Date Issued – 8th January 2025

Preview

Asian stocks slid sharply on inflation fears and concerns over China’s economic outlook, with MSCI’s regional index posting its steepest drop in two weeks. Tesla shares fell 4% after Bank of America downgraded the stock to Neutral, citing execution risks despite a price target boost. Samsung shares rose 3.1%, buoyed by Nvidia’s confidence in its AI memory progress, though it missed Q4 profit expectations. Tencent executed its largest buyback since 2006 after a U.S. blacklist triggered a selloff, but geopolitical risks remain a concern. Meanwhile, the U.S. trade deficit with Vietnam surged past $110 billion amid a weak dong and looming tariff threats from the incoming administration.

Asian Stocks Slide on Inflation Fears and China Worries

Asian equities fell sharply, mirroring Wall Street’s losses, as inflation concerns triggered a selloff in US Treasuries and investor sentiment soured over China’s economic outlook. MSCI’s regional index marked its steepest drop in over two weeks, with China’s benchmark hitting its lowest level since September amid fears of US tariff hikes. Meanwhile, Chinese government bond yields hit record lows, reflecting deep pessimism despite recent stimulus measures. Indian stocks also declined following a lowered growth forecast, while South Korea’s Samsung Electronics outperformed on optimism around its tech solutions.

Investment Insight

The global economic landscape remains fragile, with inflation risks and geopolitical tensions weighing heavily on markets. Investors should consider diversifying across sectors and geographies, focusing on high-quality assets and opportunities in resilient markets like onshore Chinese equities benefiting from policy support.

Tesla Downgraded by Bank of America Despite Price Target Boost

Bank of America downgraded Tesla (TSLA) to Neutral from Buy, citing high execution risks despite raising the stock’s price target to $490 from $400. Analyst John Murphy noted that Tesla’s current valuation reflects much of its long-term potential, including its core automotive business, robotaxi ambitions, and energy solutions. While Murphy remains optimistic about Tesla’s ability to grow its market share to 5% globally and launch new models, he flagged challenges such as scaling the robotaxi division, navigating regulatory hurdles, and competing with Chinese EV makers. Tesla shares fell 4% following the news.

Investment Insight

Tesla’s valuation may already price in much of its growth potential. Investors should monitor execution risks and focus on developments in its robotaxi rollout, new model launches, and regulatory dynamics, which could significantly impact the stock’s trajectory.

Market price: Tesla Inc (TSLA): USD 394.36

Samsung Shares Rise Despite Profit Miss, Buoyed by Nvidia Optimism

Samsung Electronics shares climbed as much as 3.1% despite missing profit expectations for Q4, after Nvidia’s founder Jensen Huang voiced confidence in Samsung’s ability to resolve technical challenges with high-bandwidth memory for AI applications. Samsung reported a preliminary operating profit of 6.5 trillion won ($4.5 billion), falling short of the 8.96 trillion won analysts expected, as heavy R&D spending and weak demand for mobile and legacy chips weighed on results. The company is racing to regain market share in the lucrative AI memory space, lagging behind competitors SK Hynix and Micron. Investors remain cautious about Samsung’s ability to catch up as it grapples with weak chip demand and aggressive competition in consumer electronics.

Investment Insight

Samsung’s recovery in AI memory could take time, but the sector’s long-term growth potential remains attractive. Investors should monitor its progress in AI chip certification and market share gains while weighing risks from weak mobile chip demand and rising competition.

Market price: Samsung Electronics Co Ltd. (KRX 005930): KRW 57,300

Tencent Executes Largest Buyback Since 2006 Following US Blacklist

Tencent repurchased 3.93 million Hong Kong-listed shares on Tuesday, the largest buyback since 2006, after its stock plunged 7.3% upon being added to a US blacklist over alleged ties to the Chinese military. The HK$1.5 billion ($193 million) buyback reflects Tencent’s effort to contain the fallout and reassure investors. Mainland investors also showed confidence, buying HK$14 billion in Tencent shares via stock connect programs. Tencent denied the allegations and pledged to cooperate with the US Department of Defense. Despite the buyback, geopolitical tensions remain a key overhang, with shares slipping another 2% on Wednesday.

Investment Insight

Tencent’s buyback signals confidence in its valuation, but heightened geopolitical risks could deter some investors. Long-term holders may find value at current levels, while staying alert to further regulatory or political developments.

Market price: Tencent Holdings Ltd (HKG: 0700): HKD 370.20

US-Vietnam Trade Deficit Surges Amid Weak Dong and Tariff Threats

The U.S. trade deficit with Vietnam soared to over $110 billion in the first 11 months of 2024, up nearly 18% from 2023, as a record depreciation of the dong bolstered Vietnamese exports. Vietnam is now the fourth-largest contributor to the U.S. trade gap, behind China, the EU, and Mexico. This growing surplus raises risks for Vietnam, as President-elect Donald Trump has threatened tariffs of up to 20% on U.S. imports. Washington is also scrutinizing Vietnam for potential currency manipulation, though the central bank denies deliberate intervention. The dong’s depreciation aligns with broader currency trends, but risks remain as U.S.-Vietnam trade tensions escalate.

Investment Insight

The weak dong and Vietnam’s export boom could face headwinds if U.S. tariffs materialize. Investors in Vietnam’s export-reliant sectors should brace for potential trade friction while monitoring policy shifts under the new U.S. administration.

Conclusion

Global markets face mounting pressures from inflation, geopolitical tensions, and shifting trade dynamics. Asia’s selloff underscores investor unease over China’s outlook and U.S.-Vietnam trade risks, while companies like Samsung and Tencent grapple with challenges but show resilience through buybacks and strategic pivots. Tesla’s downgrade highlights execution risks even in high-growth sectors, reminding investors to balance optimism with caution. As policy shifts and economic uncertainty loom, opportunities may lie in resilient sectors and regions positioned to weather volatility. Stay alert to evolving trends in AI, trade policy, and inflation to navigate the complex global landscape effectively.

Upcoming Dates to Watch

- January 8, 2025: Eurozone PPI, Consumer confidence

- January 9, 2025: China CPI, PPI

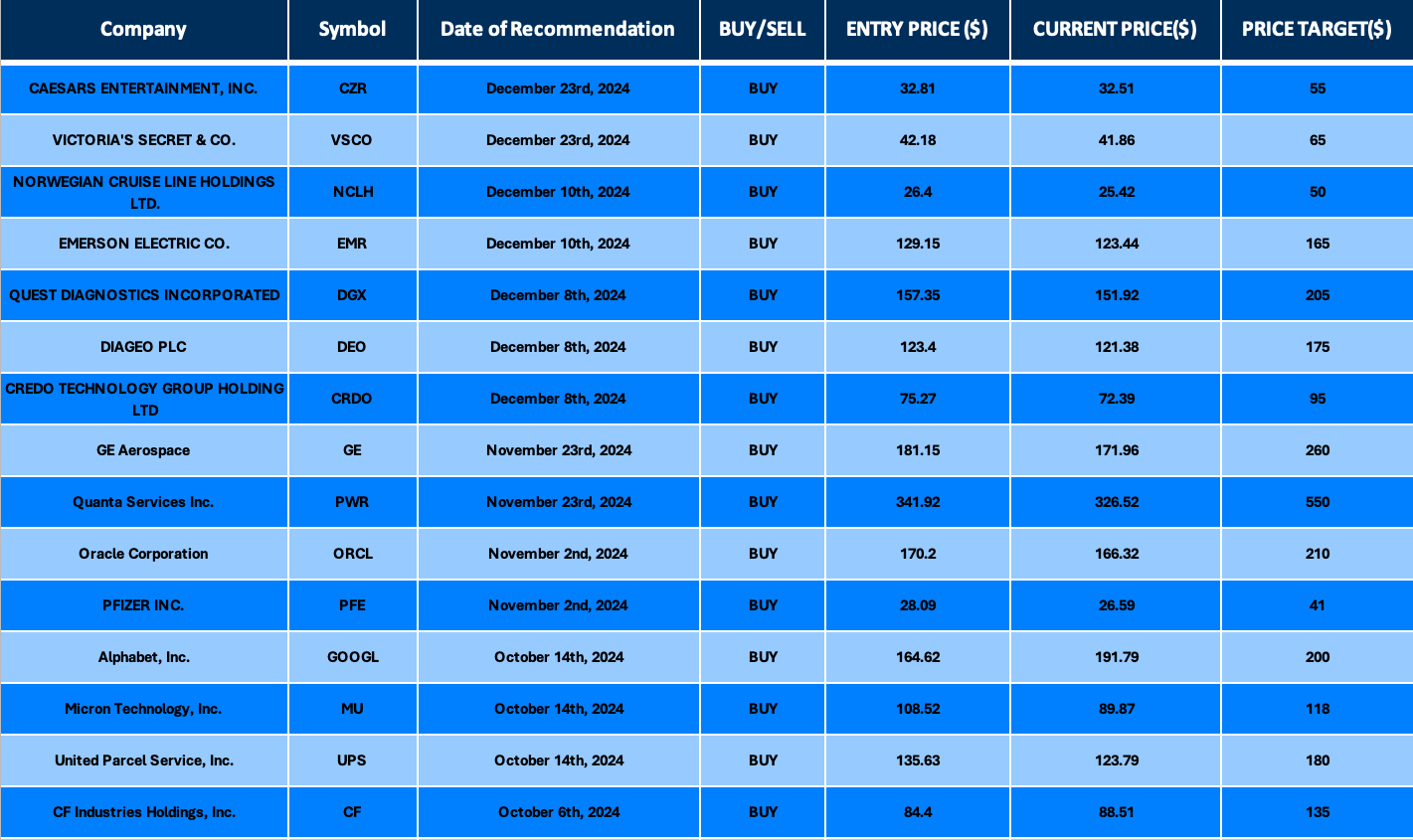

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.