Date Issued – 7th February 2025

China’s Private Oil Refiners and Global Market Impacts

China’s private oil refiners, or “teapots,” have cut operating rates to 43.64%, the lowest since March 2020, as U.S. sanctions on Russian oil disrupt supply chains and force reliance on costlier alternatives. Meanwhile, Hong Kong faces mounting risks as U.S. tariffs now treat the city like mainland China, eroding its appeal to international investors. In the U.S., January job growth is expected to slow to 170,000, with disruptions and revisions adding uncertainty. Chinese tech stocks rallied, pushing the Hang Seng Tech Index into a bull market, while Xiaomi hit a record high, fueled by subsidies, new product launches, and AI momentum.

Moderate U.S. Job Growth Expected Amid January Data Distortions

U.S. job growth likely slowed in January, with economists forecasting a gain of 170,000 jobs, down from December’s 256,000 surge. The slowdown reflects temporary disruptions from California wildfires and severe winter weather, as well as annual revisions to employment data. The unemployment rate is expected to hold steady at 4.1%, with wage growth remaining solid at 0.3% for the month. However, economists warn that job growth is increasingly concentrated in lower-paying industries, masking potential white-collar job losses.

Investment Insight: Labor market resilience supports the Federal Reserve’s pause on rate cuts, but investors should be cautious of slower employment momentum and policy-related uncertainties in early 2025.

China’s Oil Teapots Cut Runs to Pandemic Levels Amid Sanctions

Chinese private oil processors, known as “teapots,” have reduced operating rates to just 43.64%, the lowest since March 2020. The drop follows U.S. sanctions on Russian oil that have severely limited access to the preferred ESPO crude grade. The sanctions, imposed last month, disrupted supply chains and increased reliance on more expensive alternatives like Oman and Abu Dhabi crude.

Refiners in Shandong province, already grappling with a sluggish economy and weak fuel demand, are now facing mounting losses—over 150 yuan per ton compared to 300 yuan in profits a year ago. The disruption has also impacted refiners across Asia, where rising freight costs and tighter supply add to the strain.

Investment Insight: China’s teapots, a key player in the global oil market, are under unprecedented pressure. The sanctions not only highlight vulnerabilities in the supply chain but could also ripple through broader energy markets as refiners cut operations further.

Hong Kong Caught in Trump’s Trade War With China

Hong Kong’s global financial hub status faces fresh pressure as Donald Trump’s new trade war policies equate the city with mainland China. A 10% tariff on Chinese goods now includes Hong Kong, following the 2020 removal of its special privileges. The move underscores growing geopolitical risks for businesses operating in the city, as U.S. actions blur distinctions between Hong Kong and Beijing. Economists expect minimal direct economic impact from the tariffs, but the broader implications of diminished autonomy could deter international investment and further erode the city’s image.

Investment Insight: Businesses with ties to Hong Kong face escalating political risks, particularly in regions where the U.S. and China compete for influence. Investors should closely monitor geopolitical developments as Hong Kong’s unique status diminishes.

China Lifts Asian Stocks as Markets Await U.S. Jobs Data

Chinese tech stocks rallied Friday, propelling Hong Kong’s Hang Seng Index to its highest since November, while the Hang Seng Tech Index entered a technical bull market with a 20% gain since January. Mainland Chinese and Taiwanese stocks also advanced, offsetting declines in Japan and South Korea. Traders are now focused on U.S. nonfarm payroll data, expected to show 175,000 new jobs, which will shape expectations for Federal Reserve rate cuts. A weak jobs number could fuel rate-cut hopes, while a stronger figure may delay monetary easing.

Investment Insight: Chinese tech stocks show renewed momentum, driven by AI developments. Investors should monitor U.S. jobs data closely as it may impact global rate expectations and market volatility.

Xiaomi Hits Record High on China’s Subsidy Program

Xiaomi Corp. shares hit a record high in Hong Kong, surging 12% this week, fueled by China’s consumer subsidy program and upcoming launches of the SU7 Ultra EV and 15 Ultra smartphone. Analysts raised shipment forecasts, citing subsidies for wearables and falling AI costs after DeepSeek’s latest model launch. Xiaomi’s strong 2024 performance, driven by its EV entry and AIoT platform, positions it for continued growth in 2025 as factory capacity expands.

Investment Insight: Xiaomi’s record-breaking rally highlights its strength in leveraging subsidies and AI advancements. Investors should watch for further gains tied to its diversified product strategy and Chinese tech’s bull market momentum.

Conclusion

Global markets face heightened uncertainty as geopolitical tensions, economic slowdowns, and shifting policies weigh on key players. China’s oil teapots struggle under U.S. sanctions, while Hong Kong’s diminishing autonomy raises risks for investors. Slower U.S. job growth adds to concerns, though solid wage gains suggest resilience. On a brighter note, Chinese tech stocks and Xiaomi’s record-breaking rally highlight opportunities in AI and consumer-driven innovation. As markets navigate these mixed signals, investors should remain vigilant, balancing near-term risks with long-term growth potentials, particularly in tech and energy sectors. Global trends demand a close watch on evolving policies and market drivers.

Upcoming Dates to Watch

- February 7th, 2025: US nonfarm payrolls, unemployment; Canada unemployment

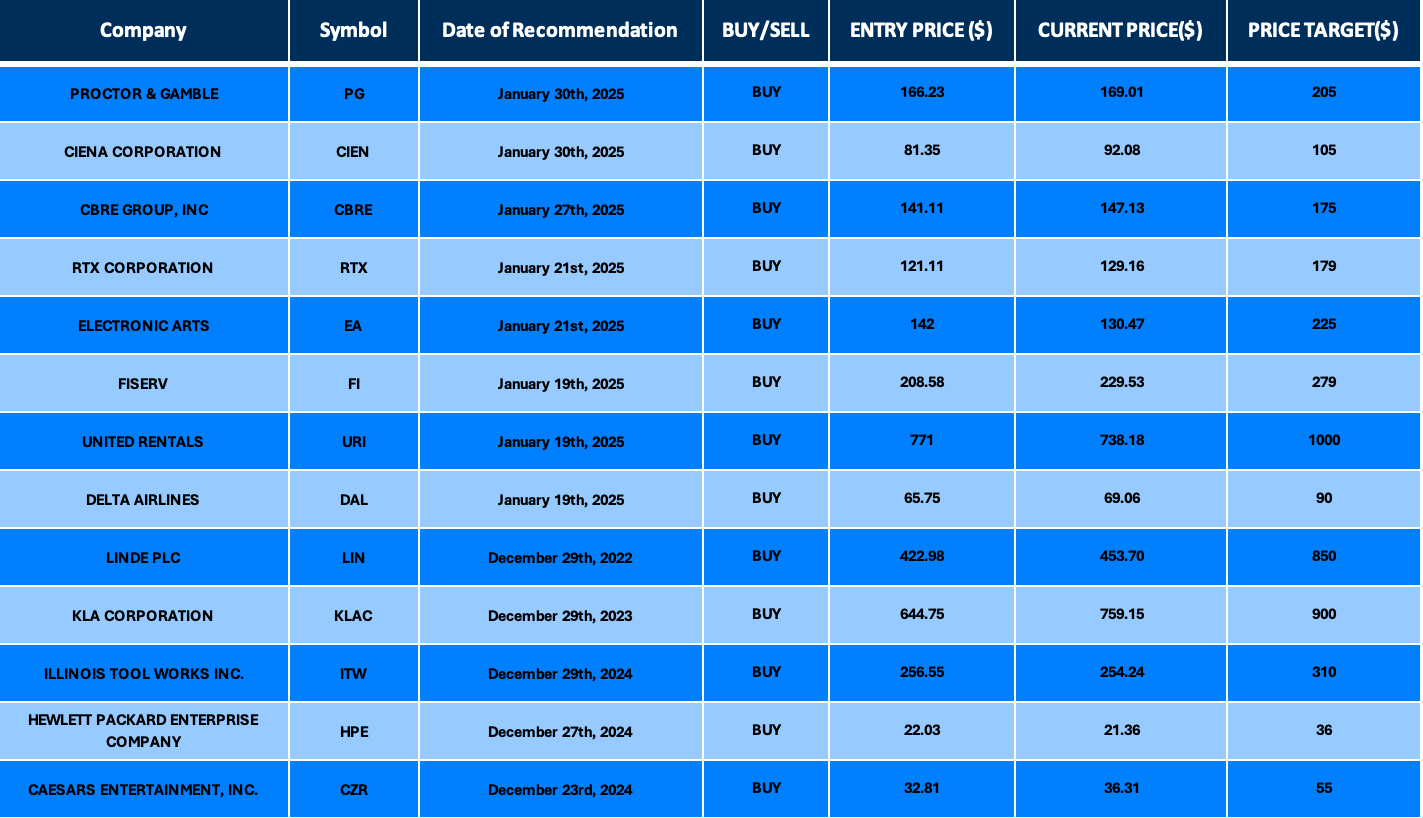

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.