Date Issued – 28th January 2025

Preview

Markets were rattled by Chinese AI startup DeepSeek’s breakthrough, sparking a sell-off in AI-linked stocks like Nvidia (-17%) and Constellation Energy (-21%). Analysts see fears as overblown, with AI infrastructure demand expected to stay strong. Meanwhile, President Trump’s proposed tariffs on copper and aluminum could raise consumer costs and disrupt trade, though they might accelerate U.S. domestic projects long-term. In Japan, MUFG shares hit a record high as rising interest rates boosted bank earnings, with further rate hikes expected. In energy, U.S. LNG exporters are poised to gain market share in Asia, driven by Trump-era trade shifts, though low prices may cap short-term gains. Gold held steady at $2,740.19 per ounce as a stronger dollar weighed on metals, while markets await clarity from the Fed’s upcoming rate decision.

DeepSeek Sends Shockwaves Through AI-Exposed Stocks

Chinese AI startup DeepSeek’s release of a cost-efficient AI model triggered a widespread sell-off Monday, rattling both tech and power stocks linked to AI infrastructure. Nvidia (-17%) led the Nasdaq’s 3% decline, erasing $589 billion in market cap, while chipmakers like Broadcom (-17%) and Lam Research (-5%) followed suit. AI-exposed power stocks felt the heat too, with Constellation Energy (-21%) and Vistra Corp (-28%) plunging as investors questioned US dominance in AI and the sustainability of spending.

Despite the market panic, analysts argue the fears are overblown. DeepSeek’s advancements, while significant, are seen as unlikely to disrupt the long-term demand for AI infrastructure. More efficient models could even expand AI adoption, supported by concepts like the Jevons Paradox. Microsoft and Meta, both major AI spenders, are expected to provide clarity on future spending in their upcoming earnings reports.

Investment Insight: Volatility can create opportunities. Power stocks remain critical to AI infrastructure, underpinned by rising energy demand forecasts. Meanwhile, efficient technology providers like Nvidia and chipmakers may benefit from long-term AI adoption trends despite short-term headwinds.

Trump’s Copper, Aluminum Tariffs May Raise Consumer Costs

President Donald Trump’s proposed tariffs on U.S. copper and aluminum imports are stirring concerns about higher costs for American consumers. While the tariffs aim to revitalize domestic production of critical metals for military hardware, analysts warn the U.S. lacks sufficient production capacity, and rebuilding infrastructure will take years. Canadian suppliers like Rio Tinto and Alcoa are unlikely to absorb the costs, which may instead be passed downstream to automakers and, ultimately, consumers.

The tariffs could also disrupt global trade flows. India, a key aluminum exporter to the U.S., is lobbying against the measures, while industry leaders suggest tariffs could accelerate domestic projects like Rio Tinto’s Resolution copper mine. However, near-term impacts would likely hurt local manufacturers facing inflated material costs.

Investment Insight: Tariffs may drive short-term inflation in key industries like automotive and manufacturing. Investors should monitor domestic producers poised to benefit from reshoring efforts, although these gains may take years to materialize.

MUFG Shares Hit Record High as BOJ Rate Hike Lifts Japanese Banks

Mitsubishi UFJ Financial Group (MUFG) shares reached a record ¥1,969.5 ($12.7) on Tuesday, their highest since listing in 2001, as investors bet on rising interest rates boosting lending income. The Bank of Japan recently raised its key policy rate to a 17-year high, with further increases likely. Other Japanese lenders, including Sumitomo Mitsui Financial Group (+2.2%) and Mizuho Financial Group (+2.8%), also rallied, pushing the Topix Bank Index up 2.2%.

Higher rates have been a windfall for Japanese banks, which have endured decades of ultra-low borrowing costs. MUFG has announced ¥300 billion in share buybacks, adding to investor optimism. Additionally, profits from overseas operations and unwinding cross-shareholdings are further bolstering earnings ahead of upcoming financial results.

Investment Insight: Rising rates and buybacks make Japanese banks attractive in the near term. MUFG and its peers are well-positioned for continued gains as BOJ policy shifts and global operations support growth.

US LNG Producers Poised to Gain Asian Market Share

US gas producers are set to capture a larger share of the Asian LNG market as countries like Japan and South Korea shift purchases to American suppliers to avoid Trump’s tariffs, according to Bloomberg Intelligence. Chinese buyers have already committed to 14 million tons of US LNG from 2026, a 50% increase from the 2021 record. Trump’s reversal of the US LNG export ban is expected to accelerate new gas projects, fueling export growth.

However, Asian LNG prices remain capped at $10/mmbtu due to surplus supply, China’s slow recovery, and Japan’s nuclear restart. These factors could limit short-term price gains, even as US exporters strengthen their foothold.

Investment Insight: US LNG exporters stand to benefit from Trump-era trade dynamics and growing Asian demand. Long-term investors should focus on companies positioned to capitalize on increased global export capacity and shifting trade flows.

Gold Steady as Dollar Rises Ahead of Fed Decision

Gold prices held steady at $2,740.19 per ounce Tuesday after a 1% drop on Monday, driven by margin calls during a tech stock sell-off sparked by Chinese AI startup DeepSeek’s success. The U.S. dollar surged 0.5%, bolstered by safe-haven demand, as investors turned cautious ahead of the Federal Reserve’s upcoming policy meeting. While the Fed is expected to hold rates steady, its inflation outlook will guide markets.

A stronger dollar, fueled further by U.S. tariff uncertainty, weighed on other metals as well. Platinum fell 0.7%, silver dipped 0.1%, and copper retreated on weak Chinese factory data and trade concerns.

Investment Insight: Gold’s long-term outlook remains bullish amid trade frictions and geopolitical concerns, but dollar strength could pressure prices short-term. Investors should watch Fed commentary closely for signals on future rate changes.

Conclusion

Markets remain volatile amid shifting global dynamics. DeepSeek’s AI breakthrough has disrupted U.S. tech and power stocks, but analysts expect long-term demand to hold. Trump’s tariff proposals could boost domestic production but risk near-term inflation and trade friction. Japanese banks are thriving on rising rates, while U.S. LNG exporters eye Asian market gains despite price caps. Gold steadies as investors await the Fed’s rate decision, with the dollar’s strength pressuring metals. As uncertainties persist, opportunities abound for investors focused on long-term trends across AI, energy, and financial sectors. Patience and adaptability are key in navigating these evolving market conditions.

Upcoming Dates to Watch:

- January 28, 2025: US Consumer confidence

- January 29, 2025: US rate decision, Australia CPI; Tesla, Microsoft, Meta, ASML earnings

- January 30, 2025: US GDP, Jobless claims; Apple, Deutsche Bank, Shell earnings

- January 31, 2025: Tokyo CPI, Japan jobless claims, US PCE inflation

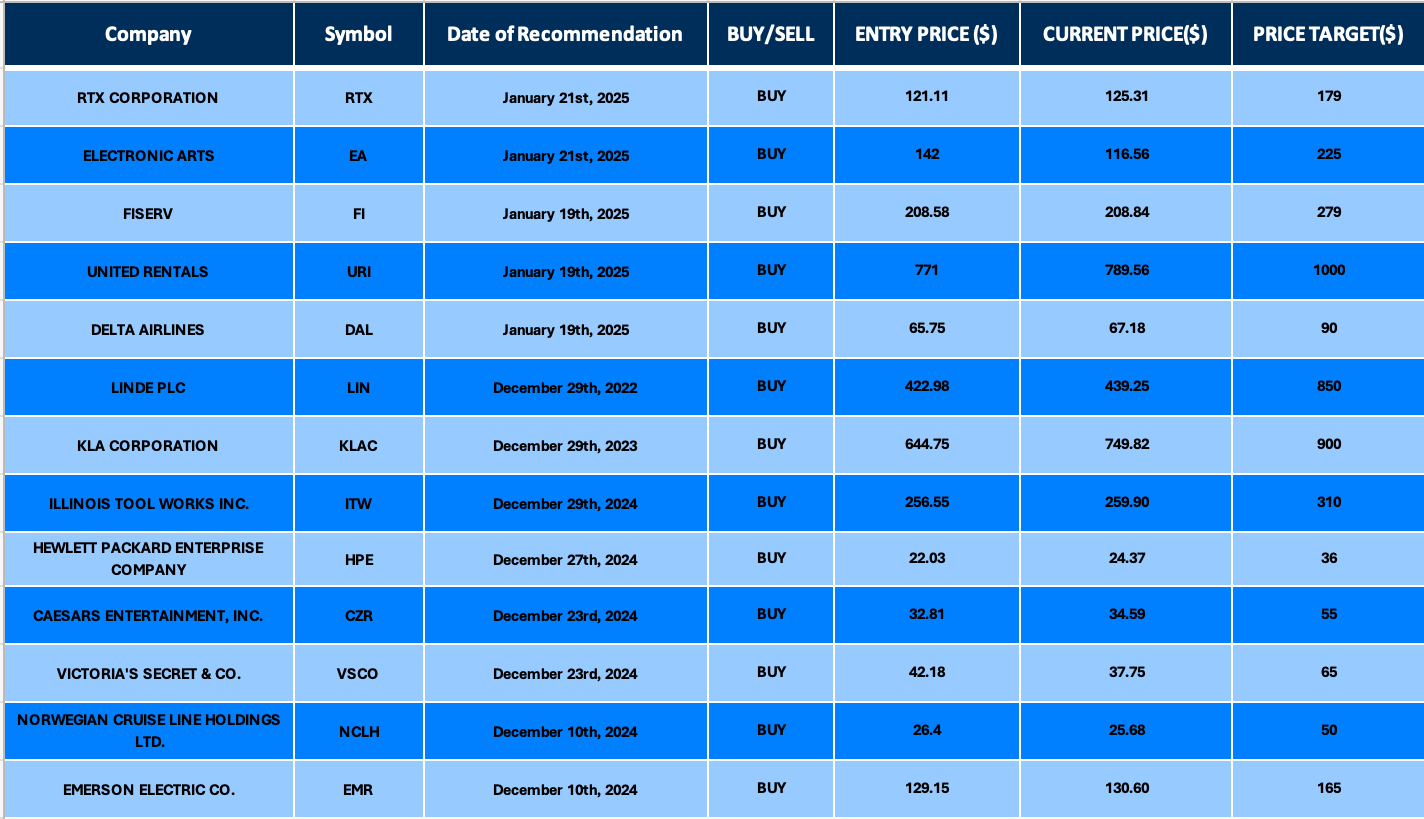

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.