Date Issued – 17th January 2025

Preview

Israel’s cabinet will deliberate a US-brokered Gaza ceasefire deal Friday, facing resistance from far-right allies as global mediators push for implementation before Donald Trump’s inauguration. In Asia, markets slipped after China reported 5% growth in 2024, with geopolitical tensions and slowing momentum raising concerns for 2025. Chinese buyers are shifting to cheaper Brazilian soybeans over US supplies amid tariff fears, further boosting Brazil’s agricultural dominance. Meanwhile, global diesel prices surged following new US sanctions on Russia, tightening supply and refining margins. Lastly, the yen is set for its strongest week in over a month on expectations of a Bank of Japan rate hike, though analysts warn yen strength could be short-lived.

Ceasefire Deal Faces Political and Diplomatic Hurdles

Israel’s cabinet is set to meet Friday to decide on a US-brokered Gaza ceasefire deal after delays stemming from disagreements within Benjamin Netanyahu’s coalition and alleged backtracking by Hamas. The deal, announced Wednesday, includes a 42-day truce, hostage exchanges, and aid access, with future talks planned for a permanent resolution. However, Netanyahu faces resistance from far-right allies threatening to leave the government if the deal leads to a lasting ceasefire. US Secretary of State Antony Blinken expressed confidence the ceasefire will begin Sunday, just before Donald Trump’s inauguration, amidst mounting pressure from global mediators.

Investment Insight

Geopolitical stability in the Middle East remains fragile, with potential impacts on energy markets and regional equities. Investors should monitor developments closely, particularly in oil prices and defense-related stocks.

Asian Markets Slip as China Hits 5% Growth Target

Asian shares mostly fell Friday after China reported its economy grew 5% in 2024, meeting government targets but slowing from the prior year. While strong exports and manufacturing growth (up nearly 6%) supported the economy, analysts foresee further slowing in 2025. Geopolitical tensions, including U.S. President-elect Donald Trump’s tariff threats and restrictions on advanced technology exports, remain key risks. Hong Kong’s Hang Seng and Shanghai Composite dipped 0.1%, while Japan’s Nikkei fell 1%. Taiwan Semiconductor Manufacturing Co. saw gains of 3.9% on strong AI-related earnings despite broader index declines.

Investment Insight

Slowing Chinese growth and geopolitical tensions could impact Asia-Pacific markets in 2025. Investors should focus on sectors like semiconductors and energy while watching U.S.-China trade developments.

Chinese Buyers Shift to Cheaper Brazilian Soybeans Amid Trade Tensions

Chinese soybean processors are pivoting to Brazilian soybeans over U.S. supplies, bracing for potential import tariffs under President-elect Donald Trump’s second term. Brazil, already China’s top supplier, now accounts for nearly all Q1 shipments as competitive pricing and trade uncertainties drive demand. Brazilian soybeans, priced at $420/ton compared to $451/ton for U.S. cargoes, benefit from favorable weather, a record crop, and a weaker real. China’s Q1 soybean imports are expected to dip slightly year-over-year, with oversupply from 2024 curbing demand. U.S. soybean exporters face mounting challenges, with stockpiles projected to hit a five-year high.

Investment Insight

Brazil’s agricultural dominance strengthens, benefiting exporters and related industries. U.S. farm sectors may face downward pressure, while trade tensions could weigh on U.S. agriculture-related equities. Watch for currency shifts and crop forecasts in Brazil.

Global Diesel Prices Surge Amid New US Sanctions on Russia

Diesel prices and refining margins have spiked globally following the US’s latest sanctions on Russia, aimed at curbing its oil revenue. Analysts warn of potential disruptions to Russian diesel exports, with up to 150,000 barrels per day at risk. European diesel futures hit a 10-month high in backwardation, signaling tight supply, while US diesel futures surged 5% to a six-month peak of $111 per barrel. Asia’s diesel margins also rose but were tempered by higher crude costs. Europe has turned to suppliers in India, the Middle East, and the US, tightening competition as Turkey and Brazil may also seek alternative sources. Analysts expect the market to adjust, with Russian exports likely rerouted via non-sanctioned vessels.

Investment Insight

Tighter diesel supplies and rising refining margins could support energy stocks, particularly in refining and oil trading. Elevated fuel prices may pressure transportation and logistics sectors. Monitor geopolitical developments and crude price trends.

Yen Set for Strongest Week in Over a Month on BOJ Rate Hike Bets

The yen is on track for its best weekly gain since November, rising 1.5% against the dollar as markets anticipate a potential Bank of Japan (BOJ) rate hike next week. Persistent inflation, stronger wage growth, and official commentary have fueled speculation, with traders pricing in an 80% chance of a hike. However, analysts caution that yen strength could be short-lived if BOJ Governor Kazuo Ueda adopts a dovish tone. Meanwhile, the dollar index dipped 0.6% this week as traders priced in potential Fed rate cuts in 2025, following easing U.S. inflation data. The yuan remained steady after China reported 5.4% Q4 growth, beating expectations, though economic headwinds persist.

Investment Insight

The yen’s rally could pressure Japanese exporters, while a potential BOJ rate hike might boost yields on Japanese government bonds. Currency volatility presents opportunities in forex markets, but investors should watch for BOJ and Fed policy shifts.

Conclusion

This week’s developments highlight the intersection of geopolitics and markets, from Israel’s fragile ceasefire talks to China’s slowing growth and shifting trade dynamics. U.S. sanctions on Russia are driving up diesel prices, while Brazil cements its role as an agricultural powerhouse with rising soybean exports to China. In currency markets, the yen rallies on Bank of Japan rate hike bets, underscoring global monetary policy shifts. As tensions and uncertainties persist, investors should remain vigilant, focusing on sectors like energy, semiconductors, and agriculture while closely monitoring geopolitical risks, central bank decisions, and commodity price movements in the weeks ahead.

Upcoming Dates to Watch

- January 17, 2025: Eurozone CPI, US Industrial Production

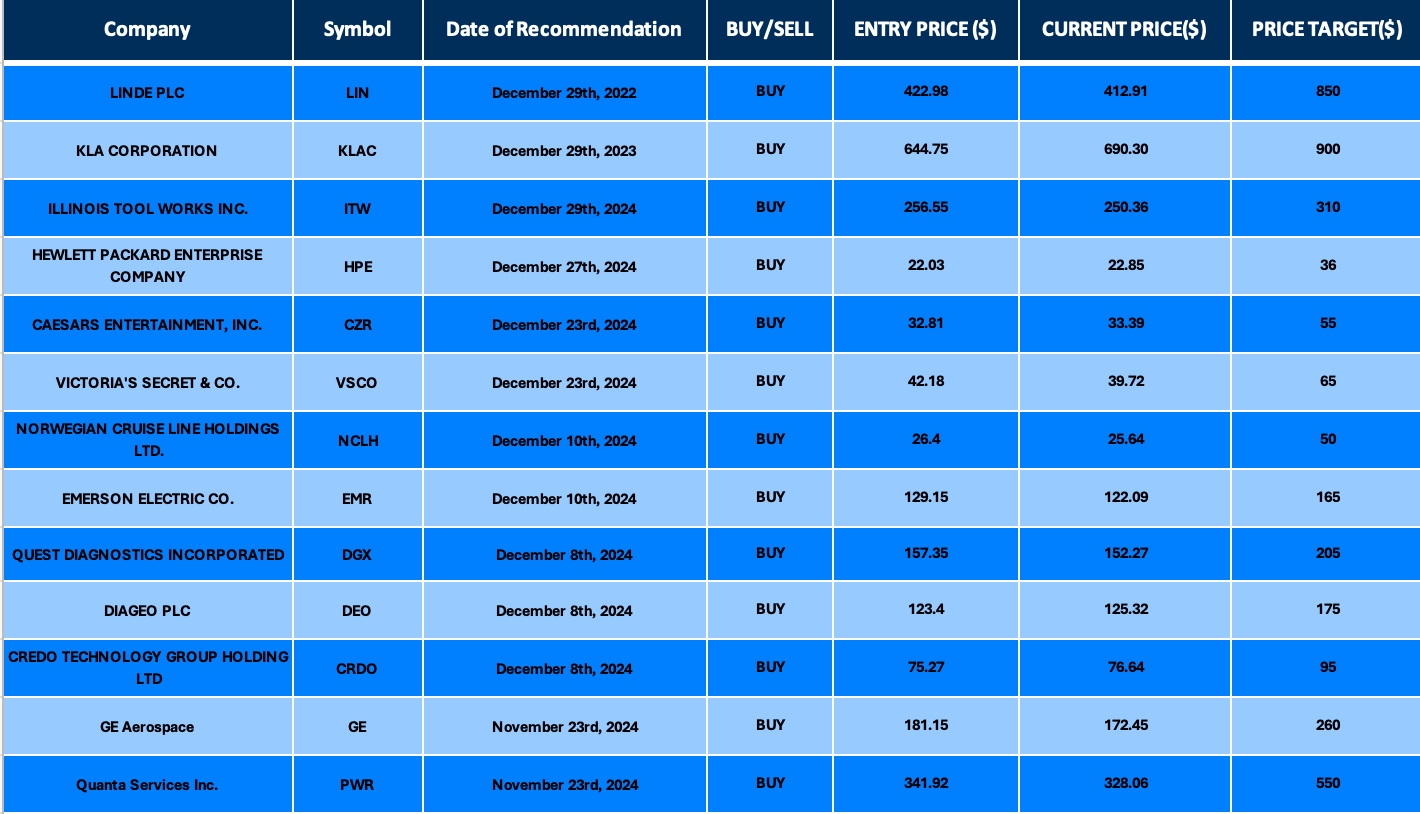

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.