Date Issued – 5th March 2025

Preview

Markets rallied as U.S. Commerce Secretary Howard Lutnick hinted at tariff rollbacks, boosting global equities, while Hong Kong stocks surged on China’s 5% growth target and Germany’s significant infrastructure spending lifted the euro. President Trump announced plans to revive U.S. shipbuilding and hailed a $22.8 billion BlackRock-led deal to acquire key Panama Canal ports, reducing Chinese influence in strategic infrastructure. Meanwhile, China plans to cut steel output to address oversupply and aid carbon goals, pressuring iron ore prices, while gold dipped slightly from near-record highs as trade tensions spurred haven demand. Investors face volatile markets driven by geopolitics and shifting trade policies.

Markets Rally on Tariff Rollback Hopes

Global markets rebounded as U.S. Commerce Secretary Howard Lutnick hinted at potential tariff rollbacks, fueling gains in U.S. and European equity futures. Hong Kong stocks surged after China reaffirmed its 5% growth target for 2025 and signaled further economic stimulus. Meanwhile, Germany’s historic decision to unlock significant defense and infrastructure spending lifted the euro to a three-month high but triggered a global bond selloff. Markets remain volatile as President Trump defended tariffs, calling for adjustments to trade policies, while traders anticipate clarity on Mexican and Canadian tariff relief.

Investment Insight: Markets are pricing in optimism around trade deals, but swings highlight the fragility of sentiment. Cautious positioning in equities and hedging against currency moves may be prudent amidst ongoing geopolitical and tariff uncertainties.

Trump Pushes for U.S. Shipbuilding Revival

President Donald Trump announced plans to revive U.S. shipbuilding for commercial and military vessels in an effort to counter China’s dominance in the industry. Speaking on Capitol Hill, Trump proposed creating a White House shipbuilding office and offering tax incentives to rebuild the sector, which has been overshadowed by China’s production of over half of the world’s merchant vessels. The administration is also preparing to impose fees on Chinese-built ships and cranes entering the U.S. to boost domestic competitiveness. Additionally, Trump revealed plans to “reclaim” the Panama Canal, as a BlackRock-led consortium acquires key ports near the waterway from a Hong Kong conglomerate.

Investment Insight: While efforts to revitalize U.S. shipbuilding could create opportunities in defense and infrastructure sectors, high costs and global competition present significant challenges. Investors should monitor potential shifts in trade and industrial policies.

China to Cut Steel Output to Address Glut and Boost Profits

China is set to mandate steel production cuts to tackle oversupply and restore profitability in its struggling steel sector, as announced at the National People’s Congress. Though no specific targets were disclosed, analysts speculate output could be reduced by as much as 50 million tons annually. This marks the first official proposal for mandatory cuts by the National Development and Reform Commission, signaling a new wave of supply-side reforms nearly a decade after similar measures under President Xi Jinping. The move comes as steel exports hit a nine-year high of 110 million tons in 2024, prompting global backlash and increased tariff scrutiny, particularly from the U.S. Lower production is also expected to aid China’s carbon reduction goals. The announcement weighed on iron ore prices, with futures falling 1.6% in Singapore, while steel prices in Shanghai also declined.

Investment Insight: Steel production cuts could alleviate oversupply and stabilize prices, but weaker-than-expected infrastructure spending signals limited growth for industrial metals. Investors in commodities should prepare for short-term price volatility.

Gold Slips From Near Record High Amid Trade War Tensions

Gold prices dipped 0.2%, trading near $2,912 an ounce, after recent gains driven by escalating trade tensions. President Donald Trump’s tariff hikes on China, Canada, and Mexico have spurred haven demand, pushing gold up over 40% since late 2023. While U.S. Commerce Secretary Howard Lutnick hinted at possible tariff relief for Canada and Mexico, retaliation from Canada and China has further fueled concerns of inflation and slower global growth, bolstering gold’s appeal as a store of value. Spot gold remains just $40 shy of its all-time high, with bond traders increasingly bullish as Treasury positions hit a 15-year peak amid recession fears. Other precious metals, including silver and platinum, held steady, while palladium advanced slightly.

Investment Insight: Gold’s resilience underscores its value as a hedge against economic uncertainty. Investors may consider maintaining exposure to precious metals, but monitor trade developments closely for potential price swings.

Trump Hails BlackRock-Led Deal to ‘Reclaim’ Panama Canal Ports

President Donald Trump praised a BlackRock-led consortium’s $22.8 billion acquisition of CK Hutchison’s global ports business, including a 90% stake in Panama Ports Company. The move grants U.S. firms control over key Panama Canal ports, long operated by the Hong Kong conglomerate, amid efforts to reduce Chinese influence in strategic infrastructure. CK Hutchison’s stock surged nearly 25% following the announcement, marking its highest level since 2023. The sale, which excludes CK Hutchison’s China-based ports, involves 43 ports across 23 countries and positions the U.S. consortium as a major player in global shipping. Analysts view the deal as a strategic shift for CK Hutchison, with infrastructure now becoming its largest earnings contributor. The $19 billion proceeds from the sale could significantly reduce the conglomerate’s debt.

Investment Insight: The deal underscores the growing intersection of geopolitics and infrastructure investments. Investors should monitor infrastructure and logistics sectors as strategic assets like ports become focal points in U.S.-China tensions.

Conclusion

Global markets remain highly reactive to geopolitical and trade developments, with optimism around potential tariff rollbacks fueling gains, while concerns over inflation and slowing growth drive demand for safe havens like gold. China’s steel production cuts and efforts to stabilize its economy highlight ongoing challenges in industrial sectors, while Trump’s push to revive U.S. shipbuilding and the Panama Canal ports deal underline the intersection of global trade and strategic infrastructure. Investors should stay cautious, balancing exposure to equities, commodities, and safe-haven assets as market volatility persists amid shifting economic and political landscapes.

Upcoming Dates to Watch:

- March 5th, 2025: Australia GDP, China’s National People’s Congress; Eurozone HCOB services PMI, PPI

- March 7th, 2025: Eurozone GDP; US nonfarm payrolls, consumer credit

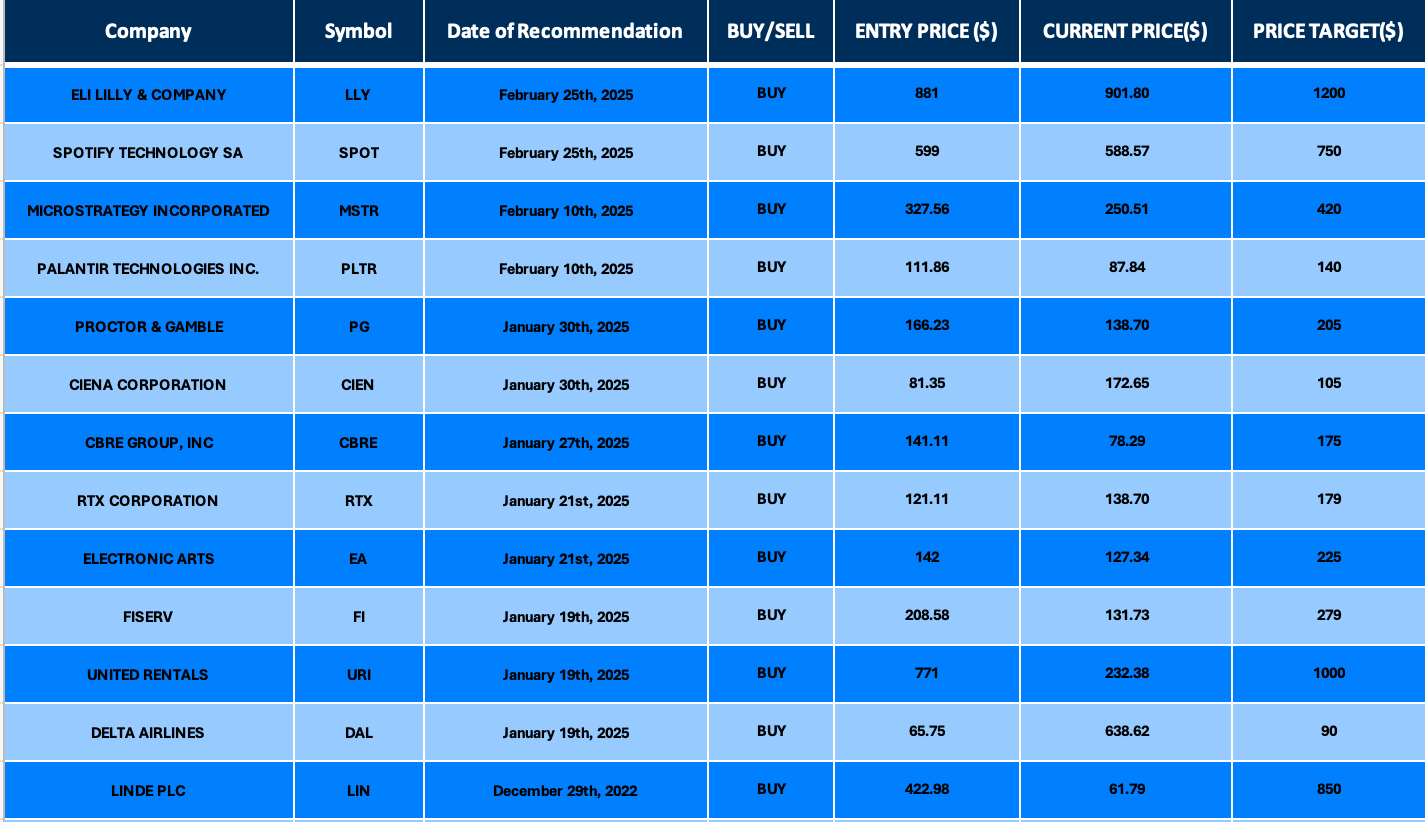

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.