Date Issued – 10th February 2025

Preview

China has launched a pilot program allowing insurers to invest in gold for the first time, unlocking up to $27.4 billion in potential demand. Separately, the country will transition to market-based pricing for renewable energy by year-end, moving its maturing clean energy sector away from subsidies. Taiwan Semiconductor Manufacturing Co. (TSMC) reported slowing sales growth amid AI market shifts and geopolitical risks but plans record $42 billion capital expenditures in 2025. Meanwhile, President Trump’s proposed 25% tariffs on steel and aluminum imports drove the dollar higher and Asian stocks lower, fueling trade tensions. In AI, OpenAI CEO Sam Altman predicts usage costs will drop 10x annually, driving exponential adoption. Tech giants like Amazon and Microsoft plan to ramp up AI investments, with combined capex surpassing $320 billion this year. Markets remain focused on monetary policy signals, inflation data, and geopolitical developments for clarity on long-term impacts.

China Opens $27 Billion Opportunity for Gold Investment

China has launched a pilot program allowing insurers to invest in gold for the first time, potentially unlocking $27.4 billion in funds. Ten major firms, including PICC Property & Casualty Co. and China Life Insurance Co., can allocate up to 1% of their assets to bullion. This marks a significant policy shift as authorities seek alternatives to traditional investment options amid a property slump and economic slowdown. Gold, which has surged 40% since late 2023, continues to rally on economic and geopolitical risks.

Investment Insight

Gold’s inclusion in Chinese insurers’ portfolios signals increased institutional demand, reinforcing its safe-haven appeal. However, investors should watch for potential volatility as prices may already reflect heightened interest.

China Moves to Market-Based Pricing for Clean Energy

China is set to end fixed pricing for renewable energy, allowing market forces to determine electricity costs. Local governments will implement the new pricing system by year-end, with safeguards like balancing payments to limit price volatility. Wind and solar projects installed before June 1, 2025, will retain existing compensation rules, while newer projects face less favorable terms. This transition reflects China’s effort to move its maturing renewable energy sector away from subsidies while managing economic pressures.

Investment Insight

Market-based pricing could improve efficiency in China’s renewable sector but may pressure profit margins for new projects. Investors should monitor how balancing payments and local policies evolve, especially for post-June installations.

TSMC Sales Growth Slows Amid AI Market Shifts

Taiwan Semiconductor Manufacturing Co. (TSMC) reported a 36% revenue increase in January to NT$293.3 billion ($8.9 billion), down from 38.8% growth in Q4 2024. Analysts had expected a 41% rise for the current quarter. The slowdown comes as Nvidia’s primary chip supplier faces uncertainty in AI spending, driven by competition from Chinese startup DeepSeek. Meanwhile, TSMC plans record capital expenditures of $42 billion in 2025, despite potential US tariffs on semiconductor imports.

Investment Insight

While AI demand remains robust, rising competition and geopolitical tensions pose risks to TSMC’s growth. Investors should monitor capital expenditure execution and US policy developments for mid-term impacts.

Market Price: Taiwan Semiconductor Manufacturing Co. Ltd. (TPE:2330): TWD 1,105.00

Dollar Rises, Asian Stocks Drop on Trump Tariffs

President Donald Trump’s plan to impose a 25% tariff on all steel and aluminum imports sent the dollar higher and Asian stocks lower, with the benchmark for regional shares experiencing its biggest drop in a week. The greenback gained against major currencies as markets speculated on rising inflation and limited Federal Reserve rate cuts. Meanwhile, US and European stock futures showed modest gains, as investors anticipated Fed Chair Jerome Powell’s testimony and key US inflation data this week.

Hong Kong stocks bucked the trend, with the Hang Seng Tech Index climbing to its highest level since October, driven by optimism over China’s AI advancements. Commodities markets remained muted, while US Treasury yields edged lower.

Investment Insight

Rising tariffs heighten global trade tensions, creating short-term volatility in equities and commodities. Investors should focus on Fed policy signals and inflation data for guidance on the broader impact of protectionist moves.

Sam Altman Predicts 10x Annual Drop in AI Costs

OpenAI CEO Sam Altman stated in a blog post that the cost of using AI will drop 10 times annually, driving exponential adoption. Highlighting a 150x price-per-token reduction from GPT-4 in 2023 to GPT-4o in 2024, Altman compared this trend to Moore’s Law but noted it is “unbelievably stronger.” He also emphasized that AI intelligence scales predictably with investment, suggesting no near-term limits to exponential growth. Altman predicts dramatic economic shifts, including falling costs for many goods and rising prices for limited resources like land.

The post comes as tech giants like Amazon, Microsoft, and Meta ramp up AI investments, with combined capex exceeding $320 billion in 2025, and following the launch of Stargate, a $500 billion US-led AI infrastructure project.

Investment Insight

Plummeting AI costs could disrupt industries, creating opportunities in software and services while pressuring hardware suppliers. Investors should focus on emerging AI applications and infrastructure initiatives like Stargate for long-term growth potential.

Conclusion

From China’s $27 billion gold investment opportunity to its market-based clean energy shift, the week highlights the nation’s evolving economic strategies. TSMC’s slowing sales growth reflects growing competition in AI, while Trump’s proposed tariffs fuel global trade tensions and market volatility. Amid this, OpenAI’s Sam Altman predicts plummeting AI costs, signaling transformative impacts across industries as tech giants ramp up investments. As geopolitical shifts and monetary policy remain in focus, investors should stay attuned to inflation data, US-China dynamics, and the AI sector’s rapid evolution for both risks and opportunities in the months ahead.

Upcoming Dates to Watch

- February 10th, 2025: China retaliatory tariffs on US to take effect

- February 11th, 2025: Brazil CPI

- February 12th, 2025: US CPI; India CPI, Industrial Production

- February 13th, 2025: German CPI, Eurozone Industrial Production

- February 14th, 2025: Eurozone GDP

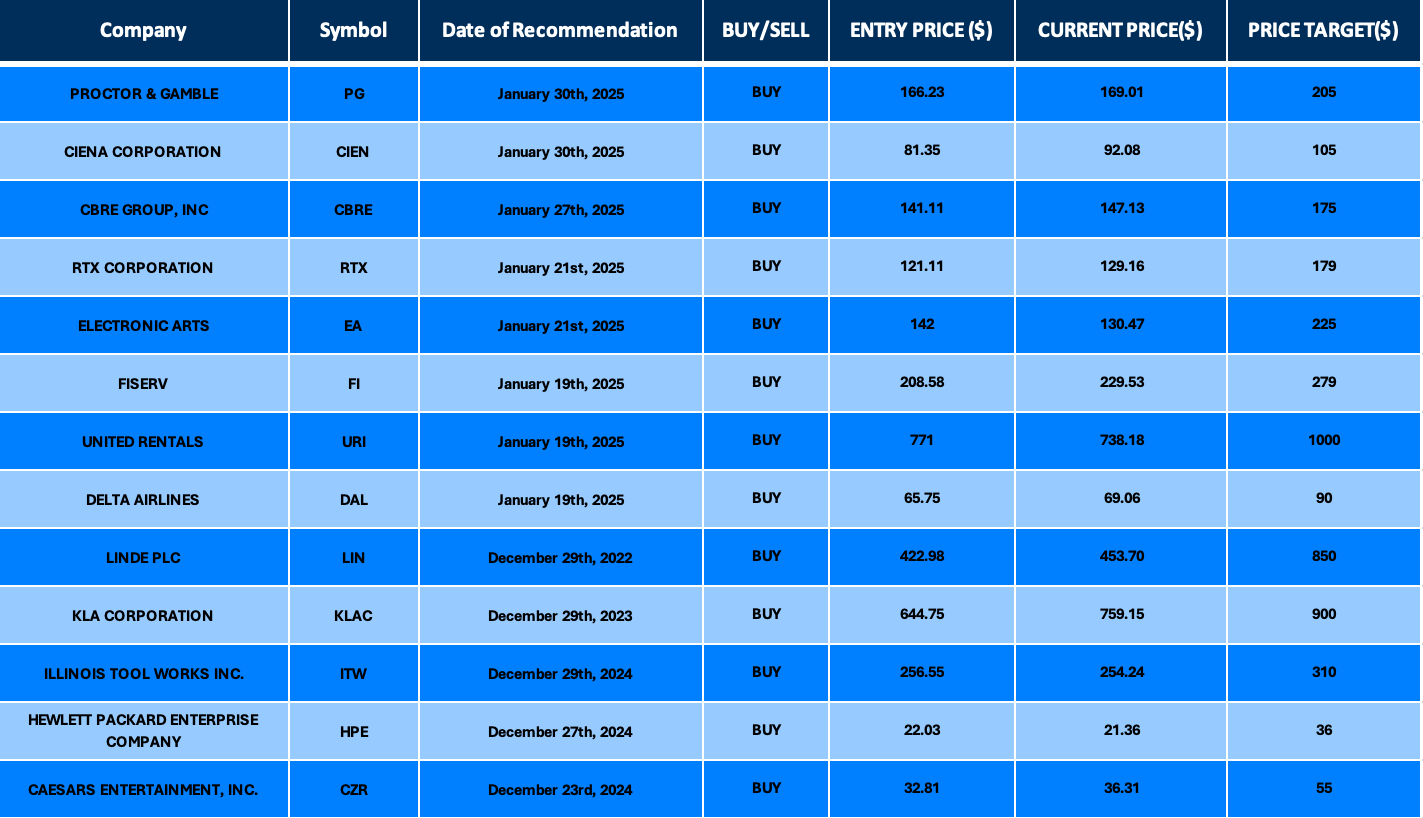

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.