Date Issued – 12th February 2025

Preview

Hon Hai (Foxconn) signaled interest in Renault’s 36% stake in Nissan, aiming to expand its EV ambitions, though risks to Nissan’s independence remain. Bond yields rose as Fed Chair Jerome Powell urged patience on rate cuts ahead of key US CPI data, while Hong Kong stocks rallied on Alibaba’s AI partnership with Apple. Super Micro (SMCI) shares swung as it pledged to meet SEC filing deadlines amid legal scrutiny and cut fiscal 2025 guidance. Commerzbank plans 3,000-4,000 job cuts and a strategy update to fend off UniCredit’s takeover bid, despite investor intrigue in the potential tie-up. Lastly, President Trump’s proposed reciprocal tariffs could raise costs for U.S. consumers, spark global retaliation, and disrupt trade-dependent sectors, adding to inflationary risks.

Hon Hai Open to Buying Renault’s Stake in Nissan

Hon Hai Precision Industry Co. (Foxconn), Apple’s largest production partner, has signaled interest in acquiring Renault SA’s 36% stake in Nissan Motor Co. This potential move comes as Nissan faces ongoing struggles, including outdated car models and leadership instability. Hon Hai Chairman Young Liu clarified that the company’s aim is cooperation, not ownership, as it explores partnerships with Nissan and Honda to expand into electric vehicles (EVs) and diversify beyond its core electronics business. Nissan’s shares briefly recovered before resuming their decline, reflecting investor uncertainty.

Investment Insight: Hon Hai’s potential stake in Nissan could enhance its EV ambitions but carries risks of diluting Nissan’s independence. Investors should monitor how this impacts Nissan’s restructuring and Hon Hai’s diversification strategy in a competitive EV market.

Market price: Hon Hai Precision Industry Co Ltd. (TPE:2317): TWD 177.00

Bonds Decline After Powell, Hong Kong Stocks Surge

Bond yields rose as Federal Reserve Chair Jerome Powell signaled patience before cutting rates further, with markets awaiting key US CPI data. US equity futures dipped, while Hong Kong stocks rallied, driven by an 8.6% surge in Alibaba on AI collaboration news with Apple and record gains in BYD, fueled by optimism over its smart-driving strategy. Japanese 5-year bond yields hit 1% for the first time since 2008, while the yen extended its decline amid tariff concerns.

Investment Insight: The Fed’s cautious approach to rate cuts reflects persistent inflation risks. Investors should closely watch CPI data, as stronger-than-expected prints could pressure bonds further. Meanwhile, AI-driven optimism in Chinese equities highlights growth potential in tech and EV sectors.

Super Micro Stock Swings on Filing Deadline and Earnings Miss

Super Micro Computer (SMCI) shares seesawed as the server maker assured investors it would meet Nasdaq’s Feb. 25 deadline for delayed SEC filings to avoid delisting. The filings were postponed after a short-seller report accused the company of accounting violations, triggering a DOJ probe. Preliminary Q2 earnings missed Wall Street estimates, with revenue guidance for fiscal 2025 cut sharply. Shares plunged 19% after the update but rebounded more than 3% in after-hours trading.

Investment Insight: Super Micro’s volatile stock reflects uncertainty from ongoing legal and regulatory issues. While the company remains confident in its compliance, cautious investors should watch for further developments around its filings and fiscal guidance.

Market price: Super Micro Computer (SMCI): USD 38.61

Commerzbank Plans Job Cuts, Strategy Update to Fend Off UniCredit

Commerzbank is planning to cut 3,000-4,000 jobs and set new financial targets in a bid to thwart takeover efforts by Italy’s UniCredit. The German lender, which is partially state-owned, aims to highlight its potential as an independent entity through a strategy update to be unveiled Thursday. The plans include cost reductions, streamlined operations via technology, and potential smaller acquisitions. Despite political resistance to UniCredit’s advances, Commerzbank’s stock has surged 50% since the Italian bank declared interest, underscoring investor intrigue in the potential tie-up.

Investment Insight: Commerzbank’s push for independence may reassure investors in the short term, but UniCredit’s persistent interest and political hurdles expose long-term uncertainties. Investors should monitor the strategy update and its impact on operational efficiency and profitability.

Trump Pushes Matching Tariffs, Risking Global Trade Showdown

President Donald Trump is set to sign an order imposing tariffs on imports that match tax rates charged by trading partners, aiming for “reciprocity.” This move could sharply increase costs for U.S. consumers and businesses, with retaliatory measures from partners like the EU, Canada, and Mexico threatening global economic stability. The sweeping tariffs, targeting goods like autos, computer chips, and pharmaceuticals, mark a break from past U.S. trade policies. While Trump argues tariffs will boost the economy, critics warn of inflation and disrupted supply chains.

Investment Insight: Trump’s tariff strategy may accelerate inflation and weigh on corporate margins. Investors should prepare for heightened market volatility, particularly in sectors reliant on global trade, such as manufacturing, tech, and consumer goods.

Conclusion

Hon Hai (Foxconn) signaled interest in Renault’s 36% stake in Nissan, aiming to expand its EV ambitions, though risks to Nissan’s independence remain. Bond yields rose as Fed Chair Jerome Powell urged patience on rate cuts ahead of key US CPI data, while Hong Kong stocks rallied on Alibaba’s AI partnership with Apple. Super Micro (SMCI) shares swung as it pledged to meet SEC filing deadlines amid legal scrutiny and cut fiscal 2025 guidance. Commerzbank plans 3,000-4,000 job cuts and a strategy update to fend off UniCredit’s takeover bid, despite investor intrigue in the potential tie-up. Lastly, President Trump’s proposed reciprocal tariffs could raise costs for U.S. consumers, spark global retaliation, and disrupt trade-dependent sectors, adding to inflationary risks.

Upcoming Dates to Watch:

- February 12th, 2025: US CPI; India CPI, Industrial Production

- February 13th, 2025: German CPI, Eurozone Industrial Production

- February 14th, 2025: Eurozone GDP

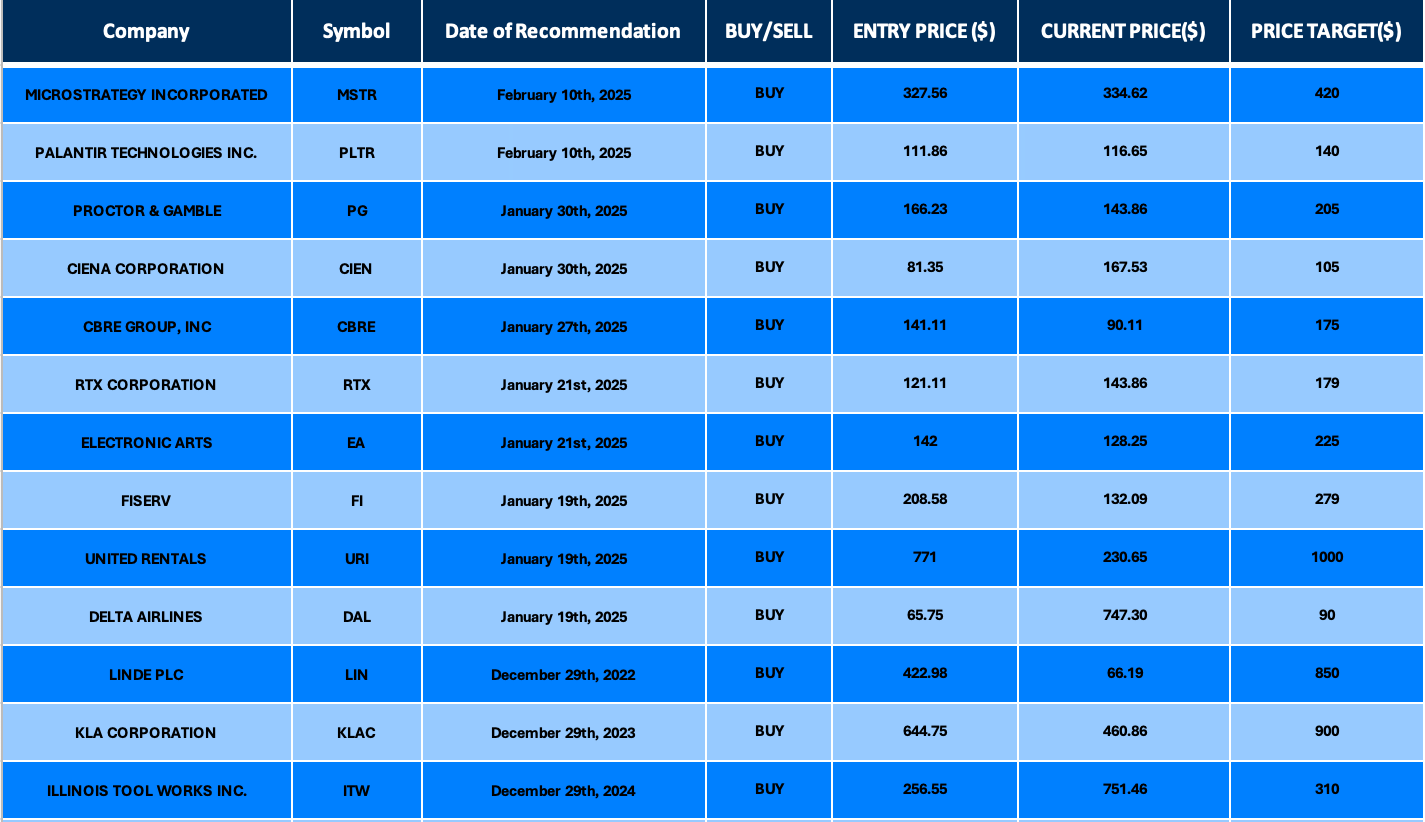

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.