Date Issued – 11th February 2025

Market Overview

Markets saw significant moves this week, starting with US Steel shares surging 6% on Trump’s proposed 25% steel tariffs, boosting domestic producers but raising concerns for industries reliant on steel. India’s rupee rallied nearly 1%, marking its biggest jump in two years, following heavy suspected intervention by the Reserve Bank of India to stabilize the currency. Meanwhile, gold hit record highs near $2,950/oz as trade war fears and geopolitical tensions over Trump’s ultimatum to Hamas drove safe-haven demand. UK savers turned to gilts for tax-free gains, with rising purchases fueled by high yields and economic uncertainty. Finally, Foxconn shares climbed 3% on strong January sales, driven by AI server demand, though challenges in consumer electronics remain.

US Steel Surges on Trump Tariff Plan

US Steel shares jumped 6% Monday after former President Donald Trump proposed a 25% tariff on steel imports. The announcement, expected to be formalized soon, boosted US metals producers like Nucor (+7%), Cleveland-Cliffs (+15%), and Steel Dynamics (+6%). The tariffs aim to curb cheaper foreign steel imports, granting domestic producers pricing power and higher profit potential. While the policy may hurt Canada, Brazil, and Mexico—America’s top steel suppliers—it is expected to have limited impact on China, which ranks lower as a supplier.

Investment Insight: Tariff-driven price hikes could bolster US steelmakers’ margins, but higher costs for key inputs may weigh on industries reliant on steel, like automotive and construction. Diversify exposure to mitigate sector-specific risks.

Market Price: United States Steel Corp (NYSE: X): USD 38.70

Rupee’s Biggest Surge in Two Years Shocks Markets

India’s rupee rallied nearly 1% on Tuesday, marking its largest single-day gain since November 2022. The unexpected surge, attributed to suspected heavy intervention by the Reserve Bank of India (RBI), halted a streak of record lows against the dollar. Traders speculate the RBI sold as much as $11 billion over two days to stabilize the currency. This comes after recent depreciation fueled by rate cuts and a stronger dollar linked to US tariff moves. Analysts see the intervention as a strategic move to curb speculative pressure while maintaining market stability under Governor Sanjay Malhotra.

Investment Insight: Currency stabilization efforts could temporarily boost investor confidence in Indian assets. However, sustained intervention may deplete reserves. Monitor RBI’s policy tone and dollar strength for emerging market exposure.

Gold Hits Record High Near $2,950 Amid Trade and Geopolitical Jitters

Gold prices soared to all-time highs in Asian trading, with spot gold reaching $2,942.69/oz and futures peaking at $2,968.39/oz. Safe-haven demand surged as U.S. President Donald Trump imposed 25% tariffs on steel and aluminum imports, with threats of further trade duties sparking fears of a global trade war. Market anxiety was further amplified by Trump’s ultimatum to Hamas over Israeli hostages, intensifying geopolitical tensions in the Middle East. While gold rallied, other metals like silver (-0.5%) and copper (-0.6%) declined as a strong dollar weighed on industrial commodities.

Investment Insight: Gold’s record surge underscores its role as a hedge against economic and geopolitical uncertainty. Investors should monitor inflation trends and central bank policy, as prolonged tensions could sustain gold’s upward momentum.

Savers Flock to Gilts for Tax-Free Gains Amid Economic Uncertainty

Savers are increasingly turning to UK government bonds (gilts) to avoid capital gains tax and secure steady returns. Gilts offer tax-free gains on redemption or sale below the purchase price, making them attractive amid frozen income tax thresholds and reduced personal savings allowances. Wealth managers report a surge in gilt purchases, driven by high yields, predictable returns, and economic concerns. Short-dated, low-coupon gilts are particularly popular for their tax efficiency and guaranteed capital growth, providing a stable option in uncertain times.

Investment Insight: Rising gilt allocations highlight a shift toward tax-efficient, low-risk strategies. Investors seeking stability and predictable returns should consider gilts, especially in a high-tax environment, but remain mindful of inflation risks impacting real yields.

Foxconn Shares Rise on Strong January Sales and AI Demand

Foxconn, a key Nvidia supplier, saw its shares climb nearly 3% on Tuesday after reporting January revenues of NT$538.67 billion ($16.42 billion), up 3.2% year-on-year. Growth was driven by robust demand for AI servers and cloud products, bolstering optimism despite entering a traditionally weaker sales period. Foxconn’s diversification into AI infrastructure has been a key driver of its recent success, though slower consumer electronics sales, including iPhones for Apple, remain a challenge. The company is also expanding into electric vehicles, with potential investments in Nissan.

Investment Insight: Foxconn’s focus on AI and diversification into EVs positions it well for long-term growth. However, its reliance on consumer electronics could weigh on performance. Investors should watch its AI-related ventures and EV developments for sustained momentum.

Market Price: Hon Hai Precision Industry Co Ltd. (TPE:2317): TWD 179.00

Conclusion

This week’s market movements highlight the interplay between policy, geopolitics, and shifting investor strategies. From Trump’s tariffs driving steel stocks and gold to new highs, to India’s rupee rallying on central bank intervention, macroeconomic forces remain in sharp focus. Savers are seeking refuge in tax-efficient gilts, while Foxconn’s AI-driven growth offers a glimpse into tech’s resilience amid weaker consumer electronics demand. As markets navigate uncertainty, diversification and a keen eye on inflation, interest rates, and geopolitical developments will be key to staying ahead. Stay tuned for more insights as these stories continue to evolve.

Upcoming Dates to Watch

- February 11th, 2025: Brazil CPI

- February 12th, 2025: US CPI; India CPI, Industrial Production

- February 13th, 2025: German CPI, Eurozone Industrial Production

- February 14th, 2025: Eurozone GDP

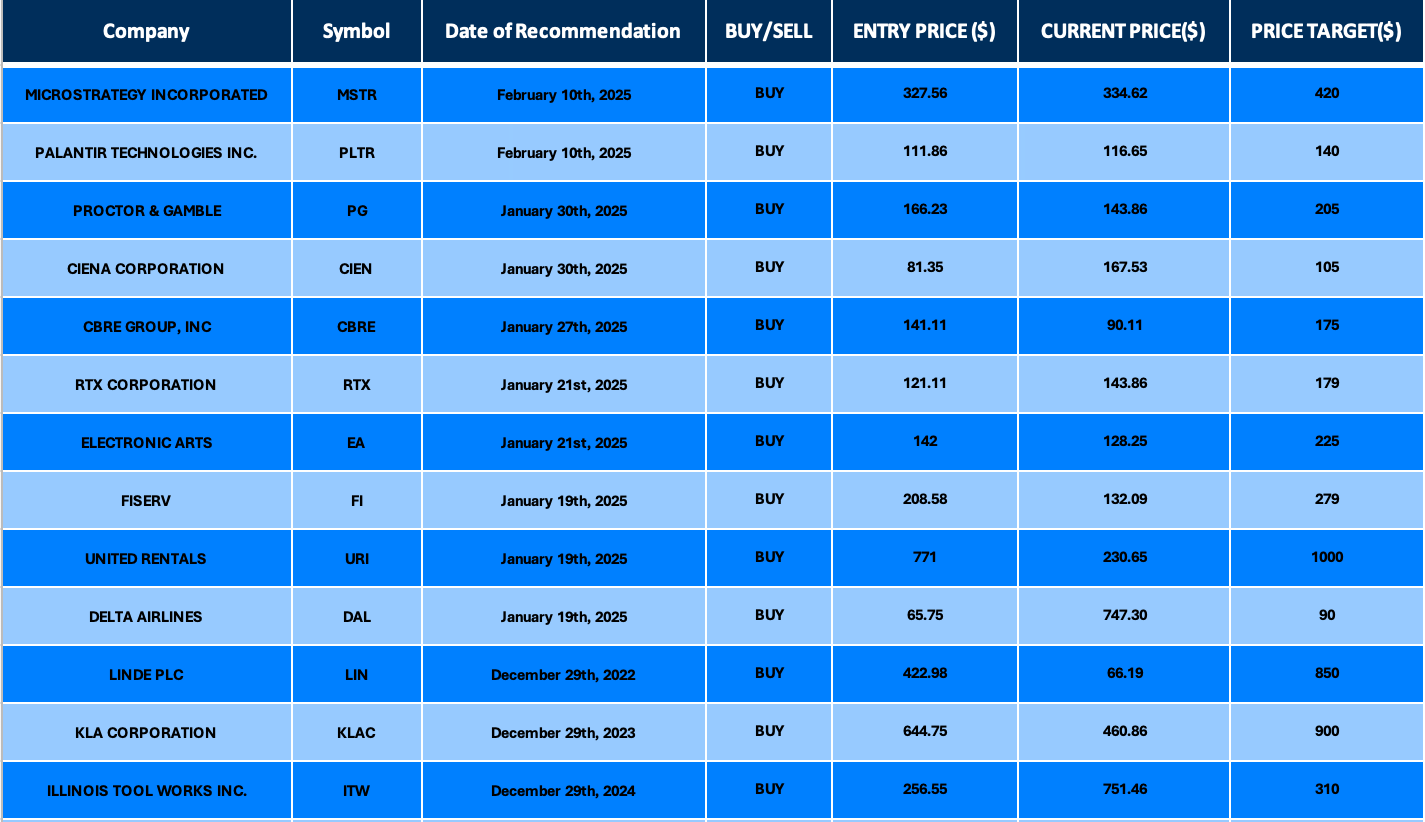

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.