Date Issued – 10th January 2025

Preview

Global markets are bracing for key U.S. jobs data, with Asian equities slipping and Treasury yields steadying. Meanwhile, Biden’s expanded AI chip export curbs target adversarial nations but face pushback from Nvidia, as Trump’s incoming administration could revise the policy. In China, Zijin Mining eyes a $6.4 billion acquisition of Zangge Mining to expand its lithium footprint amid a steep price crash. TSMC outperformed forecasts in Q4, driven by AI chip demand from clients like Apple and Nvidia. Oil is on its longest rally since July, fueled by tightening supplies, falling U.S. inventories, and geopolitical concerns as Trump’s policies on drilling and trade loom.

Markets on Edge Ahead of US Jobs Data, China Yields Rise

Asian equities slipped for a third consecutive session as investors exercised caution ahead of US nonfarm payroll data, which could shape Federal Reserve policy. MSCI’s Asia benchmark fell, while S&P 500 futures remained flat after the US market closure for Jimmy Carter’s national day of mourning. Treasury yields steadied after this week’s surge, while Chinese bond yields rose following the People’s Bank of China’s suspension of government bond purchases. The yuan edged higher, though risks from US yield movements persist. Meanwhile, the Fed signaled prolonged higher rates, citing fiscal deficits and resilient consumer spending.

Investment Insight: Caution dominates markets as key US labor data looms. Investors should monitor Treasury yield trends and Fed signals closely, as these will influence equity and currency markets globally.

Biden Tightens AI Chip Export Curbs, Nvidia Pushes Back

With days left in his presidency, Joe Biden is expanding AI chip export restrictions to adversarial nations like China and Russia, aiming to consolidate U.S. tech dominance and align global businesses with American standards. The policy introduces a three-tier system granting unrestricted access to close allies like Japan and Germany while limiting chip exports to most other nations. Nvidia criticized the move, warning it could stifle economic growth and U.S. leadership in AI. The decision’s longevity remains uncertain as Donald Trump’s administration may revise it post-inauguration.

Investment Insight: Tighter chip export curbs could disrupt global supply chains and challenge U.S. chipmakers’ growth in key markets. Investors should monitor policy shifts under the incoming administration for potential opportunities or risks in the AI sector.

Market price: Nvidia Corp (NVDA): USD 140.11

China’s Zijin Eyes Takeover of $6 Billion Lithium Miner

Zijin Mining Group, a global leader in copper and gold, is advancing its push into lithium with talks to acquire shares in Zangge Mining, a Chinese producer valued at $6.4 billion. Zangge generates a third of its revenue from lithium extracted from salt lakes in Qinghai and plans further expansion in Tibet. Amid a steep 90% drop in lithium prices since late 2022, Zijin aims to capitalize on the EV-driven demand boom, targeting 300,000 tons of lithium production by 2028. A deal could lead to Zijin gaining control of Zangge, pending board approval.

Investment Insight: Zijin’s potential acquisition signals confidence in a lithium market rebound. Investors should watch for further consolidation in the sector as low prices drive opportunistic deals and position for long-term EV battery demand growth.

Market price: Zijin Mining Group (HKG 2899): HKD 15.18

TSMC’s Sales Beat Estimates, Strengthening AI Growth Outlook

TSMC’s quarterly revenue surged 39% to NT$868.5 billion ($26.3 billion), surpassing analysts’ expectations and reinforcing optimism about sustained AI hardware demand in 2025. As the key chip supplier for Nvidia and Apple, TSMC benefits from rapid datacenter expansion by tech giants like Microsoft and Alphabet. However, concerns linger over potential overcapacity, power constraints, and geopolitical risks, including U.S. export restrictions on AI chips to China. TSMC’s expansion plans include new facilities in Europe, Japan, and Arizona, signaling its long-term confidence in AI-driven growth despite short-term uncertainties.

Investment Insight: TSMC’s strong performance highlights AI’s transformative potential, but investors should monitor geopolitical tensions, capital expenditure trends, and evolving demand for advanced chips in 2025.

Market price: Taiwan Semiconductor Manufacturing Co. (TSMC): TWD 1,100.00

Oil on Longest Weekly Winning Streak Since July

Oil prices are headed for a third consecutive weekly gain, with Brent crude rising above $77 per barrel and West Texas Intermediate nearing $74. The rally is fueled by falling U.S. crude stockpiles, colder weather boosting heating fuel demand, and reduced Russian shipments. This comes despite weaker demand signals from China, where inflation is nearing zero. Market jitters over President-elect Trump’s policies on Iran and trade are also contributing to supply concerns, while Brent’s widening backwardation signals tighter market conditions.

Investment Insight: Oil’s rally reflects tightening supply dynamics and geopolitical uncertainty. Investors should track inventory levels and upcoming U.S. drilling policies, which could shift the supply-demand balance in the months ahead.

Conclusion

Markets are navigating uncertainty as U.S. jobs data, geopolitical shifts, and policy changes reshape the global landscape. From Biden’s AI chip export curbs to Zijin’s lithium expansion and TSMC’s strong AI-driven growth, investors face a mix of challenges and opportunities. Oil’s rally highlights tightening supplies and geopolitical risks, while China’s economic signals add to the cautious sentiment. Looking ahead, key policy shifts under the incoming U.S. administration and evolving market dynamics will be critical. Staying informed and agile will be essential as investors balance short-term volatility with long-term growth prospects across sectors.

Upcoming Dates to Watch

- January 10, 2025: US Employment Report

- January 14, 2025: US PPI

- January 15, 2025: US CPI

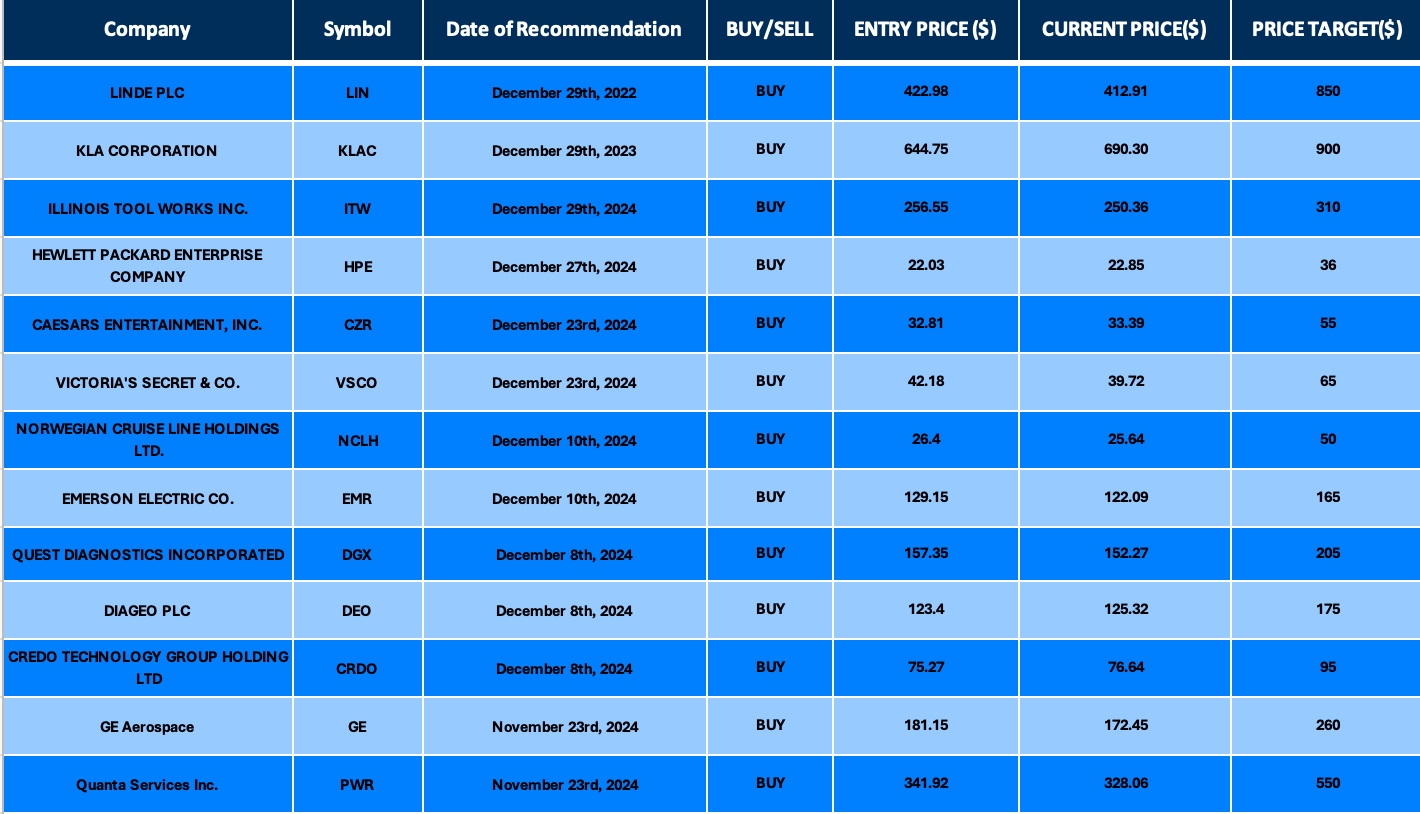

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.