Date Issued – 3rd February 2025

Preview

DeepSeek’s low-cost AI model is empowering European startups to compete with U.S. tech giants but raising regulatory concerns. The yen shows haven appeal as trade tensions escalate, though Japan faces tariff risks. Meanwhile, China proposes reviving the 2020 “Phase 1” trade deal to ease U.S. tariffs, signaling openness to dialogue. In Hong Kong, Chinese tech stocks rebounded despite weak manufacturing data, with Alibaba leading gains. France faces political turmoil as Prime Minister Bayrou’s budget push risks a no-confidence vote, threatening market stability. Investors should watch for developments in trade, AI, and fiscal reforms.

DeepSeek Offers European Tech a Shot in the Global AI Race

DeepSeek, a Chinese AI model, is disrupting the artificial intelligence landscape by offering services at a fraction of the cost of competitors like OpenAI. With pricing up to 40 times cheaper, it allows European startups to compete more effectively, bridging the gap with U.S. rivals that dominate the AI market. Early adopters, such as Novo AI and NetMind.AI, report seamless integration with DeepSeek’s technology and significant savings. However, concerns linger over regulatory scrutiny, data sources, and potential censorship. Analysts see DeepSeek’s low-cost approach as a catalyst for innovation, but larger companies remain cautious, prioritizing security and transparency.

Investment Insight: DeepSeek’s affordability could spark a pricing war in AI, challenging dominant players like OpenAI. Investors may want to monitor how regulatory hurdles and concerns over data practices evolve, as these could influence adoption and long-term profitability.

Yen Shows Flickers of Haven Strength Amid Dollar Dominance

The yen demonstrated resilience on Monday, weathering the dollar’s strength after President Trump imposed new tariffs. While most major currencies tumbled against the greenback, the yen stood out as the only G-10 currency to advance against the dollar this year. Analysts attribute the yen’s newfound haven appeal to the Bank of Japan’s rate hikes and high U.S. Treasury yields, which dip during risk-off periods. However, the yen’s safe-haven status faces uncertainty, as Japan might become a target for U.S. tariffs. Prime Minister Ishiba’s upcoming meeting with Trump could provide more clarity on this front.

Investment Insight: The yen’s relative strength could bolster its appeal as a defensive asset, particularly amid global trade tensions. However, investors should remain cautious, as potential tariff threats on Japan could undermine its haven status.

China Seeks to Revive 2020 ‘Phase 1’ Trade Deal Amid Tariff Tensions

China is reportedly proposing to restore the 2020 “Phase 1” trade deal with the U.S. as a starting point to resolve escalating trade tensions, according to the Wall Street Journal. The proposal includes pledges to avoid yuan devaluation, increase U.S. investments, and curb fentanyl precursor exports. This comes after President Trump imposed new tariffs on Chinese, Canadian, and Mexican imports over fentanyl and immigration concerns. While China condemned the tariffs, it signaled openness to dialogue, contrasting with Canada’s retaliatory measures. The original 2020 deal, which aimed to boost U.S. exports to China, fell short of targets due to the pandemic.

Investment Insight: The potential revival of the Phase 1 deal could ease trade tensions, creating opportunities for U.S. exporters and stabilizing markets. However, investors should remain wary of heightened geopolitical risks, particularly around China’s broader economic commitments and U.S. tariff strategies.

Chinese Stocks in Hong Kong Outperform as Tech Gains Offset Tariff Concerns

Chinese equities in Hong Kong outperformed regional peers, with tech giants Alibaba and SMIC driving a partial recovery in the Hang Seng China Enterprises Index after an early decline. Optimism around China’s advancements in AI, including DeepSeek’s low-cost model, supported sentiment, even as new U.S. tariffs loomed. Alibaba surged 6.1%, boasting its AI model’s performance surpasses Meta’s Llama. However, broader concerns persist as China’s manufacturing activity shrinks for a second consecutive month, fueling expectations of further stimulus measures ahead of March’s legislative meeting.

Investment Insight: Tech resilience in Hong Kong’s Chinese stocks highlights growth potential in AI, but U.S. tariffs and weak domestic consumption remain headwinds. Investors should watch for Beijing’s stimulus actions, which could stabilize markets and the yuan in the near term.

France Faces Political Crisis as Prime Minister Risks No-Confidence Vote Over Budget

French Prime Minister Francois Bayrou is set to push through the 2025 budget using Article 49.3, a constitutional provision that bypasses a parliamentary vote but allows for a no-confidence motion. Far-left lawmakers have already vowed to challenge Bayrou, whose minority government faces the threat of collapse, making it the third administration to fall in under a year. The move comes amid political gridlock in a fractured National Assembly and investor unease over France’s growing deficits. Bayrou’s budget aims to cut the deficit to 5.4% of GDP in 2025, focusing on €50 billion in savings.

Investment Insight: France’s political instability continues to weigh on markets, with sovereign debt underperforming in the region. Investors should monitor the no-confidence vote and its impact on fiscal reforms, as further gridlock could trigger renewed asset sell-offs.

Conclusion

From DeepSeek’s disruptive AI breakthroughs to China’s trade overtures and the yen’s resilience amid tariffs, global markets are navigating a complex landscape of innovation and geopolitical tension. Hong Kong’s tech rally underscores the potential of Chinese advancements, even as economic headwinds persist. Meanwhile, France’s political uncertainty highlights the challenges of fiscal reform in fragmented governments. As markets react to these developments, investors should remain vigilant, focusing on regulatory risks, trade dynamics, and stimulus measures. With shifting economic and political tides, staying informed on these key stories will be crucial in identifying opportunities and managing risks.

Upcoming Dates to Watch

- February 4th, 2025: Alphabet, UBS, BNP Paribas earnings

- February 5th, 2025: Eurozone HCOB Services PMI, PPI

- February 6th, 2025: UK rate decision, Amazon earnings

- February 7th, 2025: US nonfarm payrolls, unemployment; Canada unemployment

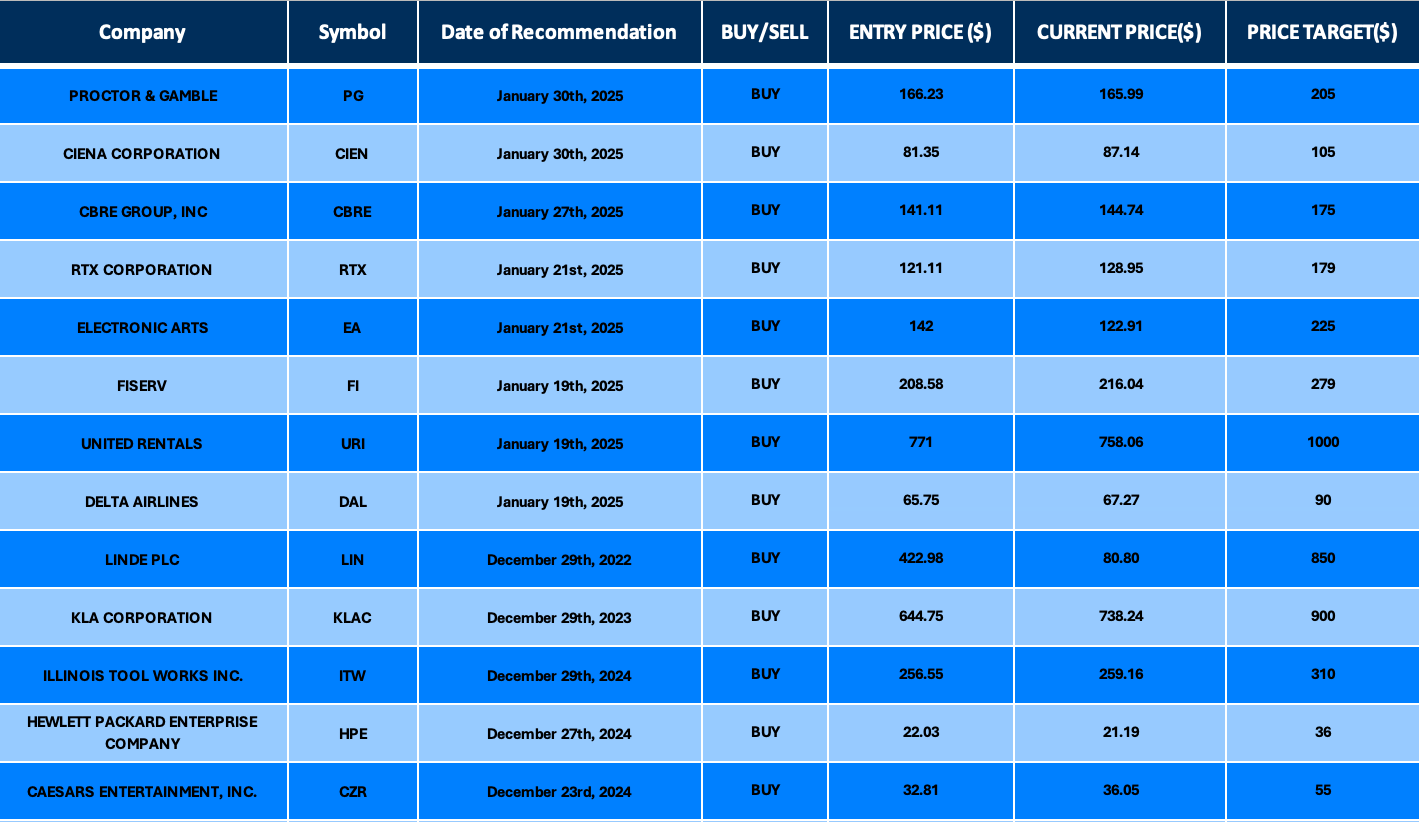

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.