Date Issued – 4th February 2025

Preview

Palantir shares surged over 23% on strong 2025 revenue forecasts, fueled by rising AI demand and US defense contracts. Meanwhile, a strong US dollar has spurred $54 billion in outflows from emerging Asian markets, pressuring currencies and equities, though supply chain shifts may benefit nations like Vietnam and Malaysia. Copper and zinc prices climbed as Trump delayed tariffs on Canada and Mexico, easing trade tensions temporarily. OpenAI and Kakao announced a partnership to develop AI products for South Korea, with OpenAI considering investment in the nation’s $1.4 billion AI computing center. Salesforce, under pressure to maintain profit margins, is cutting 1,000 jobs while hiring for its AI sales team, signaling a focus on high-growth tech innovation.

Palantir Surges Over 23% on Explosive AI Demand

Palantir Technologies saw its shares skyrocket by over 23% after releasing a bullish 2025 revenue forecast of $3.75 billion, exceeding Wall Street’s $3.54 billion expectation. The Denver-based company attributed this growth to “untamed organic demand” for its AI software. In 2024, Palantir’s stock surged 340%, fueled by growing commercial and government adoption of its data analysis tools.

Fourth-quarter revenue climbed 36% to $827.5 million, surpassing forecasts of $775.9 million, with US government sales up 45% and US commercial revenue up 64%. CEO Alex Karp highlighted Palantir’s deepening role in US defense, including partnerships with military branches, Ukraine, and Israel. The company also strengthened alliances with tech firms like Anduril and Anthropic, signaling a shift toward a software-led defense ecosystem.

Investment Insight: Palantir’s robust performance and expanding ties with US defense underscore its growing dominance in the AI space. Investors should monitor its ability to sustain growth amid political and budgetary shifts.

Market price: Palantir Technologies Inc. (PLTR): USD 83.74

Strong US Dollar Fuels $54 Billion Outflow From Emerging Asia

A surging US dollar, driven by Donald Trump’s new tariffs, is amplifying pressure on emerging Asian markets, which have already seen $54 billion in stock outflows over the past seven months. The stronger dollar limits room for interest-rate cuts in the region, while trade tensions and inflation concerns further strain economies like Indonesia, China, and India.

Currencies, including the Australian dollar and Indian rupee, plunged as US tariffs on China, Mexico, and Canada were announced. The MSCI Asia Pacific Index fell 4.4% since Trump’s election, while the Bloomberg Dollar Spot Index hit its highest level since November 2022. Analysts warn that a stronger dollar often drives investors toward safer US assets, exacerbating capital flight from emerging markets.

Singapore, Malaysia, and Vietnam may stand to gain as companies diversify supply chains away from China.

Investment Insight: The strong US dollar poses ongoing risks to emerging Asian equities. Investors should tread cautiously, focusing on resilient markets and sectors benefiting from supply chain shifts.

Copper and Zinc Rise as Trump Delays Tariffs on Canada, Mexico

Copper and zinc prices climbed after President Donald Trump postponed 25% tariffs on Canada and Mexico by a month, easing trade tensions and weakening the US dollar. Copper, a key industrial indicator, gained 0.7% to $9,159 a ton on the London Metal Exchange, while zinc and aluminum also saw modest increases.

The tariff delay follows agreements by Canada and Mexico to bolster border control measures, temporarily averting a continental trade war. Meanwhile, uncertainty persists as the US considers implementing tariffs on China, with talks between Trump and Chinese President Xi Jinping potentially on the horizon.

Investment Insight: Base metals show resilience amid easing trade tensions, but volatility will persist as US-China tariff decisions loom. Investors should monitor commodity-driven sectors and currency shifts closely.

OpenAI and Kakao Partner to Develop AI Products for South Korea

OpenAI and South Korea’s Kakao announced a strategic partnership to create AI products tailored for the Korean market. Kakao plans to integrate OpenAI technology into its offerings, while OpenAI CEO Sam Altman emphasized South Korea’s critical role in global AI development during a press conference in Seoul.

Altman also met with executives from SK Group and Samsung, highlighting the importance of South Korean companies like SK Hynix and Samsung Electronics, which produce key memory chips for AI processors. OpenAI is “actively considering” joining South Korea’s $1.4 billion national AI computing center initiative, aligning with the country’s ambition to lead in AI infrastructure.

Investment Insight: OpenAI’s expansion into South Korea underscores the region’s strategic importance in AI hardware and software innovation. Investors should monitor South Korean tech firms poised to benefit from growing AI partnerships and infrastructure investments.

Market price: Kakao Corp (KRX: 035720): KRW 40,450

Salesforce Cuts 1,000 Jobs While Expanding AI Sales Team

Salesforce is laying off over 1,000 employees as it begins its new fiscal year, even as it ramps up hiring for sales roles tied to its AI product line. Displaced workers will have the opportunity to apply for other roles within the company. This move follows broader workforce reductions across the tech sector, including Amazon, Microsoft, and Meta, as firms balance innovation with profitability.

Salesforce, with nearly 73,000 employees as of January 2024, is under pressure to maintain profit margins after scrutiny from activist investors. The company remains focused on scaling its AI-powered tools like Agentforce while improving operational efficiency.

Investment Insight: Salesforce’s dual strategy—cutting costs while investing in AI—highlights its pivot to growth in high-demand tech sectors. Investors should watch its upcoming earnings and AI product performance as key indicators of success.

Market price: Salesforce Inc (CRM): USD 339.24

Conclusion

The global landscape is shifting as AI innovation drives growth, trade tensions reshape markets, and companies balance efficiency with expansion. Palantir’s explosive growth underscores the rising demand for AI, while OpenAI’s partnership with Kakao highlights South Korea’s pivotal role in the AI ecosystem. At the same time, Salesforce’s dual strategy of layoffs and AI-focused hiring reflects the balancing act across tech industries.

However, challenges persist, with a strong US dollar pressuring emerging markets and trade uncertainties fueling volatility in commodities. Investors should stay vigilant, focusing on sectors poised for growth amid these evolving dynamics.

Upcoming Dates to Watch

- February 4th, 2025: Alphabet, UBS, BNP Paribas earnings

- February 5th, 2025: Eurozone HCOB Services PMI, PPI

- February 6th, 2025: UK rate decision, Amazon earnings

- February 7th, 2025: US nonfarm payrolls, unemployment; Canada unemployment

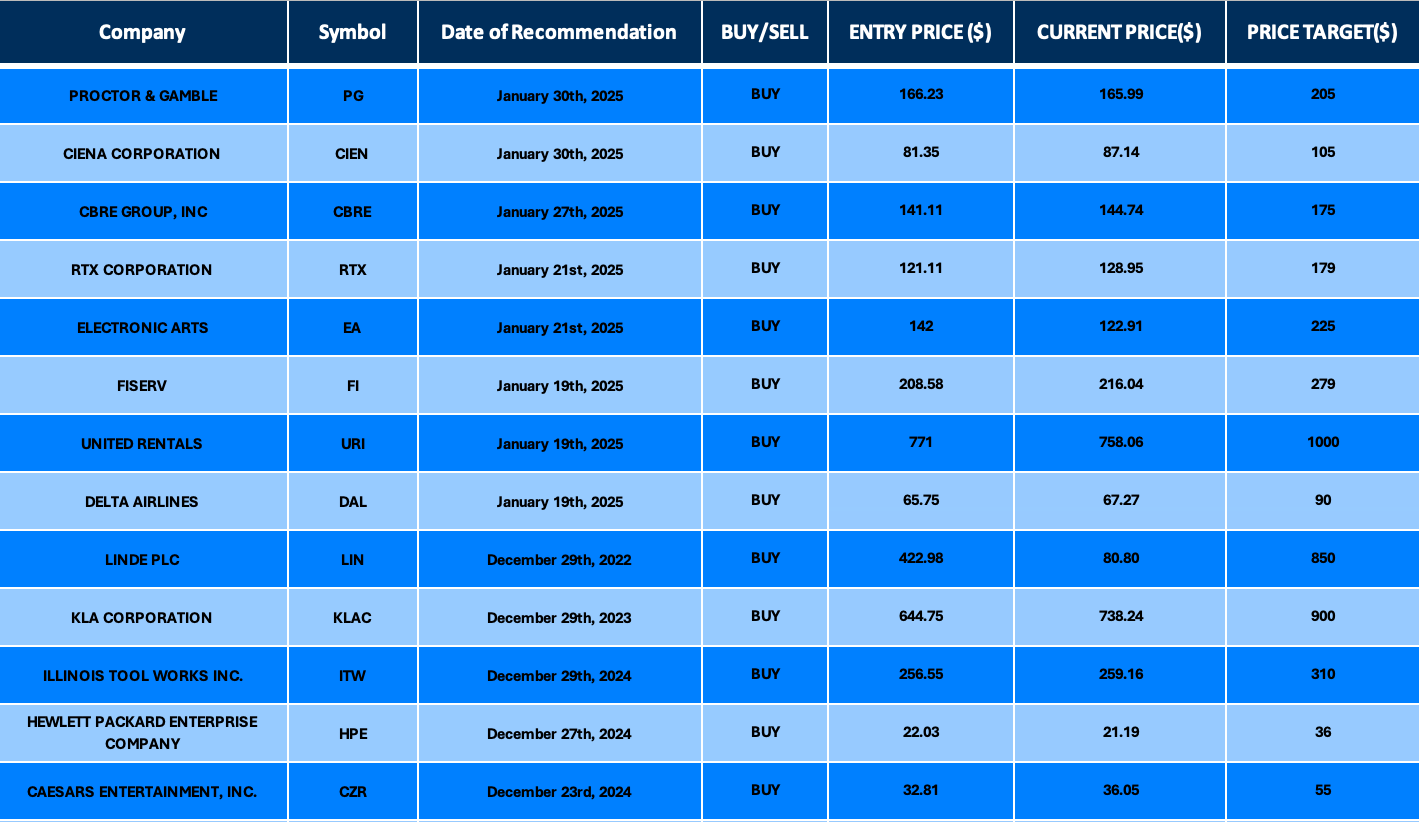

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.