Date Issued – 18th February 2025

Preview

Asian stocks surged, led by Hong Kong markets, as a meeting between President Xi Jinping and business leaders, including Jack Ma, fueled hopes for a softened stance on private enterprise, driving a $1 trillion tech rally. Goldman Sachs raised its gold price target to $3,100, citing central-bank buying and inflation fears. Indonesia mandated onshore retention of exporters’ FX earnings to stabilize the rupiah, but exporters may face cash flow challenges. Chinese convertible bonds climbed 3.3% this year, boosted by AI optimism and Beijing’s stimulus measures. Meanwhile, OpenAI is exploring special voting rights to block hostile takeovers, including Elon Musk’s rejected $97.4 billion bid, as it transitions to a for-profit model.

Asian Stocks Surge as Xi Signals Support for Private Sector

Asian stocks rallied, led by Hong Kong markets, following a meeting between Chinese President Xi Jinping and top business leaders, including Alibaba’s Jack Ma. The summit raised hopes of Beijing easing its crackdown on the private sector, fueling a tech-driven rally. Hong Kong-listed technology stocks climbed to near three-year highs, adding over $1 trillion to Chinese equity markets, driven by breakthroughs in AI and renewed investor optimism. Analysts remain cautiously optimistic, citing the need for sustainable growth to sustain the momentum.

Meanwhile, U.S. bond yields rose as the Federal Reserve signaled a pause in rate cuts pending further inflation progress. In commodities, oil prices steadied amid OPEC+ discussions, while gold maintained modest gains.

Investment Insight: The apparent softening of Beijing’s stance on private enterprise could signal long-term opportunities in Chinese tech. However, investors should remain vigilant for structural reforms to confirm sustainable growth.

Goldman Ups Gold Target to $3,100 on Central-Bank Buying

Goldman Sachs raised its year-end gold price target to $3,100 an ounce, citing increased central-bank demand and inflows into gold-backed ETFs. Analysts project monthly central-bank purchases averaging 50 tons, with potential for prices to reach $3,300 if policy uncertainty, including tariff concerns, persists. Gold has surged this year, fueled by record central-bank buying, Fed rate cuts, and inflation fears. Spot gold recently hovered near $2,909 after hitting a record above $2,942.

Investment Insight: Gold’s upward trajectory signals a hedge against global economic uncertainty. Investors may consider gold as a portfolio diversifier, but monitor central-bank activity and geopolitical risks closely.

Indonesia Mandates Onshore FX Retention to Bolster Reserves

Indonesia will require natural resource exporters to retain all foreign exchange (FX) earnings onshore for a year, starting in March, aiming to add $80 billion to central bank reserves and support the struggling rupiah. The new regulation, signed by President Prabowo Subianto, replaces the previous rule requiring exporters to keep 30% of proceeds onshore for three months. While oil and gas exporters are exempt, earnings can still be used for operational payments, loans, and certain imports. This move comes as Indonesia battles weak currency performance amid global trade tensions and slowing economic growth.

Investment Insight: Indonesia’s FX retention policy may stabilize the rupiah and attract local investment in the short term. However, exporters could face cash flow challenges as the new rules take effect. Monitor currency and trade data for broader implications.

Chinese Convertible Bonds Surge Amid AI Boom

Chinese convertible bonds are rallying as investor enthusiasm for AI, fueled by DeepSeek, spreads across markets. The CSI Convertible Bond Index has climbed 3.3% this year, reaching its highest level since August 2022. Companies like Shanghai Runda Medical and Thalys Medical have seen their convertibles soar over 22% and 16%, respectively. Beijing’s stimulus measures and AI-driven optimism are boosting confidence in CBs, which have become attractive for fixed-income investors seeking returns amid low sovereign yields and tepid growth. Analysts expect continued momentum, supported by limited new issuance and improving credit risk conditions.

Investment Insight: AI-driven optimism is reinvigorating China’s convertible bonds, offering potential upside in a recovering market. Investors should weigh the appeal of CBs’ equity-like potential against lingering credit risks.

OpenAI Weighs Special Voting Rights Amid Musk Takeover Attempt

OpenAI is exploring granting special voting rights to its non-profit board to prevent hostile takeovers, including a recent $97.4 billion bid by Elon Musk, according to the Financial Times. CEO Sam Altman and board members are considering governance changes as OpenAI shifts to a for-profit model, aiming to protect decision-making power from major investors like Microsoft and SoftBank. Musk, a co-founder who later left the company, has criticized OpenAI’s profit-driven direction and vowed to block its commercialization.

Investment Insight: Governance reforms at OpenAI highlight the tension between profitability and mission-driven principles. Investors should monitor how such measures could influence funding, partnerships, and the AI competitive landscape.

Conclusion

Markets are navigating a mix of optimism and caution. Asia’s tech rally underscores renewed confidence in China’s private sector, while gold’s rise reflects its role as a safe haven amid global uncertainty. Indonesia’s FX retention policy aims to stabilize its currency, but challenges for exporters loom. AI-driven enthusiasm is fueling Chinese convertible bonds, offering potential upside in fixed-income markets. Meanwhile, OpenAI’s governance reforms highlight the tension between innovation and control as it fends off high-profile takeover attempts. Investors should stay vigilant, balancing opportunities in growth sectors with risks tied to policy shifts and economic headwinds.

Upcoming Dates to Watch:

- February 18th, 2025: Australia rate decision, Canada CPI

- February 19th, 2025: UK CPI

- February 21st, 2025: Japan CPI

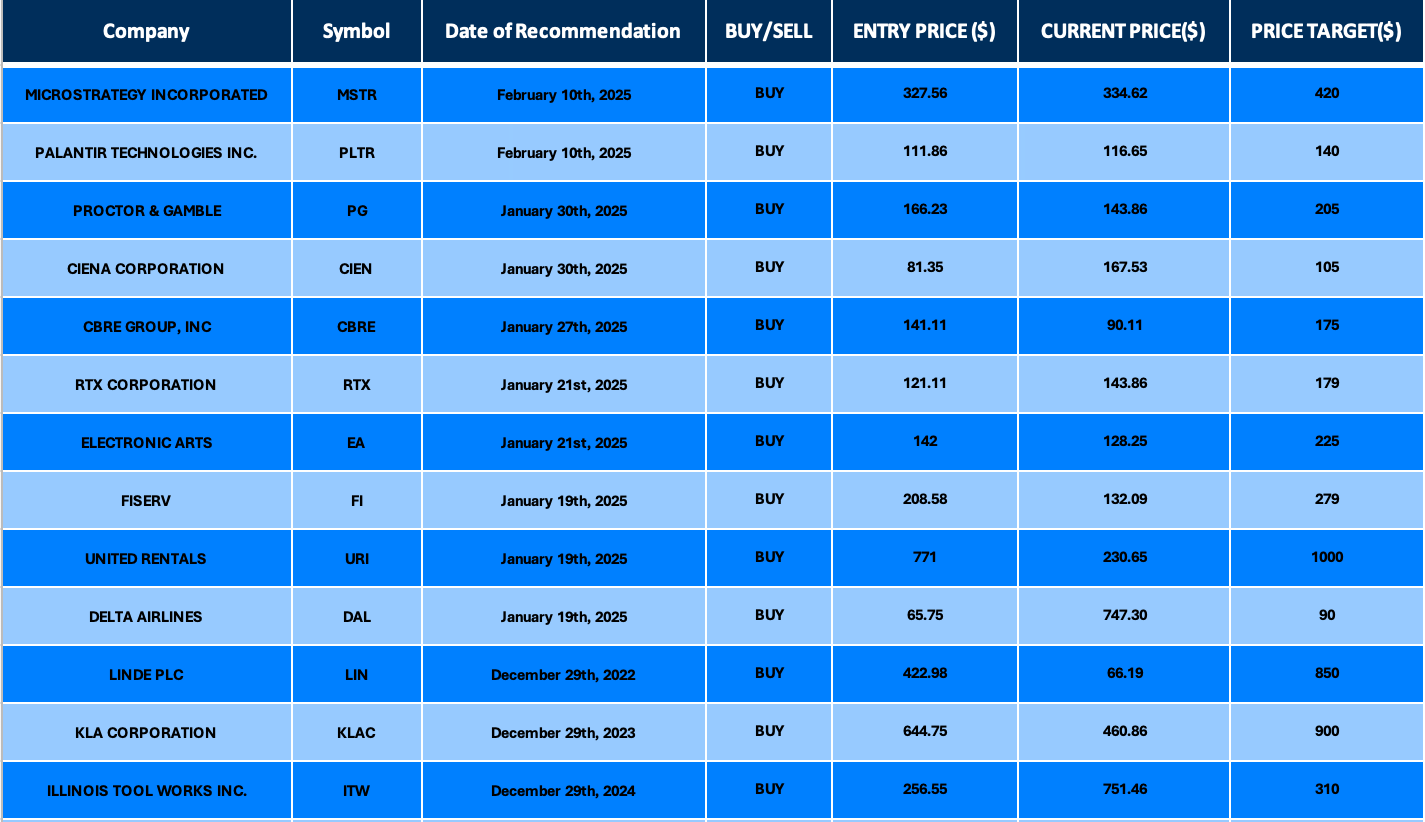

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.