Date Issued – 31st December 2024

Preview

Hong Kong’s IPO market ends 2024 on a high note

Hong Kong’s IPO market closed the year strong, with six firms, including Bloks Group and Beijing Saimo Technology, filing to raise HK$3.3 billion amid eased listing rules and Chinese regulatory support. IPO proceeds nearly doubled to $10 billion, though still below pre-pandemic levels, as firms rushed to list ahead of Donald Trump’s inauguration, fearing policy shifts. Meanwhile, cocoa led commodities with prices tripling on supply deficits, while steel-making coal and oil struggled due to China’s slowdown. India’s central bank forecasts a 2025 growth rebound, with potential rate cuts boosting consumer-driven sectors, but rising bad loans pose risks. Asian equities ended the year with a quarterly loss, pressured by dollar strength and China’s recovery concerns, though gold and oil showed resilience. Brent crude neared $75 as China’s factory activity expanded, but oversupply fears could weigh on prices in 2025. Investors face a mixed outlook with opportunities in Chinese IPOs, safe-haven assets, and commodities, tempered by geopolitical and economic uncertainties.

Hong Kong’s IPO Market Sees Year-End Surge

Hong Kong’s IPO market ended 2024 with a flurry of filings, as six firms, including Chinese toy maker Bloks Group Ltd. and autonomous vehicle tester Beijing Saimo Technology Co., announced plans to raise HK$3.3 billion ($429 million) by late January. The surge comes as the city eases IPO rules and China’s securities regulator encourages mainland firms to list in Hong Kong to solidify its role as a global financial hub.

Hong Kong’s IPO proceeds nearly doubled in 2024 to $10 billion, still below pre-pandemic averages. The Hang Seng Index gained 18% this year, while the Hang Seng China Enterprises Index posted a 27% increase, its best performance since 2009. Firms are rushing to list before Donald Trump’s inauguration on Jan. 20, fearing potential policy volatility under his administration.

Investment Insight

Hong Kong’s improving IPO market, boosted by strong equity performance and relaxed listing rules, offers opportunities for investors seeking exposure to Chinese growth sectors. However, looming geopolitical risks could heighten market volatility.

Cocoa Tops Global Commodities Rally for Second Year Amid Supply Deficit

Cocoa and coffee emerged as the best-performing commodities in 2024, driven by persistent supply deficits caused by adverse weather in key regions like West Africa and Brazil. Cocoa prices soared nearly threefold to a record $12,931 per metric ton, while coffee hit its highest levels in over 40 years. Conversely, steel-making coal and crude oil faced significant pressure, with China’s economic slowdown and property crisis dampening demand.

Looking ahead to 2025, analysts expect heightened global trade tensions, a strong dollar, and U.S. policy shifts under Donald Trump to shape the commodities market. While gold and silver remain strong safe-haven bets, oil and iron ore could struggle as supply outpaces demand, despite OPEC+ production cuts and Chinese stimulus measures.

Investment Insight

Cocoa’s meteoric rise underscores the price risks tied to geographically concentrated production. Meanwhile, gold’s safe-haven appeal and supply constraints in metals like copper position them as potential winners in 2025, while oil and bulk metals could face continued headwinds.

India’s Central Bank Governor Signals Growth Rebound in 2025

India’s new central bank governor, Sanjay Malhotra, anticipates an economic rebound in 2025, driven by strong consumer and business confidence, improved investment scenarios, and robust corporate balance sheets. In his first comments since taking office, Malhotra highlighted the recovery potential in the latter half of the current fiscal year, supported by public consumption, service exports, and easing financial conditions.

The Reserve Bank of India (RBI) projects GDP growth at 6.5% for this fiscal year, down from 8% in the previous year, but expects stronger momentum in 2025. Analysts predict Malhotra could cut interest rates as early as February to support growth. While the banking sector remains stable with strong capital buffers, the RBI warns of rising bad loan ratios and economic risks tied to geopolitical tensions and climate events.

Investment Insight

India’s economic rebound in 2025, alongside potential interest rate cuts, presents opportunities in consumer-driven sectors and financial markets. However, rising bad loan ratios and global risks warrant cautious optimism for long-term investments.

Asian Stocks Face Quarterly Loss as 2024 Ends

Asian equities are set to post their first quarterly loss of 2024, despite a strong performance earlier in the year. Weakness in Australia and mainland China dragged regional markets, while Hong Kong shares remained flat. The downturn reflects cautious sentiment as uncertainties loom for 2025, including President-elect Donald Trump’s trade policies, the Federal Reserve’s outlook, and China’s economic recovery.

The Bloomberg Dollar Spot Index is on track for its best year since 2015, supported by Trump’s reelection and a more hawkish Fed stance. Meanwhile, Asian currencies suffered, with the yen and Korean won leading regional losses. On the commodities front, gold is set for one of its best annual performances, while oil gained on signs of Chinese economic recovery.

Investment Insight

The strong dollar and ongoing global uncertainties could pressure Asian equities and currencies in early 2025. However, commodities like gold and oil may offer resilience, supported by safe-haven demand and signs of recovery in China.

Oil Gains as China’s Factory Activity Expands

Oil prices rose as the year ended, with Brent nearing $75 a barrel and WTI trading close to $72, buoyed by China’s factory activity expanding for a third consecutive month. China’s economic recovery, supported by stimulus measures, offset concerns about a potential trade war under President-elect Donald Trump and looming oversupply in 2025.

While crude remains in a narrow trading range, bullish bets on WTI have reached a four-month high, signaling investor positioning for potential volatility ahead. Analysts remain divided, with some predicting prolonged price weakness due to oversupply, while others highlight risks from geopolitical tensions or extreme weather that could disrupt production.

Investment Insight

Oil markets face conflicting drivers in 2025: oversupply pressures versus potential disruptions from geopolitical risks. Investors may find opportunities in short-term price spikes while maintaining caution on prolonged bearish trends.

Conclusion

As 2024 ends, markets reflect a mix of optimism and caution. Hong Kong’s IPO surge highlights renewed investor interest, while China’s recovery bolsters commodities like oil and gold. However, uncertainties loom with Donald Trump’s presidency, geopolitical tensions, and China’s economic slowdown shaping the 2025 outlook. India offers growth potential under a supportive central bank, yet rising bad loans warrant vigilance. Commodities markets face opposing forces of supply pressures and geopolitical risks, while equity markets brace for dollar strength and global volatility. Investors should balance opportunities in Chinese growth sectors and safe-haven assets with cautious strategies for the year ahead.

Upcoming Dates to Watch

- December 31, 2024: China manufacturing PMI, non-manufacturing PMI

- January 1, 2025: US manufacturing PMI, Jobless claims

- January 2, 2025: US ISM manufacturing

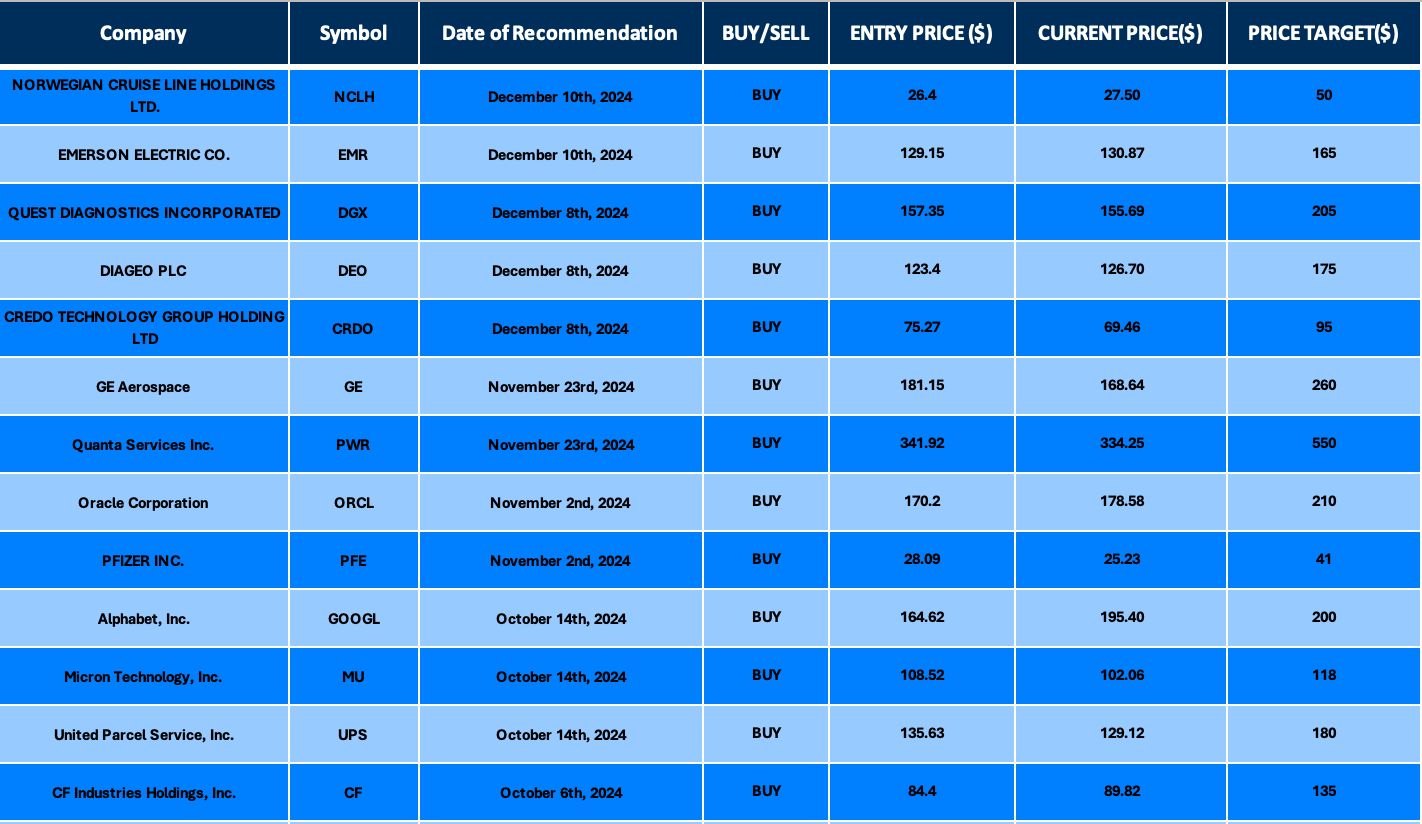

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.