Date Issued – 14th March 2025

Preview

Global markets steadied as optimism grew that the U.S. will avert a government shutdown, lifting equities after recent declines. The S&P 500 and Nasdaq 100 remain in correction territory, while China’s CSI 300 hit a year-high on expectations of policy support. Gold surged near $3,000 an ounce, driven by escalating U.S. tariffs and safe-haven demand, with analysts forecasting further gains. Foxconn projected strong Q1 revenue despite a 13% Q4 profit decline, citing robust AI server and cloud demand amid trade risks. Meanwhile, CK Hutchison shares tumbled up to 6.7% after Beijing condemned its $22.8 billion port sale to a U.S.-led group, heightening geopolitical tensions. Investors are watching China’s upcoming economic briefing for stimulus details, as consumer stocks rallied on expectations of policy measures.

Markets Stabilize as US Shutdown Risks Recede

Global equities steadied Friday as optimism grew that the U.S. will avert a government shutdown, easing some investor anxiety after weeks of market declines. Asian stocks advanced, with China’s CSI 300 reaching a year-high, while U.S. and European futures pointed higher. The S&P 500 and Nasdaq 100, both in correction territory, had fallen sharply on Thursday, shedding over 10% from recent peaks. Meanwhile, the dollar strengthened for a third consecutive session, and Treasury yields edged lower after a prior rally in haven assets. Traders remain cautious amid U.S. economic risks, including a potential recession and escalating trade tensions under President Trump’s tariff policies.

Investment Insight:

With the S&P 500 in correction territory, the potential for a short-term rebound is rising, particularly as extreme market moves often revert. Investors should watch for rotation opportunities, as capital flows indicate growing interest in Asian equities, especially Chinese A-shares. Meanwhile, persistent trade uncertainties and tightening liquidity conditions underscore the need for selective positioning in global markets.

CK Hutchison Shares Slide Amid Beijing’s Criticism of Port Sale

CK Hutchison shares tumbled as much as 6.7% on Friday after China’s Hong Kong and Macau Affairs Office publicly condemned the company’s $22.8 billion sale of its global port assets, including holdings along the Panama Canal, to a U.S.-led group. The state-owned Ta Kung Pao newspaper labeled the deal a “betrayal” of Chinese interests, amplifying investor concerns about Beijing’s stance. The backlash underscores rising geopolitical tensions as President Trump supports efforts to limit Chinese influence over critical infrastructure. Despite CK Hutchison’s assurances of operational independence, the selloff highlights market wariness over potential regulatory or retaliatory actions from China.

Investment Insight:

The sharp drop in CK Hutchison’s stock reflects the risks of geopolitical entanglements for multinational firms, particularly those with exposure to U.S.-China tensions. Investors should monitor potential regulatory fallout and shifts in Chinese policy toward Hong Kong-based businesses. In the near term, uncertainty over Beijing’s response may weigh on CK Hutchison’s valuation, while broader Hong Kong equities remain resilient, as evidenced by the 2.5% rise in the Hang Seng Index.

Market price: CK Hutchison Holdings Ltd (HKG: 0001): HKD 46.15

Gold Surges Toward $3,000 as Trade Tensions Fuel Safe-Haven Demand

Gold soared to a record high near $2,994 an ounce on Friday, driven by escalating trade tensions as President Trump’s tariff policies stoked concerns over global economic growth. The precious metal has gained 2.6% this week—its strongest advance since November—bolstered by central bank purchases, ETF inflows, and investor flight from risk assets. Futures in New York surpassed $3,000, underscoring bullion’s momentum amid market volatility, with the S&P 500 slipping into correction territory. Analysts see further upside, with Macquarie forecasting a potential rally to $3,500 in Q2. Gold producers, particularly in Asia-Pacific, benefited from the surge, with stocks like Evolution Mining Ltd. hitting record highs.

Investment Insight:

Gold’s rally underscores its role as a preferred hedge in times of geopolitical and economic uncertainty. With reciprocal tariffs set to take effect in Q2 and equity markets facing headwinds, the metal’s appeal remains strong. Investors should monitor central bank buying trends and ETF inflows, as sustained demand could push prices beyond the psychological $3,000 mark. However, any easing in trade tensions or a rebound in risk assets could temper gold’s momentum.

Foxconn Projects Strong Q1 Revenue Despite Profit Miss

Foxconn reported a 13% drop in fourth-quarter profit to T$46.33 billion ($1.41 billion), missing analyst expectations, but forecast strong revenue growth in Q1, particularly in consumer electronics and cloud products. The company’s record 15.2% revenue surge in Q4, driven by AI server demand, failed to offset pressure on margins. Trade tensions remain a headwind, as Foxconn’s major manufacturing hubs in China and Mexico face heightened U.S. tariffs. Despite challenges, the company is expanding its U.S. footprint, partnering with Apple to build a server assembly facility in Houston. Foxconn shares are down 8.7% year-to-date amid trade policy concerns.

Investment Insight:

Foxconn’s outlook signals resilience, with AI and cloud-related demand offsetting volatility in consumer electronics. However, geopolitical risks remain a key factor, as escalating U.S. tariffs could impact supply chain costs and profitability. Investors should watch for further updates on Foxconn’s U.S. expansion strategy, which may help mitigate trade risks. Despite near-term pressures, the company’s positioning in AI infrastructure could provide long-term upside.

Market price: Hon Hai Precision Industry Co Ltd. (TPE: 2317): TWD 170.00

Chinese Stocks Rally on Policy Optimism Ahead of Consumption Briefing

China’s CSI 300 Index surged 2.6% to a year-high on Friday as investors anticipated policy measures to boost consumption ahead of a government briefing scheduled for Monday. Consumer stocks led the gains, with liquor makers Kweichow Moutai and Wuliangye Yibin jumping over 5%, while childcare-related shares hit the daily 10% limit after local governments announced subsidies. Authorities are expected to outline initiatives such as consumer trade-in programs, expanded social safety nets, and increased financing for service industries. The rally follows China’s renewed commitment to economic stimulus, including a 5% annual growth target set at the National People’s Congress.

Investment Insight:

While optimism around policy support has lifted Chinese equities, sustainability will depend on the specifics of upcoming stimulus measures. Investors should watch for details on income-boosting initiatives and consumer loan facilitation, as these could determine whether the rally extends. Short-term momentum favors consumer stocks, but long-term gains will require structural improvements in household spending power. Economic data releases on Monday could further shape sentiment, providing key insights into the strength of China’s recovery.

Conclusion

Markets remain at a crossroads as investors weigh policy risks against signs of resilience in key sectors. U.S. equities are searching for stability after entering correction territory, while Chinese stocks rally on stimulus expectations. Gold’s surge underscores persistent geopolitical uncertainty, with upcoming trade developments and economic data likely to shape sentiment. Foxconn’s outlook highlights both opportunities in AI and risks from escalating tariffs. Meanwhile, CK Hutchison’s selloff reflects the broader challenges facing multinational firms amid tightening regulatory scrutiny. As the week unfolds, attention turns to China’s economic briefing and U.S. policy shifts for clues on market direction.

Upcoming Dates to Watch

- March 14th, 2025: France CPI, Germany CPI, UK industrial production

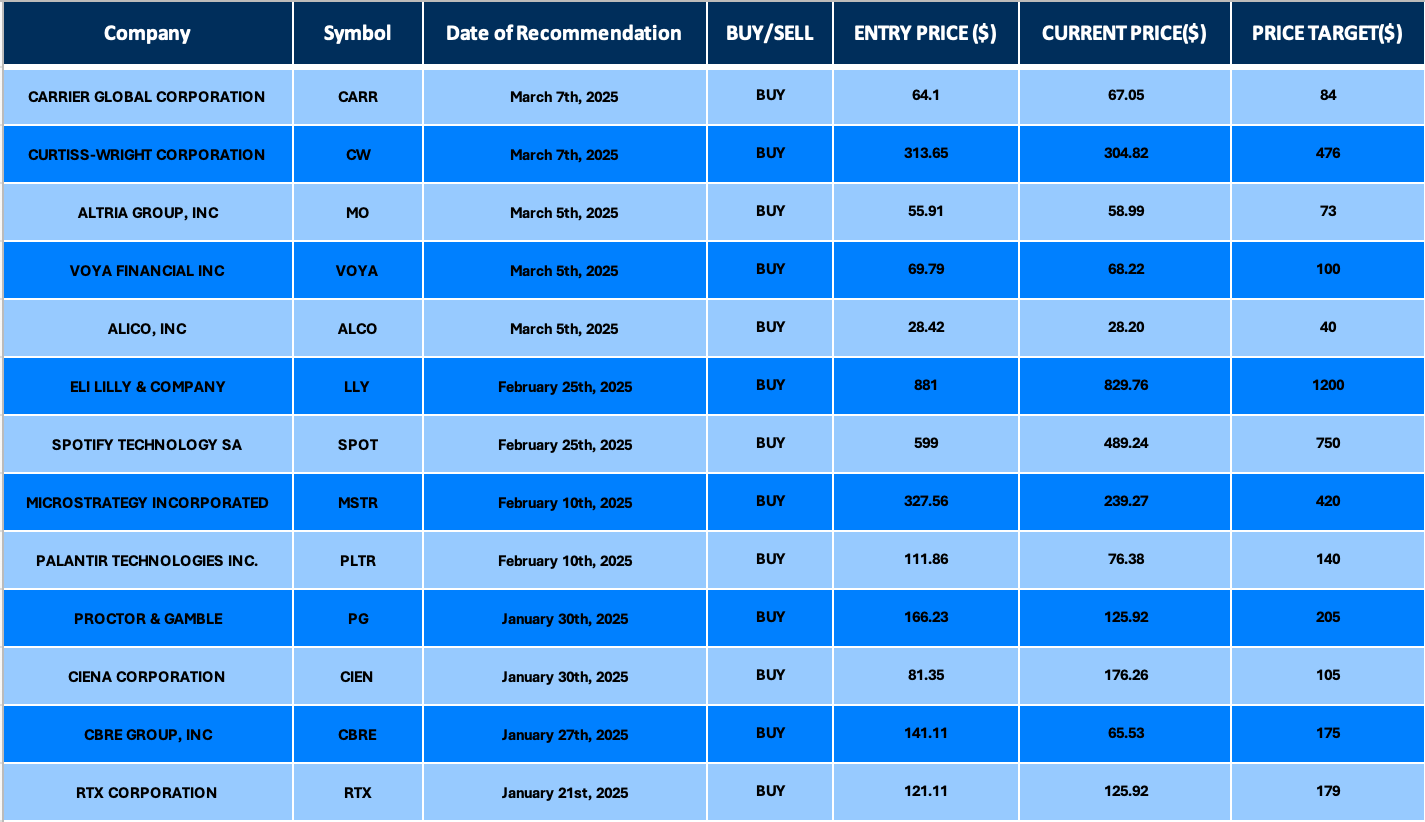

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.