Date Issued – 27th January 2025

Preview

Asian stocks rallied Monday as optimism around Chinese AI startup DeepSeek boosted tech shares, though U.S. futures dipped on concerns over its challenge to U.S. tech leadership. Meanwhile, China’s industrial profits fell 3.3% in 2024, marking a third consecutive annual decline, highlighting persistent domestic challenges despite stimulus measures. Bond markets steadied ahead of the Fed’s rate decision, with traders adjusting to inflation data and Trump’s unpredictable tariff threats. The yen outperformed G-10 currencies as haven demand grew, driven by geopolitical uncertainties and the BOJ’s rate hike. In Germany, an export-reliant economy faces mounting risks from slowing Chinese demand, rising energy costs, and protectionist policies, underscoring the need for structural reforms.

Asian Stocks Gain as DeepSeek Fuels China AI Rally

Asian markets climbed on Monday, led by gains in Japan, Hong Kong, and mainland China, as optimism surrounding Chinese AI startup DeepSeek boosted tech shares. The company’s cost-efficient AI models are seen as a potential disruptor to global AI investment dynamics. Meanwhile, U.S. futures slipped amid concerns over DeepSeek’s challenge to U.S. technological leadership. Broader market sentiment remained cautious following Donald Trump’s last-minute decision to reverse tariffs on Colombia, which raised fears of further trade-related unpredictability.

Oil prices fluctuated as investors adjusted to rapid U.S. trade developments, while gold edged lower but stayed near record highs. As the Lunar New Year holiday approaches, China’s slowing factory and services activity signals a need for stronger fiscal stimulus.

Investment Insight: The rally in Chinese tech stocks reflects growing confidence in AI as a long-term growth driver, but geopolitical risks tied to U.S.-China tensions remain a critical factor. Investors should monitor AI sector valuations and broader trade policy shifts carefully.

China’s Industrial Profits Decline for Third Consecutive Year

China’s industrial profits fell 3.3% in 2024, marking the third straight year of declines. The ongoing contraction highlights the challenges facing the industrial sector, including weak domestic demand and geopolitical risks. Stimulus measures have thus far failed to offset the downward trend, with private enterprises showing more resilience compared to state-owned firms. Analysts caution that the sector may require stronger government intervention to stabilize growth, particularly as external demand softens.

Investment Insight: China’s industrial sector faces sustained headwinds, with geopolitical risks and weak domestic conditions weighing on profitability. Investors should factor in potential stimulus policies and sector-specific resilience, especially in private enterprises, when assessing opportunities.

Bond Traders Shift Focus to Fed as Trump Muddies Tariff Outlook

Bond traders are bracing for the Federal Reserve’s Wednesday decision to pause its rate-cutting cycle, as speculation over inflation and economic resilience under Donald Trump’s presidency influences the market. Treasury yields, which surged late last year, have eased amid slower-than-expected inflation data and Trump’s restrained tariff actions during his first week in office. However, market uncertainty remains as Trump’s unpredictable policies—such as a now-resolved emergency tariff on Colombian goods—continue to stir inflationary and trade risks.

Investment Insight: Bond markets face a volatile 2025, tied closely to Trump’s economic policies and inflation trends. Investors should monitor yield curve shifts and Fed signals, balancing duration exposure amid heightened uncertainty.

Yen Outperforms G-10 Peers as Haven Demand Rises

The Japanese yen strengthened against the dollar on Monday, outperforming its G-10 peers as investors sought its haven appeal amidst concerns over Donald Trump’s tariff threats against Colombia. The yen rose as much as 0.5% to 155.29 per dollar, buoyed by a risk-off sentiment and lingering support from the Bank of Japan’s recent interest rate hike, its highest since 2008.

While Japan’s financial exposure to Colombia is minimal, strategists suggest the yen’s strength reflects broader market caution as well as narrowing yield gaps following the BOJ’s policy shift. Some analysts expect further yen gains, with a 12-month target of 145 against the dollar.

Investment Insight: The yen’s haven status is reaffirmed amid geopolitical and economic risks. Investors should watch Japan’s monetary policy trajectory and global risk sentiment as key drivers for the currency’s performance.

Germany’s Economic Model Faces Crisis Amid Export Dependence

Germany’s export-driven economy is faltering under slowing Chinese demand, rising energy costs, and growing competition from Chinese manufacturers. Automotive giants like Audi, once pillars of German manufacturing, are cutting profits and jobs as the nation grapples with its second consecutive year of economic contraction—its worst stagnation since World War II. The lack of a diversified “Plan B” leaves Germany vulnerable, with politicians and businesses largely clinging to the status quo. Rising protectionism under Trump and global trade disruptions further compound the challenges, while high energy costs and underinvestment in infrastructure deter innovation and growth.

Investment Insight: Germany’s economic woes highlight risks for investors in export-reliant industries. Diversification into sectors like technology or renewable energy may offer long-term opportunities, but near-term risks remain elevated amid trade uncertainties and structural stagnation.

Conclusion

Global markets are navigating a complex environment shaped by geopolitical risks, monetary policy shifts, and structural economic challenges. Asian tech stocks surged on AI optimism, but China’s industrial struggles and U.S. tariff threats weigh on sentiment. Bond markets await clarity from the Fed, while the yen’s haven appeal underscores heightened uncertainty. Germany’s export-dependent model faces mounting pressure, with diversification efforts lagging behind. As 2025 unfolds, investors should remain vigilant, balancing opportunities in emerging sectors like AI and renewables with caution around geopolitical risks and policy shifts that could redefine global trade and growth trajectories.

Upcoming Dates to Watch

- January 28, 2025: US Consumer confidence

- January 29, 2025: US rate decision, Australia CPI; Tesla, Microsoft, Meta, ASML earnings

- January 30, 2025: US GDP, Jobless claims; Apple, Deutsche Bank, Shell earnings

- January 31, 2025: Tokyo CPI, Japan jobless claims, US PCE inflation

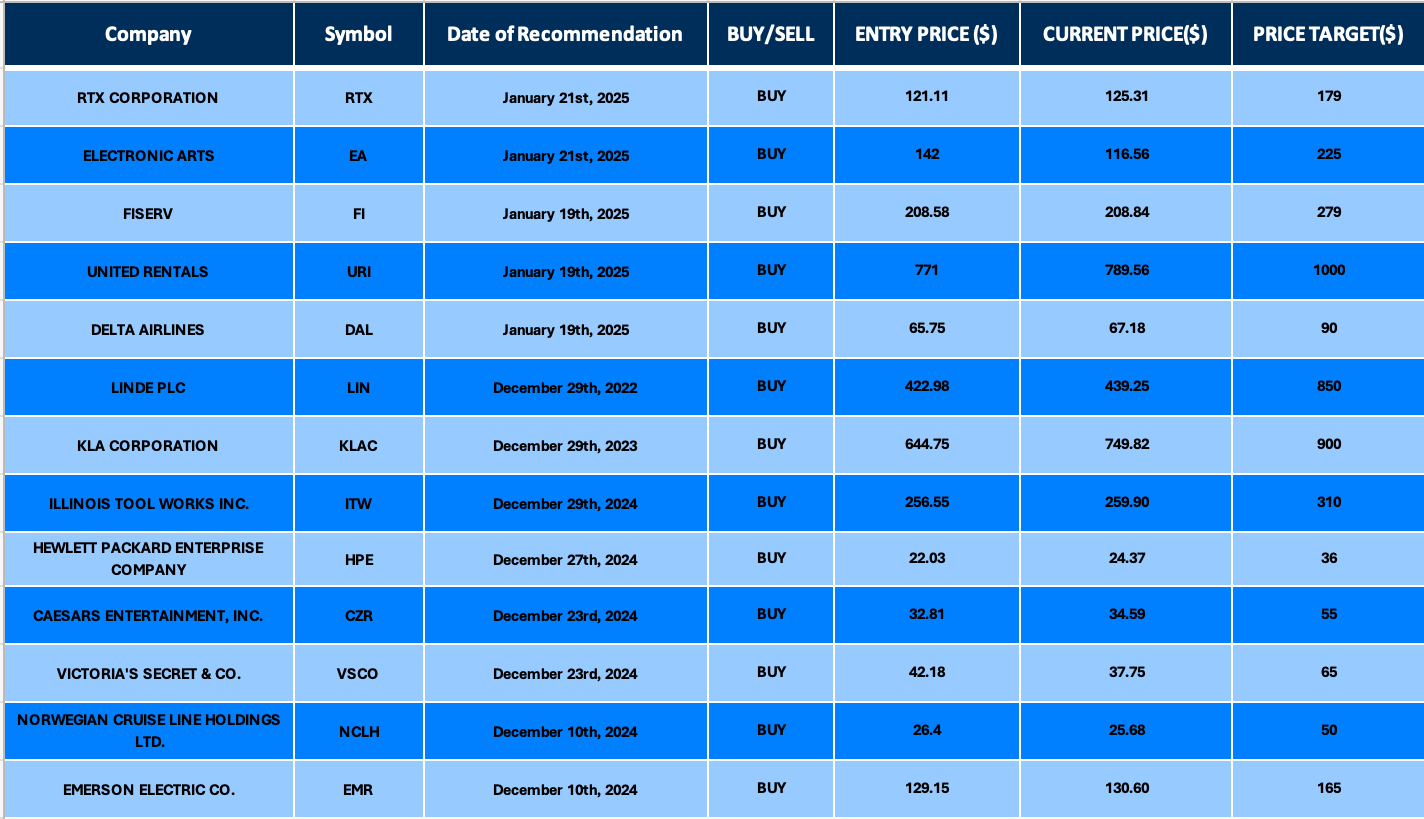

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.