Date Issued – 27th February 2025

Preview

Markets are Grappling with Uncertainty as Nvidia’s Strong Earnings Were Overshadowed by Geopolitical Risks

Markets are facing uncertainty as Nvidia’s strong earnings were overshadowed by geopolitical risks, including President Trump’s sweeping tariff plans on the EU, Mexico, and Canada. Asian equities dropped, with European futures down 0.9%, while oil steadied near its yearly low amid concerns over Russian supply increases.

In Japan, Seven & I Holdings shares plunged after the founding family failed to secure funding for a $58 billion buyout, leaving Canada’s Couche-Tard poised for a potential acquisition. Nomura downgraded Taiwanese stocks, citing AI sector scrutiny and US tariffs, with TSMC underperforming the broader MSCI Asia Pacific Index.

Meanwhile, gold retreated 0.8% from its record high as a stronger dollar and rising Treasury yields weighed on the metal, while investors await the Fed’s inflation data for further monetary policy signals.

Nvidia Beats Estimates, Tariff Worries Weigh on Stocks

Asian equities fell Thursday as Nvidia’s mixed outlook failed to sustain investor enthusiasm, and President Trump’s announcement of 25% tariffs on EU goods and potential trade restrictions on chips rattled markets. Nvidia posted strong Q4 earnings — beating estimates with $0.89 EPS on $39.3 billion revenue — and issued solid Q1 guidance, buoyed by the rapid success of its Blackwell AI chips.

However, concerns over tighter profit margins, supply chain constraints, and the rise of alternatives like custom AI chips from Big Tech dampened some optimism. European futures dropped as much as 0.9%, while Nvidia’s stock initially climbed on its earnings report but pared gains in after-hours trading. Meanwhile, US Treasury yields edged higher as traders anticipated Federal Reserve rate cuts amidst slowing economic growth.

Investment Insight:

Nvidia remains a dominant force in AI, but geopolitical risks like tariffs and export controls loom large. Investors should monitor Big Tech’s shift toward custom AI chips and consider the potential impact on Nvidia’s revenue. Diversifying into regions like Europe and China or hedging with fixed-income assets may help navigate this uncertain environment.

Market price: Nvidia Corp (NVDA): USD 131.28

7-Eleven Owner’s Founding Family Fails in Buyout Bid, Couche-Tard Eyes Acquisition

Japan’s Seven & I Holdings, the owner of 7-Eleven, announced that its founding Ito family failed to secure the $58 billion needed for a management buyout. This opens the door for Canada’s Alimentation Couche-Tard, which has proposed a $47 billion acquisition. The company stated it is now evaluating Couche-Tard’s offer alongside other strategic alternatives to maximize shareholder value.

Seven & I shares plunged over 12% in Tokyo trading, marking their worst drop since 2005, while Itochu, a key stakeholder, rose 6.8% after ending its consideration of the buyout. Couche-Tard reaffirmed its commitment to negotiating a deal, underscoring the growing foreign interest in Japanese assets amid improving corporate governance and economic reforms.

Investment Insight:

The collapse of the founding family’s buyout bid strengthens Couche-Tard’s position, signaling potential opportunities in Japanese equities as global investors target undervalued assets. Seven & I’s stock remains volatile, but Couche-Tard’s acquisition pursuit may provide upside potential.

Oil Prices Steady Near Year’s Low Amid Tariff and Supply Concerns

Oil prices stabilized near their lowest close of the year, with Brent crude trading below $73 per barrel and West Texas Intermediate near $69. The market remains pressured by US President Trump’s tariff threats against Mexico, Canada, and the European Union, compounding concerns about economic growth. Crude is on track for its largest monthly loss since September, overshadowing potential price lifts from tighter Iran sanctions and OPEC+ production delays.

On the supply front, Trump’s plan to revoke Chevron’s Venezuelan oil license threatens the nation’s recovery, while Iraq announced an agreement to restart Kurdistan crude exports without specifying timing. Additionally, prospects of a peace deal between Ukraine and Russia raise the possibility of increased Russian oil supplies, further weighing on prices.

Investment Insight:

Oil markets face persistent headwinds from geopolitical uncertainty and weakening demand signals. Investors should remain cautious, as potential Russian supply increases and global trade tensions could keep prices under pressure in the near term.

Nomura Downgrades Taiwanese Stocks Amid AI Scrutiny and Tariff Concerns

Nomura Holdings downgraded Taiwanese equities from “tactical overweight” to “neutral,” citing rising scrutiny of the AI sector, US tariff threats, and elevated valuations. Taiwan Semiconductor Manufacturing Co. (TSMC), the island’s largest stock, has fallen over 3% this year, underperforming the broader MSCI Asia Pacific Index, which gained 3.6%.

The move comes as cost-efficient AI models from Chinese startup DeepSeek raise questions about the need for massive capital expenditure, potentially impacting TSMC, a key supplier to Apple and Nvidia. Meanwhile, tensions between China and Taiwan and President Trump’s tariffs on Chinese goods continue to weigh on sentiment.

Investment Insight:

Taiwan’s equity outlook faces pressure from geopolitical risks and valuation concerns. Investors may consider shifting focus to Chinese equities, which Nomura highlighted for their innovation-driven recovery and reduced discount to global peers.

Gold Declines as Stronger Dollar and Rising Yields Weigh

Gold prices fell 0.8% to $2,893 an ounce as the US dollar strengthened and Treasury yields climbed, eroding demand for the non-yielding metal. This comes after gold set a record high earlier in the week, driven by haven demand amid uncertainty over President Trump’s sweeping tariff plans, including a 25% levy on EU goods and unclear deadlines for tariffs on Canada and Mexico. The stronger dollar makes gold less attractive to investors holding other currencies, while rising yields further pressure bullion.

Investors are now closely watching the Federal Reserve’s preferred inflation gauge on Friday for clues on monetary policy shifts, which could influence gold’s outlook.

Investment Insight:

Gold’s pullback highlights its sensitivity to rising yields and currency strength. Investors may consider gold as a long-term hedge but should remain cautious of near-term volatility tied to geopolitical and economic developments.

Conclusion

Markets remain on edge as geopolitical tensions, trade tariffs, and shifting monetary policy dominate investor sentiment. Nvidia’s earnings highlight ongoing strength in AI but fail to offset concerns over supply chain risks and rising competition. Meanwhile, oil prices hover near yearly lows as trade uncertainty and potential increases in Russian supply weigh on the outlook.

The collapse of Seven & I’s buyout bid signals opportunities for foreign investors targeting undervalued Japanese assets. With gold slipping from record highs and Taiwanese equities facing headwinds, investors should brace for continued volatility while keeping an eye on key economic and policy developments.

Upcoming Dates to Watch

- February 27th, 2025: US GDP, Eurozone consumer confidence

- February 28th, 2025: US PCE inflation, Germany CPI, Tokyo CPI

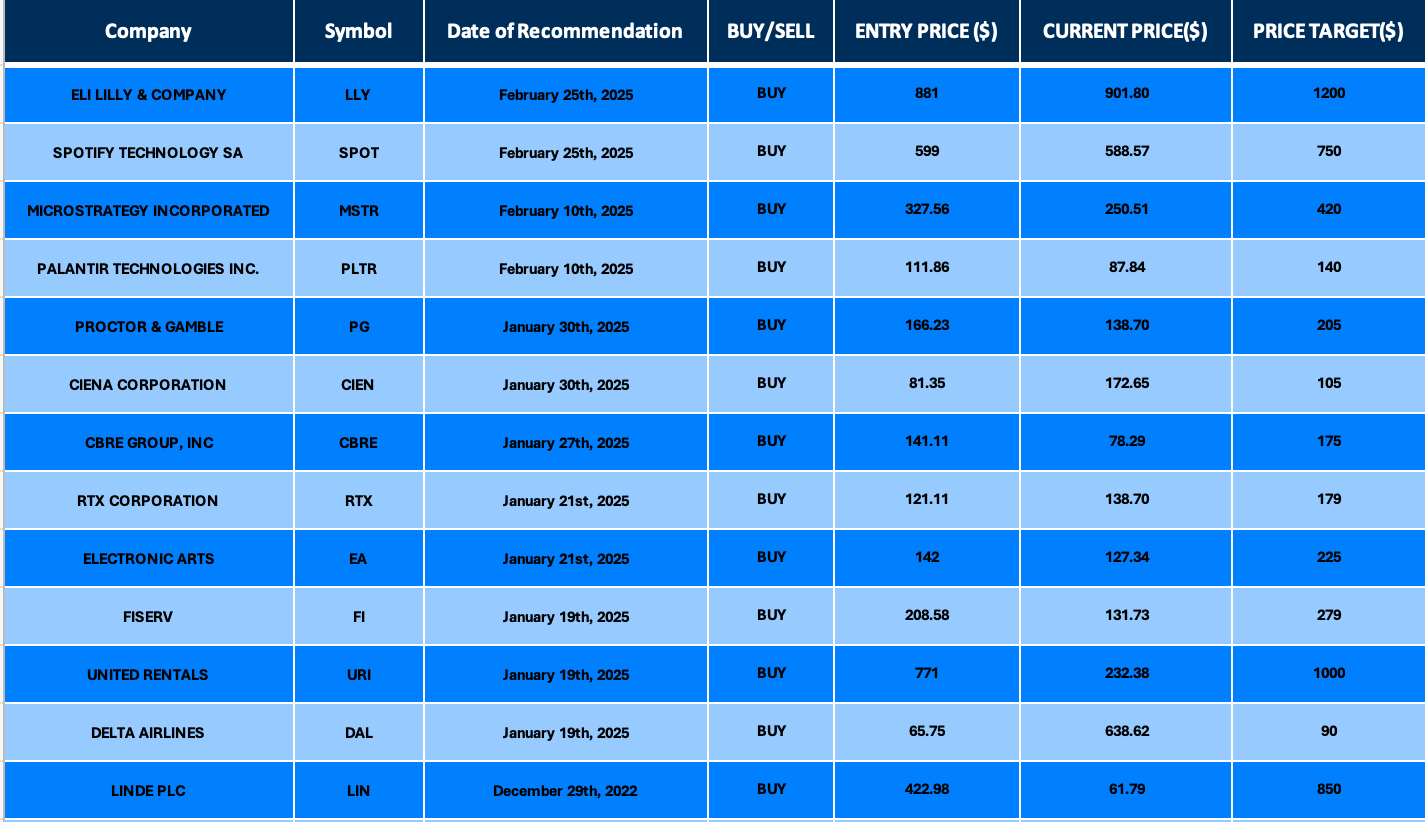

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.