Date Issued – 24th December 2024

Preview

Asian stocks climbed in quiet pre-holiday trading, lifted by a US tech rally and surging Honda shares

Honda shares jumped 14% on a $7 billion buyback plan. Taiwan Semiconductor hit record highs, but broader regional sentiment remains fragile as the MSCI Asia Index heads for its first quarterly loss since 2023 amid China’s weak recovery and global monetary concerns. Japan’s yen strengthened slightly on warnings against speculative moves, though risks of further depreciation linger ahead of key Bank of Japan events. In China, a stimulus-driven property stock rally faces challenges in 2025, with analysts forecasting declining sales and home prices due to persistent structural issues. Meanwhile, US chip stocks soared on AI optimism, with Broadcom and AMD leading gains, though elevated valuations warrant caution. Spotify also hit record highs, driven by strategic overhauls, cost-cutting, and improved margins, marking its first year of profitability. Investors remain focused on macro risks, earnings diversification, and selective opportunities in tech, FX, and property markets.

Asian Stocks Rise Amid US Tech Rally; Honda Soars on Buyback Plans

Asian markets gained in subdued pre-holiday trading, buoyed by a strong rally in US tech stocks. Taiwan Semiconductor Manufacturing Co. hit record highs, while Honda surged 14% after announcing a $7 billion share buyback. However, sentiment in Asia remains fragile, with the MSCI Asia Index heading for its first quarterly loss since 2023, driven by China’s weak recovery and global monetary concerns. Meanwhile, Japan’s yen strengthened slightly as officials warned of forex volatility, though risks of further depreciation remain.

Investment Insight

Tech continues to dominate market gains, but a broader earnings rally in 2025 could diversify opportunities. Honda’s buyback highlights potential value in underperforming sectors. Stay cautious on Asia as macro uncertainties persist.

Japan Warns Against Yen Speculation as Liquidity Thins

Japan reiterated its warnings against speculative yen movements as the currency remains under pressure ahead of key Bank of Japan (BOJ) events this week. Finance Minister Katsunobu Kato signaled potential intervention, briefly strengthening the yen to 157.06 against the dollar. Analysts expect heightened tension if the yen nears 160, with low holiday market liquidity making intervention more impactful. The BOJ Governor’s speech on Wednesday and Friday’s policy meeting summary may influence further yen moves, especially as markets anticipate delayed rate hikes.

Investment Insight

The yen’s weakness reflects Japan’s prolonged ultra-easy monetary policy relative to US rates. Investors should monitor BOJ signals closely—any intervention or hawkish pivot could trigger sharp currency moves, presenting risks and opportunities in FX markets.

China’s Property Stock Rally Faces Tough 2025 Amid Weak Fundamentals

China’s property sector remains mired in a prolonged slump, with home prices and sales expected to decline further in 2025, despite a recent stimulus-fueled stock rally. Analysts forecast a 12% drop in sales and a single-digit decline in home prices next year. While state-owned developers like China Overseas Land & Investment Ltd. are seen as better positioned, the broader sector continues to struggle with unfinished projects, default risks, and lackluster buyer confidence. Beijing’s piecemeal policy support has offered little lasting relief, raising concerns about the sustainability of any rebound.

Investment Insight

Focus on state-backed developers as consolidation accelerates and market share shifts. However, structural challenges and weak fundamentals suggest limited upside in the broader property market. Expect only tactical opportunities in a sector still under pressure.

Broadcom and AMD Lead Chip Rally on AI Growth Optimism

Chip stocks surged Monday, with Broadcom (+5.5%) and AMD (+4.5%) leading gains as analysts issued bullish calls driven by AI demand. UBS raised Broadcom’s price target to $270, citing significant AI revenue growth projections for 2026 and 2027. Rosenblatt named AMD a “top pick” for early 2025, highlighting its growing market share and AI-related potential. Other chipmakers, including Nvidia, Qualcomm, and Intel, also posted gains, pushing the PHLX Semiconductor Index up 3%.

Investment Insight

AI demand remains a key driver for chipmakers, making industry leaders like Broadcom and AMD attractive picks. However, recent rallies suggest valuations may already reflect significant optimism. Look for near-term opportunities but exercise caution on overheated stocks.

Market price: Broadcom Inc (AVGO): USD 232.35

Spotify Hits Record Highs After Strategic Overhaul and Profitability Breakthrough

Spotify’s stock has soared to nearly $500, a sixfold increase from its 2022 low of under $80. The turnaround stems from aggressive cost-cutting, broad price hikes, and a shift in strategy that reduced podcast spending while focusing on bundles combining music, podcasts, and audiobooks. Layoffs, restructuring, and operational efficiency drove gross margins from 25% in 2022 to 31.1% in the latest quarter, with full-year profitability on track for the first time. Analysts remain bullish, with a median price target of $486.

Investment Insight

Spotify’s resurgence highlights the value of disciplined cost management and pricing power. While growth opportunities in audiobooks and bundles remain promising, sustained profitability will be key to justifying its lofty valuation.

Market price: Spotify Technology SA (SPOT): USD 456.29

Conclusion

Asian markets showed mixed signals as strong performances in tech and individual stocks like Honda contrasted with broader fragility tied to China’s slowdown and ongoing macroeconomic concerns. Japan’s yen volatility and the BOJ’s upcoming decisions add further uncertainty, while China’s property sector struggles to sustain momentum despite stimulus efforts. In contrast, US chipmakers and Spotify highlighted the potential of AI growth and strategic overhauls, though lofty valuations urge caution. Investors should remain selective, focusing on opportunities in resilient sectors like tech and state-backed developers while closely monitoring global monetary trends and China’s structural challenges heading into 2025.

Upcoming Dates to Watch

- December 26th, 2024: US initial jobless claims

- December 27, 2024: Japan Tokyo CPI, unemployment, retail sales

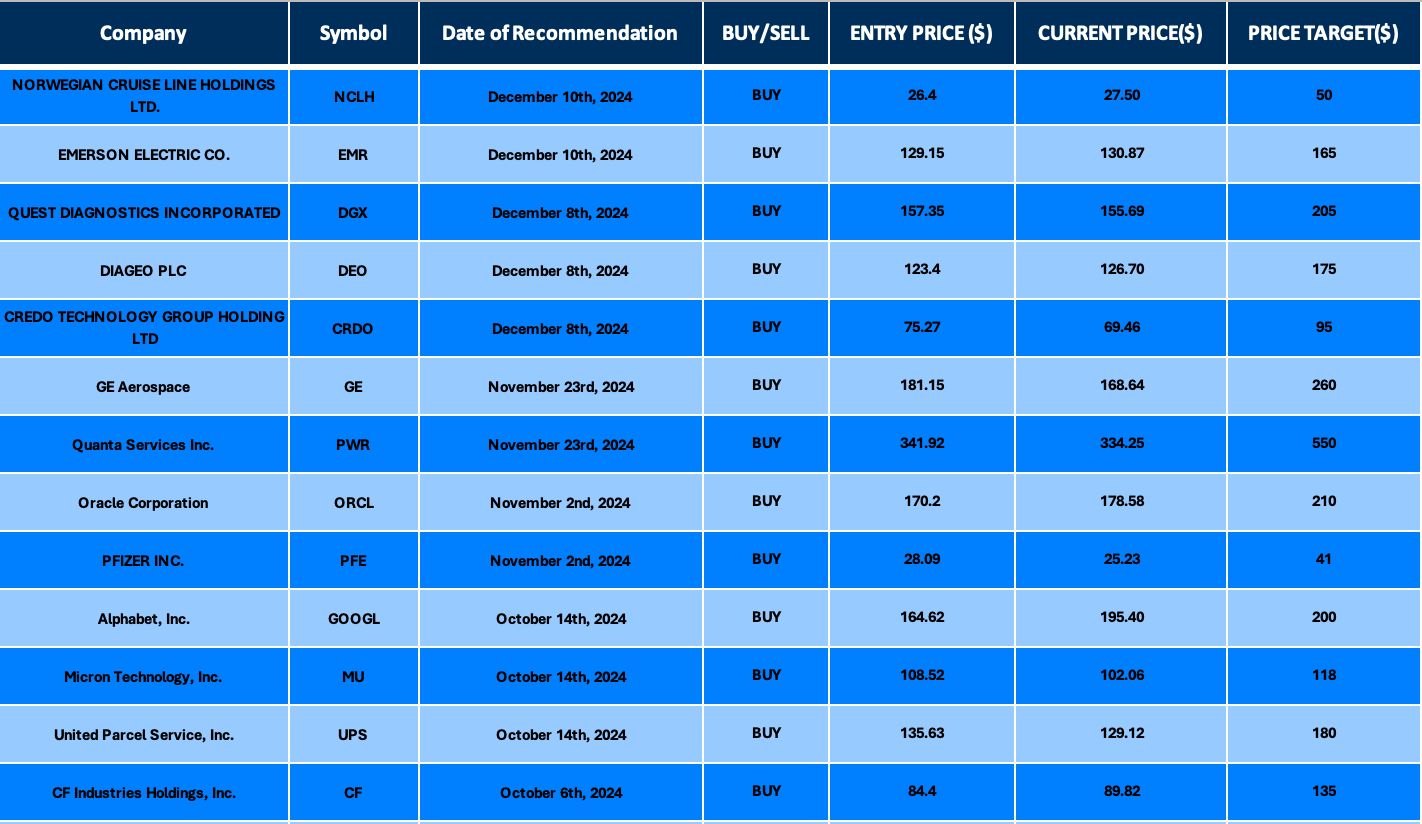

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $400 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.