Date Issued – 18th March 2025

Preview

Global markets are seeing a shift in sentiment as European stocks prepare to follow Asia’s rally, with the MSCI Asia Pacific Index up for a third consecutive session and Hong Kong’s Hang Seng reaching a three-year high on optimism around China’s economic recovery. Gold hit a record $3,017 per ounce amid geopolitical tensions and US slowdown fears, while oil extended gains on Middle East concerns. In corporate news, BYD shares soared to a record after unveiling ultra-fast EV charging technology, and Nvidia’s GTC conference is in focus as investors await updates on AI and next-gen chips to reverse a 20% stock decline. Meanwhile, Indonesia’s market tumbled on fiscal worries, and the Fed’s upcoming policy meeting adds a layer of caution for investors managing global risk exposure.

European Stocks Track Asian Rally Amid Global Rebalancing

European markets are set to follow Asia’s lead, with Euro Stoxx 50 futures rising 0.5% after a robust session in Asia, where the MSCI Asia Pacific Index climbed for a third day. Hong Kong surged over 2%, driven by Chinese tech stocks as investors pivot toward non-US assets following a US equity correction earlier this month. Meanwhile, Germany’s proposed fiscal expansion, featuring billions in debt-financed infrastructure and defense spending, has further bolstered European sentiment. Gold hit a record high above $3,017 an ounce amid lingering uncertainties, while the US 10-year Treasury yield steadied ahead of the Federal Reserve’s policy meeting. Elsewhere, Indonesian stocks suffered their worst single-day drop in over a decade, triggering a temporary trading halt. Oil extended its rally on heightened Middle East tensions, and the dollar strengthened slightly, gaining 0.1%.

Investment Insight:

The global shift toward non-US assets signals a strategic reallocation opportunity for investors. Europe’s fiscal expansion and Asia’s tech-driven rally suggest a favorable environment for selective exposure to these regions, particularly in Chinese technology and German infrastructure sectors. However, caution remains warranted as US retail sales data and Fed projections point to a slowing US economy, keeping valuations under scrutiny. Gold’s record high underscores persistent risk aversion, making it a potential hedge as markets navigate geopolitical and policy uncertainties. Investors should monitor upcoming earnings and policy decisions closely to refine positioning in this volatile macro backdrop.

Gold Hits Record High Amid Geopolitical and Economic Uncertainty

Gold surged to a historic high above $3,017 an ounce, boosted by escalating Middle East tensions and concerns over a slowing US economy. Israel’s military strikes on Hamas targets in Gaza rattled markets, reinforcing gold’s haven appeal. Meanwhile, softer-than-expected US retail sales data for February added to the cautious sentiment, as consumer spending showed signs of strain. Despite this, traders remain uncertain over the Federal Reserve’s rate trajectory, with expectations for near-term rate cuts largely unchanged. Gold’s year-to-date rise of over 14% underscores its role as a preferred store of value in an environment of geopolitical risks and economic uncertainty. Other precious metals, including silver, platinum, and palladium, also traded higher.

Investment Insight:

Gold’s record-breaking rally highlights its enduring role as a hedge against geopolitical instability and economic headwinds. With the metal’s upward momentum bolstered by both rising Middle East tensions and a weakening US growth outlook, investors may consider increasing exposure to gold and related assets as part of a defensive strategy. However, with prices already at historic highs, future gains may depend on the persistence of these risks. Diversifying into other precious metals, which have yet to see similar surges, could provide additional upside potential while balancing portfolio risk.

Hong Kong Stocks Surge to Three-Year High on China Optimism

The Hang Seng Index climbed 2% on Tuesday, reaching a three-year high and extending its year-to-date gain to 23%, the strongest performance among major global markets. Investors cheered China’s recent retail sales data and new measures to boost domestic consumption, including childcare subsidies and a “special action plan.” Asian markets broadly followed suit, with the MSCI Asia Pacific Index rising 1%. The positive momentum is expected to carry into European trading as futures for the Euro Stoxx 50 and DAX gained 0.35% and 0.43%, respectively. Meanwhile, mainland Chinese stocks posted modest gains, and the yuan hovered near its strongest levels of the year. In contrast, Indonesia’s Jakarta Index tumbled 7%, weighed down by fiscal concerns and trade tensions.

Investment Insight:

China’s economic recovery and policy-driven boost to consumption present compelling opportunities for investors seeking growth exposure. Hong Kong’s outperformance underscores the region’s appeal, particularly in sectors tied to domestic demand and financial flows. Elevated sentiment in Europe and Asia signals a shift in investor focus toward non-US markets, especially as US growth slows. However, risks from geopolitical developments and trade tensions remain, making diversification across markets and asset classes a prudent strategy. Currencies tied to China’s economy, such as the Australian and New Zealand dollars, may also offer tactical opportunities for short-term gains.

BYD Stock Hits Record High on Game-Changing EV Charging Technology

BYD shares surged as much as 6% in Hong Kong on Tuesday, reaching a record valuation of nearly $162 billion—surpassing Ford, GM, and Volkswagen combined. The rally followed the company’s unveiling of an ultra-fast charging system capable of delivering 400 kilometers (249 miles) of range in just five minutes, showcased in its new Han L sedan. The groundbreaking technology directly addresses one of the biggest hurdles to EV adoption—charging time—positioning BYD as a leader in the increasingly competitive EV market. BYD plans to roll out over 4,000 dedicated charging stations across China to support the new technology. With a 161% year-over-year jump in February sales, BYD continues to expand its dominance as China’s leading automaker, with a market share nearing 15%.

Investment Insight:

BYD’s technological leap in charging speed could redefine the EV landscape, offering a significant advantage over rivals like Tesla and Mercedes-Benz. The ability to charge an EV as quickly as refueling a gas-powered car may accelerate the transition from internal combustion engines to EVs, boosting BYD’s market share in China and beyond. Investors should note BYD’s strategic shift from price competition to innovation-driven differentiation, which could enhance margins and sustain long-term growth. While competition in EV charging infrastructure remains fierce, BYD’s investment in proprietary networks could solidify its leadership. This innovation-led momentum positions BYD as a strong contender for global EV dominance, making it an attractive long-term investment in the sector.

Market price: BYD Ord Shs H (HKG:1211): HKD 402.20

Nvidia’s GTC Conference in Focus as Investors Seek AI-Driven Catalyst

Nvidia’s annual GPU Technology Conference (GTC), highlighted by CEO Jensen Huang’s keynote, has captured Wall Street’s attention as the chipmaker looks to regain momentum following a 20% drop from its January peak. Investors are anticipating significant updates, particularly on Nvidia’s next-generation Blackwell GPUs, advancements in quantum computing, and partnerships in robotics, automotive, and cloud AI adoption. Analysts at Bank of America and Melius Research have reiterated their “buy” ratings, citing optimism around Nvidia’s innovation pipeline and potential for a 10% quarter-over-quarter growth trajectory. While macroeconomic headwinds persist, including China-related volatility, the event is expected to reaffirm Nvidia’s leadership in AI and provide a badly needed boost to its stock.

Investment Insight:

Nvidia’s upcoming product cycle, led by Blackwell GPUs and quantum computing advancements, underscores its continued dominance in AI-driven technology. Despite recent stock volatility, Nvidia remains well-positioned to capitalize on growing demand for AI infrastructure, particularly as cloud and enterprise adoption accelerates. Current valuations, which are 41% lower than during the peak of AI excitement in 2022, may present a compelling entry point for long-term investors. However, near-term risks, including competitive pressure in China and broader market uncertainty, warrant a cautious approach. Investors should monitor GTC announcements closely, as breakthroughs in product innovation could serve as a strong catalyst for recovery.

Market price: NVIDIA Corp (NVDA): USD 119.53

Conclusion

Markets are navigating a mix of optimism and caution as investors respond to shifting global dynamics. While Asia’s rally and China’s economic recovery provide reasons for optimism, geopolitical tensions and US economic uncertainty are keeping risk sentiment balanced. Corporate innovation is taking center stage, with BYD’s EV breakthrough and Nvidia’s AI updates offering potential catalysts. Gold’s record high and oil’s extended rally underscore a cautious approach as investors seek safe havens amid volatility. As the Federal Reserve prepares its next move, staying attuned to policy updates and macro trends will be key for navigating an increasingly complex landscape.

Upcoming Dates to Watch:

- March 18th, 2025: Canada CPI; US Housing starts, import price index

- March 19th, 2025: US Fed rate decision, Eurozone CPI, Brazil rate decision; Japan rate decision, industrial production

- March 20th, 2025: Australia unemployment, China loan prime rates, Switzerland rate decision, Taiwan rate decision, UK rate decision, US jobless claims

- March 21st, 2025: Japan CPI

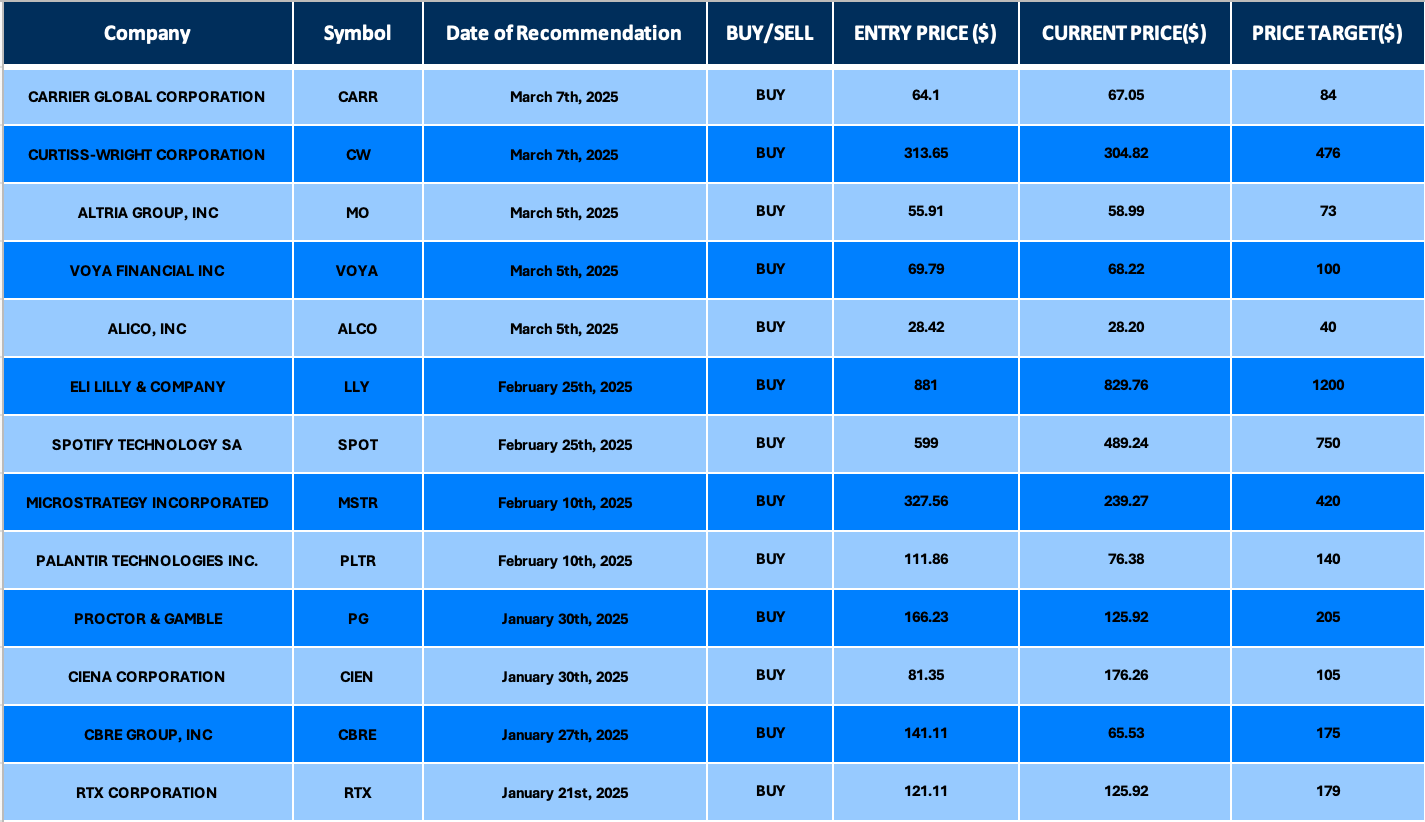

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.