Date Issued – 28th February 2025

Preview

Markets Reeling as Trump’s New Tariffs Spark Fears and Global Equities Tumble

Markets are reeling as President Trump’s new tariffs on Canada, Mexico, and China spark fears of trade tensions, sending global equities tumbling and safe-haven assets rallying. Meanwhile, Tencent unveiled its Hunyuan Turbo S AI model to rival DeepSeek, highlighting China’s intensifying AI race, though profitability remains a concern.

In crypto, Bitcoin has plunged 25% from its January peak amid risk-off sentiment, with ETFs seeing record outflows. Broadcom fell 7% alongside a broader chip selloff, with analysts pointing to key support and resistance levels as uncertainty clouds tech stocks. Lastly, China tightened its grip on critical metals by investing record sums in overseas mining, deepening global concerns over supply chain dependencies.

Market Turmoil as Trump’s New Tariffs Hit Global Stocks

Equities tumbled worldwide after President Donald Trump announced new tariffs on Canada, Mexico, and China, sparking fears of heightened trade tensions. Asian markets posted their sharpest drop in a month, while European and US futures signaled further losses. The S&P 500 slid 1.6%, erasing its gains for the year, and the Nasdaq 100 fell 2.8%, with Nvidia plunging 8.5%. Treasury yields dropped to December lows as havens rallied, while the dollar strengthened.

Economists warned the tariffs could dampen growth and worsen inflation, with potential recessions in Mexico and Canada. Meanwhile, China vowed retaliation, deepening uncertainty.

Investment Insight:

Heightened trade tensions are driving investors toward safe-haven assets like Treasuries and away from riskier equities, especially tech stocks. Near-term caution is advised, though China’s potential stimulus measures could restore sentiment in its markets. Diversification and hedging strategies remain key.

Tencent Joins AI Arms Race With Hunyuan Turbo S

Tencent Holdings unveiled its Hunyuan Turbo S AI model, claiming it surpasses DeepSeek, the Chinese startup that has revolutionized the AI landscape. The Turbo S focuses on instant responsiveness, contrasting with DeepSeek’s deep reasoning approach, and is now available via Tencent Cloud. This move follows a surge of AI rollouts from major players like Alibaba, Baidu, and ByteDance, as Chinese tech giants intensify efforts to close the gap with US counterparts.

Despite Tencent’s advancements, analysts suggest its AI ventures will remain unprofitable in the near term.

Investment Insight:

The AI race in China is accelerating, but profitability remains elusive for many players. Investors should monitor Tencent’s AI cloud strategy and its ability to convert innovation into meaningful revenue, while considering broader opportunities in AI infrastructure and cloud services.

Market price: Tencent Holdings Ltd. (HKG: 0700): HKD 478.80

Bitcoin Drops 25% From Peak as Crypto Selloff Deepens

Bitcoin plunged 5.5% in Asian trading, extending losses to 25% from its all-time high of $109,241 in January. Broader cryptocurrencies like Ether, Solana, and XRP also fell sharply amid a global risk-off sentiment fueled by President Trump’s tariff announcements. Once buoyed by hopes of Trump’s pro-crypto stance, Bitcoin’s rally has reversed as economic uncertainty and bearish market sentiment weigh heavily on digital assets.

Spot Bitcoin ETFs saw $1 billion in outflows this week, underscoring waning investor confidence.

Investment Insight:

The crypto market’s volatility highlights the importance of cautious positioning. With Bitcoin near $79,000, technical support at $70,000 may offer a potential floor, but broader market sentiment remains a decisive factor. Diversification into less volatile assets could help mitigate near-term risks.

Broadcom Falls 7% Amid Chip Selloff: Key Levels to Watch

Broadcom (AVGO) shares slid 7% Thursday, hitting a one-month low as chip stocks tumbled following Nvidia’s earnings and President Trump’s new tariff announcements. The stock has dropped 15% year-to-date but remains up over 50% in the past year, fueled by AI chip demand.

Technical analysis highlights key support levels at $185, $160, and $140, while resistance at $230 and a speculative upside target of $295 could come into play if the longer-term uptrend resumes.

Investment Insight:

Chip stocks are under pressure amid macroeconomic uncertainty and AI-related spending concerns. Investors should closely monitor Broadcom’s technical levels and broader market sentiment before taking positions. A potential rebound could offer opportunities, but downside risks persist.

Market price: Broadcom Inc (AVGO): USD 197.80

China Tightens Grip on Metals Supply Chain With Record Mining Push Abroad

China committed over $21 billion to overseas mining projects last year under Xi Jinping’s Belt and Road Initiative — the largest annual investment since the program began in 2013, according to a new study. This strategic expansion bolsters Beijing’s dominance in critical metals like lithium, cobalt, and rare earths, which are essential for EV batteries, electronics, and defense industries. Amid rising geopolitical tensions, China has imposed export restrictions on key minerals, countering efforts by the US, EU, and Japan to diversify supply chains.

Investment Insight

China’s control over critical minerals reinforces its influence on global commodity markets. Investors should monitor developments in alternative supply chains, such as US partnerships with Canada and Australia, while assessing opportunities in companies tied to rare earths and battery metals outside China.

Conclusion

Global markets face mounting pressure as trade tensions, tech selloffs, and crypto volatility dominate headlines. President Trump’s tariffs have rattled equities, while safe-haven assets see renewed interest. In tech, Tencent’s AI push reflects China’s ambition to lead in innovation, though challenges to profitability remain. Bitcoin’s sharp decline underscores the fragility of the crypto market amid broader economic uncertainty. Meanwhile, China’s aggressive overseas mining investments cement its dominance in critical metals, raising concerns over global supply chains. As risks escalate across sectors, investors should stay vigilant, focusing on diversification and monitoring key market trends for opportunities and challenges ahead.

Upcoming Dates to Watch

- February 28th, 2025: US PCE inflation, Germany CPI, Tokyo CPI

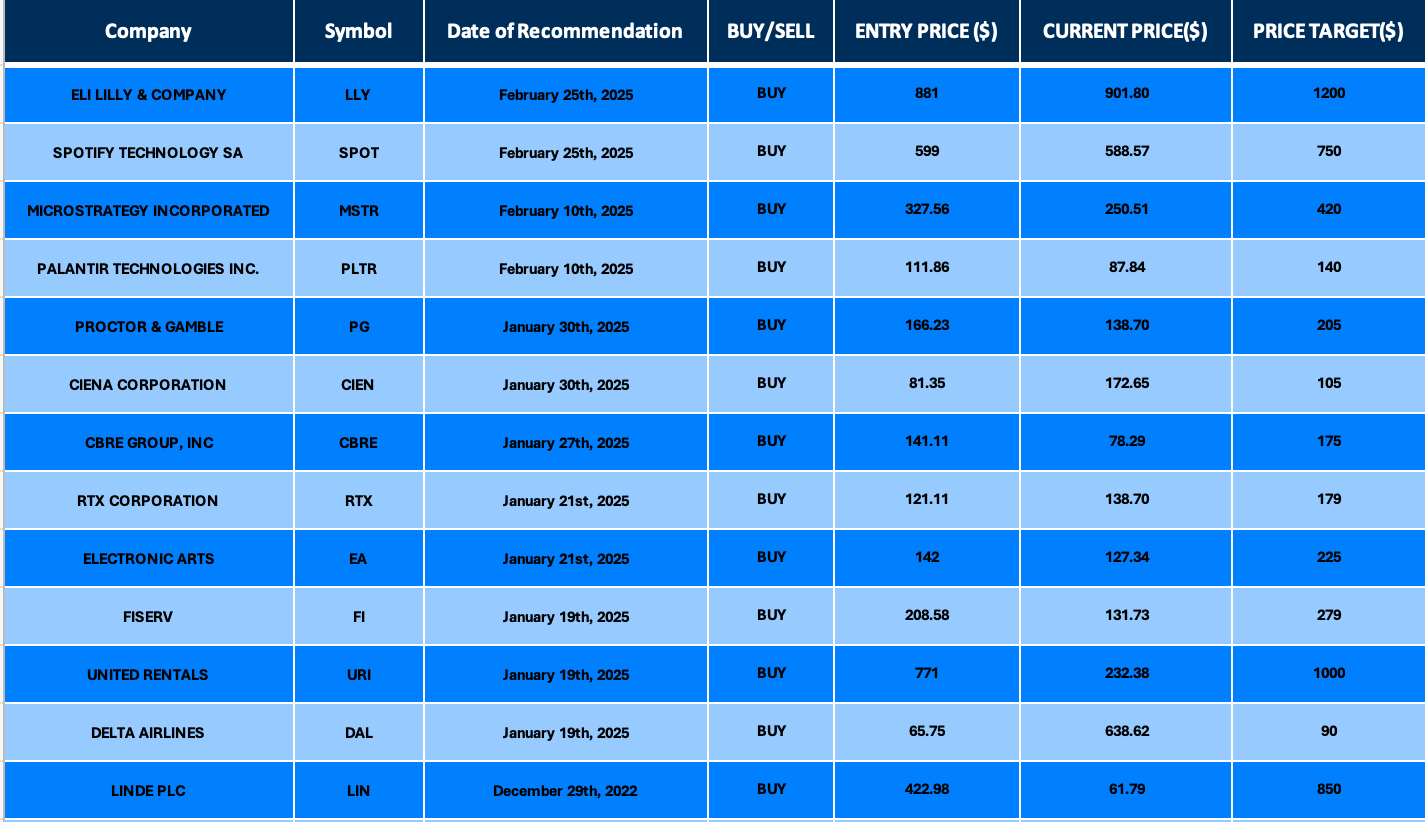

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.