Date Issued – 20th February 2025

Preview

Asian stocks fell, with Hong Kong’s tech index dropping 3.6%, as geopolitical tensions and US tariff uncertainty weighed on sentiment. Gold hit a record $2,947.23, and the yen strengthened on rising Bank of Japan rate hike bets. In India, unseasonably warm weather threatens wheat yields, potentially tightening global supply. Airbus forecast 7% growth in jet deliveries for 2025 despite supply chain challenges and delays to its A350 freighter program. Meanwhile, Lenovo’s revenue surged 20%, boosted by PC market recovery and AI-driven innovations. Lastly, the yen rallied past 150 per dollar, its strongest since December, amid expectations of BOJ policy tightening.

Asian Stocks Slip, Hong Kong Tech Retreats Amid Geopolitical Tensions

Asian equities slid Thursday, with a regional index falling 0.6%, as geopolitical concerns dampened risk appetite. Hong Kong’s tech benchmark dropped as much as 3.6% after recent highs, and US futures pointed lower. Gold surged to a record $2,947.23 an ounce, while the yen strengthened on speculation of a Bank of Japan rate hike. US President Donald Trump’s intensified pressure on Ukraine to settle with Russia, coupled with potential new tariffs on lumber, added to market jitters. Chinese tech stocks like Alibaba and Meituan, which had seen a remarkable bull run recently, also retreated as investors grew cautious.

Investment Insight: Heightened geopolitical uncertainty is driving demand for safe-haven assets like gold, now at record levels, while pressuring tech-heavy Asian markets. Investors should monitor developments in US-China trade talks and the BOJ’s policy stance for near-term market direction.

India’s Wheat Crop Faces Risks from Warm Weather and Low Rainfall

India’s wheat harvest is under threat as unusually warm and dry weather persists, with rainfall in key northern regions down 80% since January. Meteorologists predict continued unfavorable conditions, which could reduce yields by more than 20%. As domestic stockpiles hover near 16-year lows, the government may consider cutting the current 40% import duty to stabilize food prices. Despite record production last year, the crop’s outlook is uncertain, with harvesting set to begin in March.

Investment Insight: Adverse weather conditions could tighten India’s wheat supply, potentially lifting global wheat prices. Investors in agricultural commodities should watch for policy shifts on import duties and assess the impact on international grain markets.

Airbus Projects 7% Growth in Jet Deliveries, Flags Production Challenges

Airbus expects to deliver 820 aircraft in 2025, up 7% from last year, despite ongoing supply chain issues and delays to its A350 freighter program, now pushed to 2027. The company reported €5.35 billion in adjusted operating income for 2024, down 8%, reflecting production pressures and €300 million in new charges for its Space business. Airbus is integrating Spirit AeroSystems’ factories to streamline operations, with neutral income impact but mid-triple-digit cash flow costs. The A400M military transport program remains under pressure due to slow orders and defense spending cuts. Airbus declared a €2 dividend per share, up 11%, alongside a €1 special dividend.

Investment Insight: Airbus’ steady jet delivery growth and dividend hikes signal resilience amid supply chain headwinds. However, defense and space project challenges may weigh on long-term margins. Investors should monitor defense spending trends and Spirit integration progress.

Lenovo Posts 20% Revenue Surge Amid PC Market Recovery and AI Expansion

Lenovo’s Q3 revenue jumped 20% to $18.8 billion, surpassing analyst forecasts of $17.82 billion, as the PC market showed signs of recovery. Net profit more than doubled to $693 million, driven by a 4.8% rise in PC shipments and a dominant 24.5% market share. The company’s AI innovations, including AI-powered PCs and integration with Chinese startup DeepSeek, positioned it for long-term growth. Lenovo’s infrastructure solutions group saw a 59% revenue surge, while its solutions and services group rose 12% to $2.3 billion, boosted by demand for enterprise IT and cloud solutions.

Investment Insight: Lenovo’s focus on AI-driven PCs and infrastructure solutions supports its growth trajectory amid a recovering PC market. Its strong financial performance and leadership in AI innovation position it as a key player in the evolving tech landscape.

Yen Strengthens Beyond 150 per Dollar Amid BOJ Rate Hike Speculation

The yen surged past 150 per dollar on Thursday, its strongest level since December, as expectations for a Bank of Japan (BOJ) rate hike intensified. Market bets now see an 83% chance of a rate hike by July and near certainty by September, following hawkish comments from BOJ officials and robust economic data, including faster-than-expected GDP growth and wages rising at a near 30-year high. Japan’s 10-year bond yield also reached its highest level since 2009. Traders are eyeing Friday’s CPI data, with a strong print likely to bolster the yen further.

Investment Insight: The yen’s rally reflects shifting BOJ policy dynamics and resilient economic data. Investors should monitor CPI data and BOJ signals closely, as a stronger yen could pressure Japan’s export-driven sectors while impacting global currency markets.

Conclusion

Markets are navigating a mix of geopolitical tensions, shifting central bank policies, and evolving industry dynamics. Asian equities are under pressure as safe-haven assets like gold surge to record highs. Weather-driven risks to India’s wheat crop could tighten global grain supplies, while Airbus remains resilient despite supply chain hurdles. Lenovo’s strong performance highlights the growing role of AI innovations in driving tech industry recovery. Meanwhile, the yen’s rally underscores increasing confidence in a BOJ rate hike. As investors assess these developments, staying attuned to macroeconomic shifts and sector-specific trends will be crucial in the weeks ahead.

Upcoming Dates to Watch

February 20th, 2025: Japan CPI

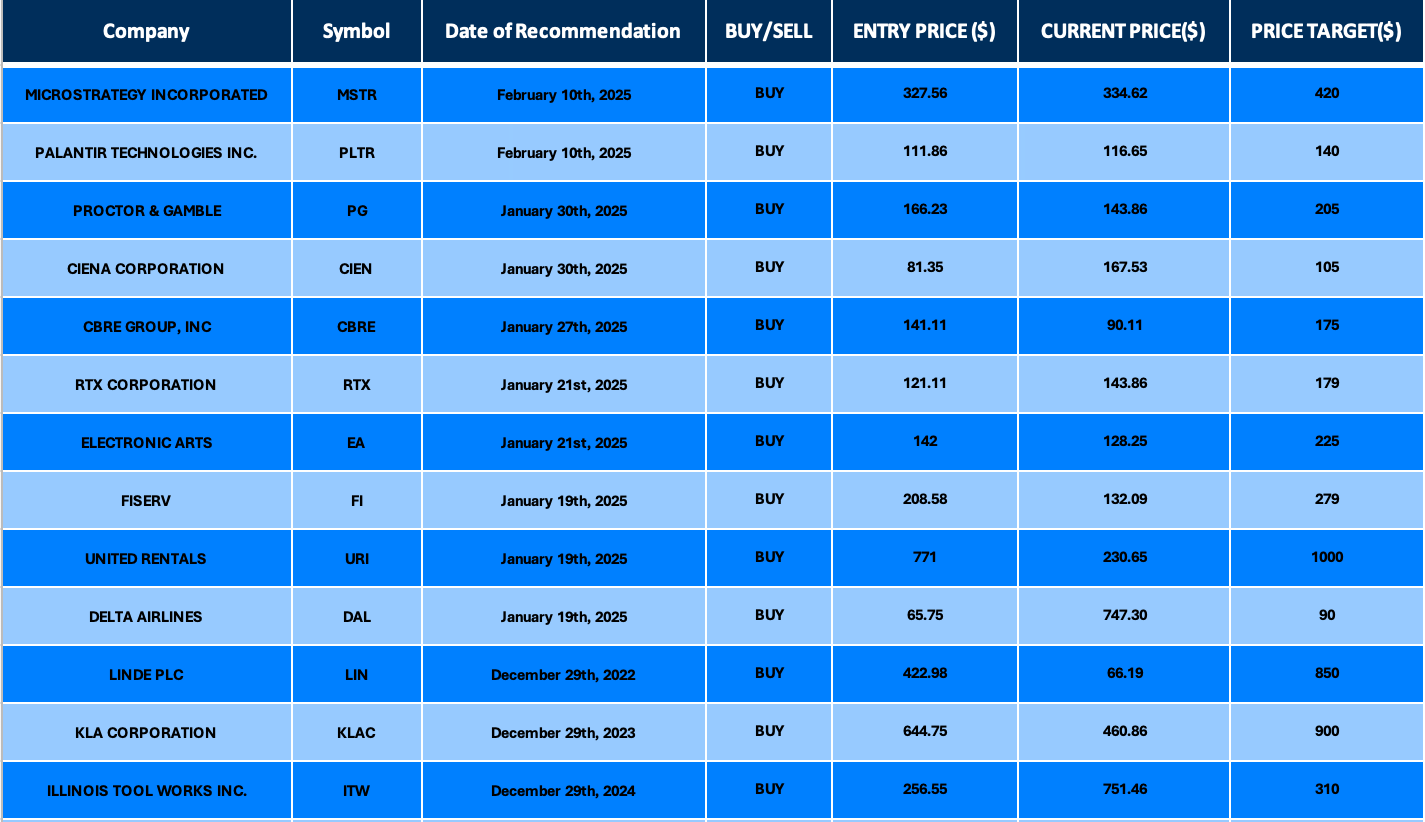

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.