Date Issued – 15th January 2025

China Explores Elon Musk as a Mediator for TikTok’s US Operations

China is exploring Elon Musk as a mediator to resolve TikTok’s US operations crisis, with ByteDance facing pressure to divest. Meanwhile, China’s loan market shows signs of recovery after its first annual decline since 2011, aided by government bond issuance and stimulus measures. Quantum computing stocks rebounded sharply as industry leaders like D-Wave defended the sector’s near-term potential despite Big Tech skepticism. Global markets treaded water ahead of US CPI data, with investors eyeing inflation’s impact on Fed policy, while the BOJ hinted at a potential rate hike next week, strengthening the yen.

TikTok’s Fate: China Eyes Elon Musk as Deal Broker

Chinese officials are reportedly exploring the possibility of involving Elon Musk to mediate a solution for TikTok’s US operations, which face a looming ban under a new US law unless its parent company, ByteDance, divests its stake. Musk, a trusted figure in both China and the US, has expressed opposition to banning TikTok, citing free speech concerns. While discussions remain in the early stages, Beijing hopes Musk’s influence could help avert a shutdown of the platform, which boasts 170 million US users. ByteDance, however, continues to focus on its legal battle to delay or overturn the legislation.

Investment Insight:

Elon Musk’s potential involvement in the TikTok negotiations highlights his growing geopolitical clout. Investors should monitor how this situation unfolds, as decisions here could impact Musk’s ventures, including Tesla’s China operations and the competitive positioning of his platform, X (formerly Twitter).

China’s Loan Market Rebounds After First Annual Decline Since 2011

China’s credit market showed signs of revival in December, fueled by government bond issuance and modest improvements in the housing sector. Aggregate financing surged to 2.86 trillion yuan ($390 billion), with 998 billion yuan in new loans—both at three-month highs. Despite Beijing’s stimulus measures, 2024 marked the first annual drop in new loans in 13 years, driven by weak household and corporate borrowing. Policymakers are expected to roll out further support, including interest rate cuts, to sustain growth amid deflation risks, a housing slump, and looming trade tensions with the US.

Investment Insight:

China’s fiscal push signals potential stabilization in credit demand, but weak private sector borrowing underscores lingering economic fragility. Investors should watch for further monetary easing and its impact on yuan stability and global trade dynamics.

Quantum Computing Stocks Rebound Amid Industry Optimism

Quantum computing stocks surged Tuesday after sharp declines fueled by skepticism from Big Tech leaders. Rigetti Computing (RGTI) jumped 48%, D-Wave (QBTS) rose 23%, and Quantum Computing Inc. (QUBT) gained 14%. This rebound followed D-Wave CEO Alan Baratz’s assertion that quantum computing is already delivering practical value, contradicting comments from Meta’s Mark Zuckerberg and Nvidia’s Jensen Huang, who argued the technology is decades away from mainstream use. Recent momentum in the sector has been supported by Amazon’s advisory program, Google’s new quantum chip, and increased US government funding.

Investment Insight:

Despite volatile sentiment, quantum computing remains a high-risk, long-term bet. Investors should assess near-term gains cautiously while monitoring advancements in commercial applications and government backing for the sector.

BOJ Signals Possible Rate Hike Decision Next Week

Bank of Japan Governor Kazuo Ueda hinted at the possibility of a rate hike during the January 23-24 policy meeting, citing spring wage negotiations and economic momentum as key factors. The yen strengthened 0.2% to 157.67 against the dollar following his comments. Markets are pricing in a 68% chance of a hike this month, rising to 86% by March. The BOJ is also expected to release an updated economic outlook, potentially raising its inflation projections due to higher rice costs and a weaker yen.

Investment Insight:

A BOJ rate hike could strengthen the yen and pressure Japanese equities, particularly exporters. Investors should monitor inflation revisions and wage growth signals for further policy direction.

Markets Hold Steady Ahead of US Inflation Data

Asian equities traded cautiously Wednesday, with the MSCI Asia Pacific Index trimming early gains and US equity futures remaining flat, as investors awaited US inflation data for signals on Federal Reserve policy. The dollar steadied after a prior drop, while 10-year Treasury yields dipped slightly. A higher-than-expected CPI reading could tighten financial conditions globally, impacting Asian markets. Meanwhile, China’s central bank injected significant liquidity to address pre-Lunar New Year cash demand, and European and US bank earnings loom on the horizon.

Investment Insight:

With markets in a holding pattern, today’s US CPI report could influence the Fed’s rate trajectory and global liquidity conditions. Investors should monitor inflation closely, as a hotter-than-expected print may pressure equities and strengthen the dollar.

Conclusion

From geopolitical negotiations to shifting global markets, this week highlights the intricate balance between policy, innovation, and investment. China’s potential enlistment of Elon Musk in the TikTok dispute underscores his growing influence, while its credit market rebound signals cautious optimism amid economic fragility. Quantum computing’s resurgence reflects the sector’s long-term promise despite volatility. As markets await US inflation data and the BOJ’s potential rate hike, investors should stay alert to policy shifts shaping global liquidity and currency trends. With key developments unfolding across sectors, opportunities and risks continue to evolve in today’s dynamic economic landscape.

Upcoming Dates to Watch

- January 15, 2025: US, France, and UK CPI; Eurozone industrial production

- January 16, 2025: Australia unemployment, Germany CPI

- January 17, 2025: Eurozone CPI, US industrial Production

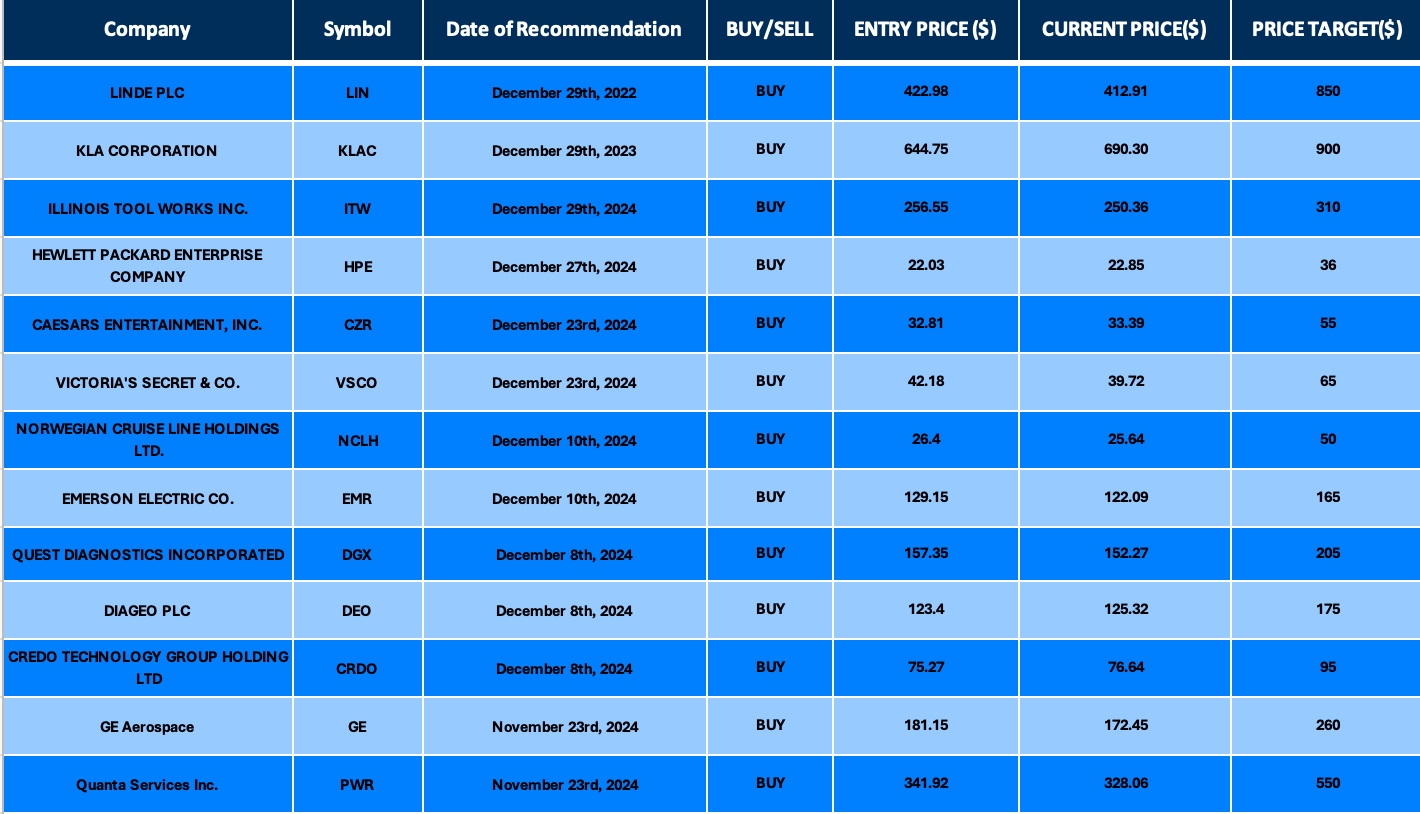

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.