Date Issued – 22nd April 2025

Preview

US stock futures rebounded Tuesday after Monday’s selloff, driven by Federal Reserve criticism and economic concerns. Gold hit a record $3,500 as haven demand surged, while trade tensions and upcoming earnings from Tesla and Alphabet kept markets cautious. Ericsson will localize antenna production in India to meet soaring 5G demand, offsetting slowing US orders. Japan is resisting US pressure to strengthen the yen, with limited room for intervention, as trade negotiations loom. China’s trade flows remained strong in April despite tariffs, though early signs of strain are emerging in rail cargo and e-commerce pricing. Meanwhile, Roche announced a $50 billion US investment, creating 12,000 jobs, as drugmakers brace for potential pharmaceutical tariffs.

Futures Rebound as Market Eyes Fed and Trade Tensions

US stock futures showed resilience on Tuesday, with S&P 500 and Nasdaq 100 contracts gaining 1% following Monday’s sharp selloff. The decline was fueled by President Trump’s criticism of the Federal Reserve and concerns over rate policy and economic growth. While risk appetite saw a tentative recovery, haven assets like gold surged to a record $3,500 an ounce, and the yen strengthened to its highest level since September. Global markets remain jittery as trade tensions escalate, with investors scrutinizing US-China tariff talks and upcoming earnings from Tesla and Alphabet. Meanwhile, the dollar’s haven appeal faltered, weighed down by uncertainty over Fed leadership and rate cuts.

Investment Insight: Persistent trade tensions and uncertainty over Fed independence are reshaping market dynamics, with haven assets like gold and the yen gaining ground. Investors should remain cautious, as volatility may persist amid mixed signals from global markets. Diversifying into non-correlated assets and monitoring geopolitical developments will be key to navigating this turbulent environment.

Ericsson Expands Indian Manufacturing Amid Surging 5G Demand

Ericsson announced plans to localize all telecom antenna production for the Indian market by June, capitalizing on soaring demand from Bharti Airtel and Jio as they scale up 5G services. This expansion, which builds on Ericsson’s decades-long presence in India since 1994, offsets a slowdown in US orders, its largest market. The Swedish telecom giant also aims to export antennas globally after fulfilling domestic needs, leveraging India’s growing role as a manufacturing hub alongside its facilities in Mexico, Romania, and China.

Investment Insight: Ericsson’s strategic shift to localize production in India underscores the region’s critical role in the global 5G supply chain. As 5G adoption accelerates, investors should monitor telecom infrastructure providers with strong exposure to high-growth markets like India, where increasing demand could drive revenue diversification and long-term upside.

Japan Unlikely to Yield on Yen Strengthening Amid U.S. Talks

As Japanese Finance Minister Katsunobu Kato prepares to meet U.S. Treasury Secretary Scott Bessent in Washington, expectations for a significant agreement on yen policy remain low. Despite U.S. pressure to address exchange rates and Japan’s slow monetary tightening, Tokyo is unlikely to take immediate measures to strengthen the yen, citing limited tools and concerns over exporters’ margins. With the yen already at seven-month highs against the dollar, Japan aims to resist currency intervention or interest rate hikes, focusing instead on gauging U.S. intentions regarding trade and tariffs. Analysts predict the discussions may result in vague commitments to stable exchange rates rather than coordinated action.

Investment Insight: Rising yen strength and geopolitical currency tensions highlight risks for exporters and sectors reliant on dollar-based pricing. Investors should monitor Japanese equities, particularly manufacturers, for potential margin compression. Currency-sensitive hedging strategies may be prudent given the uncertain outcomes of U.S.-Japan negotiations and the yen’s recent appreciation.

China’s Trade Resilient Despite Tariff Pressures

China’s trade flows surged in April, with ports processing 6.3 million containers, a 10% year-over-year increase, defying expectations amid ongoing US-China tariff tensions. The resilience reflects exemptions on high-value goods like smartphones and computers, as well as a delay in broader reciprocal duties by the US. While US exports to China have declined sharply, Chinese exports to the US remain robust, with major shipping hubs like the Port of Los Angeles maintaining steady activity. However, early signs of strain are emerging, as China-Europe rail cargo volumes dropped and platforms like Shein and Temu face price pressures due to shifting trade rules.

Investment Insight: China’s ability to sustain trade growth underscores its adaptability in redirecting exports and leveraging exemptions during tariff wars. Investors should watch for potential disruptions in the second half of 2025 as tariffs tighten, particularly in consumer electronics and e-commerce. Supply chain shifts could create opportunities in logistics and trade hubs, while rising costs may pressure margins for exporters reliant on US demand. Diversifying into non-US markets remains critical for long-term stability.

Roche to Invest $50 Billion in U.S. Amid Tariff Pressures

Swiss pharmaceutical giant Roche announced a $50 billion investment in the United States over the next five years, creating more than 12,000 jobs and expanding its manufacturing and R&D footprint. The move comes as the Trump administration targets pharmaceutical imports with potential tariffs of up to 31%. Roche plans to expand facilities in Kentucky, Indiana, New Jersey, and California, build a gene therapy factory in Pennsylvania, and establish a weight-loss medicine plant at an undisclosed location. The investment will make the U.S. a net exporter of Roche medicines, underscoring the company’s commitment to its largest market and its strategy to mitigate tariff risks.

Investment Insight: Roche’s significant U.S. expansion highlights a growing trend of reshoring in response to protectionist trade policies. Investors should monitor pharmaceutical firms with heavy reliance on U.S. markets, as domestic manufacturing investments could shield them from tariffs while boosting long-term production capacity. Those with less diversified operations may face margin pressures, making this a key inflection point for the sector.

Conclusion

Global markets remain in flux as geopolitical tensions, trade dynamics, and monetary policy shifts drive uncertainty. US stock futures show signs of recovery, but persistent volatility underscores the need for cautious positioning. Ericsson’s India focus highlights growth opportunities in emerging markets, while Roche’s $50 billion US investment reflects the reshoring trend amid tariff pressures. China’s resilience in trade offers a silver lining, though risks are mounting. With Japan resisting US demands on the yen and gold hitting record highs, investors are navigating a complex landscape. Diversification and close monitoring of global developments will be key to weathering near-term challenges.

Upcoming Dates to Watch

- April 22nd, 2025: Japan (BoJ) CPI

- April 23rd, 2025: Singapore CPI, US S&P Global Manufacturing PMI, US Crude Oil imports, South Korea GDP

- April 24th, 2025: Tokyo CPI

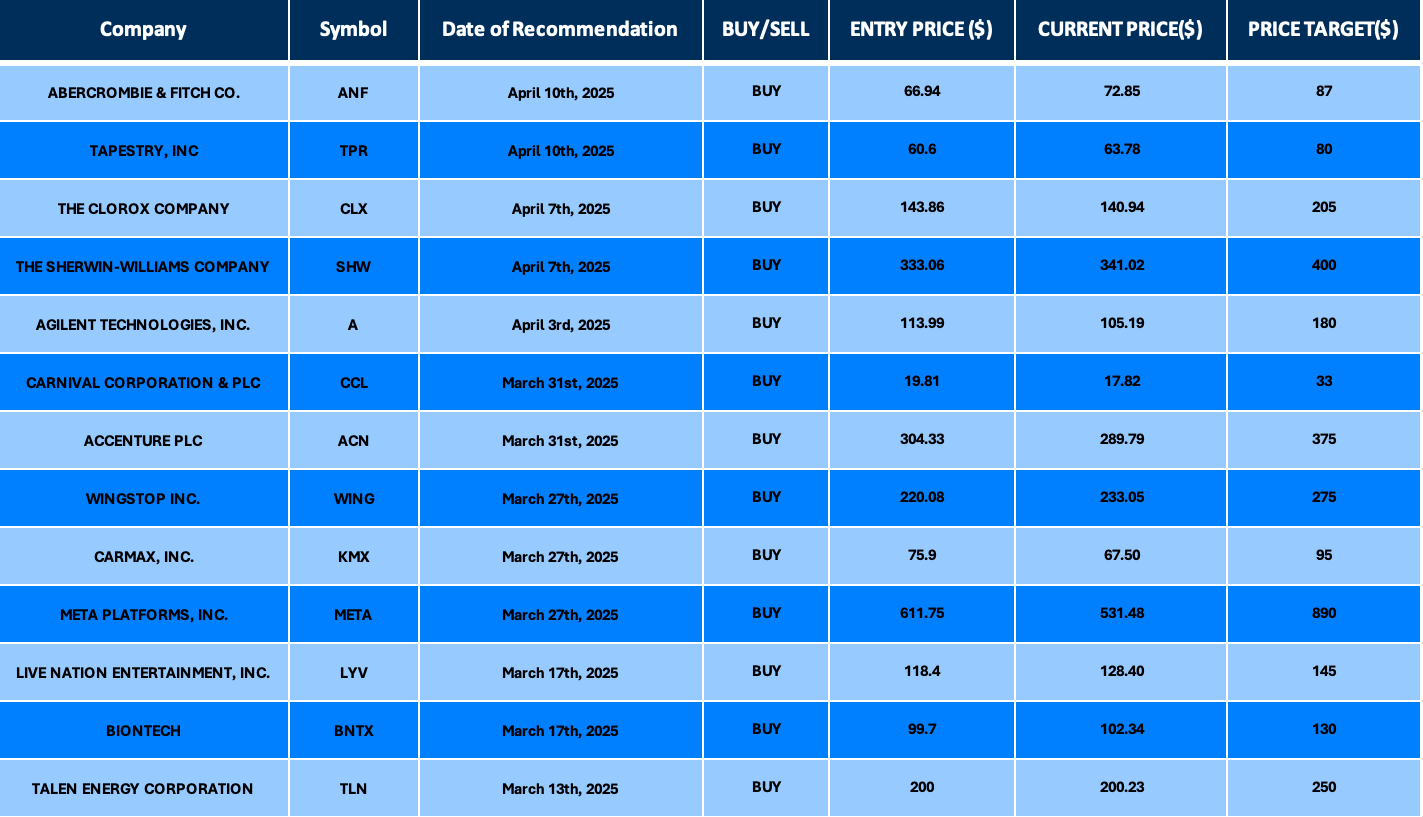

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.