Date Issued – 21st April 2025

Preview

Global markets opened the week under pressure as political risk in the US rattled investor confidence—President Trump’s attacks on the Fed sent the dollar sliding and lifted gold to record highs. Meanwhile, emerging market local bonds surged ahead of their dollar peers, buoyed by expectations of rate cuts and a weaker greenback. Oil extended losses, with Brent dipping below $67, as demand fears and easing geopolitical tensions—especially US-Iran nuclear talks—undermined sentiment. In Asia, LG Energy Solution exited an $8.45 billion Indonesian EV battery project, raising concerns about the region’s investment climate. Separately, South Korea is edging closer to MSCI developed market status after lifting its short-selling ban, a move that could attract index-driven inflows if reclassification proceeds.

Dollar Slides, Futures Fall as Trump Targets Fed Independence

US stock futures and the dollar fell sharply after President Donald Trump publicly criticized the Federal Reserve and hinted at the potential removal of Chair Jerome Powell, fueling investor anxiety over the central bank’s independence. The Bloomberg Dollar Spot Index dropped 0.9%, extending last week’s losses, as all major currencies gained against the greenback—led by the euro and Swiss franc. Gold surged to an all-time high, underscoring demand for safe havens amid rising political risk. Treasuries sold off across longer maturities, steepening the yield curve, while Japanese and European bonds attracted fresh inflows. Equity markets in Asia declined, with Japan’s Nikkei falling over 1%, as concerns mounted over the politicization of US monetary policy and its knock-on effects on global asset allocation.

Investment Insight: Investor confidence in US assets is wavering as political interference in Fed policy stokes fears of long-term instability. With the dollar under pressure and global diversification accelerating, investors should reassess exposure to US sovereign debt and consider reallocating toward non-dollar safe havens such as gold, high-grade European bonds, and Japanese government securities. Elevated volatility around US policy decisions may continue to drive defensive positioning in the near term.

Emerging Markets Gain Favor as Dollar Weakens, Rate Cuts Loom

Emerging market local-currency bonds are outperforming their dollar-denominated counterparts in a rare shift, as investors respond to a weakening US dollar, rising recession risks, and increasing expectations for rate cuts in developing economies. The Bloomberg index for EM local debt has returned 3.2% year-to-date, compared with just 0.9% for EM dollar bonds, despite offering lower yields—averaging 4.03% versus 7.1%. A steep drop in oil prices and US trade tensions have cooled inflationary pressures, giving EM central banks room to ease policy. Meanwhile, volatility in US Treasuries and declining demand for dollar assets are driving capital flows toward local-currency instruments. Dollar bond issuance in EMs (ex-China) has fallen 36% year-over-year in April, underscoring the shift in investor appetite.

Investment Insight: With the dollar under sustained pressure and EM central banks pivoting toward easing, local-currency bonds offer a compelling risk-reward profile. Investors should consider increasing exposure to EM local-rate markets, particularly in economies with stable inflation dynamics and credible monetary frameworks. As US policy volatility elevates term premiums and threatens dollar assets’ haven status, diversified fixed-income strategies anchored in select EM currencies could provide both yield pickup and portfolio resilience.

Oil Slumps as Demand Fears and Geopolitical Easing Weigh on Prices

Crude prices opened the week lower, with Brent falling below $67 and WTI nearing $64, as bearish signals swept through the energy market. Weaker global demand expectations—driven by escalating US-led trade tensions and a potential global economic slowdown—continue to pressure prices. Talks between the US and Iran over Tehran’s nuclear program added to the downside, raising prospects of increased Iranian crude supply. Meanwhile, OPEC+’s faster-than-expected return of output has revived oversupply concerns. A return to contango in portions of the futures curve and a broadly risk-off market tone further compounded the retreat. Analysts warn that sentiment remains fragile, with macro, fundamental, and geopolitical indicators all pointing lower.

Investment Insight: Energy investors should brace for continued volatility as bearish fundamentals, trade-driven demand uncertainty, and shifting geopolitical dynamics converge. Hedging exposure to oil-sensitive assets and reevaluating overweight positions in energy may be prudent until demand signals stabilize. The evolving US-Iran negotiations and OPEC+ supply trajectory will remain key catalysts. In the near term, defensive commodity strategies and exposure to sectors less reliant on global trade may offer relative resilience.

LG Energy Withdraws from $8.45 Billion Indonesia EV Battery Project

LG Energy Solution has formally exited a major $8.45 billion electric vehicle battery investment in Indonesia, citing market conditions and an unfavorable investment environment. The South Korean battery maker had been a key player in the Indonesia Grand Package deal signed in 2020, aimed at building out the EV battery supply chain in Southeast Asia’s largest economy. Despite the withdrawal, LGES reaffirmed its commitment to the region through its existing joint venture, HLI Green Power, with Hyundai Motor Group—a partnership that launched Indonesia’s first EV battery cell plant last year. The move raises questions about Indonesia’s attractiveness as a long-term hub for global battery manufacturing amid growing competition and policy uncertainty.

Investment Insight: LGES’s retreat underscores the rising sensitivity of large-scale industrial investments to geopolitical, regulatory, and market dynamics. For investors, the decision highlights the importance of evaluating execution risks in emerging-market infrastructure plays, particularly in sectors like EVs where supply chains are complex and capital-intensive. While Indonesia retains strategic appeal due to its nickel reserves, the setback suggests a more cautious outlook on near-term investment flows. Watch for how other global battery and EV players recalibrate their Southeast Asia strategies in response.

Market price: LG Energy Solutions Ltd. (KRX: 373220): KRW 332,500

South Korea Edges Closer to Developed Market Status in MSCI Index

South Korea is nearing a long-anticipated upgrade to developed market status by MSCI, according to the country’s Financial Services Commission. Vice Chairman Kim So-young stated Monday that over 90% of MSCI’s concerns have been addressed, and a reclassification could come “soon, if not this time.” The recent lifting of a five-year ban on short selling marks a key reform aimed at improving market accessibility for global investors. Currently classified as an emerging market, South Korea’s inclusion in the MSCI Developed Markets Index would represent a structural shift in global capital flows and elevate the nation’s standing in passive investment strategies. MSCI’s next market classification review is set for June.

Investment Insight: South Korea’s potential upgrade to developed market status may trigger significant inflows from global index-tracking funds and institutional investors. While near-term market impact depends on MSCI’s timeline, positioning ahead of a formal watch-listing could be advantageous. Investors should monitor Korean equities with high foreign ownership and liquidity—likely candidates to benefit most from reweighting—and consider the broader implications for EM portfolios facing potential outflows.

Conclusion

Markets are navigating a volatile landscape shaped by political interference, shifting global capital flows, and geopolitical recalibrations. As the Fed’s independence comes under fire and US trade tensions ripple across asset classes, investors are repositioning toward safe havens and emerging-market local debt. Commodities remain vulnerable to demand shocks, while structural reform in Asia—highlighted by South Korea’s MSCI ambitions—offers longer-term opportunities. The retreat of LG Energy in Indonesia underscores rising execution risks in frontier markets. In the weeks ahead, investors will need to stay nimble, balancing macro uncertainty with selective, risk-adjusted exposure across fixed income, equities, and commodities.

Upcoming Dates to Watch

- April 21st, 2025: IMF Meetings, South Korea PPI

- April 22nd, 2025: Japan (BoJ) CPI

- April 23rd, 2025: Singapore CPI, US S&P Global Manufacturing PMI, US Crude Oil imports, South Korea GDP

- April 24th, 2025: Tokyo CPI

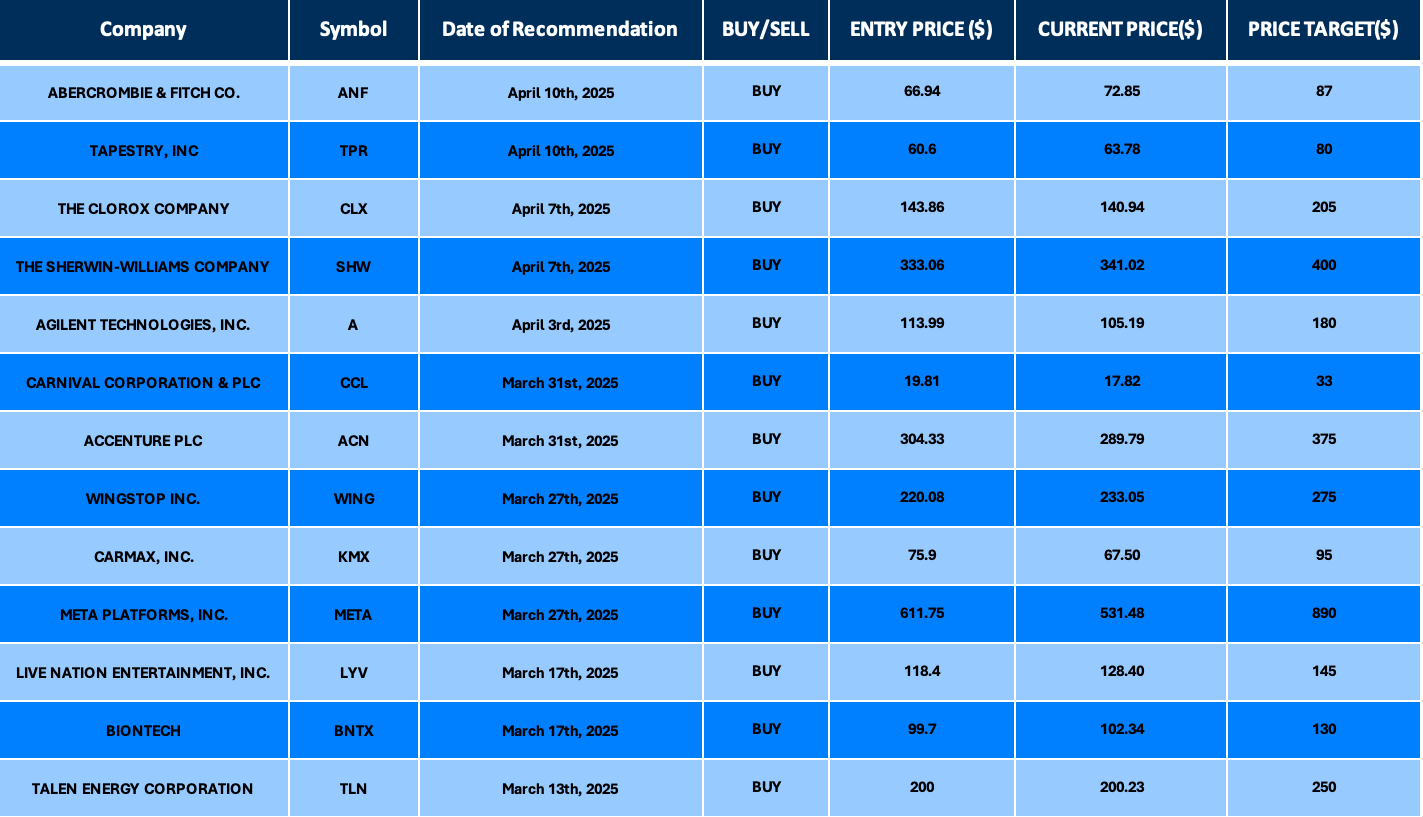

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.