Date Issued – 24th April 2025

Preview

Global markets waver as trade tensions and tariff uncertainties weigh on sentiment

Stocks retreated after mixed signals from the US-China trade dispute, while China’s tightened export controls on critical minerals disrupted supply chains and pushed prices higher. Boeing faces a $1 billion revenue gap as Chinese tariffs block aircraft deliveries, but strong Q1 results highlight its resilience. Japanese investors returned to overseas bonds after a six-week selloff, while foreign demand for Japanese assets surged amid expectations of delayed BOJ rate hikes. Unilever exceeded sales forecasts with premium demand and price hikes, reaffirming its outlook despite macroeconomic pressures.

Stocks Stall Amid Trade Tariff Uncertainty

Global equities pared recent gains on Thursday as mixed signals from the US administration on China tariffs dampened risk appetite. European stocks fell, with US futures and Asian markets retreating after a five-day rally. Treasury Secretary Scott Bessent warned of a protracted resolution to the US-China trade dispute, sending the dollar lower while boosting demand for safe havens like the yen, Swiss franc, and gold.

Corporate earnings added to the volatility, with Unilever rising on solid sales but BNP Paribas slipping on weaker profits. Investors remained cautious amid headline-driven market swings, as President Trump hinted at potential tariff adjustments in the coming weeks but offered no clarity on broader trade policy.

Investment Insight

With US equities facing valuation pressures and geopolitical risks, investors should consider diversifying globally. Opportunities in Chinese, Indian, and European markets may offer a hedge against potential corrections in US stocks and the dollar. Strategic portfolio rebalancing is critical as the era of US market dominance shows signs of waning.

China Tightens Grip on Mineral Exports, Disrupting Global Supply

China’s control over critical minerals has intensified with its expanded export control list, now covering 16 minerals vital for clean energy, defense, and semiconductors. Recent additions, including seven rare earths, aim to counter U.S. tariffs, creating supply disruptions and driving up prices.

Under China’s export licensing system, exporters must provide detailed documentation, including sensitive end-user data, while importers face strict non-transfer commitments. License approvals, involving multiple agencies, can take months, particularly for U.S. clients amid ongoing trade tensions. These measures highlight Beijing’s leverage over global supply chains and its strategic use of export controls to safeguard national interests.

Investment Insight

China’s export restrictions underscore the strategic importance of diversifying supply chains for critical minerals. Investors should monitor companies outside China that mine or refine rare earths and other essential materials, as they could benefit from increased demand and rising prices. Enhanced geopolitical risks also favor investment in technologies and industries focused on resource independence and recycling.

Boeing Faces $1 Billion China Challenge Amid Trade Tensions

Boeing is grappling with a $1 billion revenue gap as 50 aircraft originally destined for Chinese airlines remain undelivered due to escalating trade tensions. Chinese tariffs have forced the American aerospace giant to redirect these planes to other markets, with Malaysia Airlines among potential buyers. Despite the setback, Boeing reported strong first-quarter revenues of $19.5 billion, an 18% increase, and narrowed losses to $31 million. However, executives warn that global adoption of protectionist policies could cost the company $500 million annually and threaten its competitive edge against rivals like Airbus.

Investment Insight

Boeing’s resilience, showcased by rising revenues and proactive market redirection, highlights its ability to weather geopolitical disruptions. Investors should monitor its success in securing new buyers for the redirected planes and mitigating tariff-related costs. Meanwhile, heightened trade risks may benefit Boeing’s competitors in untapped markets, presenting both challenges and opportunities for global aerospace supply chains.

Market price: Boeing Co (BA): USD 172.37

Japanese Investors Return to Overseas Bonds Amid U.S. Recovery

Japanese investors became net buyers of overseas bonds for the first time since February, purchasing ¥223.7 billion ($1.57 billion) in the week ending April 19. This shift follows a six-week selling streak driven by concerns over U.S. tariffs and economic uncertainty. The rebound aligns with a partial recovery in U.S. bond markets, despite rising Treasury yields and ongoing doubts about the dollar’s safe-haven status.

Meanwhile, foreign investors have increasingly favored Japanese assets, injecting ¥11.95 trillion into Japanese bonds and ¥3.7 trillion into equities over the past three weeks, bolstered by expectations of delayed rate hikes by the Bank of Japan.

Investment Insight

The renewed appetite for overseas bonds by Japanese investors signals cautious optimism about global debt markets, particularly U.S. Treasuries. However, rising yields and geopolitical risks warrant vigilance. Investors should also monitor the Bank of Japan’s dovish stance, which continues to attract foreign capital to Japanese markets, potentially enhancing opportunities in yen-denominated assets.

Unilever Tops Sales Forecasts Amid Price Hikes and Premium Demand

Unilever reported a 3% rise in first-quarter underlying sales, surpassing analysts’ expectations of 2.8%, driven by price increases and resilient demand for premium products like Dove and Ben & Jerry’s. The consumer goods giant reaffirmed its 2025 outlook, despite ongoing macroeconomic uncertainty and evolving consumer habits shaped by tariff concerns and inflationary pressures.

Under new CEO Fernando Fernandez, Unilever continues to execute cost-cutting measures and plans to save £550 million by 2025, including separating its ice cream division, which will be listed in Amsterdam with secondary listings in London and New York.

Investment Insight

Unilever’s ability to pass on higher costs while maintaining demand highlights its pricing power and brand strength, making it a stable pick in uncertain markets. Investors should watch its cost-saving initiatives and ice cream business spin-off, as these could unlock further shareholder value. However, macroeconomic risks and shifting consumer trends warrant close monitoring.

Market price: Unilever plc (ULVR): GBX 4,830.00

Conclusion

Global markets are navigating a complex web of trade tensions, geopolitical risks, and shifting consumer behaviors. From Boeing’s efforts to mitigate a $1 billion revenue gap to China’s strategic grip on critical minerals, the ripple effects of protectionist policies are reshaping industries. Meanwhile, Japanese investors’ renewed interest in overseas bonds signals cautious optimism, while Unilever’s strong sales reaffirm its pricing power and resilience.

As macroeconomic uncertainties persist, diversification and strategic positioning remain critical for navigating these volatile conditions. Investors should stay alert to evolving opportunities and risks across global supply chains, asset classes, and emerging market trends.

Upcoming Dates to Watch

April 24th, 2025: Tokyo CPI

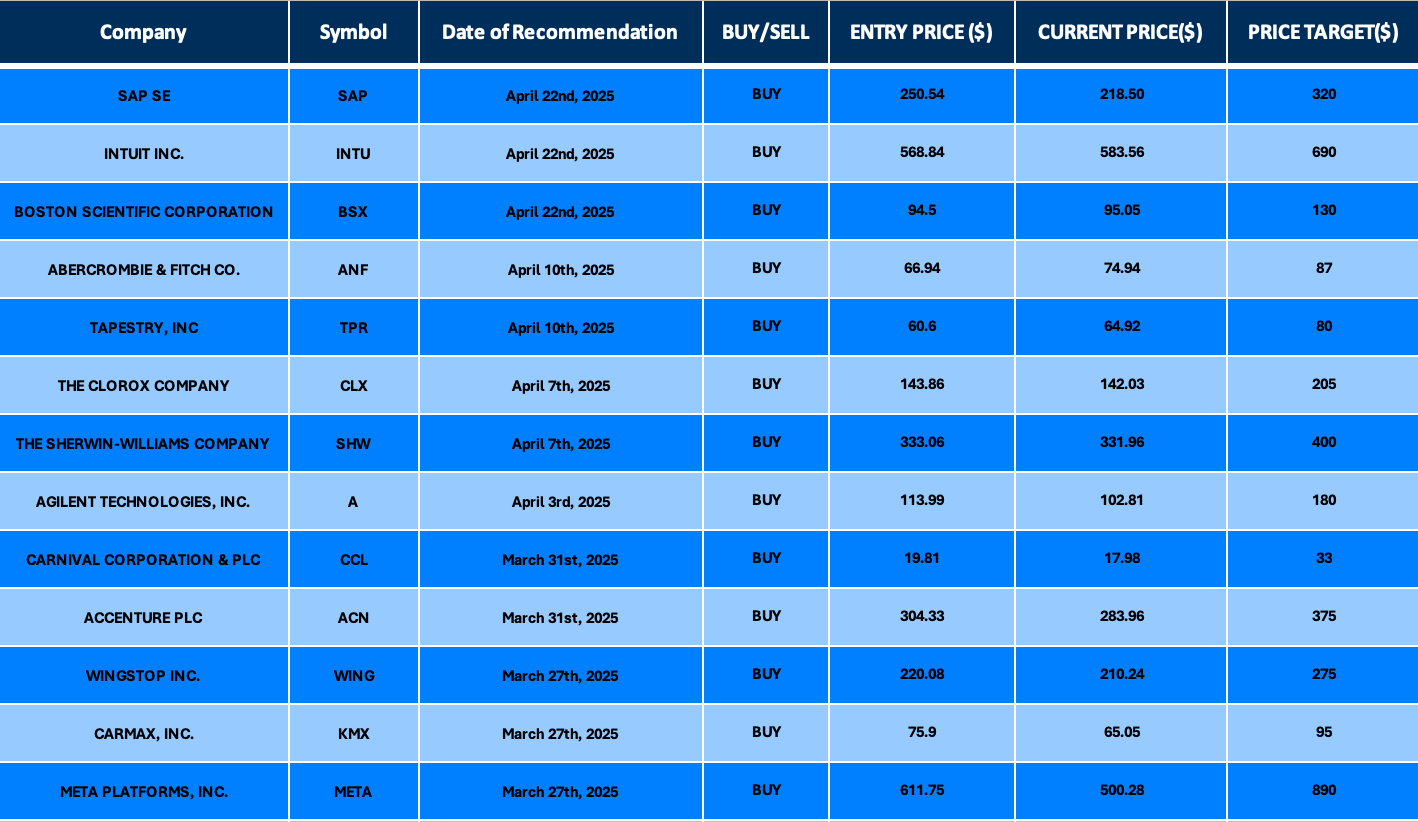

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.