Date Issued – 19th December 2024

Preview

Asian stocks slipped Thursday after the Federal Reserve signaled slower rate cuts in 2025, while the Bank of Japan maintained its policy, weakening the yen. Wall Street mirrored global jitters, with the Dow plunging over 1,000 points as the Fed reinforced its “higher-for-longer” stance. Nvidia regained momentum after a December slump, with Chinese firms like ByteDance emerging as top AI chip buyers despite U.S. export controls. Battery giant CATL plans a $5 billion Hong Kong listing to fund global expansion, while Apple explores Chinese AI partnerships to counter Huawei’s competitive edge. Meanwhile, Foxconn eyes Nissan’s stake as Honda and Nissan discuss a potential merger to navigate EV and tech challenges. Investors face heightened volatility amid shifting market dynamics, geopolitical risks, and evolving corporate strategies.

Asian Stocks Slip as Fed Slows Rate-Cut Plans, BOJ Holds Steady

Asian equities dropped Thursday following the Federal Reserve’s signal of slower rate cuts in 2025, while the Bank of Japan held its policy steady, as expected. The Fed’s hawkish stance pushed the dollar to a two-year high, with the yen weakening to a one-month low of 155.43 per dollar. BOJ Governor Kazuo Ueda is set to address the decision and future rate hike plans amidst growing inflationary risks. Meanwhile, Wall Street losses mirrored global market jitters, with the Dow plunging over 1,000 points. The Fed now projects only two rate cuts by 2025, reinforcing the “higher-for-longer” narrative on interest rates.

Investment Insight

The Fed’s cautious pivot suggests prolonged dollar strength and persistent pressure on global equities. Investors should brace for continued volatility in currency and bond markets while keeping an eye on inflation-linked assets.

Nvidia’s AI Chip Orders Reveal Surprising Buyers Amid Market Shift

Nvidia (NVDA) is regaining ground after a December slump driven by concerns over slowing AI spending and rising competition. A recent Omdia report, based on supply chain analysis, highlights Nvidia’s top AI chip customers in 2024. Microsoft leads with 485,000 Hopper GPU orders, followed by ByteDance (230,000), Tencent, Meta Platforms, Tesla, Amazon, and Google. Notably, Chinese buyers ByteDance and Tencent rank high despite U.S. export controls limiting chip power. Meanwhile, Amazon and Google appear to be scaling back Nvidia reliance, favoring in-house chip development.

Investment Insight

As competition intensifies, Nvidia’s reliance on international markets, particularly China, heightens risk amid geopolitical uncertainties. Investors should monitor alternative AI chipmakers like Broadcom and shifts in U.S.-China trade policies.

Battery Giant CATL Eyes $5 Billion Hong Kong Listing

Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest EV battery maker, is considering a secondary listing in Hong Kong to raise at least $5 billion, potentially the city’s largest offering since 2021. The listing, expected as early as the first half of 2025, would support CATL’s overseas expansion efforts. CATL’s Shenzhen-listed shares have surged 65% this year, buoyed by government stimulus optimism, giving the company a market value of $164 billion. Analysts predict strong demand from international investors if the plan moves forward, pending regulatory approval.

Investment Insight

CATL’s Hong Kong listing could bolster its global growth ambitions while offering investors exposure to the EV supply chain. Keep an eye on Hong Kong market trends and CATL’s expansion strategy as key drivers of its valuation.

Apple Explores AI Partnerships in China Amid Market Challenges

Apple is in early talks with Tencent and ByteDance to integrate their AI models into iPhones sold in China, sources reveal. With ChatGPT unavailable in China due to regulatory restrictions, Apple is seeking local collaborators to deliver AI features like enhanced Siri capabilities. The move comes as Apple faces declining market share in China amid fierce competition from domestic brands like Huawei, whose AI-powered Mate 70 series is gaining traction. Discussions with Baidu over its Ernie AI model reportedly faced setbacks over data usage disputes.

Investment Insight

Apple’s push for local AI partnerships highlights its strategic pivot to retain relevance in China’s competitive smartphone market. Investors should monitor developments in AI integration and Apple’s ability to counter Huawei’s resurgence.

Market price: Apple Inc (APPL): USD 248.05

Foxconn Eyes Nissan Stake as Honda-Nissan Merger Talks Advance

Foxconn, the iPhone maker, is reportedly in talks with Renault, Nissan’s largest shareholder, about acquiring its 36% stake in the Japanese automaker, according to Taiwan’s Central News Agency. Nissan, struggling with slashed earnings forecasts and global job cuts, has yet to respond favorably to Foxconn’s direct approach. Meanwhile, Honda and Nissan are exploring a potential merger to counter competition from Toyota, Tesla, and Chinese automakers. Honda has threatened to withdraw its software partnership with Nissan if it aligns with Foxconn but may act as a “white knight” investor to block a hostile takeover. Official merger talks could begin as early as Dec. 23.

Investment Insight

The potential Honda-Nissan merger reflects the auto industry’s push for consolidation to tackle EV and tech challenges. Foxconn’s interest in Nissan signals its growing EV ambitions. Investors should track Renault’s stance and Honda’s strategic maneuvers.

Conclusion

Global markets are navigating a volatile landscape as central banks signal cautious policy shifts and geopolitical risks loom large. The Fed’s “higher-for-longer” stance pressures equities and currencies, while Nvidia, Apple, and CATL adapt to evolving market demands and international challenges. The potential Honda-Nissan merger and Foxconn’s growing EV ambitions reflect the auto sector’s push for consolidation. Investors must stay vigilant, balancing opportunities in AI, EVs, and inflation-linked assets against risks from U.S.-China tensions and tightening financial conditions. As uncertainties persist, strategic positioning in resilient sectors will be key to navigating 2024’s complex economic and market environment.

Upcoming Dates to Watch

- December 19, 2024: Japan rate decision

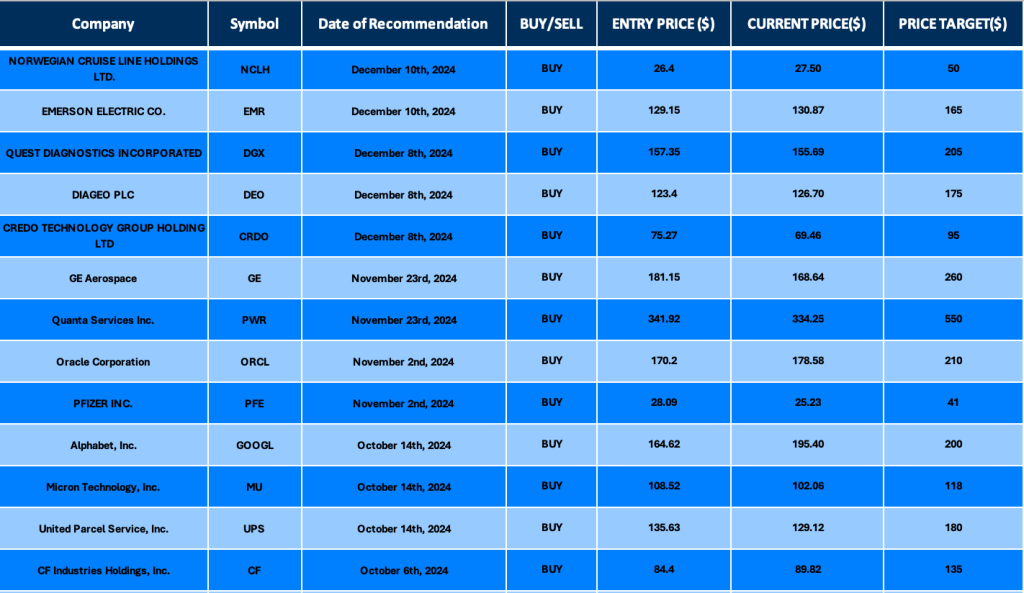

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.