Date Issued – 13th February 2025

Preview

Asian markets are set for a mixed open as investors weigh optimism over US-Russia peace talks against lingering inflation concerns. Gold continues its climb toward record highs, supported by haven demand and a weaker US dollar, while Chinese tech stocks rally on AI breakthroughs, boosting the Hang Seng Tech Index. Meanwhile, the euro strengthened on renewed geopolitical hopes, and oil prices dipped as US-Russia negotiations eased supply concerns. Traders are also closely watching central bank moves, with the ECB signaling potential rate cuts this year, even as the Fed takes a more cautious approach. Key inflation data and geopolitical updates will remain in focus.

Alibaba Shares Skyrocket on AI Momentum, Reaching 2022 Highs

Alibaba’s Hong Kong-listed shares surged 46% since mid-January, adding $87 billion to its market value, fueled by renewed investor confidence in its AI ambitions. This rally outpaced the Hang Seng Tech Index and rival Chinese tech giants like Tencent and Baidu, positioning Alibaba as 2025’s top Big Tech performer in China. Optimism about its AI capabilities, including its Qwen 2.5 Max model outperforming Meta’s Llama, has been bolstered by partnerships like a rumored collaboration with Apple. Analysts see Alibaba’s AI and cloud business as key drivers for future growth, though challenges remain in monetizing AI services and competing with US cloud leaders.

Investment Insight: Alibaba’s AI-driven rebound highlights opportunities in undervalued tech stocks with strong growth prospects. Investors should monitor its cloud business expansion and AI monetization strategies, which are critical for sustaining long-term momentum.

Market price: Alibaba Group Holding Ltd. (HKG: 9988): HKD 120

ECB Signals More Rate Cuts Despite Slower Fed Moves

The European Central Bank (ECB) could enact three additional rate cuts in 2025, even if the U.S. Federal Reserve resists easing, according to Croatian policymaker Boris Vujcic. While the ECB has already cut rates five times since June, further reductions hinge on a sharp drop in core and services inflation, which Vujcic sees as critical in the coming months. Despite a weaker euro and soft economic growth in the eurozone, Vujcic expressed confidence in avoiding a recession while cautioning against expecting rapid recovery. The ECB may also revise its “restrictive” policy language as rates approach levels seen as less constraining.

Investment Insight: The ECB’s commitment to rate cuts, even amid weak growth, presents opportunities in European equities sensitive to lower borrowing costs. Investors should also watch for inflation data and potential currency impacts on trade and energy costs.

Stocks Climb, Euro Gains Amid US-Russia Peace Talks

Asian equities rallied as optimism grew over potential peace talks between the US and Russia to end the war in Ukraine, boosting global risk sentiment. European and US stock futures rose, while the euro strengthened 0.5% against the dollar as traders shifted away from haven assets. Chinese tech stocks, driven by AI developments, also contributed to the positive momentum, with the Hang Seng Tech Index nearing its highest level since the Covid-era reopening rally. Meanwhile, oil prices declined on speculation of eased risks to Russian supply, and US Treasury yields edged lower after inflation concerns tempered rate-cut expectations.

Investment Insight: Geopolitical progress, such as the US-Russia talks, can drive short-term market optimism, but inflation data and central bank policies remain critical for long-term positioning. Investors should weigh opportunities in AI-driven tech and European markets while monitoring energy price volatility.

Los Angeles Wildfires Leave Insurers Facing Billions in Losses

Insurers like AIG, Allstate, and Travelers are bracing for massive losses from the January wildfires in Los Angeles, which destroyed over 16,000 properties. AIG estimates $500 million in losses, while Travelers and Chubb project $1.7 billion and $1.5 billion, respectively. Risk modellers estimate the global insurance industry will bear $40 billion of the $250 billion in total wildfire-related losses. Insurers had already scaled back their California operations due to rising natural disaster risks and stringent consumer protection laws, leaving many residents vulnerable as premiums failed to keep pace with inflation.

Investment Insight: The escalating frequency and intensity of natural disasters, paired with regulatory challenges, are forcing insurers to reassess market exposure and risk-adjusted returns. Investors in the insurance sector should monitor shifts toward higher premiums and increasing reliance on non-admitted markets for profitability.

Gold Nears Record High Amid Dollar Weakness and Geopolitical Focus

Gold climbed to $2,917 an ounce, approaching its all-time high of $2,942, as the US dollar weakened and Treasury yields fell. The metal’s ascent was supported by haven demand, optimism surrounding US-Russia peace talks on Ukraine, and central bank purchases, including from China. Traders are also monitoring President Donald Trump’s trade policies and lingering inflation concerns, which weakened the case for US rate cuts. Spot gold has gained over 11% this year, with momentum building toward a potential test of $3,000 an ounce.

Investment Insight: Gold’s rally underscores its role as a hedge against geopolitical risks and currency volatility. Investors should consider gold-backed ETFs and related assets as central bank buying and haven demand continue to drive prices higher.

Conclusion

Markets are navigating a complex mix of geopolitical optimism, inflation pressures, and central bank signals. The US-Russia peace talks have buoyed risk sentiment, lifting equities and weakening the dollar, while gold edges closer to record highs as a safe-haven asset. Chinese tech stocks continue to shine on AI momentum, adding strength to Asian markets. However, concerns over inflation and the Fed’s cautious stance on rate cuts remain key factors for investors. As the day unfolds, market participants will stay focused on geopolitical developments, central bank commentary, and economic data to guide their next moves. Stay tuned for further updates.

Upcoming Dates to Watch:

- February 13th, 2025: German CPI, Eurozone Industrial Production

- February 14th, 2025: Eurozone GDP

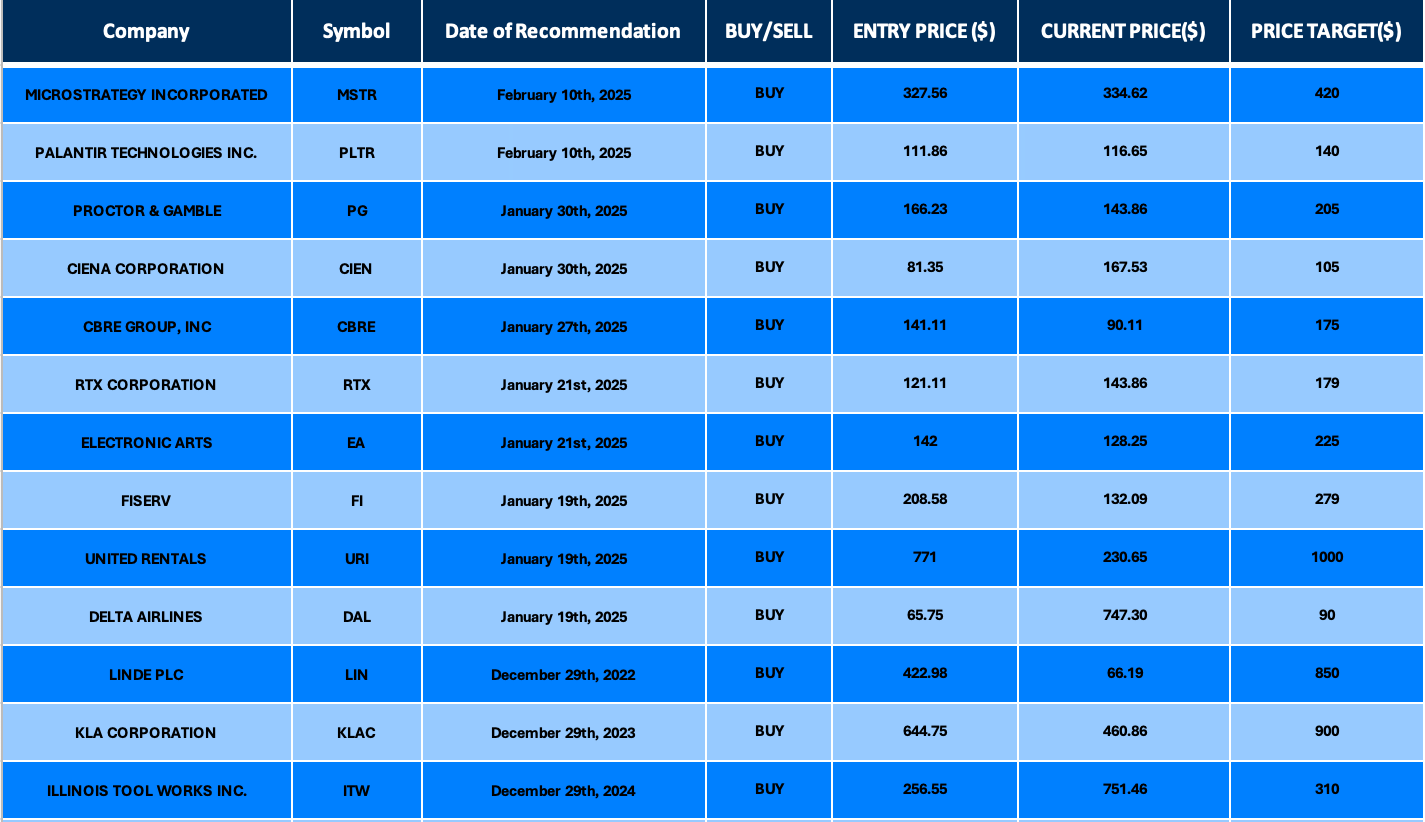

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.