Date Issued – 29th August 2024

Thursday’s Big Stock Stories: Key Movers to Watch in the Next Trading Session

As Thursday’s trading session approaches, here are three tech giants that are likely to impact market sentiment:

Nvidia

Shares of Nvidia have dropped approximately 7% in after-hours trading following the release of its quarterly report. Despite reporting a more than doubling of profit and revenue compared to the same quarter last year, which exceeded Wall Street expectations, the stock is facing pressure. Bob Pisani from CNBC noted earlier that day that as Nvidia continues to deliver strong results, it’s becoming harder to surpass Wall Street’s ever-increasing expectations. The stock is now about 11% off its peak in June.

Salesforce

Bucking the trend, Salesforce is up 4% after hours, having delivered better-than-expected results for its fiscal second quarter. The company also raised its guidance. CEO Marc Benioff, in an exclusive conversation with CNBC’s Jim Cramer, highlighted the company’s advancements in AI, citing clients like OpenTable and Wyndham Hotels as examples of how Salesforce’s new Agentforce technology is being utilized. Despite the positive momentum, the stock is still 19% below its March 1 high.

CrowdStrike

The cybersecurity leader saw its stock dip over 2% after reporting earnings. While the fiscal second-quarter results exceeded expectations, the company cut its guidance, leading to continued investor concern, particularly following the massive IT outage in July. CEO George Kurtz is set to discuss the company’s outlook on Jim Cramer’s “Mad Money” on Thursday at 6 p.m. Eastern. The stock remains 33% below its July high.

These three stocks will be crucial to watch as they could set the tone for Thursday’s market activity.

Dollar Gains Ahead of Key Economic Data; Euro Weakens Amid Lower German Inflation

The U.S. dollar edged higher on Thursday, recovering from recent lows, while the euro softened due to declining German inflation, positioning the greenback for an important day of economic data releases.

Dollar Rebounds as Safe-Haven Demand Rises

As of 04:10 ET (09:10 GMT), the Dollar Index, which measures the greenback against a basket of six major currencies, climbed 0.2% to 101.182, after hitting a 13-month low earlier in the week. The dollar’s resurgence comes on the back of its traditional safe-haven appeal, supported by concerns over escalating geopolitical tensions in regions such as the Middle East, Libya, and Ukraine, as well as renewed fears of trade conflicts between China and Western economies. Despite its recent rebound, the dollar remains under pressure due to expectations of lower U.S. interest rates. The Federal Reserve is widely anticipated to ease its aggressive monetary tightening, which had previously supported the dollar over the past two years. The dollar has lost nearly 2.9% this month, putting it on track for its steepest monthly decline in nine months.

All eyes are now on key U.S. economic data, including weekly jobless claims and a revised reading of second-quarter GDP, to gauge the health of the U.S. economy. While the first Q2 GDP reading indicated resilience, recent labor market data has hinted at some softening. The release of the PCE price index, the Fed’s preferred inflation measure, on Friday is expected to weigh heavily on future interest rate decisions.

Euro Pressured by Falling German Inflation

The euro retreated, with EUR/USD down 0.4% to 1.1079, as cooling inflation in Germany, Europe’s largest economy, weighed on the currency. Preliminary data from German states showed a significant drop in inflation in August, including North Rhine-Westphalia, where inflation fell to 1.7% from 2.3% in July. Similar trends were seen in other regions of the country.

The national inflation figures for Germany will be released later today, followed by the eurozone’s inflation data on Friday, which is expected to show a decline to 2.2% in August from 2.6% in July. The European Central Bank (ECB), which started cutting interest rates in June, may be prompted to further ease monetary policy as inflation continues to drop.

Pound Holds Steady Near Recent High

GBP/USD traded flat at 1.3188, close to its recent high of 1.3269, the strongest level since March 2022. The British pound has held its ground despite broader market volatility, supported by resilient UK economic data.

Yen Stabilizes After Rally; China Faces Trade Pressure

In Asia, USD/JPY rose slightly by 0.1% to 144.72, after a strong rally earlier this week driven by growing speculation that the Bank of Japan (BOJ) may raise interest rates further this year. However, recent inflation data from Japan fell short of BOJ’s targets, tempering expectations of aggressive rate hikes. Meanwhile, USD/CNY dropped 0.3% to 7.1060, with support from a series of stronger-than-expected midpoint fixes by the People’s Bank of China. Despite this, investor sentiment towards China remains cautious due to escalating trade tensions, especially after Canada joined the U.S. and the EU in imposing heavy tariffs on China’s electric vehicle sector. As global economic uncertainty intensifies, all eyes will be on the upcoming data to gauge the future trajectory of these currencies.

Bond Markets Face Reckoning After Stellar Summer Gains

Government bond markets, which have experienced strong price gains throughout the summer, are now bracing for a potential reversal as expectations for swift central bank rate cuts, slowing inflation, and the uncertainties of a tightly contested U.S. presidential election come into sharper focus.

Summer Surge in Bonds: A Mixed Blessing?

Benchmark 10-year U.S. Treasury yields are on track to close August with a nearly 30 basis point decline their largest monthly drop this year. This decline has been driven by expectations of faster rate cuts by the Federal Reserve, despite economic data that has somewhat alleviated recession fears sparked by the latest U.S. jobs report. Similar downward trends have been observed in borrowing costs across Germany and Britain, positioning all three regions for their first quarterly yield drops since the end of 2023. Since bond yields move inversely to prices, this has led to significant gains for government bonds. For some investors, these movements reinforce the notion that “bonds are back” after suffering substantial losses amid the post-pandemic surge in inflation and interest rates. Global government bonds returned just 4% last year after enduring 15% losses in 2021-22, and they have posted a modest 1.3% gain year-to-date.

However, many big investors caution that these gains may be fleeting or even overdone. Guillaume Rigeade, co-head of fixed income at Carmignac, expressed skepticism: “We have many indicators showing that the economy is not falling into a recession. We are just in a soft landing. It’s not justified to us, this acceleration to a cutting cycle so quick.”

Diverging Market Signals

The rally in bonds has been fueled by bets that the Fed will cut rates by up to 100 basis points across its three remaining meetings this year—a far more aggressive easing than what was anticipated just a month ago. Similar expectations have been priced into markets for the European Central Bank. However, this bond market optimism contrasts sharply with the performance of equity markets, which have remained flat since mid-July, while global government bonds have returned around 2%. Economists polled by Reuters also expect fewer rate cuts from the ECB and the Fed than what the bond markets are currently pricing in. This divergence highlights the complexities investors face as they navigate the government bond market for the rest of 2024, with the quest for meaningful returns growing increasingly challenging.

Key Tests and Future Uncertainties

The first major test for the bond market comes with next week’s U.S. jobs report for August. A second month of significant labor market weakness could intensify bets on a 50 basis point Fed rate cut in September, while stronger data might push those expectations back, analysts suggest. Guy Stear, head of developed markets strategy at Amundi Investment Institute, advises waiting to see how much of their summer yield declines bonds retain in early September before adjusting investment positions. Easing inflation has also supported bond markets, with U.S. inflation expectations recently falling to their lowest level in more than three years, and eurozone expectations hitting their lowest in nearly two years. While headline inflation figures are approaching central bank targets, core inflation remains stubbornly high, necessitating cautious market behavior.

“The market is too optimistic in the way it is pricing a perfect normalization,” Rigeade warned, noting that risks are skewed towards higher-than-expected inflation in the coming quarters. The recent surge in oil prices, driven by geopolitical tensions in Libya and the Middle East, further underscores the uncertainties ahead.

The November Puzzle: U.S. Presidential Election

The looming U.S. presidential election in November adds another layer of complexity to bond market forecasts. The race between Vice President Kamala Harris and Republican rival Donald Trump is tight, with significant implications for fiscal policy and bond supply.

“Whatever the outcome will be, it will result in still high fiscal spending and large bond supply of U.S. Treasuries,” noted Flavio Carpenzano, investment director at Capital Group. A Trump presidency with Republican control of Congress could pressure longer-dated bonds, potentially leading to higher spending and inflation that remains above the Fed’s 2% target.

In contrast, a focus on fiscal discipline, coupled with clearer signals on U.S. economic growth, could bolster eurozone bonds. While the U.S. economy grew faster than expected in Q2, with economists forecasting 2.5% growth for the year, the eurozone faces a more challenging outlook. Growth in the region was just 0.3% last quarter, and Germany unexpectedly contracted. Salman Ahmed, Fidelity International’s global head of macro and strategic asset allocation, emphasized the need for rate cuts in the eurozone, stating, “If there’s one economy which needs proper [interest rate cuts], it’s the eurozone, because that’s where the fundamentals are weaker and deteriorating.”

HSBC Wealth Chief Matos Resigns Amid Leadership Overhaul

HSBC Holdings plc has announced the resignation of Nuno Matos, the Chief of Wealth and Personal Banking, who will depart to explore new opportunities. This move comes as part of a broader reshuffle under incoming CEO Georges Elhedery, who begins his tenure officially next week. Matos will be succeeded by Barry O’Byrne, the current CEO of HSBC’s Commercial Banking division. This decision signals Elhedery’s intent to maintain strategic continuity within the wealth management sector rather than bringing in an external leader. RBC Capital Markets analyst Ben Toms suggests that Elhedery aims to ensure stability at the executive level while driving significant operational activity behind the scenes. He notes, however, that this approach might limit short-term opportunities for ambitious internal executives.

The wealth management division, now under O’Byrne’s leadership, is pivotal to HSBC’s strategy of boosting fee-based income, especially as the bank anticipates a decline in lending revenue due to expected reductions in global central bank interest rates. HSBC has ambitious plans to double the assets under management in its UK wealth business to £100 billion ($131 billion) over the next five years. Matos, who joined HSBC in 2015, was a prominent internal contender for the CEO role before Elhedery’s appointment. He will stay on in an advisory capacity through 2024 and depart the bank in 2025. HSBC will announce O’Byrne’s successor in due course.

Additionally, HSBC will see the departure of John Hinshaw, Group Chief Operating Officer, and Elaine Arden, Group Chief Human Resources Officer, both members of the executive committee. As Elhedery officially steps into the CEO role on Monday, he will implement a new structure with two senior roles: Group Chief Information Officer (GCIO) and Group Chief Operating Officer (GCOO). Stuart Riley has been appointed as the GCIO, responsible for Data and Innovation. The GCOO role will be filled at a later date. In response to concerns over potential management disruptions and to retain internal talent, HSBC is offering financial incentives and reassigning key projects. Elhedery also faces the challenge of filling three critical roles early in his tenure: the CFO position, currently held by Jonathan Bingham on an interim basis, and the Global Banking & Markets Chief Operating Officer role, temporarily filled by Suzy White as she assumes the GCOO responsibilities. White will participate in HSBC’s Global Executive Committee in her interim role but will not be a formal member.

Apple Boosts iPhone Orders by Over 10% in Anticipation of AI-Driven Sales Surge – Nikkei

Apple Inc. (NASDAQ: AAPL) has significantly increased its component orders for iPhones, according to a report by Nikkei on Thursday. The technology giant is preparing for a potential boost in sales driven by advancements in artificial intelligence (AI).

Apple has ordered components for approximately 88 million to 90 million iPhones, surpassing last year’s initial order of around 80 million units. Some suppliers have even reported orders exceeding 90 million devices. This surge in component orders comes just ahead of the anticipated launch of the iPhone 16 series, which is expected to feature a range of generative AI capabilities amidst growing industry interest. The higher order volumes reflect optimistic analyst projections that AI innovations will drive renewed growth in iPhone sales, which have experienced a steady decline over the past year. Apple has faced mounting challenges in key markets, notably in China, where competition from Huawei has eroded its market share. Additionally, Apple has contended with heightened rivalry from Samsung Electronics Co. Ltd. (KS:005930), which has already integrated a range of AI features into its flagship Galaxy devices.

Despite these increased orders, Apple’s suppliers remain cautious about the iPhone’s future prospects, forecasting relatively flat shipment volumes for 2024. The company is also navigating heightened trade tensions between the U.S. and China, including recent restrictions imposed by Beijing on the use of Apple products by government officials.

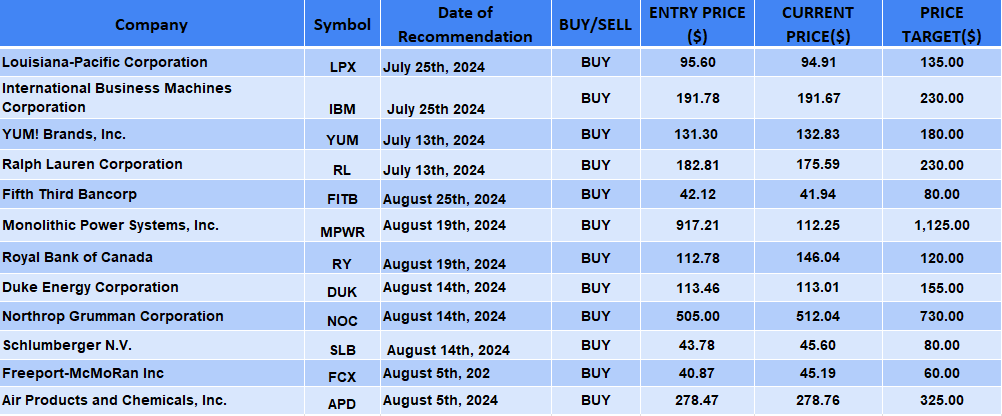

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.