Date Issued – 17th March 2025

Preview

Global Markets Enter a High-Stakes Week

Global markets enter a high-stakes week, with key central bank rate decisions—including the Federal Reserve, Swiss National Bank, and Bank of England—alongside critical economic data releases. Asian equities began on a positive note, supported by strong Chinese consumption data, though mixed signals from China’s property market tempered optimism.

Oil prices extended gains on hopes of rising Chinese demand, while gold surged past $3,000/oz for the first time, reflecting safe-haven demand amid economic uncertainty. Meanwhile, South Korea’s chip exports plunged as US tech curbs bite, and Switzerland faces a tough rate decision with limited policy space. Investors brace for heightened volatility and shifting sentiment.

Asian Markets Gain Amid Mixed Signals From China; US Futures Dip

Asian equities climbed Monday, buoyed by stronger-than-expected Chinese consumption data, while US stock futures edged lower following remarks from Treasury Secretary Scott Bessent, who dismissed recent market declines as a healthy correction.

Key Chinese indices showed mixed performance as optimism around consumption clashed with concerns over a deepening property slump. Oil prices extended gains on hopes for rising Chinese demand, while Treasuries inched higher with the 10-year yield easing to 4.30%. European futures saw a modest uptick, supported by Germany’s new spending plan, which also lifted the euro.

Meanwhile, investors are bracing for a pivotal week of central bank meetings, with the Fed, BOJ, and BOE expected to provide crucial policy signals.

Investment Insight

China’s renewed focus on boosting domestic consumption presents opportunities for investors, particularly in consumer, travel, and healthcare sectors. However, lingering risks from the property market and export headwinds warrant cautious optimism.

For US markets, the Treasury Secretary’s dismissal of equity volatility underscores a broader expectation of resilience amid policy shifts. Investors should monitor upcoming central bank decisions for cues on global liquidity and growth trajectories.

Oil Prices Rise Amid China’s Economic Stimulus Plans and Red Sea Tensions

Oil extended its gains Monday, with Brent crude climbing above $71 per barrel and WTI nearing $68, as China pledged fresh measures to boost income and consumption.

Optimism over demand from the world’s largest crude importer was tempered by geopolitical risks, with the US launching military strikes on Yemen’s Houthi militants after Red Sea shipping routes were targeted.

Despite the recent uptick, oil remains over $10 below its January highs, weighed down by easing supply concerns, escalating US-China trade tensions, and expectations of slower demand growth. Goldman Sachs cut its year-end Brent forecast to $71, citing downside risks tied to tariffs and OPEC+ production increases.

Investment Insight

China’s stimulus plans could provide a short-term lift to oil demand, but global investors should remain cautious amid persistent macro headwinds, including geopolitical risks and trade uncertainties.

Energy markets are likely to see continued volatility, with US resilience and sanctions on Russia offering some support. Investors should focus on defensive plays in the energy sector and monitor OPEC+ policy shifts and broader economic signals for long-term positioning.

Gold Tops $3,000 as Safe-Haven Demand Soars; Key Levels to Watch

Gold surged past the $3,000/oz mark for the first time on Friday, driven by growing demand for safe-haven assets amid economic uncertainty tied to US tariff policies. The yellow metal has gained 14% year-to-date, significantly outperforming the S&P 500, which has fallen 8% over the same period.

Technical analysis suggests further upside potential, with a breakout from a pennant pattern pointing to a target of $3,365 per ounce in the coming months. However, profit-taking could drive short-term pullbacks, with key support levels at $2,833, $2,790, and $2,721 offering potential entry points for investors.

Investment Insight

Gold’s record-breaking rally underscores its appeal in times of economic and political volatility. While momentum remains strong, investors should approach with caution as overbought conditions could trigger short-term corrections. Establishing positions near key support levels may provide a more favorable risk-reward profile.

Longer-term, the combination of inflation fears and turbulent equity markets could sustain gold’s uptrend, making it a compelling hedge in diversified portfolios.

South Korea’s Chip Exports Tumble Amid US Curbs on China

South Korea’s semiconductor exports to China plunged 31.8% year-over-year in February, intensifying concerns over weakening global demand and escalating US restrictions on advanced technology exports to Beijing. This marked a sharper decline than January’s 22.5% contraction, signaling mounting pressure on South Korea’s chipmakers, including SK Hynix and Samsung Electronics.

The US has tightened export curbs on high-bandwidth memory chips, aiming to curb China’s progress in AI and advanced technologies. With semiconductor exports accounting for a significant portion of South Korea’s economy, the slowdown, coupled with weak private spending, poses a risk to economic growth in 2025.

Investment Insight

South Korea’s semiconductor sector faces a dual headwind of geopolitical restrictions and declining global demand, signaling potential earnings pressure for key players like SK Hynix and Samsung. Investors should monitor pricing trends in memory chips and geopolitical developments for clarity on long-term prospects.

Diversified exposure across regions and sectors may help mitigate risks tied to the US-China tech rivalry and South Korea’s economic vulnerabilities.

Swiss Central Bank Faces High-Stakes Rate Decision Amid Limited Policy Flexibility

The Swiss National Bank (SNB) faces a challenging decision this week as it weighs whether to cut its benchmark rate by 25 basis points to 0.25%—a move economists describe as a “coin toss.” While resilient economic growth, a weaker franc, and stable inflation argue for holding rates steady, global trade uncertainty driven by US tariffs increases the case for preemptive easing.

With limited room for further cuts before hitting zero, the SNB must carefully balance short-term economic risks against its longer-term policy arsenal. Markets remain on edge, with a 75% probability of a rate cut priced in, though SNB’s history of surprise moves keeps investors cautious.

Investment Insight

The SNB’s rate decision underscores the complexity of navigating limited policy tools amid global uncertainty. A cut could support Swiss growth in the face of trade risks but risks depleting future policy flexibility.

Investors should monitor the franc’s performance and export data closely, as these remain critical to Switzerland’s economic outlook. Positioning in sectors less sensitive to currency volatility and trade uncertainty could offer a hedge against potential market disruptions stemming from the SNB’s decision.

Conclusion

Global markets are navigating a complex landscape marked by geopolitical tensions, shifting economic policies, and central bank decisions. China’s efforts to stimulate consumption are offering pockets of optimism, but risks from trade disputes and slowing demand persist. Commodities like oil and gold reflect this uncertainty, with price movements driven by both safe-haven demand and supply dynamics.

Meanwhile, South Korea’s chip exports and Switzerland’s policy conundrum highlight the ripple effects of US trade restrictions. As investors assess central bank actions and macroeconomic signals this week, strategic positioning and a focus on diversification remain crucial in mitigating volatility and uncovering opportunities.

Upcoming Dates to Watch

- March 17th, 2025: US retail sales

- March 18th, 2025: Canada CPI; US Housing starts, import price index

- March 19th, 2025: US Fed rate decision, Eurozone CPI, Brazil rate decision; Japan rate decision, industrial production

- March 20th, 2025: Australia unemployment, China loan prime rates, Switzerland rate decision, Taiwan rate decision, UK rate decision, US jobless claims

- March 21st, 2025: Japan CPI

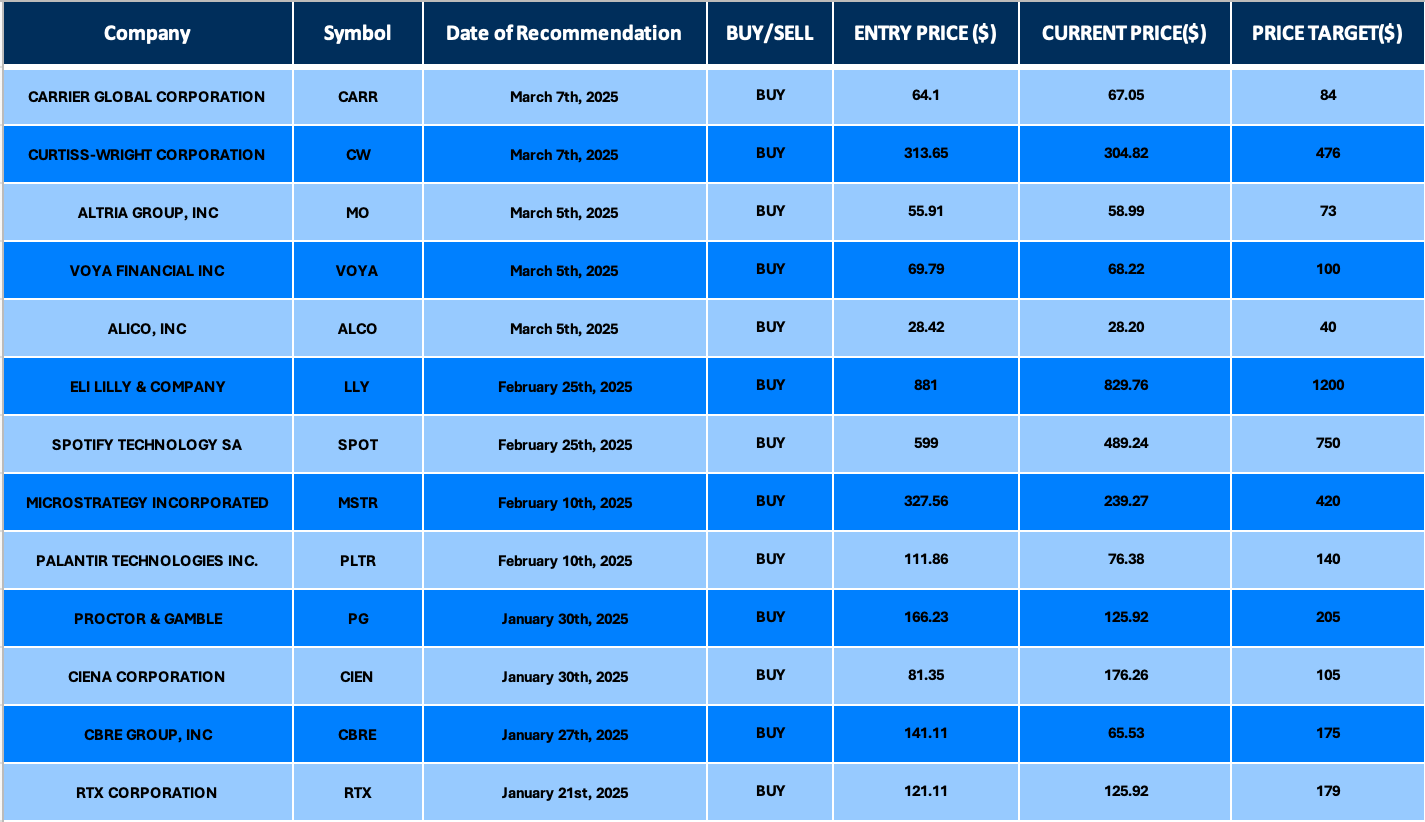

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.