Date Issued – 22th January 2025

Preview

Tech innovation and policy shifts dominate the headlines this week. OpenAI, Oracle, and SoftBank unveiled Stargate, a $500 billion U.S. AI infrastructure initiative, solidifying AI’s role in future innovation. Meanwhile, President Trump signaled openness to Elon Musk or Larry Ellison acquiring TikTok, adding complexity to U.S.-China tech relations. Netflix surged 14% after record Q4 subscriber growth and price hikes, driven by live events and a $15 billion buyback. In Asia, AI optimism lifted markets, but SK Hynix’s 26% rally faces profit-taking as investors rotate into domestic stocks benefiting from Trump’s policies. Tech remains the focal point for global markets.

Tech Titans Commit $500 Billion to U.S. AI Development

OpenAI, Oracle, and SoftBank have announced plans to invest up to $500 billion in U.S. artificial intelligence infrastructure through a new venture called Stargate. The initiative, unveiled at the White House with President Trump, highlights AI’s growing importance to the American economy. Stargate’s first data center, already under construction in Texas, will be operated by Oracle and used by OpenAI. Additional investors and debt financing are expected to support the ambitious project. Microsoft, Nvidia, and Arm Holdings have signed on as technology partners, solidifying AI as a cornerstone of future innovation.

Investment Insight

The Stargate initiative underscores AI’s pivotal role in reshaping industries. Investors should monitor the capital-intensive nature of AI infrastructure, as it could drive demand for semiconductor stocks, cloud providers, and data center operators.

Trump Open to Musk or Ellison Buying TikTok in Joint US Venture

President Trump expressed openness to Elon Musk or Oracle Chairman Larry Ellison acquiring TikTok through a joint venture with the U.S. government. While ByteDance has resisted selling the app, Trump extended the deadline for a sale by 75 days via executive order. Potential bidders include American investors, billionaire Frank McCourt, and Shark Tank’s Kevin O’Leary, whose $20 billion bid excludes TikTok’s algorithm to ease national security concerns. Oracle and Amazon have also been floated as potential suitors, though Beijing’s stance on the matter remains uncertain.

Investment Insight

TikTok’s potential sale highlights opportunities in the social media and AI sectors. Watch for regulatory outcomes, as antitrust issues and geopolitical tensions could reshape valuations and investor strategies.

Netflix Stock Surges 14% on Record Subscriber Growth, Price Hikes Announced

Netflix shares soared over 14% in after-hours trading after the company reported its largest-ever quarterly subscriber gain of 18.9 million in Q4, far surpassing Wall Street’s expectations. Revenue and earnings beat forecasts, with full-year revenue guidance upgraded to $43.5-$44.5 billion. Netflix also announced a $15 billion stock buyback and price increases across its plans in the U.S., Canada, Portugal, and Argentina. Key drivers included successful live events like the “Jake Paul vs. Mike Tyson” match and NFL games, though the company emphasized no single event accounted for the surge.

Investment Insight

Netflix’s focus on special live events, price hikes, and aggressive buybacks signals long-term confidence. Investors should monitor its ability to sustain subscriber growth amid rising competition and higher pricing.

Market price: Netflix Inc (NFLX): USD 869.68

Asian Stocks Rise on AI Optimism, China Faces Pressure from Tariff Threats

Asian markets climbed as enthusiasm over AI investments under President Trump overshadowed concerns about potential 10% U.S. tariffs on Chinese goods. Japanese, South Korean, and Taiwanese tech stocks surged, with SoftBank shares jumping 11% after its inclusion in the U.S.-backed Stargate AI venture. However, Chinese and Hong Kong markets lagged, with the CSI 300 Index falling 1.3% amid trade fears. The MSCI Asia Pacific Index edged up 0.1%, while the dollar strengthened and Chinese yuan weakened.

Investment Insight

AI-driven optimism supports regional tech stocks, but lingering trade tensions with China may weigh on broader Asian markets. Investors should balance exposure between AI opportunities and risks tied to geopolitical uncertainty.

SK Hynix’s AI-Driven Rally Faces Investor Pullback Amid Trump Policies

SK Hynix shares, up 26% this year on AI excitement, face pressure as Korean retail investors rotate into domestic-focused stocks benefiting from President Trump’s policies. Despite expectations of record Q4 earnings driven by demand for high bandwidth memory (HBM) chips, concerns over Nvidia’s slowing momentum, declining memory prices, and stretched valuations (2.8x price-to-book ratio) are prompting profit-taking. Foreign investors, who propelled the stock higher, may also see memory chips as laggards in the AI space. Broader market focus is shifting toward sectors like shipbuilding and nuclear power under Trump’s agenda.

Investment Insight

SK Hynix’s rally reflects AI optimism, but valuation concerns and sector rotation may cap further gains. Investors should weigh long-term AI demand against short-term macro and policy-driven shifts favoring other industries.

Market price: SK Hynix Inc (KRX: 000660): KRW 226,500

Conclusion

This week highlights the transformative power of AI and the global impact of policy decisions. Stargate’s $500 billion investment cements AI as a cornerstone of U.S. innovation, while Netflix’s record-breaking growth underscores the value of strategic content and pricing. However, geopolitical tensions loom, from TikTok’s potential sale to Trump’s tariff threats on China. In Asia, AI-driven optimism is tempered by profit-taking in SK Hynix and sector rotations into domestic industries. As technology reshapes industries and markets, investors must balance growth opportunities with the risks posed by evolving policies and macroeconomic pressures. The tech-driven narrative remains a dominant market force.

Upcoming Dates to Watch

- January 23, 2025: South Korea GDP, Eurozone Consumer Confidence

- January 24, 2025: Japan CPI, rate decision

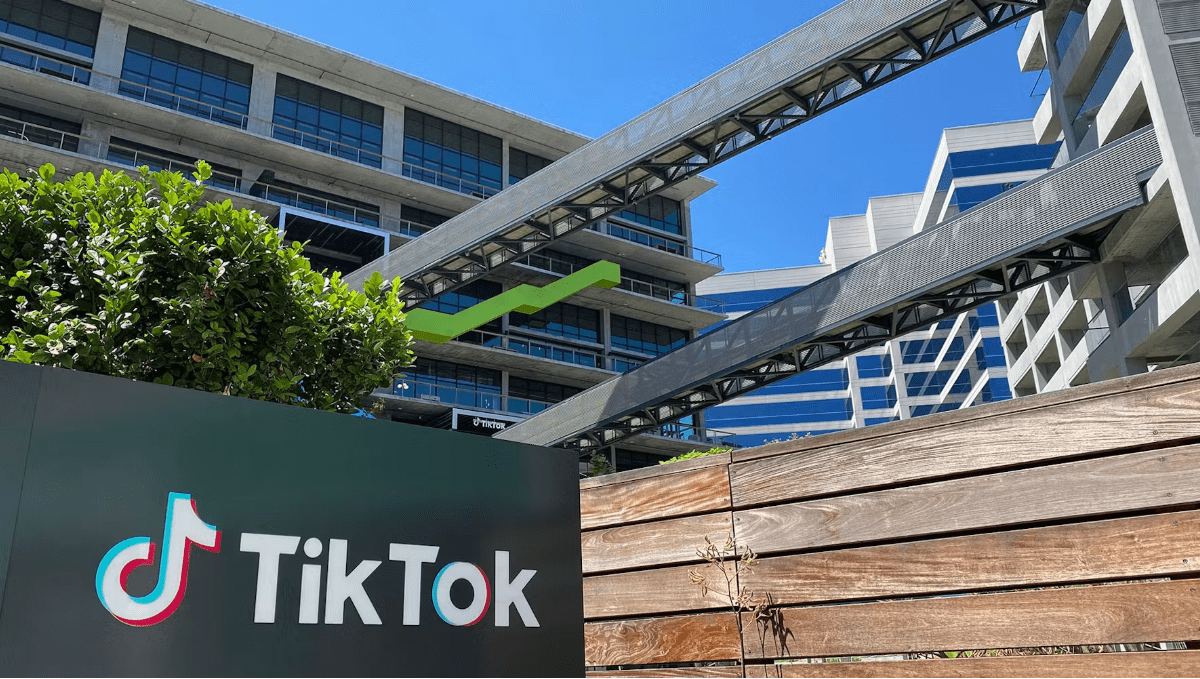

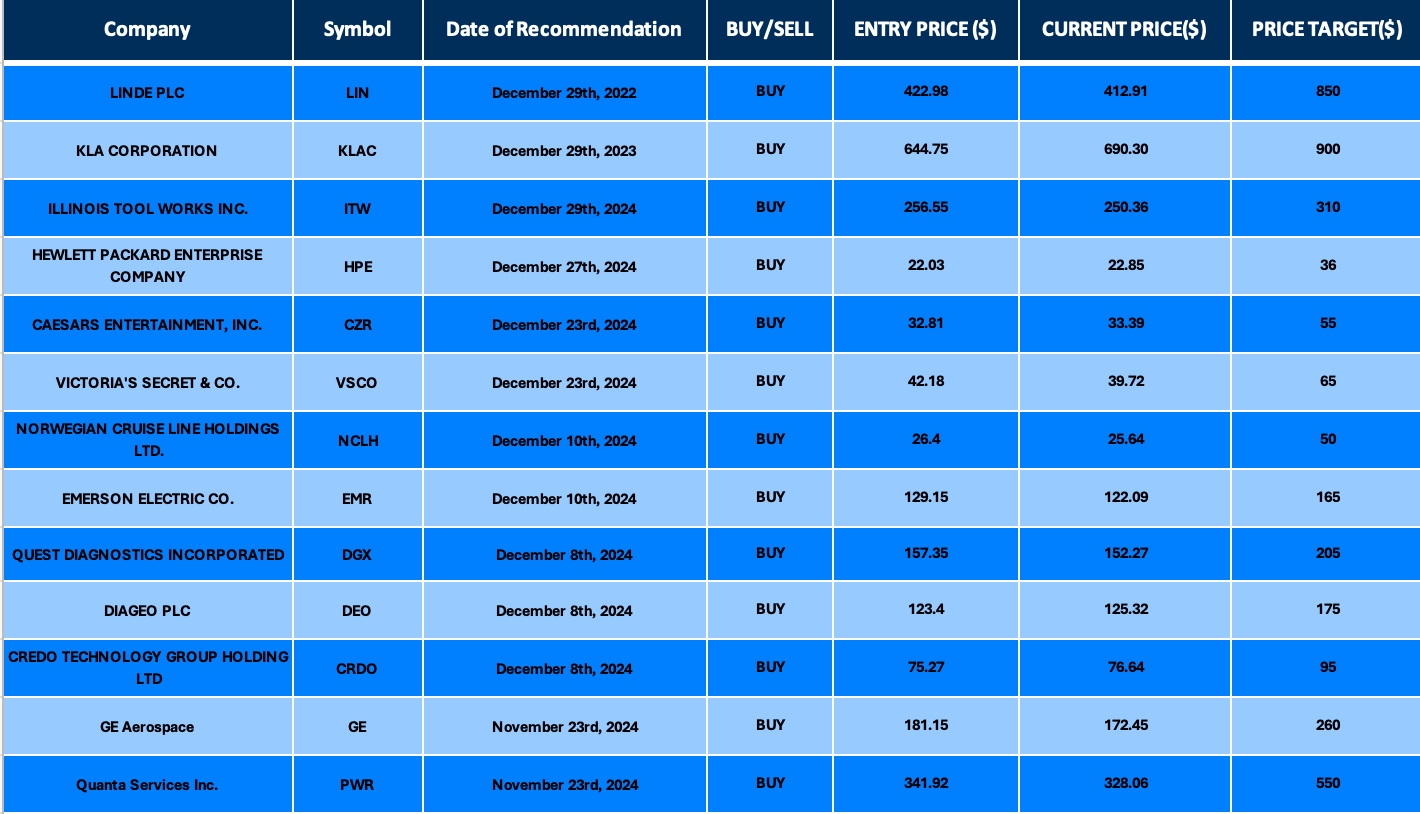

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.