Date Issued – 23rd January 2025

Preview

President Trump’s $300 billion freeze on green infrastructure funding threatens U.S. renewable energy projects, while his tariff threats loom over China despite market-boosting measures by Beijing. In Japan, a surge in foreign stock investments via the expanded NISA system is weakening the yen, adding pressure to import-heavy industries. Meanwhile, Russia’s economy faces rising inflation and high interest rates, with Putin signaling concerns as Trump considers more sanctions. On Wall Street, the S&P 500 nears record highs, fueled by strong earnings and optimism around a $500 billion AI initiative. Investors should watch for policy risks, geopolitical tensions, and valuation challenges.

Donald Trump Freezes $300bn in Green Infrastructure Funding

President Donald Trump has paused over $300 billion in federal green infrastructure funding, targeting key components of Joe Biden’s climate agenda. The executive order halts disbursements tied to Biden’s Inflation Reduction Act (IRA) and infrastructure law, including $50 billion in Department of Energy loans already approved and $280 billion in pending requests. This move has sent shockwaves through the clean energy sector, raising fears of stranded capital, stalled renewable projects, and reduced federal support for electric vehicle (EV) and battery manufacturing. Key renewable projects, such as offshore wind farms, are now at risk, with some investors already scaling back U.S. plans.

Investment Insight: The freeze signals heightened regulatory risk for renewable energy and EV sectors in the U.S., with potential long-term impacts on investment stability. Investors should monitor policy shifts closely and consider diversifying geographically to mitigate exposure.

Asian Stocks Rise on China’s Market-Boosting Measures

Asian stocks climbed as Chinese regulators pledged government-wide support to boost share prices, with the CSI 300 Index advancing up to 1.8%. The MSCI Asia Pacific Index extended its rally, marking its longest winning streak in nearly a month. During a high-profile briefing, officials urged insurers and mutual funds to increase equity holdings, signaling Beijing’s commitment to stabilizing markets. However, analysts warn that while this move is positive, it won’t resolve deeper economic challenges. Meanwhile, U.S.-China trade tensions remain a looming concern for global investors, following tariff threats from President Trump earlier this week.

Investment Insight: China’s efforts to stabilize its stock market may offer short-term opportunities, but investors should remain cautious given lingering economic headwinds and geopolitical risks. Focus on selective, value-driven investments rather than speculative plays.

Japan’s Foreign Stock Appetite Adds Pressure on the Yen

Japanese retail investors are pouring record amounts into overseas equities, with ¥10.4 trillion ($66 billion) invested last year via the expanded Nippon Individual Savings Account (NISA) system. This surge, driven by tax-free incentives and higher returns abroad, is further weakening the yen, which already faces pressure from the U.S.-Japan interest rate gap and trade uncertainties under Donald Trump. With NISA accounts growing by 60% since 2020, analysts expect continued yen-selling pressure in the near term, though increased yields or stronger domestic stock performance could shift flows back to Japan.

Investment Insight: The yen’s prolonged weakness benefits Japanese exporters but poses risks for import-heavy industries. Investors should monitor NISA-driven outflows and consider currency hedging for exposure to Japanese equities.

Putin Eyes Economy as Trump Signals More Sanctions

Vladimir Putin is increasingly concerned about Russia’s strained wartime economy, which faces inflation near double digits, high interest rates at 21%, and labor shortages driven by record defense spending. While Russia’s economy showed resilience during the war, growth is now slowing, with forecasts below 1.5% in 2025. These pressures have led some in the Kremlin to favor a negotiated end to the Ukraine conflict. Meanwhile, newly inaugurated U.S. President Donald Trump has threatened more sanctions and tariffs unless progress is made, heightening economic risks for Russia.

Investment Insight: Russia’s economic fragility and potential sanctions create a challenging environment for global investors. Focus on sectors resilient to geopolitical pressures, such as energy, while avoiding areas vulnerable to sanctions and high domestic interest rates.

S&P 500 Near Record Highs on Strong Earnings and AI Optimism

The S&P 500 surged past 6,100 intraday on Wednesday, fueled by strong corporate earnings and optimism around Donald Trump’s pro-business agenda. While the index closed just shy of its all-time high, 79% of reporting firms have beaten earnings estimates, with Netflix leading the charge after adding record subscribers. Investor sentiment also soared following Trump’s announcement of a $500 billion AI infrastructure partnership between Oracle, SoftBank, and OpenAI. Oracle shares rose 7%, SoftBank jumped 11%, and semiconductor stocks rallied, underscoring confidence in the AI sector’s growth potential.

Investment Insight: Strong earnings and AI-driven initiatives are bolstering U.S. equities, but risks from high interest rates and stretched valuations remain. Focus on AI and tech leaders driving innovation while keeping an eye on macroeconomic headwinds.

Conclusion

Global markets are navigating a complex mix of opportunities and risks. While strong earnings and AI-driven initiatives push U.S. equities near record highs, policy shifts under President Trump are creating uncertainty, from green energy funding freezes to potential sanctions on Russia. In Asia, China’s efforts to stabilize markets offer short-term optimism, but long-term challenges persist, and Japan’s appetite for foreign stocks is pressuring the yen. Investors should remain cautious, balancing growth opportunities in sectors like AI and renewables with the need to hedge against geopolitical risks, regulatory changes, and macroeconomic headwinds shaping the global economic landscape.

Upcoming Dates to Watch

- January 23, 2025: South Korea GDP, Eurozone Consumer Confidence

- January 24, 2025: Japan CPI, rate decision

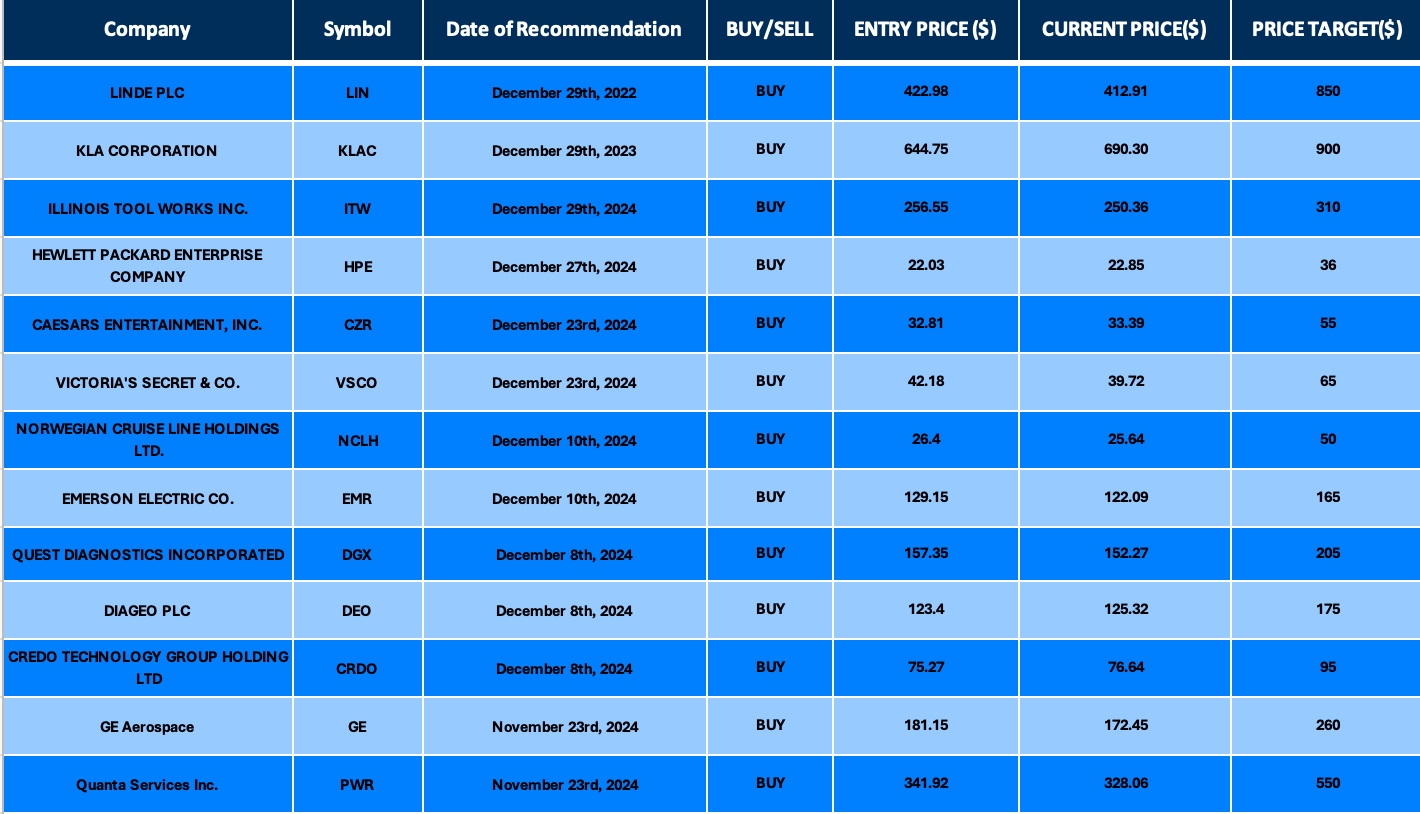

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.