Date Issued – 5th February 2025

Preview

Toyota is expanding its EV operations in China with a new Shanghai unit set to produce 100,000 Lexus vehicles annually by 2027 while raising its profit forecast to ¥4.7 trillion ($30.7 billion) despite a quarterly earnings dip. Meanwhile, Trump’s revocation of the de minimis rule and new 10% tariffs on Chinese imports are raising costs for e-commerce giants like Shein and Temu, spurring legal challenges and market shifts. Asian stocks slid after weak Chinese manufacturing data and escalating US-China trade tensions, with gold hitting a record high. The USPS also suspended parcels from China and Hong Kong, further straining supply chains. Lastly, California’s wildfires underscore the state’s insurance crisis, as reliance on the underfunded FAIR Plan grows amid private insurer pullbacks. Elevated risks persist across trade, insurance, and commodity markets.

Toyota Expands in China and Raises Profit Forecast

Toyota Motor is establishing a wholly owned unit in Shanghai to develop and produce electric vehicles and batteries for its Lexus brand, with production beginning in 2027. The unit aims to produce 100,000 vehicles annually and create 1,000 jobs in its initial phase. Toyota will also partner with the Shanghai municipal government on carbon-neutral initiatives, aligning with China’s 2060 carbon neutrality goal.

Meanwhile, Toyota raised its full-year operating profit forecast by 9% to 4.7 trillion yen ($30.7 billion), driven by strong hybrid vehicle demand and improved product competitiveness. Despite a 28% decline in third-quarter profit, Toyota remains the world’s top-selling automaker, with 2024 global sales of 10.8 million vehicles.

Investment Insight: Toyota’s strategic investment in China’s EV market and strong financial performance highlight its resilience and foresight in adapting to global trends. Its leadership in hybrid sales and expansion into electrification make it a solid contender for long-term growth.

Market price: Toyota Motor Corp (TYO: 7203): JPY 2,958

Trump’s Tariffs Close Loophole for Shein and Temu

The White House has eliminated the de minimis exemption, which allowed packages under $800 to enter the U.S. duty-free, as part of Trump’s new 10% tariff on Chinese goods. This change targets Chinese e-commerce giants like Shein and Temu, whose rapid growth relied on tax-free shipments of low-cost goods. The exemption, expanded in 2016, fueled a surge from 139 million packages in 2015 to over 1.36 billion in 2024, sparking criticism from U.S. manufacturers and scrutiny over its use in drug trafficking. Ending de minimis for Chinese imports could cost U.S. consumers $11.4 billion in fees and tariffs annually, disproportionately affecting low-income households. Legal challenges to the tariffs are likely, as their legality under existing laws remains uncertain.

Investment Insight: The closure of the de minimis loophole may reshape e-commerce by increasing costs for Chinese retailers and incentivizing domestic alternatives. Investors should monitor shifts in consumer spending and potential litigation outcomes, as they could impact major platforms like Amazon and disrupt the discount retail market.

US Futures Dip, Asian Stocks Lose Momentum Amid Trade Tensions

Asian stocks pared gains as Chinese shares fell upon reopening after Lunar New Year, weighed down by escalating trade tensions between the US and China. Hong Kong equities slid, while US and European futures turned lower, impacted by Alphabet Inc. and AMD’s extended trading losses. The US Postal Service temporarily halted international packages from China and Hong Kong following Trump’s revocation of the de minimis exemption for Chinese imports. Meanwhile, the yuan weakened under mounting trade pressures, and weaker-than-expected Chinese manufacturing data further dampened sentiment. Gold surged to a record high above $2,854 an ounce, while oil declined on concerns over global growth.

Investment Insight: Rising US-China trade tensions and weak Chinese economic data are driving market volatility. Investors should remain cautious of near-term risks to equities, particularly in Asian markets, while gold and other safe-haven assets may continue to gain appeal amid uncertainty.

US Postal Service Halts Parcels From China and Hong Kong

The US Postal Service (USPS) has temporarily suspended inbound international packages from China and Hong Kong, disrupting shipments from e-commerce giants like Shein and Temu. The move follows President Trump’s revocation of the de minimis rule, which previously allowed packages under $800 to enter the US duty-free, and the implementation of a new 10% tariff on Chinese goods. Critics argue the loophole enabled a flood of untracked parcels, some linked to illicit goods like fentanyl. While the USPS restriction rattled Asian markets, analysts believe its impact may be limited as private carriers like UPS and FedEx now handle most cross-border shipments.

Investment Insight: The USPS suspension signals heightened US-China trade tensions, adding pressure on Chinese e-commerce players and their supply chains. Investors should watch for potential tariff pauses or negotiations, but near-term risks to Chinese retail stocks and global shipping remain elevated.

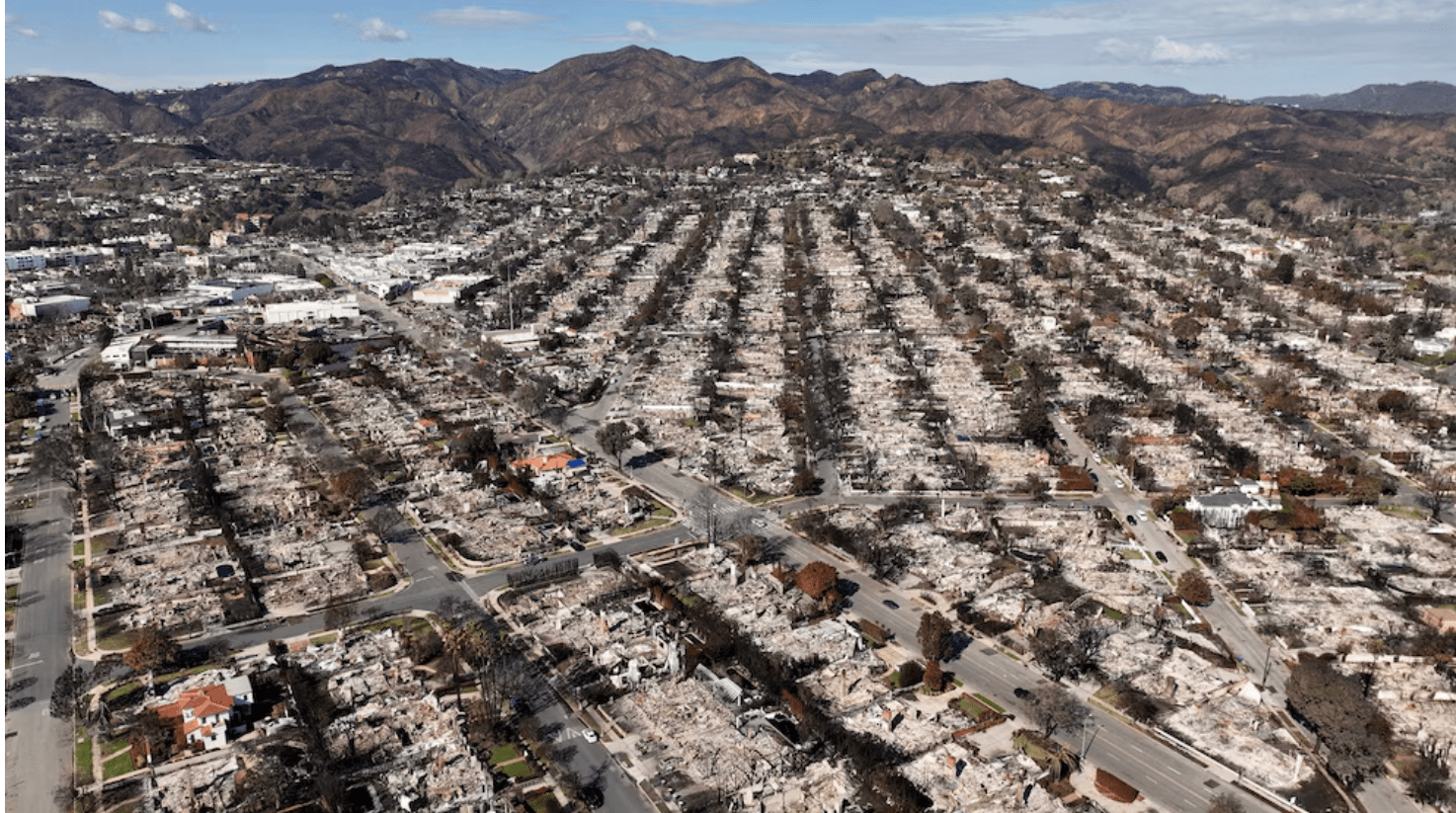

LA Wildfires Expose California’s Insurance Crisis

The devastating Eaton and Palisades wildfires have highlighted California’s growing home insurance crisis. Homeowners like Chris Wilson, forced onto the state’s FAIR Plan after private insurers declined coverage, are receiving far less support to rebuild than neighbors with private insurance. The FAIR Plan, a last-resort option for high-risk properties, often comes with higher premiums and limited coverage, leaving many underinsured. With FAIR policies doubling to 452,000 since 2020, the state is grappling with how to balance rising wildfire risks and the retreat of private insurers. Proposed solutions include allowing insurers to raise premiums for high-risk areas and directing $25 million toward fire mitigation efforts.

Investment Insight: The shrinking private insurance market in wildfire-prone areas underscores risks for insurers and homeowners alike. Investors should monitor regulatory developments and climate-driven pricing changes, which could reshape the insurance industry and influence real estate values in high-risk zones.

Conclusion

Global markets are grappling with uncertainty as US-China trade tensions escalate, impacting Asian equities, e-commerce giants, and supply chains. Toyota’s strategic EV expansion in China highlights opportunities amid shifting industry dynamics, while California’s wildfire insurance crisis underscores the growing financial risks of climate change. Gold’s record surge reflects investor caution, while oil’s decline signals concerns over global growth.

As regulatory changes reshape industries from retail to insurance, investors should remain vigilant, focusing on safe-haven assets and sectors with long-term growth potential. The week ahead promises further volatility as geopolitical and economic developments continue to drive markets. Stay prepared.

Upcoming Dates to Watch

- February 5th, 2025: Eurozone HCOB Services PMI, PPI

- February 6th, 2025: UK rate decision, Amazon earnings

- February 7th, 2025: US nonfarm payrolls, unemployment; Canada unemployment

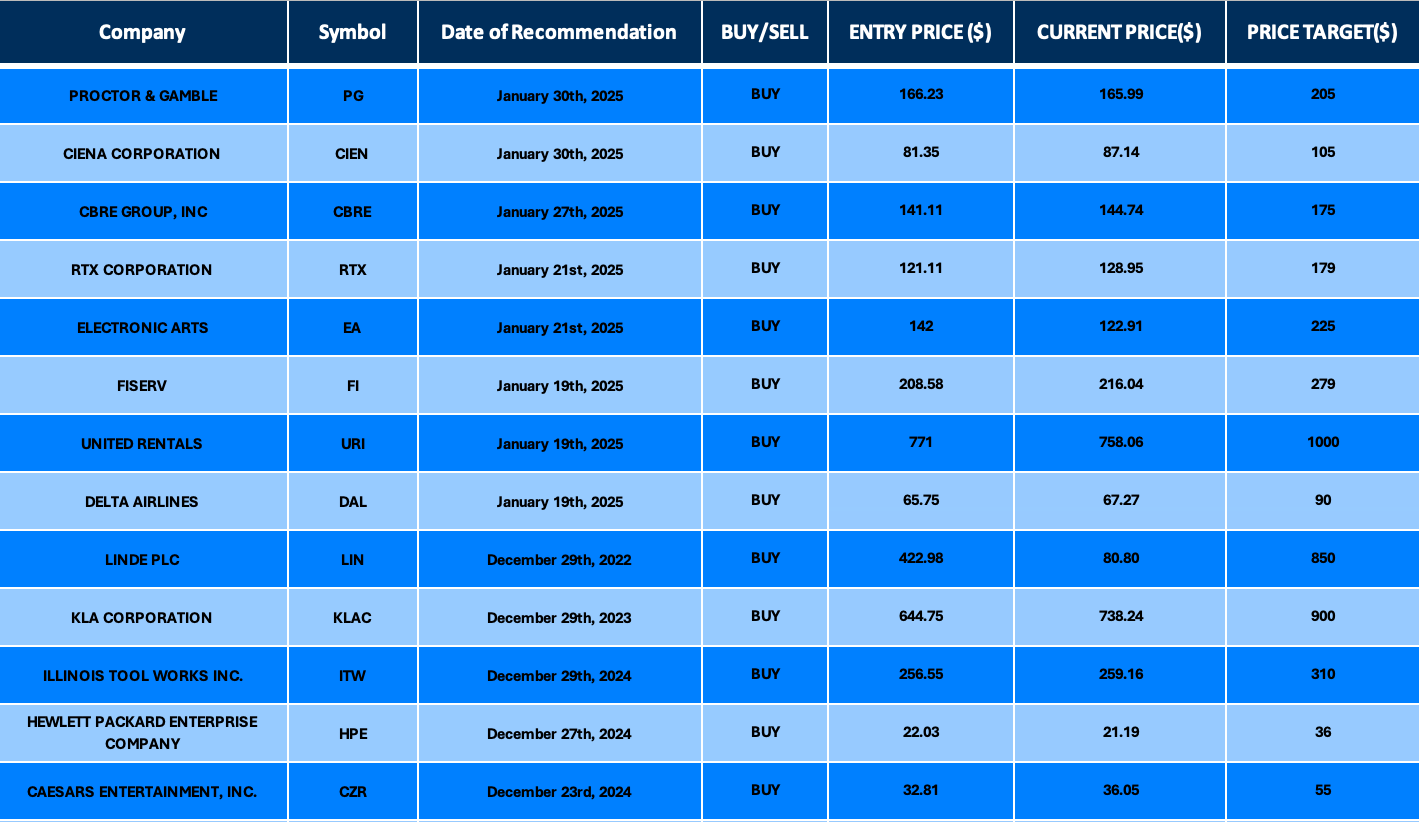

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.