Date Issued – 26th February 2025

Preview

Global markets steadied Wednesday after weak U.S. consumer data shook sentiment, with Hong Kong’s Hang Seng Index rallying on optimism over China’s tech advancements and AI growth. U.S. oil stabilized near $69 a barrel amid demand concerns, while copper surged 4.9% after President Trump launched a tariff probe to protect U.S. producers. Tesla shares plunged 8%, falling below a $1 trillion market cap, as European sales dropped 45% in January, highlighting intensifying competition. Meanwhile, the FAA tapped SpaceX’s Starlink for airspace IT upgrades, raising conflict-of-interest concerns around Elon Musk’s dual roles. Investors remain focused on Nvidia’s earnings and OPEC+ production controls as key market drivers.

Global Markets Stabilize, Hang Seng Soars Amid Optimism

Global assets steadied Wednesday after weak U.S. economic data spurred investor caution. Asian markets outperformed, with Hong Kong’s Hang Seng Index continuing its rally, driven by optimism over China’s tech advancements and renewed AI development. U.S. and European futures pointed to gains, while 10-year Treasury yields rebounded slightly after sharp declines. Key focus remains on Nvidia’s earnings, seen as pivotal for market sentiment. Meanwhile, copper rose on news of potential U.S. tariffs, and oil prices stabilized after slipping into the $60 range.

Investment Insight: The Hang Seng’s rally highlights opportunities in Chinese equities, particularly in AI-driven sectors. However, geopolitical risks and U.S.-China decoupling efforts remain significant headwinds for investors.

FAA Taps SpaceX’s Starlink for Airspace Modernization, Sparking Conflict Concerns

The FAA has awarded a contract to SpaceX’s Starlink to upgrade its IT network managing U.S. airspace, marking a step toward modernizing outdated systems. The deal, involving 4,000 terminals over 12-18 months, comes as CEO Elon Musk advocates federal budget cuts, including FAA staff reductions, raising concerns about conflicts of interest. Musk’s dual roles—as head of SpaceX and leader of the Department of Government Efficiency under President Trump—have drawn scrutiny over regulatory oversight of his businesses. Critics argue Musk’s financial interests, including the potential for lucrative space mining ventures, demand greater transparency.

Investment Insight: SpaceX’s increasing reliance on federal contracts highlights the company’s critical role in infrastructure upgrades. Investors should monitor regulatory risks and Musk’s political entanglements, which could impact market perception and government partnerships.

US Oil Stabilizes in the $60s Amid Demand Concerns

West Texas Intermediate (WTI) crude steadied near $69 a barrel after dropping to its lowest level since mid-December. Weak U.S. consumer confidence data and escalating trade tensions under President Trump have fueled anxiety about energy demand. Oil prices have fallen nearly 5% this month, pressured by sluggish Chinese consumption and the potential resumption of Iraqi pipeline flows. While sanctions on Iran and expected OPEC+ production limits offer some support, market sentiment remains clouded by uncertainty over global economic growth.

Investment Insight: Oil’s decline reflects broader economic fears, but OPEC+ production controls may stabilize prices. Investors should watch for geopolitical developments and further signals on global demand trends.

Tesla Drops 8%, Market Cap Falls Below $1 Trillion on Weak European Sales

Tesla shares plunged 8% Tuesday after reporting a 45% drop in January European car sales, a stark contrast to the region’s 37.3% EV market growth. Tesla’s market share in Europe slid to just 1%, while competitors like China’s SAIC Motor surged ahead. This marks continued struggles for Tesla in Europe, with German sales down 41% in 2024. Rising competition, Elon Musk’s political controversies, and slower adoption of Tesla’s self-driving technology are fueling investor concerns. Tesla’s market cap now stands at $974 billion, below the $1 trillion threshold.

Investment Insight: Tesla faces intensifying competition in key markets. Investors should monitor its ability to regain momentum in Europe and defend its position against rising Chinese EV manufacturers like BYD.

Copper Prices Surge as Trump Orders Tariff Probe

Copper futures soared 4.9% in New York after President Trump directed the Commerce Department to investigate tariffs on imported copper under Section 232 of the Trade Expansion Act. The move aims to protect U.S. producers and reshape supply chains, with Trump arguing global actors have weakened the domestic copper industry. Shares of U.S. copper miners, including Freeport-McMoRan, rallied over 6% in after-hours trading. Meanwhile, Chile’s Codelco resumed mining operations following the country’s largest power outage in 15 years.

Investment Insight: Tariff actions could create a price gap between U.S. and global copper markets, benefiting domestic producers. Investors should watch for further policy developments and potential supply disruptions.

Conclusion

Markets showed signs of stabilization midweek, but investor sentiment remains fragile amid weak U.S. data and ongoing geopolitical tensions. Tesla’s struggles in Europe, coupled with intensifying competition, highlight challenges in the EV sector, while copper’s surge reflects shifting trade policies under President Trump. Oil markets face uncertainty as demand concerns weigh against OPEC+ production controls. Meanwhile, the Hang Seng’s rally underscores opportunities in China’s tech-driven growth. As Nvidia’s earnings loom, investors should remain vigilant for signals of broader market direction, while keeping an eye on policy developments and global economic indicators shaping the next wave of market movements.

Upcoming Dates to Watch

- February 26th, 2025: Nvidia Earnings

- February 27th, 2025: US GDP, Eurozone consumer confidence

- February 28th, 2025: US PCE inflation, Germany CPI, Tokyo CPI

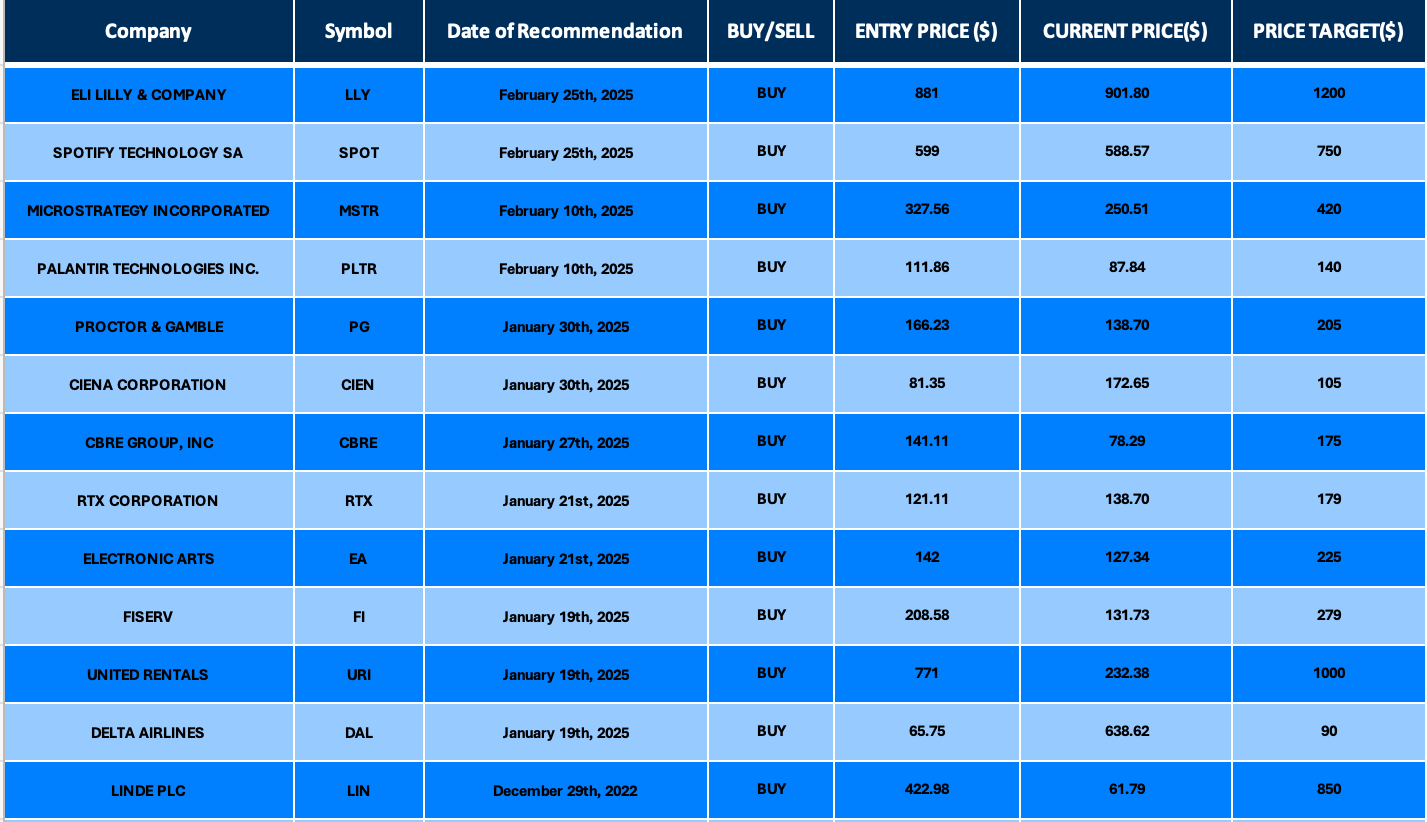

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.