Date Issued – 19th December 2024

Preview

Asian stocks rebounded Monday, ending a six-day decline as softer US inflation data revived hopes for Federal Reserve rate cuts in 2025. The MSCI Asia Pacific Index rose, led by South Korea and Taiwan, while US equity futures gained and the dollar steadied after Friday’s slide. Semiconductor and computing stocks in China saw optimism despite broader concerns over global tariffs and sluggish recovery. Hedge funds trimmed nuclear tech exposure after a rally, shifting focus to uranium producers amid supply chain constraints. Oil prices climbed on policy optimism, though capped by concerns over China’s slowing consumption and global overcapacity. Japan’s bond market faces pressure with its largest supply in a decade as yields rise, fueling bearish sentiment. Bitcoin logged its first weekly drop since Trump’s victory, with a 7% decline amid hawkish Fed signals and ETF outflows, leaving its near-term outlook volatile. Investors are urged to diversify, monitor macroeconomic risks, and focus on undervalued opportunities across asset classes.

Markets Stabilize as Fed Rate Cut Bets Resurface

Asian stocks rebounded Monday, snapping a six-day losing streak, as softer-than-expected US inflation data revived hopes of Federal Reserve rate cuts in 2025. The MSCI Asia Pacific Index rose, with gains led by South Korea and Taiwan, while US equity futures climbed. Meanwhile, the dollar steadied after Friday’s 0.5% slide, and US Treasuries held firm in thin holiday trading.

Investor sentiment remains cautious, weighed by concerns over global tariffs under President-elect Trump and China’s sluggish recovery. In China, semiconductor and computing stocks saw gains, signaling optimism around innovation and policy support.

Investment Insight: Easing inflation could fuel Fed rate cut bets, offering short-term upside for equities. However, geopolitical risks, global tariffs, and economic uncertainty may constrain gains in 2024. Diversified strategies are key.

Investment Insight

The Fed’s cautious pivot suggests prolonged dollar strength and persistent pressure on global equities. Investors should brace for continued volatility in currency and bond markets while keeping an eye on inflation-linked assets.

Hedge Funds Scale Back Nuclear Tech Exposure After Rally

Hedge funds, including Tribeca Investment Partners and Segra Capital Management, are trimming their exposure to nuclear power stocks after a strong rally this year. Key players like Constellation Energy and NuScale Power saw massive gains, but stretched valuations and uranium supply-chain constraints have raised caution. While some funds are reducing nuclear tech holdings, others are pivoting to oversold uranium producers, betting on supply chain disruptions and potential Big Tech investments in nuclear energy.

Investment Insight: Nuclear stocks have seen explosive growth but now face valuation challenges. Investors may find better opportunities in uranium supply chain plays, which could benefit from rising demand and constrained supply in 2025.

Oil Prices Edge Higher on US Policy Optimism

Oil prices rose on Monday, with Brent crude at $73.20 per barrel and WTI at $69.77, buoyed by cooling US inflation data and expectations of policy easing that may support economic growth and energy demand. Risk assets, including equities, also gained after the US Senate passed legislation to avoid a government shutdown. However, lingering concerns over global growth, China’s projected peak oil consumption in 2027, and Fed caution limited optimism.

Investment Insight: Oil markets remain sensitive to macroeconomic signals. While easing inflation supports demand prospects, structural concerns like slowing Chinese consumption and global overcapacity may cap price rallies in 2024. Focus on diversified energy plays.

Japan’s Bond Market Braces for Largest Supply in a Decade

Japan is set to issue its largest supply of sovereign bonds in over ten years, as the Bank of Japan (BOJ) reduces its balance sheet and scales back purchases. A projected 64% increase in net bond supply for the next fiscal year, coupled with rising interest rates, adds pressure on investors navigating a bearish bond market. While some strategists believe short- and medium-term bonds can absorb the excess, others warn of worsening supply-demand imbalances and upward pressure on yields.

Investment Insight: Rising bond supply and higher yields signal challenges for Japanese government debt. Investors should monitor yield movements and consider opportunities in short- to intermediate-term bonds, which may offer better absorption capacity.

Bitcoin Logs First Weekly Decline Since Trump’s Victory

Bitcoin fell over 7% last week, marking its first weekly drop since Donald Trump’s election win. A hawkish Federal Reserve stance, signaling slower monetary easing, dampened market optimism despite Trump’s pro-crypto policies. Broader crypto markets, including Ether and Dogecoin, slid 10%. Bitcoin ended the week at $94,344, well below its $108,000 record high, as outflows from Bitcoin-focused ETFs and increased hedging in the options market weighed on sentiment. Analysts expect volatility ahead, especially with a record options expiry event on December 27.

Investment Insight: Bitcoin’s near-term outlook remains volatile amid low liquidity and macro headwinds. Long-term investors may find opportunities post-correction, but caution is warranted with key levels like $90,000 under pressure.

Conclusion

Markets are navigating a complex landscape of easing inflation, geopolitical risks, and shifting monetary policies. While hopes for Federal Reserve rate cuts in 2025 have lifted sentiment, concerns over China’s recovery, global tariffs, and stretched valuations in key sectors like nuclear tech and Bitcoin underline the need for caution. Rising oil prices and Japan’s bond market challenges further highlight the balancing act investors face. Diversification and a focus on undervalued opportunities, such as uranium supply chains or short-term bonds, may offer resilience. As volatility persists, staying attuned to macroeconomic signals and sector-specific shifts will be crucial heading into 2024.

Upcoming Dates to Watch

- December 23, 2024: Singapore CPI, UK GDP, Taiwan industrial production

- December 26, 2024: US initial jobless claims

- December 27, 2024: Japan Tokyo CPI, unemployment, retail sales

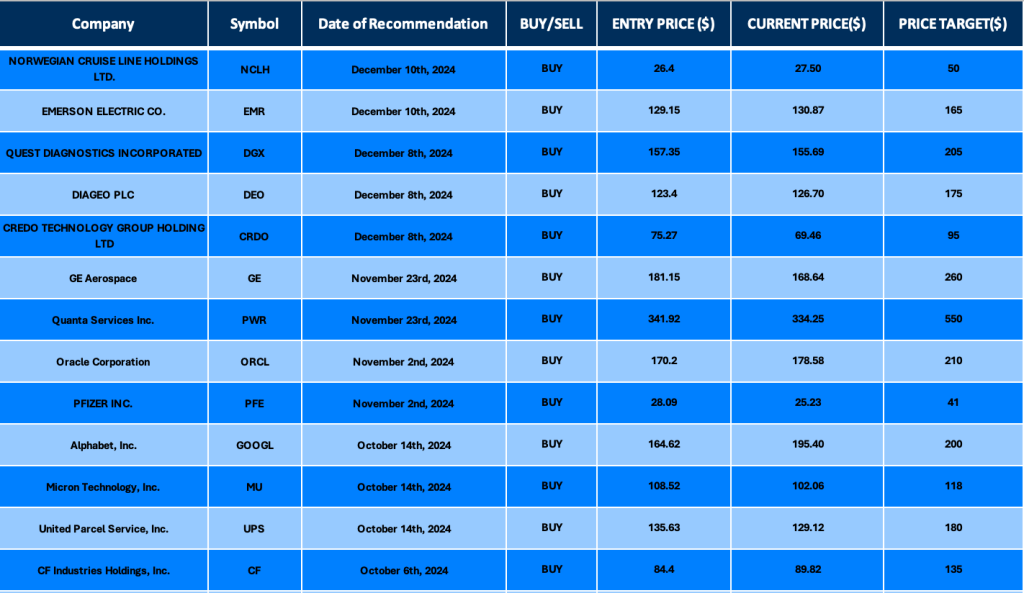

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.