Date Issued – 23rd April 2025

Preview

Markets rebounded sharply Tuesday as easing trade tensions and a softer tone from President Trump toward Fed Chair Jerome Powell calmed investor nerves, driving the Dow up over 1,000 points and lifting the S&P 500 and Nasdaq more than 2.5%.

Gold retreated from record highs, reflecting reduced haven demand, while Tesla rallied over 5% in after-hours trading despite a Q1 miss, as Elon Musk pledged to refocus on the company. Meanwhile, short interest in SK Hynix hit a record, with investors increasingly wary of AI-linked chipmakers amid trade uncertainty and tightening U.S. tech policy. Despite improved sentiment, investors remain cautious, with political risk and macro headwinds continuing to shape market direction.

Market Rebounds Sharply on Trade Hopes Amid Political Volatility

U.S. equities staged a powerful rally Tuesday, with the Dow Jones Industrial Average surging over 1,000 points and the S&P 500 and Nasdaq gaining 2.5% and 2.7%, respectively. The rebound followed comments from Treasury Secretary Scott Bessent suggesting potential deescalation in trade tensions with China, despite cautioning that negotiations remain complex. Investor sentiment also improved on signs of progress in U.S.-India trade talks. The gains reversed sharp losses from the prior session, which were driven by renewed tensions between President Trump and Fed Chair Jerome Powell. After the bell, Tesla reported weaker-than-expected earnings and withheld forward guidance, citing trade uncertainty and brand challenges tied to Musk’s political role.

Investment Insight

The market’s swift rebound highlights investors’ sensitivity to trade rhetoric and the potential for volatility tied to political developments. While improved diplomatic signals offer short-term relief, the absence of concrete policy resolution suggests continued risk. Investors should remain defensively positioned, favoring quality assets with low trade exposure as the geopolitical landscape continues to shape market direction.

Tesla Shares Climb Despite Q1 Miss as Musk Vows Refocus on Company

Tesla stock rose more than 5% in after-hours trading Tuesday after CEO Elon Musk pledged to reduce his time spent at the Department of Government Efficiency (DOGE) and reallocate efforts toward the company. This came despite Tesla reporting Q1 results that missed both revenue and earnings expectations, citing $19.34 billion in revenue versus the $21.43 billion consensus and adjusted EPS of $0.27 against estimates of $0.44. Musk reiterated plans to launch affordable EVs in early 2025 and begin robotaxi testing in Austin by June. Investors appeared to welcome Musk’s renewed focus, even as Tesla warned that ongoing trade uncertainty and political factors are weighing on global demand and its brand image.

Investment Insight

Tesla’s post-earnings rally underscores investor appetite for leadership stability amid operational headwinds. While Q1 results reveal softening demand and mounting competition, particularly from BYD, Musk’s commitment to refocus on Tesla may ease concerns over strategic drift. However, with guidance withdrawn and trade policy in flux, investors should treat the stock’s rebound cautiously and monitor delivery trends and pricing power closely heading into midyear.

Market Price

Tesla Inc. (TSLA): USD 237.97

Trump Walks Back Powell Threats, Easing Market Anxiety

President Trump signaled a softer stance toward Federal Reserve Chair Jerome Powell on Tuesday, stating he has “no intention of firing” the central bank head, despite recent public criticisms over interest rate policy. The clarification comes after days of escalating tension, including Trump’s social media remarks calling Powell a “major loser” and suggestions from White House officials that the administration was exploring legal avenues for potential removal. The president’s walk-back follows market unease and bipartisan defense of Fed independence. Powell, whose term runs through May 2026, has maintained that he will complete his term and that the Fed remains focused on inflation and economic stability amid rising tariffs and political volatility.

Investment Insight

Trump’s deescalation may calm near-term market jitters, but the episode underscores the political risks facing monetary policy independence. Investors should remain vigilant as the Fed balances inflation pressures from rising tariffs with political demands for rate cuts. Policy clarity may be limited until legal questions around Fed independence are resolved, suggesting continued volatility in rate-sensitive assets. Holding a diversified position across fixed income durations and inflation-hedged equities may help mitigate policy-driven swings.

Gold Retreats as Geopolitical Tensions Ease on Trump Comments

Gold prices slid for a second consecutive session on Tuesday, falling 2.7% to $3,326.90 per ounce, as investor anxiety eased following more conciliatory remarks from President Trump on both Federal Reserve policy and U.S.-China trade relations. The precious metal, which recently touched a record high above $3,500, has been buoyed this year by haven demand amid global economic uncertainty and aggressive ETF and central bank buying. However, Trump’s pivot away from threats to remove Fed Chair Jerome Powell and signals that China tariffs may be lowered triggered profit-taking in an overbought market, leading to the sharp pullback.

Investment Insight

Gold’s decline reflects a partial unwind of risk hedges as geopolitical rhetoric softens, but its broader uptrend remains underpinned by macro uncertainty. With inflation risks still elevated and central banks continuing to accumulate reserves, dips may present strategic entry points for long-term positioning. Investors should monitor real yields and Fed policy signals closely, as any renewed volatility could quickly restore demand for safe-haven assets.

Short Sellers Target SK Hynix Amid AI and Trade Policy Uncertainty

Bearish bets against SK Hynix surged to a record this month, with short positions totaling 1.5 trillion won ($1 billion) as of mid-April, following South Korea’s removal of its short-selling ban. The memory chipmaker, once buoyed by AI-driven demand, now faces heightened scrutiny amid fears of a slowdown in U.S. AI capital expenditure and intensifying global trade tensions. Foreign institutional investors have offloaded a net 2.9 trillion won in shares, signaling broad skepticism ahead of earnings. Despite expectations that SK Hynix will surpass Samsung as the top DRAM vendor, concerns over macro risks and valuation have prompted many to view strong earnings as a trigger for profit-taking rather than a bullish catalyst.

Investment Insight

The surge in short interest reflects deepening investor caution toward tech names highly sensitive to geopolitical developments and AI spending trends. While SK Hynix’s fundamentals remain solid, positioning suggests markets are bracing for downside amid policy-driven volatility. Investors should be wary of momentum reversals in AI-linked semiconductors and consider risk-managed exposure, particularly in firms with high trade exposure and elevated valuations.

Market Price

SK Hynix Inc (KRX: 000660): KRW 181,000

Conclusion

Markets may have found temporary relief in softer rhetoric from Washington and signs of diplomatic progress, but underlying risks remain firmly in play. Trade uncertainty, political volatility, and shifting central bank dynamics continue to challenge investor confidence. While rebounds in equities and Tesla suggest resilience, rising short interest in key tech names like SK Hynix and a pullback in gold signal caution beneath the surface. As earnings season unfolds and policy signals evolve, investors should stay nimble, prioritize quality, and brace for renewed volatility in a landscape still defined by geopolitical tension and economic recalibration.

Upcoming Dates to Watch

April 23rd, 2025: Singapore CPI, US S&P Global Manufacturing PMI, US Crude Oil imports, South Korea GDP

April 24th, 2025: Tokyo CPI

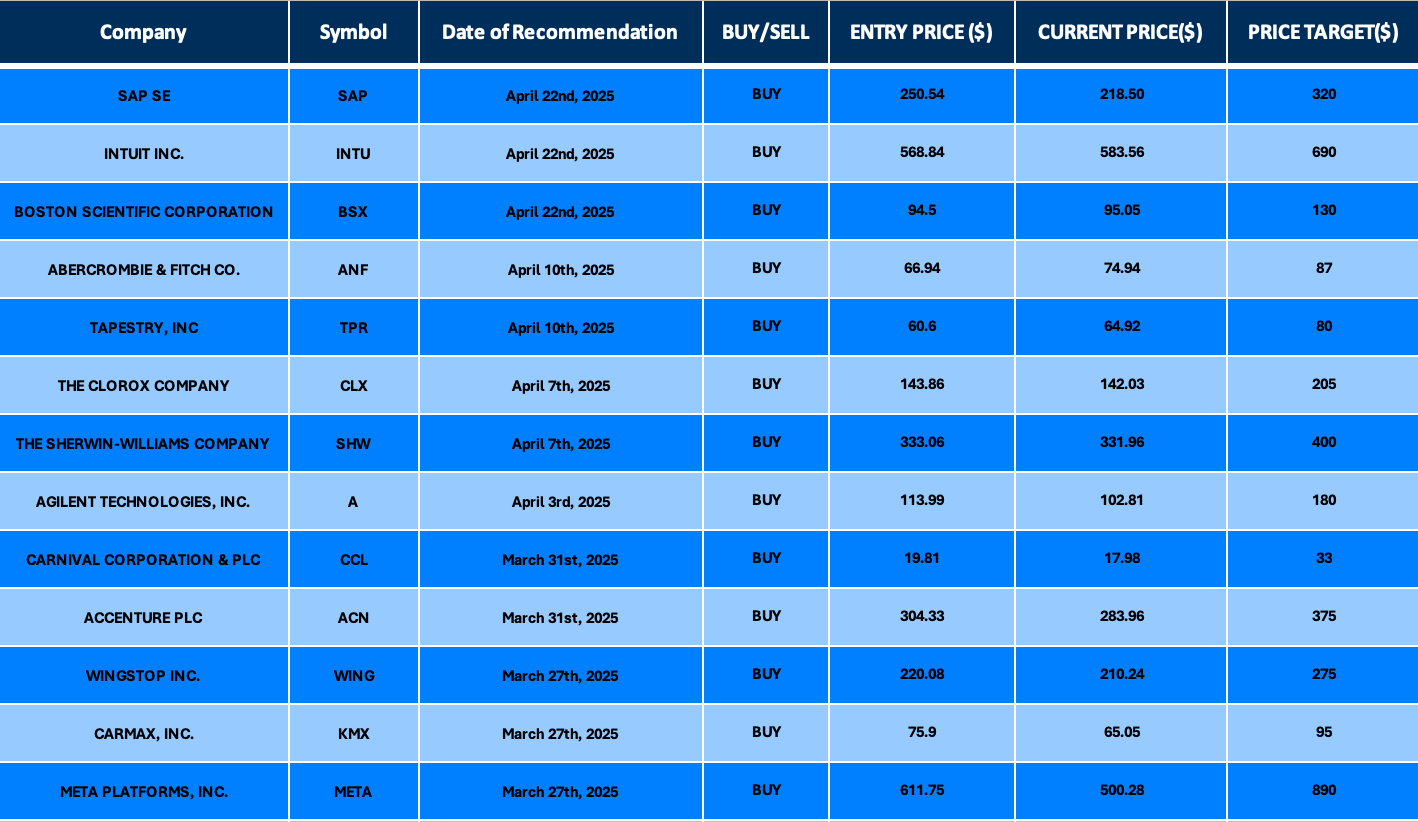

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.