Date Issued – 25th February 2025

Preview

Asian stocks tumbled as U.S. tariffs and curbs on Chinese investments heightened market uncertainty, while gold hit near-record highs. Tata Capital announced plans for a blockbuster IPO, signaling strong investor appetite in India’s financial sector. Chinese cobalt stocks surged after Congo’s unexpected export ban, which could tighten global supply and benefit Indonesia. Meanwhile, Japanese trading houses rallied on Warren Buffett’s increased stakes, seen as a vote of confidence in the sector. On the downside, Palantir shares plunged 25% amid U.S. defense budget cuts and valuation concerns, ending a streak of record gains.

Trump’s Tariffs and Curbs on China Rattle Asian Markets

Asian stocks experienced their sharpest drop in three weeks after U.S. President Donald Trump announced tariffs on Canada and Mexico while ordering restrictions on Chinese investments in key sectors like tech and energy. The uncertainty weighed heavily on markets in Japan, Taiwan, and Hong Kong, with 10-year Treasury yields dropping three basis points to 4.4% and gold holding near record highs. Trump’s deepening rift with U.S. allies over Ukraine and potential restrictions on semiconductor exports to China added to investor unease. Meanwhile, Bitcoin and other cryptocurrencies continued their slide amidst broader risk-off sentiment. In Japan, trading houses rallied after Berkshire Hathaway signaled plans to increase stakes in key firms. The Bank of Korea lowered its key interest rate to 2.75%, while oil prices edged higher following new U.S. sanctions on Iran.

Investment Insight: Escalating U.S. trade tensions and geopolitical shifts are driving volatility in Asian markets. Investors should monitor sectors sensitive to tariffs and geopolitical risk while considering diversification into safe-haven assets like gold.

Tata Capital Prepares for One of India’s Biggest IPOs of 2025

Tata Capital Ltd., the financial arm of the $165 billion Tata Group, is set to go public in what could be India’s largest IPO this year, aiming to raise at least ₹150 billion ($1.7 billion). The company plans to sell 230 million new shares and offer ₹15 billion worth of stock to existing shareholders through a rights issue. This IPO could surpass the $1.5 billion offering planned by LG Electronics’ Indian unit and follows Tata Technologies’ successful IPO in 2023. The announcement boosted Tata Investment Corp.’s shares by as much as 10%, reflecting market enthusiasm. India’s IPO market continues to thrive, with $20 billion raised last year and over 60 IPOs currently in the pipeline. Tata Capital serves diverse customer segments through 900 branches, offering products ranging from consumer finance to private equity.

Investment Insight: Tata Capital’s IPO reflects strong investor appetite for India’s financial services sector. Investors should capitalize on the momentum in India’s thriving IPO market but remain selective, focusing on companies with robust fundamentals and long-term growth potential.

China’s Cobalt Stocks Soar After Congo’s Surprise Export Ban

Chinese cobalt stocks surged after the Democratic Republic of Congo, which produces about 75% of the world’s cobalt, announced a four-month export ban to address global oversupply. Shares in Nanjing Hanrui Cobalt Co. jumped 17%, while Zhejiang Huayou Cobalt Co. rose 7.8%. However, CMOC Group Ltd., which operates major mines in Congo, dipped 2% in Hong Kong. The export halt, expected to cut global cobalt supply by 20,000 tons, could ease oversupply and buoy prices, which have fallen to multi-decade lows. Analysts note that the ban may benefit Indonesia, the second-largest cobalt producer, as it gains market share with increased Chinese investment.

Investment Insight: Cobalt market disruptions present opportunities for investors in Chinese and Indonesian producers. Monitor supply chain adjustments and price recovery trends, as well as the strategic moves of key producers like CMOC.

Buffett’s Bet Boosts Japanese Trading House Shares

Shares of Japanese trading houses surged after Warren Buffett’s Berkshire Hathaway revealed plans to increase its stakes in key firms, including Mitsubishi Corp. and Marubeni Corp. Mitsubishi rose 9.2%, its largest gain in a year, while Marubeni and others posted similar advances. Berkshire’s long-term commitment was praised as a vote of confidence in the sector, which benefits from diversified operations across commodities, energy, and consumer goods.

Buffett highlighted the firms’ shareholder-friendly practices, such as dividends and share buybacks, and their conservative executive pay compared to U.S. companies. Analysts see the move as a signal of stability amid global market uncertainty, with trading houses trading at relatively low valuations.

Investment Insight: Buffett’s endorsement reinforces the appeal of Japanese trading houses as value plays with diversified revenue streams. Investors may find opportunities in this sector, particularly in firms with strong fundamentals and shareholder-friendly policies.

Palantir Plunges 25% Amid Defense Cuts and Valuation Worries

Palantir shares, a retail trader favorite, have dropped over 25% in the past week, pressured by U.S. plans to cut defense spending by 8% ($50 billion). The Department of Defense, Palantir’s largest client, accounted for 41% of its Q4 revenue, raising concerns about growth prospects.

Adding to the sell-off, CEO Alex Karp amended a stock-trading plan to sell up to 10 million shares worth $1.2 billion, unsettling investors. Analysts remain cautious, citing Palantir’s high valuation, with Deutsche Bank calling it “nearly impossible to grow into.” Despite strong recent earnings, the stock’s plunge ends a streak of record-high gains earlier this month.

Investment Insight: Palantir’s heavy reliance on defense contracts highlights its vulnerability to policy changes. Long-term investors should weigh its valuation challenges against potential opportunities in a restructured Pentagon budget.

Market price: Palantir Technologies Inc (PLTR): USD 90.68

Conclusion

Global markets remain volatile as geopolitical tensions, trade policies, and shifting supply chains drive investor sentiment. While Warren Buffett’s bullish stance on Japanese trading houses and Tata Capital’s IPO highlight opportunities in value stocks and emerging markets, challenges persist. Palantir’s steep decline underscores the risks of over-reliance on government contracts, while Congo’s cobalt export ban shakes up critical supply chains. Investors should stay cautious, focusing on diversification and sectors with strong fundamentals. Amid uncertainty, safe-haven assets like gold and resilient markets like India and Japan offer compelling opportunities for those looking to navigate an evolving global investment landscape.

Upcoming Dates to Watch

- February 25th, 2025: US consumer confidence, South Korea rate decision

- February 26th, 2025: Nvidia Earnings

- February 28th, 2025: US PCE inflation, Germany CPI, Tokyo CPI

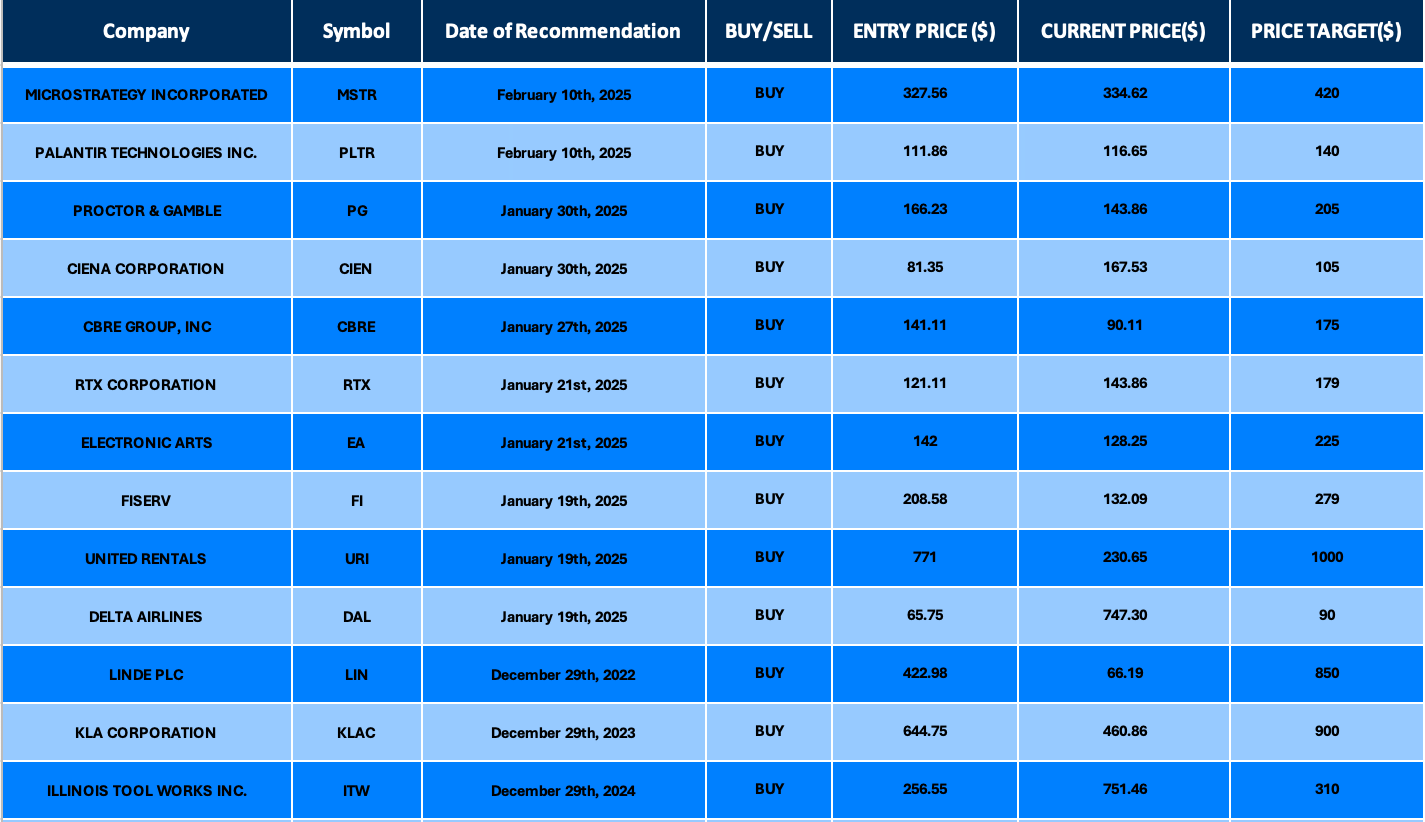

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.