Date Issued – 29th January 2025

Preview

Markets rallied as tech stocks rebounded, with the Nasdaq 100 up 1.6%, led by Nvidia’s 8.9% surge. Asian and European equities followed suit, as investors shifted focus to the Federal Reserve’s rate decision and US mega-cap earnings. ASML shares soared 8.7% on strong Q4 bookings, easing near-term growth concerns. Bitcoin climbed to record highs as the Czech central bank considered holding 5% of its reserves in the cryptocurrency, signaling rising institutional adoption. US power stocks recovered after Monday’s AI-driven selloff, though long-term energy demand remains uncertain. Meanwhile, Volkswagen is exploring US production sites for Audi and Porsche to mitigate tariff risks, reflecting the growing importance of localized manufacturing.

Tech Stocks Rebound as Markets Brace for Fed Decision

Asian stocks and European futures climbed, following a tech-led rebound on Wall Street. The Nasdaq 100 gained 1.6%, driven by Nvidia’s 8.9% rally after its historic single-day loss. Investors shrugged off concerns about Chinese AI startup DeepSeek, shifting focus to the Federal Reserve’s rate decision and US mega-cap earnings. Analysts expect the Fed to hold rates steady, with bond traders eyeing signs of potential rate cuts in March. Meanwhile, ASML’s strong order bookings and easing Australian inflation captured markets’ attention. Sony also announced Hiroki Totoki as its new CEO, boosting its stock to record highs.

Investment Insight:

Tech remains a key driver, but discerning stock selection is critical as AI-driven gains become less straightforward. Monitor Fed signals for rate-cut cues and focus on resilient sectors as volatility persists.

Czech Central Bank Eyes Bitcoin Reserves Amid Rate Cut Outlook

Czech National Bank Governor Ales Michl plans to propose holding up to 5% of the bank’s €140 billion reserves in bitcoin, citing its potential for asset diversification. The plan, if approved, could make the Czech central bank one of the first to invest significantly in the cryptocurrency. Michl also indicated a likely 25-basis-point rate cut next week. Bitcoin has surged to record highs recently, fueled by regulatory approval of spot-price ETFs and optimism over crypto-friendly policies under U.S. President Donald Trump.

Investment Insight:

Bitcoin’s growing institutional adoption signals its rising credibility as an alternative asset. However, central bank moves into crypto carry risks—investors should weigh long-term volatility against diversification benefits.

Power Stocks Rebound After DeepSeek AI Model Sparks Industry Uncertainty

US power stocks tied to AI demand rebounded Tuesday after sharp losses triggered by the release of DeepSeek’s cheaper, competitive AI model. Constellation Energy gained 1%, Vistra Corp surged 9%, and GE Vernova rose 7%, recovering from steep declines the day before. The selloff followed concerns over whether AI-driven energy demand growth would sustain its earlier momentum. While analysts see medium-term stability in data center deployments, long-term energy usage forecasts remain speculative as AI technologies evolve and become more efficient.

Investment Insight:

AI-driven energy demand remains a key growth driver for power stocks, but uncertainties about longer-term trends call for cautious optimism. Focus on companies with diversified energy portfolios and infrastructure investments.

ASML Shares Soar on Strong Q4 Bookings

ASML shares jumped 8.7% in Frankfurt trading Wednesday after reporting better-than-expected Q4 bookings of €7.08 billion, driven by strong demand for its advanced chip-making tools. The results helped ease investor concerns following recent losses tied to the DeepSeek AI model’s market impact. Analysts at Jefferies noted the robust backlog alleviates 2025 growth worries, though uncertainties around 2026 remain.

Investment Insight:

ASML’s strong bookings highlight enduring demand for advanced semiconductor equipment. However, investors should remain cautious about long-term growth projections amid broader industry uncertainties.

Volkswagen Weighs US Production for Audi, Porsche Amid Tariff Threats

Volkswagen is exploring US production sites for its Audi and Porsche brands to mitigate potential tariffs threatened by President Donald Trump, according to Handelsblatt. Unlike VW’s core brand, Audi and Porsche currently lack US-based production, leaving them vulnerable to trade barriers. The move could safeguard the luxury brands from heightened costs and maintain their competitiveness in the US market. Volkswagen has not commented on the report.

Investment Insight:

Tariff threats underscore the importance of localized production for global automakers. Investors should monitor VW’s expansion plans, which could reduce trade risks and strengthen its foothold in the US premium car market.

Conclusion

Markets remain in flux as investors balance optimism in tech and energy sectors with looming uncertainties. Strong Q4 results from ASML and Nvidia’s rebound highlight resilience in semiconductor and AI-driven industries, while bitcoin’s rise reflects growing institutional interest. The Federal Reserve’s upcoming decision adds another layer of anticipation, with potential signals on future rate cuts. Meanwhile, Volkswagen’s US production plans underscore the importance of mitigating geopolitical risks. As volatility persists, investors should focus on sectors demonstrating both adaptability and long-term growth potential while staying alert to shifting macroeconomic and regulatory dynamics.

Upcoming Dates to Watch

- January 29, 2025: US rate decision, Australia CPI; Tesla, Microsoft, Meta, ASML earnings

- January 30, 2025: US GDP, Jobless claims; Apple, Deutsche Bank, Shell earnings

- January 31, 2025: Tokyo CPI, Japan jobless claims, US PCE inflation

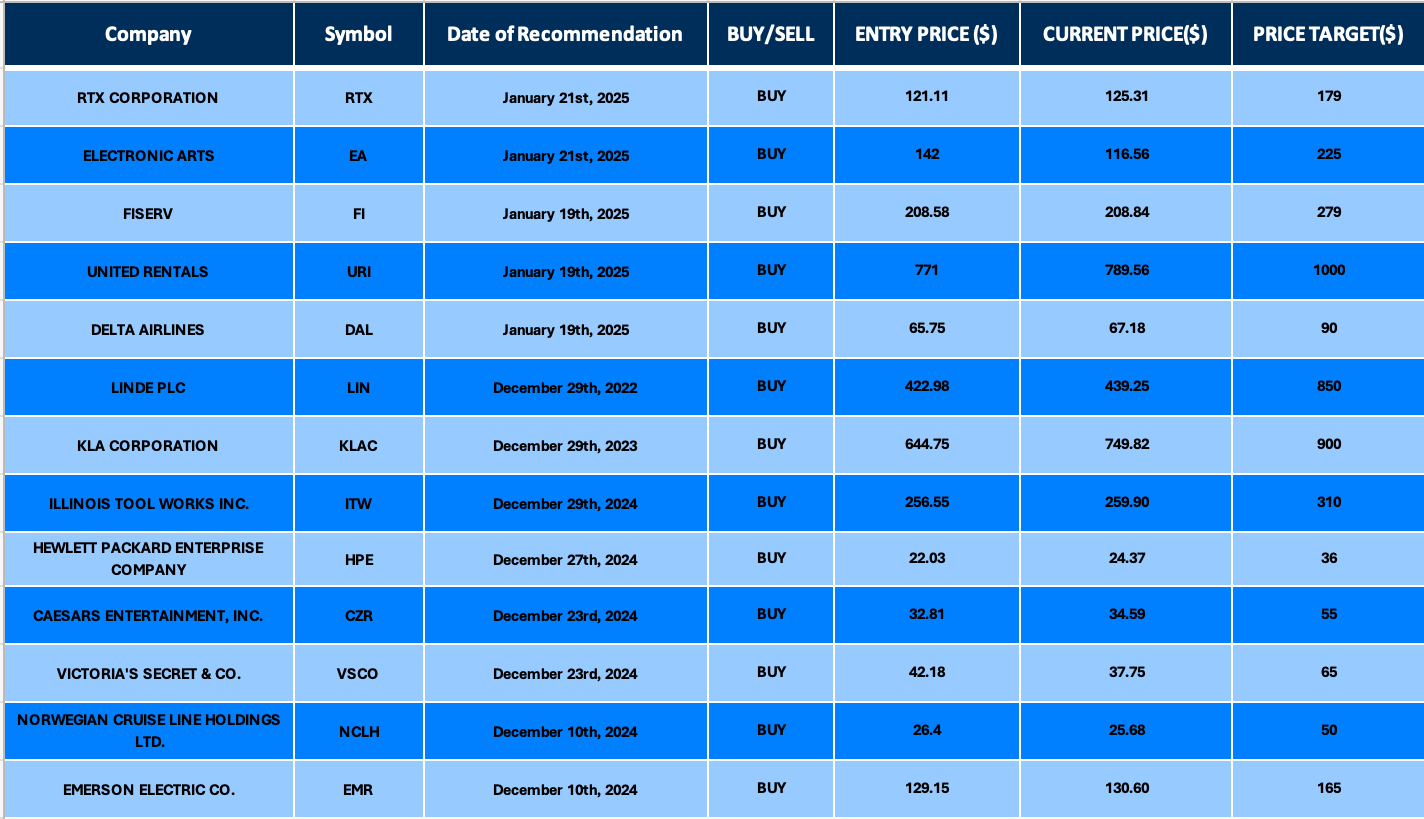

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.