Date Issued – 13th December 2024

Preview

Xiaomi’s stock has soared 103% this year, driven by strong momentum in its electric vehicle (EV) business, which now accounts for 10% of revenue. Demand for its SU7 sedan and upcoming YU7 SUV positions Xiaomi to rival smartphone revenues with EV sales by 2025. Meanwhile, Rio Tinto’s $2.5 billion investment in Argentina’s Rincon lithium mine underscores confidence in EV growth, despite falling prices. In Europe, central banks are cutting rates to brace for potential global disruptions tied to Donald Trump’s return, while Asian bond markets face $1.92 billion in outflows amid U.S. trade fears and a surging dollar. South Korean bonds, however, remain resilient due to global index inclusion. Costco capped the week with robust Q1 results, beating earnings estimates as membership income surged and same-store sales grew 7.2%. Despite tariff uncertainties, Costco’s pricing power and growth make it a standout in retail. Across sectors, EVs, geopolitical shifts, and resilient consumer plays dominate investor focus.

Xiaomi’s EV Push Powers 103% Stock Surge, Nears Record High

Xiaomi Corp.’s stock has more than doubled this year, surging 103% as the company rapidly establishes itself in China’s competitive electric vehicle (EV) market. Leveraging its expertise in marketing and manufacturing, Xiaomi’s EV business now contributes 10% of its total revenue, with strong demand for its SU7 sedan and an upcoming YU7 SUV poised to drive further growth. Analysts project EV sales could surpass smartphone revenues by 2025, with overall sales expected to double. Despite valuation concerns, bullish sentiment prevails as Xiaomi capitalizes on China’s booming EV market, outperforming rivals like Nio and Li Auto.

Investment Insight: Xiaomi’s successful entry into EVs reflects its operational efficiency and market agility. While the stock’s valuation at 27x forward earnings may seem stretched, its growth trajectory and dominance in China’s EV space could sustain investor enthusiasm.

Market price: Xiaomi Corp (HKG 1810): HKD 31.25

Rio Tinto’s $2.5 Billion Lithium Bet Aligns With Argentina’s Deregulation Push

Rio Tinto will invest $2.5 billion in Argentina’s Rincon lithium mine, marking a major win for President Javier Milei’s pro-business reforms. The project, supported by Milei’s RIGI incentives program, includes a processing plant with a capacity of 60,000 metric tons annually and is set to begin construction next year. Despite falling lithium prices, Rio is doubling down on Argentina’s lithium triangle, leveraging direct extraction technology to reduce environmental impact. This move aligns with Rio’s broader strategy to expand its battery metals portfolio amid growing global demand.

Investment Insight: Rio Tinto’s aggressive push into lithium signals confidence in long-term EV growth despite current market challenges. Investors should monitor risks tied to the novel extraction technology and fluctuating prices but may find opportunity in Rio’s strategic positioning in the lithium triangle.

Market price: Rio Tinto Ltd. (RIO): AUD 120.72

Europe Cuts Rates as Central Banks Brace for Trump’s Return

European central banks are easing rates to prepare for economic disruptions tied to Donald Trump’s second presidency. The Swiss National Bank made a surprise 0.5% rate cut, while the European Central Bank lowered its rate to a 1.5-year low, signaling further reductions in early 2025. Concerns about trade tensions, currency volatility, and slowing growth are prompting this dovish shift, with the ECB slashing its growth projections for 2025 to 1.1%. Analysts warn that additional cuts may be needed as inflation risks ease and geopolitical uncertainty looms.

Investment Insight: Eurozone rate cuts reflect mounting economic caution ahead of global trade shifts under Trump. Investors should anticipate prolonged accommodative monetary policy but remain vigilant about risks tied to sluggish growth and geopolitical turbulence.

Asian Bonds See $1.92 Billion Outflows Amid Trump Policy Fears, Strong Dollar

Asian bond markets faced $1.92 billion in foreign outflows in November, marking the first net sales in seven months. Concerns over U.S. trade restrictions under the incoming Trump administration and a surging dollar weighed on investor sentiment. Indonesian bonds saw $1.8 billion in foreign outflows, while Thailand and Malaysia posted their second consecutive month of declines. The Malaysian ringgit, Thai baht, and South Korean won each fell 1.5% against the dollar. However, South Korean bonds bucked the trend with $1.07 billion in inflows, buoyed by their future inclusion in the FTSE Russell’s WGBI.

Investment Insight: Rising U.S. trade tensions and a strong dollar are pressuring Asian bond markets, signaling potential volatility ahead. Investors should monitor currency risks and focus on markets like South Korea, which may benefit from structural tailwinds like global index inclusion.

Costco Beats Expectations With Strong Sales Growth Amid Mixed Consumer Trends

Costco delivered solid fiscal Q1 results, with adjusted earnings per share of $4.04 beating estimates of $3.81 and revenue of $62.15 billion exceeding expectations of $61.98 billion. Same-store sales grew 7.2%, driven by U.S. performance, while foot traffic rose 5.1%. Membership income increased 7.8% following a September fee hike, with renewal rates hitting 90.4%. E-commerce sales grew 13.2%, slightly missing estimates. Management acknowledged uncertainty around potential Trump-era tariffs, citing strategies like alternative sourcing to mitigate risks. Year-to-date, Costco shares are up over 50%, significantly outpacing the S&P 500.

Investment Insight: Costco’s resilience in a challenging retail environment highlights its pricing power and membership model’s strength. While tariff risks loom, its capacity to manage costs and sustain growth positions it as a defensive play for long-term investors.

Market price: Costco Wholesale Corporation (COST): USD 988.39

Conclusion

This week’s market movements highlight a landscape shaped by innovation, geopolitical shifts, and investor adaptability. Xiaomi’s EV success underscores the transformative potential of new ventures, while Rio Tinto’s lithium bet reflects confidence in the EV boom despite price pressures. Central banks in Europe signal caution amid Trump-era uncertainties, as Asian bonds face volatility from trade fears and a strong dollar. Meanwhile, Costco’s strong performance showcases resilience in a challenging retail environment. From EV growth to shifting monetary policies, the week reaffirms the need for investors to balance optimism with vigilance in navigating an evolving global economy.

Upcoming Dates to Watch

- December 18, 2024: US Federal Reserve Economic Projections

- December 18, 2024: US interest rate decision

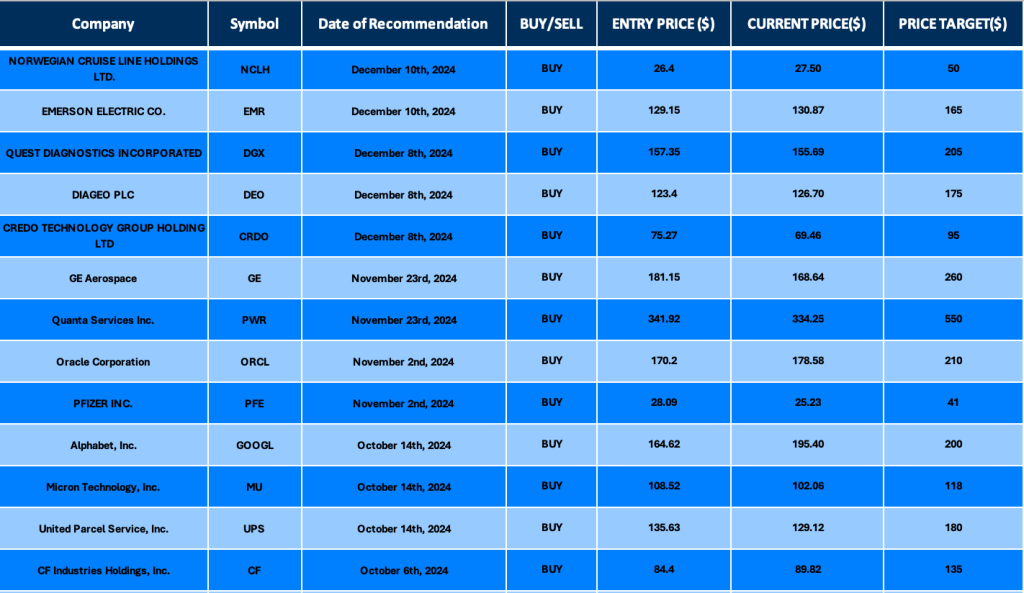

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.