Date Issued – 31th January 2025

Preview

Chinese AI lab DeepSeek has unveiled cost-efficient AI models that rival industry giants by automating labor-intensive tasks with reinforcement learning. Its R1 model demonstrates strong reasoning skills while using fewer resources, even running on mobile devices. The breakthrough has shaken semiconductor markets, with SK Hynix shares plunging 11% as the innovation questions demand for costly AI chips. Meanwhile, Apple beat earnings expectations but fell short on iPhone and China sales, highlighting risks tied to its core markets. In Australia, severe storms threaten life and key industries like sugarcane, fueling climate resilience debates. Lastly, Japan is exploring a $44 billion Alaska LNG pipeline to ease U.S. trade tensions, though economic viability remains uncertain.

DeepSeek’s AI Breakthrough: Powerful Models Built for Less

Chinese AI lab DeepSeek has unveiled a groundbreaking approach to building AI models at a fraction of the cost of industry leaders like OpenAI and Meta. By leveraging reinforcement learning (RL) to automate labor-intensive tasks and refining existing large language models, DeepSeek’s R1 model showcases strong reasoning capabilities despite using fewer resources. The company’s “aha moment” came when the model began solving problems autonomously, challenging the traditional reliance on human data labeling. Smaller models created through this process can even run on mobile devices, offering a cost-effective solution for developers. However, DeepSeek faces controversy as OpenAI accuses it of using its outputs to train its systems.

Investment Insight

DeepSeek’s innovation highlights the growing trend of smaller, more efficient AI models disrupting the industry. Investors may find opportunities in startups focusing on cost-effective AI solutions, as they pose a competitive threat to billion-dollar AI giants while expanding accessibility to smaller developers.

SK Hynix Shares Slide After DeepSeek AI Disruption

SK Hynix shares plunged over 11% as trading resumed in South Korea, following DeepSeek’s cost-efficient AI breakthrough that rattled global chipmakers. The news, which questions the reliance on expensive chips for AI development, triggered a selloff in semiconductor stocks, with Samsung Electronics also falling 3.7%. Korean internet firms like Kakao and Naver gained over 7% as investors speculated on potential cost-saving benefits. Despite SK Hynix reporting a 20-fold profit surge last quarter, the DeepSeek disruption has cast doubt on the long-term demand for costly AI hardware.

Investment Insight

The semiconductor sector faces heightened volatility as DeepSeek’s innovation reshapes AI development costs. Investors should monitor Korean tech stocks, which may gain from AI’s wider adoption, while remaining cautious about chipmakers exposed to shifting AI hardware demand.

Market price: SK Hynix Inc (KRX: 000660): KRW 199,200

Apple Earnings Beat Expectations Despite iPhone, China Sales Miss

Apple topped Wall Street forecasts with Q1 earnings per share of $2.40 on $124.3 billion in revenue, but iPhone sales and Greater China revenue fell short. iPhone revenue hit $69.1 billion, missing the $71 billion estimate, as market share dipped despite broader smartphone growth. Sales in China reached $18.5 billion, well below the $21.5 billion expected, continuing a multi-year decline. Apple’s AI-powered “Apple Intelligence” updates, part of its iPhone 16 push, have underwhelmed analysts as a growth driver. Shares remain up 24% over the last year, trailing Nvidia’s 102% surge and Meta’s 69% rise.

Investment Insight

Apple’s growth challenges highlight risks tied to its reliance on iPhone sales and the Chinese market. Investors may look to Apple’s Services segment and upcoming product launches for stability while monitoring broader AI-driven industry dynamics.

Market price: Apple Inc (AAPL): USD 237.59

Australia Faces Life-Threatening Floods as Storms Intensify

Australia is bracing for severe weather, with six storms brewing across its territories. One system in Queensland is expected to bring gale-force winds and potentially life-threatening flooding, with up to half a meter of rain forecast in 24 hours. Three other tropical lows have moderate chances of developing into cyclones by Monday, though they are not expected to cause onshore damage. The storm could disrupt Queensland’s sugarcane industry, a key export sector, while warmer ocean temperatures continue to fuel extreme weather. Australia’s cyclone season, ending in April, is expected to intensify amid climate-driven changes.

Investment Insight

Agriculture, mining, and energy sectors face heightened risks from Australia’s worsening weather. Investors should monitor sugarcane supply disruptions and potential hits to mining infrastructure, especially in cyclone-prone regions. Climate resilience strategies may present long-term opportunities.

Japan Considers $44 Billion Alaska LNG Pipeline to Ease US Trade Tensions

Japan is weighing support for a $44 billion Alaska LNG pipeline to court U.S. President Donald Trump and reduce trade friction. The project, which would transport gas 800 miles for liquefaction and export to Asia, aligns with Trump’s push for U.S. energy dominance. While Japan doubts the project’s economic viability, it may pledge exploratory support alongside increased U.S. gas purchases and defense investments to stave off potential tariffs. The pipeline could help Japan diversify energy supplies away from Russia and the Middle East, but any commitments will hinge on pricing and flexibility.

Investment Insight

Energy infrastructure players like Mitsubishi and Mitsui may benefit from Japan’s potential involvement in the Alaska LNG project, though risks remain tied to project feasibility. Investors should watch for developments in U.S.-Japan trade relations, which could impact broader markets, including energy and LNG shipping.

Conclusion

DeepSeek’s disruptive AI innovation underscores a shift toward cost-efficient models, sparking ripples across tech and semiconductor markets. Apple’s earnings highlight ongoing challenges in its core iPhone and China segments, while severe weather in Australia threatens key industries, emphasizing the growing impact of climate risks. Japan’s potential support for the Alaska LNG pipeline reflects broader geopolitical and energy diversification strategies amid global trade tensions. Together, these stories reveal a dynamic landscape where technological breakthroughs, environmental challenges, and shifting global alliances are reshaping industries and investment opportunities, urging stakeholders to adapt to rapidly evolving market and geopolitical realities.

Upcoming Dates to Watch

January 31, 2025: Tokyo CPI, Japan jobless claims, US PCE inflation

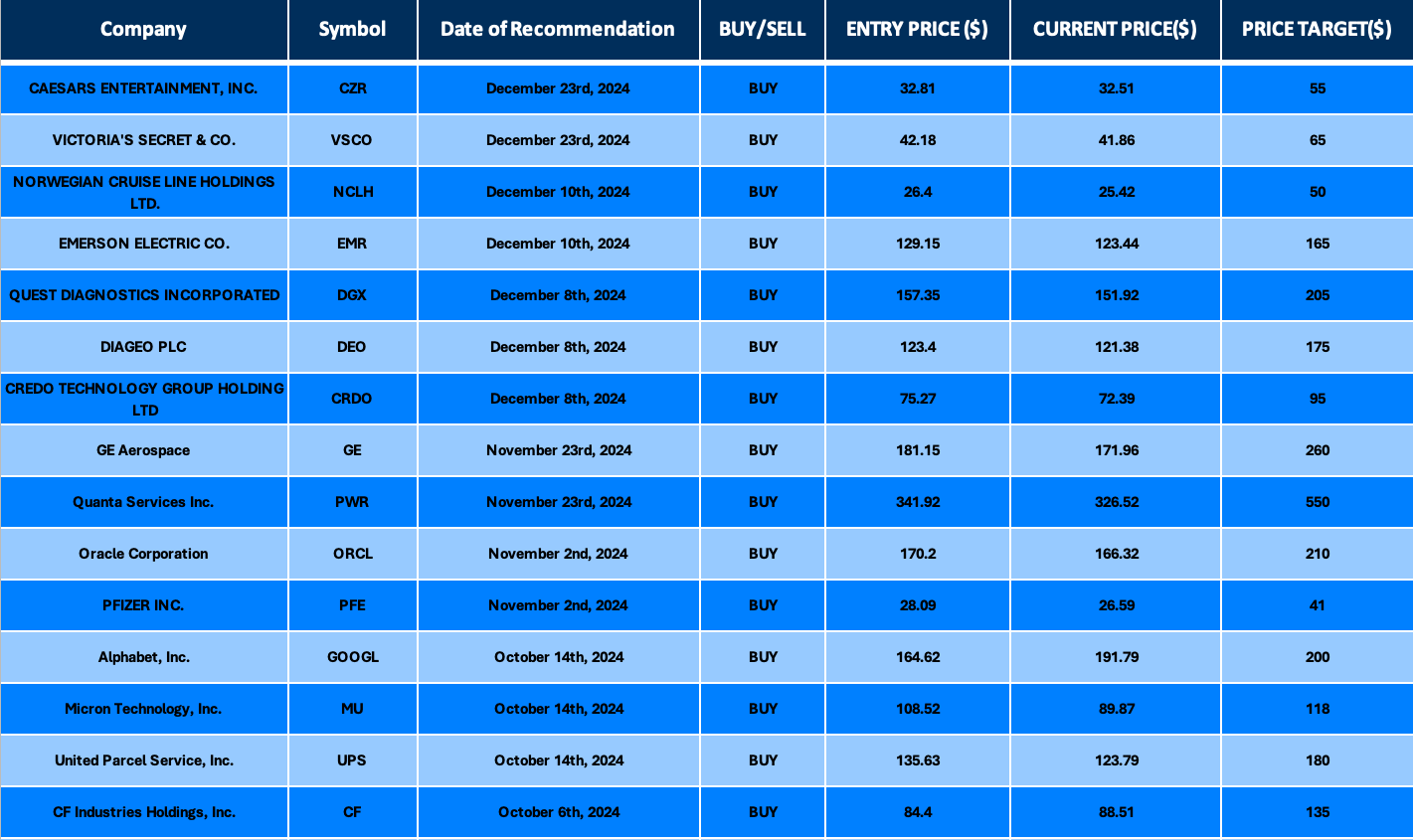

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.