Date Issued – 12th March 2025

Preview

Global markets steadied as President Trump’s remarks downplaying recession fears and signaling economic growth initiatives buoyed sentiment. Asian stocks traded narrowly, with US and European futures rising, aided by optimism over a proposed 30-day Ukraine-Russia truce. However, inflation, Fed policy, and trade tensions, including Trump’s tariffs and EU retaliation, continue to weigh on outlooks.

Meanwhile, China’s retail investors are driving a tech-led stock rally, with equity mutual fund inflows surging to their highest since 2021, though elevated valuations pose risks. Tesla shares, down 52% from December highs, remain under pressure from weak demand and growing investor skepticism, despite a brief rebound following Trump’s purchase of a Model S.

In a surprise move, Musk’s SpaceX and Ambani’s Reliance Jio announced a Starlink deal targeting India’s growing satellite internet market, pending regulatory approval. Oil prices also climbed as the US cut global surplus forecasts, though geopolitical tensions and demand concerns keep markets volatile.

Stock Selloff Eases as Trump Comments Buoy Markets

Global markets steadied following remarks by President Donald Trump that downplayed recession fears and signaled economic growth initiatives. Asian stocks traded in a narrow range, while US and European futures climbed. Relief over a proposed 30-day truce between Ukraine and Russia added to the market’s optimism. However, concerns linger over inflation, Federal Reserve policy, and heightened volatility.

Trump’s tariffs on steel and aluminum imports, coupled with retaliatory measures from the EU, remain a key headwind for global trade, with US equities nearing correction territory. Meanwhile, Cathay Pacific reported stronger-than-expected profits, though trade conflicts cloud its cargo outlook.

Investment Insight

While Trump’s reassurances offered temporary relief, persistent inflation and geopolitical tensions suggest continued market volatility. Investors should maintain a cautious approach, focusing on defensive sectors and monitoring inflation data closely for signs of sustained pressure.

China’s Retail Investors Fuel Stock Market Rally

China’s retail investors are pouring into equity mutual funds, with inflows reaching 56.4 billion yuan ($7.8 billion) in the first two months of 2025—a fivefold increase year-on-year and the highest since 2021. Buoyed by optimism over domestic tech breakthroughs and bullish signals from Beijing’s National People’s Congress, Chinese equities have outperformed global peers, with the STAR50 Index climbing over 9% and Hong Kong’s tech gauge soaring nearly 25%.

However, interest in mixed-allocation and bond-focused funds has waned, signaling a clear shift toward riskier assets amid rising confidence in China’s tech-driven growth.

Investment Insight

China’s tech sector rally underscores the importance of tracking innovation-driven markets. While the gains may lure investors, elevated valuations and geopolitical risks could temper long-term returns. Diversifying exposure across sectors may mitigate volatility.

Tesla’s Freefall Shakes Even Its Most Loyal Fans

Tesla shares have plunged 52% from their December highs, with even its staunchest supporters stepping back amid mounting concerns over weak sales, poor sentiment, and Elon Musk’s growing political distractions. The stock, the S&P 500’s worst performer this year, briefly rebounded 3.8% after President Trump purchased a Tesla Model S in a show of support.

However, Wall Street analysts continue to downgrade price targets, citing deteriorating global demand and overvaluation. Retail investors remain a rare source of support, but doubt is creeping into even the most bullish corners. With no major catalysts in sight, Tesla remains vulnerable to further declines.

Investment Insight

Tesla’s volatility highlights the risks of overreliance on sentiment-driven stocks. While its steep valuation could fuel a sharp recovery, investors should stay cautious and prioritize long-term fundamentals over short-term trading opportunities. Consider diversifying into less volatile sectors.

Market price: Tesla Inc (TSLA): USD 230.58

Musk and Ambani Forge Surprise Starlink Internet Deal in India

In a surprising turn, Elon Musk’s SpaceX and Mukesh Ambani’s Reliance Jio have partnered to bring Starlink satellite internet to India. The agreement allows Jio to stock Starlink equipment in thousands of retail outlets, providing Starlink with a direct distribution network. This deal follows months of disputes between the billionaires over spectrum allocation, with India siding with Musk’s preferred approach.

The collaboration helps Jio expand offerings in underserved areas while giving Starlink a low-cost market entry. The partnership is conditional on regulatory approval, as India’s satellite internet market is projected to grow 36% annually to $1.9 billion by 2030.

Investment Insight

The Starlink-Jio deal highlights the growing potential of India’s satellite internet market. Investors should watch for regulatory developments and the competitive dynamics between telecom incumbents and satellite disruptors. Early movers in this space could see significant long-term gains.

Oil Prices Climb as US Cuts Global Surplus Forecasts

Oil prices rose, with Brent crude nearing $70 a barrel and WTI approaching $67, after the US Energy Information Administration slashed its global oversupply forecasts for 2025 and beyond. The revised outlook, which follows similar moves by the IEA, reflects expectations of reduced flows from Iran and Venezuela.

Despite the gains, market sentiment remains fragile amid ongoing tariff uncertainty, US growth concerns, and rising inventories. Geopolitical tensions also persist, with Yemen’s Houthis resuming attacks on Israeli ships and Ukraine agreeing to a 30-day truce with Russia.

Investment Insight

Crude oil’s rebound highlights supply-side adjustments, but volatility driven by geopolitical risks and demand concerns persists. Investors should remain cautious, focusing on energy equities with strong fundamentals and hedging against further price swings.

Conclusion

Global markets remain in a delicate balance as optimism from geopolitical developments and economic signals is tempered by persistent risks. President Trump’s reassurances provided temporary relief, but inflation, Fed policy, and trade tensions continue to dominate investor concerns.

China’s tech-driven rally highlights opportunities in innovation-focused markets, while Tesla’s struggles underscore the dangers of sentiment-driven investments. The Starlink-Jio partnership signals growth potential in India’s satellite internet sector, while oil’s rebound reflects tightening supply dynamics amid geopolitical uncertainty.

Investors should navigate cautiously, focusing on diversification and sectors with strong fundamentals to weather ongoing volatility and capitalize on emerging opportunities.

Upcoming Dates to Watch

- March 12th, 2025: US CPI, Japan PPI

- March 13th, 2025: US PPI, initial jobless claims; Eurozone industrial production

- March 14th, 2025: France CPI, Germany CPI, UK industrial production

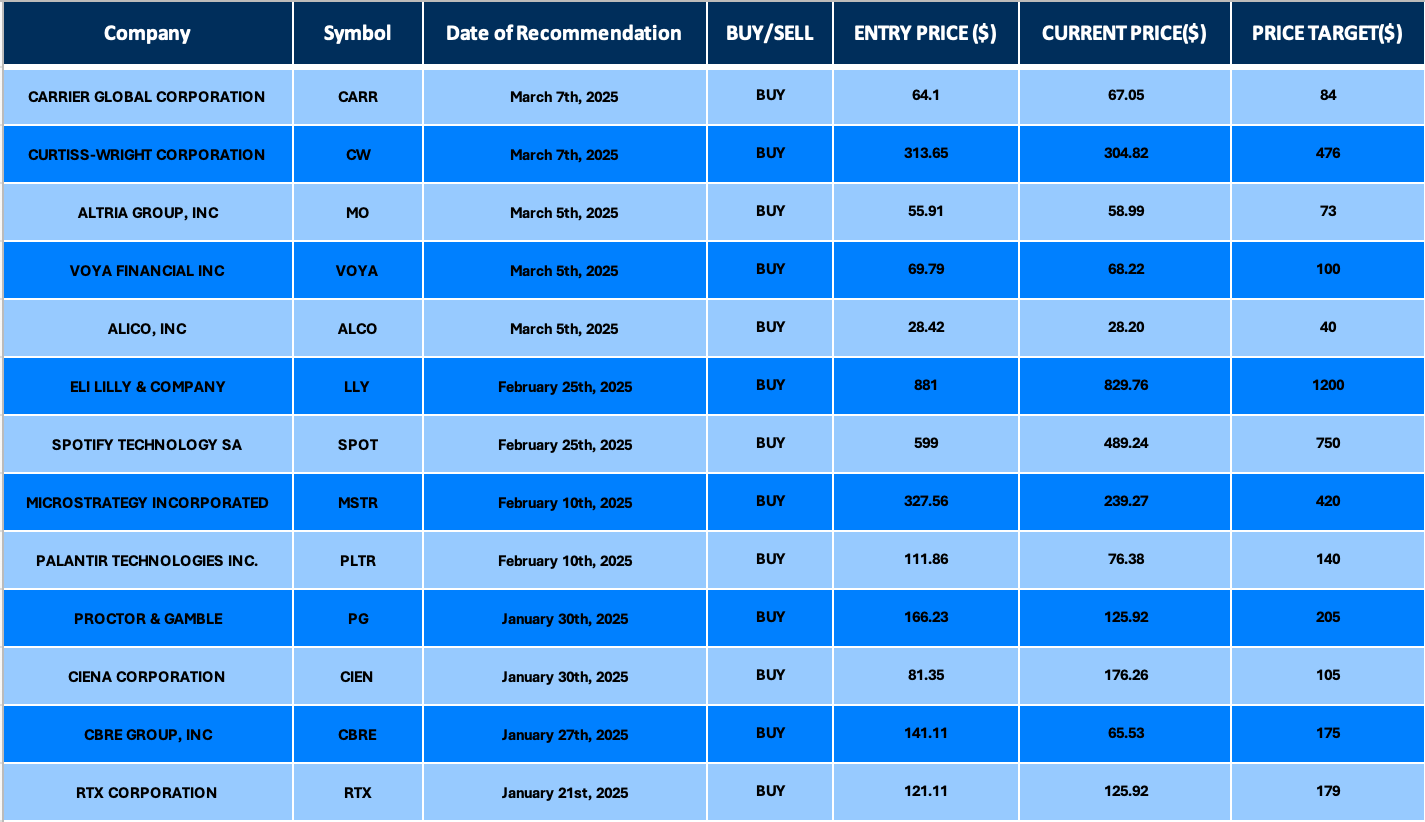

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.