enterprise cloud software could thrive as businesses seek scalable cloud solutions, making it a standout in the expanding cloud computing market.

- Parsons (NYSE): Specializing in critical infrastructure, Parsons could benefit from increased AI and cloud infrastructure projects, particularly in the government sector.

- Quanta Services (NYSE): With a focus on electric power infrastructure, Quanta is well-positioned to gain from the expected rise in electricity generation and distribution needs.

- Super Micro Computer (NASDAQ): As AI and cloud computing demand advanced server technology, Super Micro Computer is set to become a key player in this sector.

- Vertiv Holdings (NYSE): Vertiv’s critical digital infrastructure solutions will be essential to supporting the growing data center industry driven by AI.

Navellier also noted the broader implications for the energy sector, particularly with natural gas and crude oil, suggesting that Trump’s policies could create a unique investment landscape favoring companies at the intersection of energy and technology.

Canada to impose 100% tariff on Chinese EVs, including Teslas

In a bold move aligned with recent actions by the United States and the European Union, Canada has announced a 100% tariff on imports of Chinese electric vehicles (EVs), including those produced by Tesla in Shanghai. This tariff, set to take effect on October 1st, comes alongside a 25% tariff on imported Chinese steel and aluminum, marking a significant escalation in trade tensions between Canada and China.

Canadian Prime Minister Justin Trudeau justified the tariffs as a response to what he described as China’s “intentional, state-directed policy of over-capacity,” accusing China of not playing by global trade rules. Trudeau emphasized that Canada’s actions are coordinated with other global economies, underscoring a united front against China’s trade practices. The Chinese government has sharply criticized Canada’s decision, labeling it as “protectionist” and a violation of World Trade Organization (WTO) rules. The Chinese embassy in Canada warned that the tariffs would harm economic and trade relations between the two nations and urged Canada to reconsider its stance.

The tariffs are expected to have immediate implications for Tesla, whose shares dropped by 3.2% following the announcement. Tesla, which has been exporting its Model 3 and Model Y vehicles from its Shanghai Gigafactory to Canada, may now face higher costs if it continues to source vehicles from China. Analysts suggest Tesla might shift production and logistics to its U.S. facilities to mitigate the impact of the tariffs, although this would involve higher production costs.

Canada’s decision is part of a broader strategy to strengthen its position in the global EV supply chain, particularly as it seeks to attract European automakers. The tariffs also reflect growing domestic pressure to protect Canadian industries from what are seen as unfair trade practices by China.

Further punitive measures from Ottawa, potentially targeting Chinese semiconductors and solar cells, could be on the horizon, as Trudeau hinted at ongoing efforts to counter non-market practices by China. This move by Canada, while likely to strain bilateral relations, underscores its commitment to protecting domestic industries and aligning with international allies in the face of global trade challenges.

Where Will Nvidia Stock Open on Thursday After Earnings?

Nvidia’s stock is likely to experience significant volatility following its earnings report on August 28, with options activity suggesting a potential 10% fluctuation in its price on August 29. The stock’s recent trading range has been between $90 and $140 since May 23, with a majority of investors predicting it will settle between $120 and $140 post-earnings, according to a survey by Evercore ISI. Key factors influencing Nvidia’s stock include the strong demand for its H200 and H20 products, which are expected to mitigate any potential revenue shifts due to delays with its Blackwell product. Despite these delays, market sentiment remains bullish, as investors view the situation as a buying opportunity.

Morgan Stanley analysts have expressed confidence in Nvidia’s ability to manage the production and ramp-up of new products, expecting initial volumes in the October quarter and a more significant increase in production by January. The company’s momentum, driven by robust demand signals, is anticipated to continue, even in the face of minor headwinds. Given these dynamics, if Nvidia’s earnings report aligns with or exceeds expectations, the stock could open on Thursday, August 29, within the higher end of the predicted range, possibly around $120 to $140 or even above $140 if the market reacts positively. Conversely, any unexpected negative news could push the stock lower, though a drop below $90 seems unlikely based on current investor sentiment.

Gold (XAU) Daily Forecast: Will Fed Signals and Geopolitical Risks Drive Prices Above $2,516?

Market Overview

Gold prices (XAU/USD) are experiencing a downward trend, currently hovering around $2,509. The recent decline, marked by an intra-day low of $2,505.93, can be attributed to a modest recovery in the US Dollar (USD) on Tuesday. However, this trend could shift as potential changes in US monetary policy and escalating geopolitical tensions come into play.

Fed Signals: Could Interest Rate Cuts Propel Gold?

A key factor currently influencing gold prices is the prospect of interest rate cuts by the US Federal Reserve. Fed Chair Jerome Powell hinted at Jackson Hole that rate cuts might be on the horizon, which could be a boon for gold. Lower interest rates generally make non-yielding assets like gold more attractive, as they reduce the opportunity cost of holding them. Additionally, other Fed officials, such as San Francisco Fed President Mary Daly, have suggested that rate cuts could soon be appropriate, potentially providing further support for gold prices.

Geopolitical Uncertainty: A Safe Haven for Gold?

Rising geopolitical tensions, particularly in the Middle East, continue to keep gold in focus as a safe-haven asset. Recent military skirmishes between Israel and Hezbollah, coupled with ongoing concerns about Iran, have added a layer of uncertainty to the global landscape. While fears of a broader conflict have somewhat eased, the situation remains fluid. Any escalation could drive investors towards gold, pushing prices higher as they seek refuge in safe assets.

China’s Economic Slowdown: A Drag on Gold?

China’s sluggish economy is another factor exerting downward pressure on gold prices. The People’s Bank of China (PBOC) has paused gold purchases for the third consecutive month, weakening overall market support for the precious metal. As the world’s largest producer and consumer of gold, China’s economic health significantly influences gold market trends. Traders are closely monitoring any new data that might indicate shifts in China’s demand for precious metals.

Looking Ahead: What’s Next for Gold?

Traders and analysts will be closely watching upcoming US economic indicators, including the Consumer Confidence report and the Housing Price Index, for further insights into the direction of gold prices. Additionally, preliminary US GDP data and the PCE Price Index later this week will be critical in assessing the likelihood of further monetary policy adjustments.

Short-Term Forecast

Gold remains under pressure below the $2,516 mark, with immediate support at $2,500. A move above $2,516 could signal a bullish trend, but broader market uncertainties continue to pose risks. Currently, gold (XAU/USD) is priced at $2,509.32, down 0.35%. The key level to watch is the pivot point at $2,516.55. If prices remain below this threshold, the outlook is bearish, with immediate support at $2,500.15, followed by $2,486.23 and $2,470.51.

On the upside, breaking above $2,516.55 could lead to a bullish trend, with resistance levels at $2,529.03, $2,541.48, and $2,555.85. The 50-day EMA at $2,495.79 and the upward trendline offer some support for a potential bullish move, but caution is warranted given the 200-day EMA at $2,442.47.

Conclusion

Gold remains bearish below $2,516, but if it climbs above $2,516, it could shift towards a more bullish outlook. Key drivers will include Fed signals on interest rates, geopolitical developments, and economic data from the US and China.

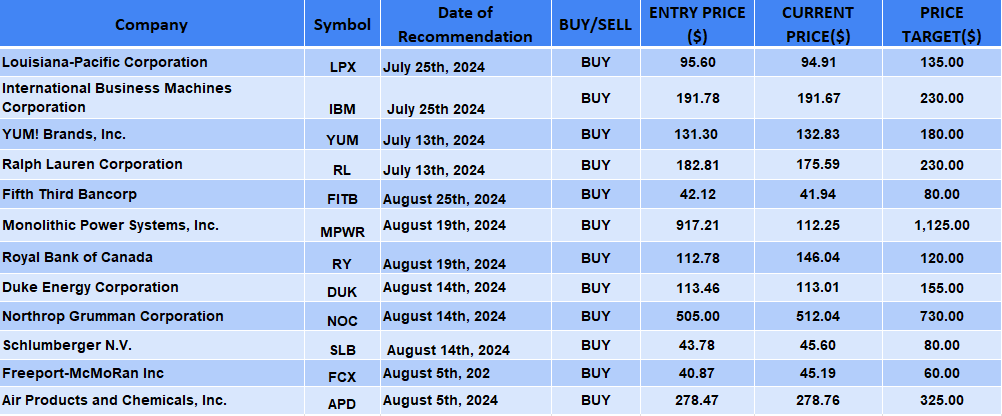

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.