Date Issued – 16th April 2025

Preview

Global markets are under pressure as escalating US-China trade tensions weigh on investor sentiment. Nvidia shares fell 6.3% after warning that new US export restrictions on AI chips to China would cost the company $5.5 billion, dragging tech stocks lower. Oil prices extended losses, with Brent crude near $64 per barrel, as oversupply concerns and slowing demand forecasts from the International Energy Agency fuel bearish sentiment. Meanwhile, ASML flagged tariff-driven uncertainty for its 2025–2026 outlook, despite AI demand supporting growth projections. In China, Q1 GDP grew 5.4%, beating expectations, but economists warn that mounting tariffs could slow momentum in the coming quarters. Gold surged to a record $3,275 per ounce, as trade war fears push investors toward safe havens. Markets await further clarity on US tariff policies, with US retail sales data and corporate earnings reports in focus.

US Futures Slide Amid Nvidia Export Restrictions

US stock futures dropped on Wednesday as Nvidia disclosed a $5.5 billion hit tied to new US export restrictions on its H20 AI chips to China, intensifying trade tensions. Nasdaq futures fell 2.2%, leading declines, while S&P 500 and Dow futures slid 1.4% and 0.8%, respectively. Nvidia shares dropped over 6% in after-hours trading. Meanwhile, gold hit a record $3,275 per ounce, surging as investors sought safety amid escalating US-China trade uncertainty. The broader market remains on edge as shifting tariff policies and slowing retail sales data add to recession fears.

Investment Insight

Heightened geopolitical risks and regulatory headwinds are pressuring growth-heavy sectors like technology, while safe-haven assets such as gold are outperforming. Investors should consider diversifying portfolios with defensive plays, including gold and consumer staples, while approaching high-growth equities with caution as trade tensions and policy unpredictability weigh on sentiment.

China’s Economy Beats Expectations Ahead of Tariff Impact

China’s GDP grew by 5.4% in Q1 2025, outperforming forecasts of 5.1%, as export-driven growth provided resilience in the face of escalating trade tensions with the US. Retail sales rose 5.9% in March, and factory output surged 7.7%, underscoring consumer and industrial strength. However, US tariffs—now exceeding 145% on Chinese imports—are expected to weigh heavily on the economy in coming quarters. Economists have downgraded China’s 2025 growth forecast, with UBS projecting a sharp slowdown to 3.4%. Beijing has signaled readiness to counteract pressures with fiscal stimulus and monetary easing, while continuing to diversify trade relationships beyond the US.

Investment Insight

China’s stronger-than-expected Q1 growth reflects short-term resilience but masks longer-term risks from trade restrictions. As tariffs bite, investors should anticipate increased volatility in export-reliant sectors and closely watch for further policy stimulus. Diversifying exposure to Southeast Asian markets, where China is strengthening trade ties, could offer a hedge against the fallout from the US-China trade war.

UK Inflation Slows, Rate Cuts Expected

UK inflation eased to 2.6% in March, down from 2.8% in February, beating expectations of 2.7%, according to the ONS. The drop was driven by lower petrol and diesel prices, with fuel costs declining by 1.6p per litre compared to March 2024. Food prices remained stable, while clothing saw notable price increases. The cooling inflation strengthens expectations for a Bank of England interest rate cut next month, aimed at supporting households amid growing concerns over Donald Trump’s trade war and its potential to dampen global growth. Chancellor Rachel Reeves welcomed the progress but stressed the need for continued economic vigilance.

Investment Insight

The easing inflation and likely rate cuts signal a more accommodative monetary stance, which could boost consumer spending and equity markets in the near term. Investors should focus on rate-sensitive sectors like real estate and financials, while also considering defensive positions as global trade tensions persist. With risks of a broader economic slowdown, diversification remains essential.

ASML Warns of Tariff-Driven Uncertainty Despite AI Growth

ASML, the global leader in chipmaking equipment, cautioned that recent tariffs are clouding its 2025–2026 outlook, despite expectations of continued growth driven by demand for AI-related technologies. CEO Christophe Fouquet highlighted the macroeconomic risks, while CFO Roger Dassen detailed four areas of impact, including tariffs on shipments, imported tools, and materials for manufacturing. The indirect effects on global growth remain uncertain. ASML reported Q1 net bookings of €3.9 billion, missing analyst estimates of €4.89 billion, and issued a Q2 revenue forecast of €7.2–€7.7 billion, slightly below market expectations. AI remains a key growth driver, though market shifts pose mixed risks and opportunities.

Investment Insight

ASML’s reliance on high-value AI chip demand positions it as a pivotal player in the semiconductor sector, but tariff uncertainties could pressure its supply chain and margins. Investors should monitor geopolitical developments and consider the potential for delayed capital spending by its customers. A long-term focus on AI-driven growth remains valid, though diversification into less tariff-sensitive parts of the supply chain could help mitigate risks.

Market price: ASML Holding NV (ASML): EUR 605.40

Oil Falls as Glut Concerns and Trade War Cloud Demand Outlook

Oil prices extended their decline on Wednesday as fears of oversupply and weakening global demand intensified amid escalating US-China trade tensions. Brent crude traded near $64 per barrel, while West Texas Intermediate slipped below $61, both hovering near four-year lows. China’s warning that domestic consumption alone cannot sustain growth, coupled with the International Energy Agency’s downgraded oil demand forecast, added to bearish sentiment. Rising US crude inventories and uncertainty over retaliatory trade measures further weighed on risk appetite, leaving investors wary of near-term demand recovery.

Investment Insight

Oil markets face dual pressures from oversupply concerns and trade-driven demand uncertainty. Investors should brace for continued volatility, particularly in energy-related equities and commodities. Defensive positioning with exposure to midstream oil infrastructure or diversified energy ETFs could provide stability while awaiting clarity on geopolitical and economic developments.

Conclusion

Markets remain caught in a web of uncertainty as trade tensions, tariff impacts, and slowing global demand dominate headlines. Tech and energy sectors face mounting pressures, while safe-haven assets like gold continue to attract investors seeking stability. China’s stronger-than-expected GDP growth offers a brief reprieve, but the long-term effects of US tariffs loom large. As earnings season unfolds and economic data trickles in, investors are bracing for heightened volatility. The path forward hinges on geopolitical clarity and policy decisions, leaving markets in a precarious balance between opportunity and risk. Caution and diversification remain key strategies in this turbulent environment.

Upcoming Dates to Watch

- April 16th, 2025: Industrial Production

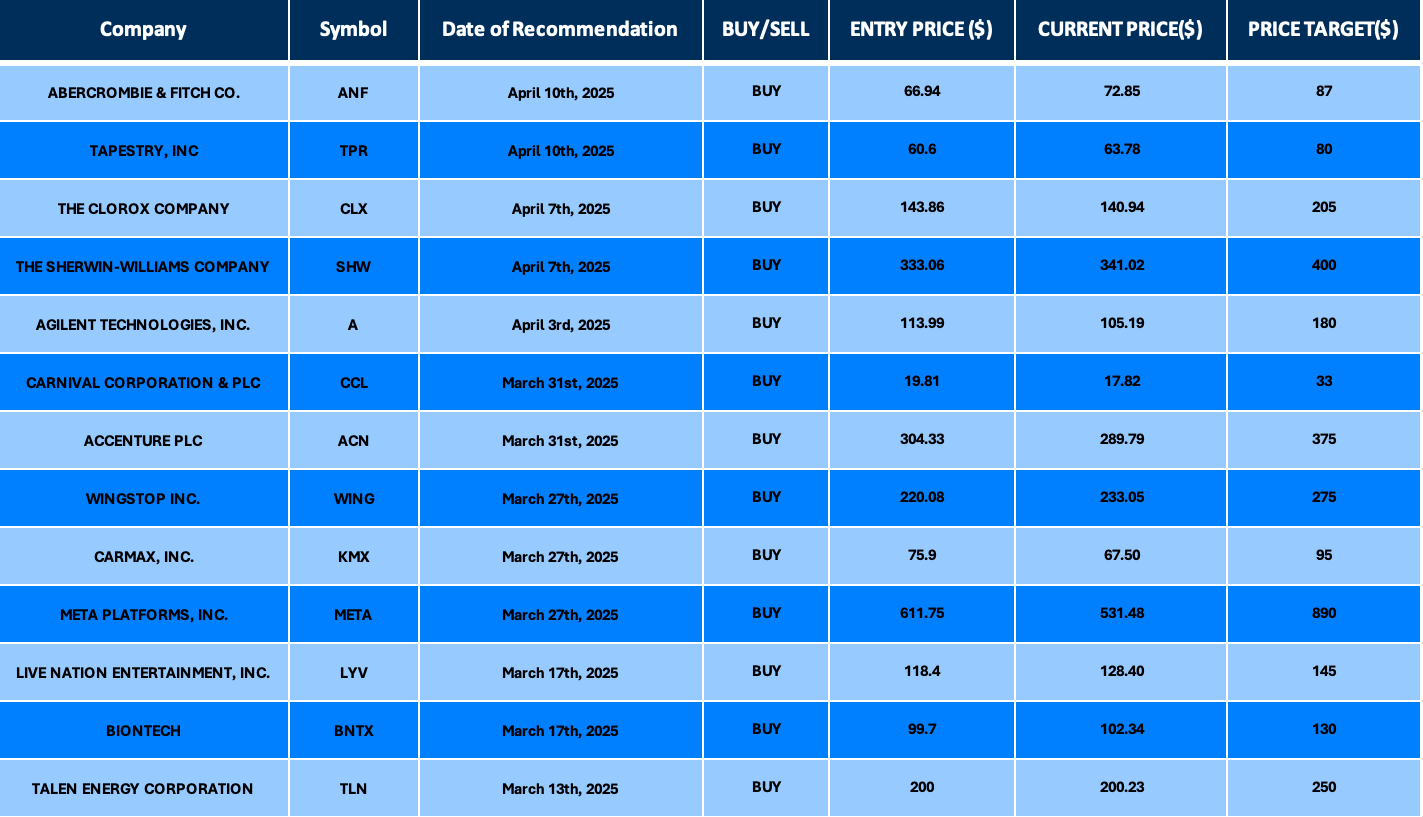

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.