Date Issued – 25th April 2025

Preview

Wall Street rallied on optimism over easing US-China trade tensions and possible Federal Reserve rate cuts, with the Nasdaq jumping 2.7%. Alphabet surged nearly 5% after strong Q1 earnings driven by search advertising and cloud profitability, while Apple announced plans to shift most US iPhone production to India by 2026 to reduce reliance on China. Meanwhile, Intel slid 4% in Frankfurt trading on weak forecasts, and JD.com and Meituan lost $70 billion in combined market value amid an escalating price war. Investors remain focused on inflation data and corporate strategies to navigate geopolitical and competitive pressures.

Wall Street Rallies on Easing Trade Tensions and Rate-Cut Hints

US equities surged on Friday, with the Dow Jones climbing 1.2% (nearly 500 points), the S&P 500 gaining 2%, and the Nasdaq soaring 2.7%. Markets were buoyed by signs of easing US-China trade tensions as China hinted at pausing its 125% tariff on select goods. Federal Reserve officials also signaled a potential rate cut, further fueling optimism. Alphabet led the Nasdaq higher after beating earnings expectations, hiking its dividend, and announcing a $70 billion stock buyback. Meanwhile, investors are eyeing the University of Michigan consumer sentiment report for further clues on inflation and economic resilience.

Investment Insight:

The rally underscores how sensitive markets remain to trade and monetary policy developments. With easing trade tensions and potential rate cuts on the horizon, growth-oriented sectors like technology are poised for further upside. Investors should monitor consumer sentiment closely, as persistent inflationary pressures could temper the current bullish momentum. Diversifying into high-quality growth stocks with strong fundamentals may offer a strategic edge amid these developments.

Intel Shares Slide Amid Weak Outlook and Trade Concerns

Intel shares tumbled nearly 4% in Frankfurt trading on Friday, extending a 6% drop in after-hours trading Thursday. The selloff followed a downbeat revenue and profit forecast that rattled investor confidence. While Intel’s stock had gained 4.37% during Thursday’s regular session to close at $21.49, concerns about the chip sector’s resilience amid ongoing US-China trade tensions overshadowed the earlier optimism.

Investment Insight:

Intel’s weak guidance highlights the challenges facing the semiconductor industry as geopolitical tensions and shifting demand weigh on growth prospects. Investors should remain cautious about chipmakers with significant exposure to China while focusing on companies with diversified revenue streams and strong cash flow to weather sector volatility.

JD.com and Meituan’s Price War Erases $70 Billion in Market Value

JD.com’s aggressive push into food delivery through its JD Takeaway platform has sparked a costly battle with Meituan, eroding investor confidence in both companies. Shares of JD.com and Meituan have each dropped about 30% from March highs, wiping out approximately $70 billion in combined market value. Analysts warn that JD’s cash-burning strategy, which includes $1.4 billion in subsidies and waived merchant fees, risks slashing operating profits by 36% this year. Meanwhile, Meituan has countered by expanding into JD’s quick-commerce stronghold. This intensifying rivalry has weighed heavily on the Hang Seng Tech Index, where both companies now rank among the worst performers in 2025.

Investment Insight:

The escalating competition between JD.com and Meituan underscores the risks of aggressive market-share battles in a maturing domestic landscape. Investors should remain cautious, as prolonged price wars threaten profitability for both firms. Defensive positioning in options markets reflects broader skepticism about near-term recovery. For exposure to Chinese tech, consider diversifying into companies with less exposure to domestic rivalries and stronger international growth prospects.

Market price: JD.COM (BA): USD 172.37

Alphabet Shares Soar on Strong Q1 Earnings and AI-Driven Growth

Alphabet’s stock surged nearly 5% in after-hours trading after the tech giant reported first-quarter earnings that beat expectations. Revenue rose 12% year-on-year to $90.2 billion, led by a 9.8% jump in Google Search advertising revenue to $50.7 billion. Google Cloud also saw a remarkable 28% revenue growth, with its profitability surging over 200% to $2.18 billion. Alphabet’s AI investments bolstered growth across all divisions, while a $70 billion share buyback and a 5% dividend hike further lifted investor sentiment. Despite these strong results, the stock remains down 16% year-to-date, weighed by broader tech-sector challenges and US tariff headwinds.

Investment Insight:

Alphabet’s robust Q1 results underscore the resilience of its core advertising business and the growing profitability of its cloud segment, driven by strategic AI investments. While geopolitical and tariff-related risks linger, Alphabet’s solid fundamentals and shareholder-friendly initiatives, including its $70 billion buyback, make it an attractive long-term play. Investors seeking exposure to transformative AI technologies and scalable growth may find Alphabet well-positioned in a competitive tech landscape.

Market price: Alphabet Inc (GOOG): USD 161.47

Apple Accelerates iPhone Production Shift to India Amid Geopolitical Risks

Apple plans to manufacture most iPhones sold in the US in India by the end of 2026, doubling its output in the country to reduce reliance on China and mitigate tariff and geopolitical risks. Currently, Apple produces 20% of its iPhones in India, including premium Pro models, with exports reaching $17.5 billion in the fiscal year through March 2025. The shift, supported by India’s state subsidies and manufacturing incentives, gained momentum after US tariffs on Chinese imports tightened. While China remains Apple’s largest production base, India’s role in its supply chain is rapidly expanding, reflecting its growing importance as a manufacturing hub.

Investment Insight:

Apple’s pivot to India strengthens its supply chain resilience while capitalizing on local subsidies and export opportunities. This strategic shift reduces exposure to geopolitical tensions and tariffs, supporting long-term margin stability. Investors should view this as a positive development, reinforcing Apple’s ability to navigate external challenges while expanding its manufacturing footprint in a high-growth market. With India emerging as a key player in Apple’s global strategy, further upside potential exists for the company’s operational efficiency and regional sales.

Market price: Apple Inc (AAPL): USD 208.37

Conclusion

This week’s market movements highlighted the delicate balance between optimism and caution. While easing trade tensions and strong earnings from tech giants like Alphabet lifted investor sentiment, challenges persist as Intel’s weak outlook and JD.com’s costly rivalry with Meituan underscore sector-specific pressures. Apple’s strategic pivot to India signals a growing emphasis on supply chain resilience amid geopolitical risks. As markets navigate inflation concerns and shifting economic conditions, the focus remains on companies with robust fundamentals and adaptive strategies. Investors should stay vigilant, balancing growth opportunities with defensive positioning to weather potential volatility in the months ahead.

Upcoming Dates to Watch

- April 29th, 2025: EU Consumer Confidence, South Korea industrial production

- April 30th, 2025: EU GDP, US GDP

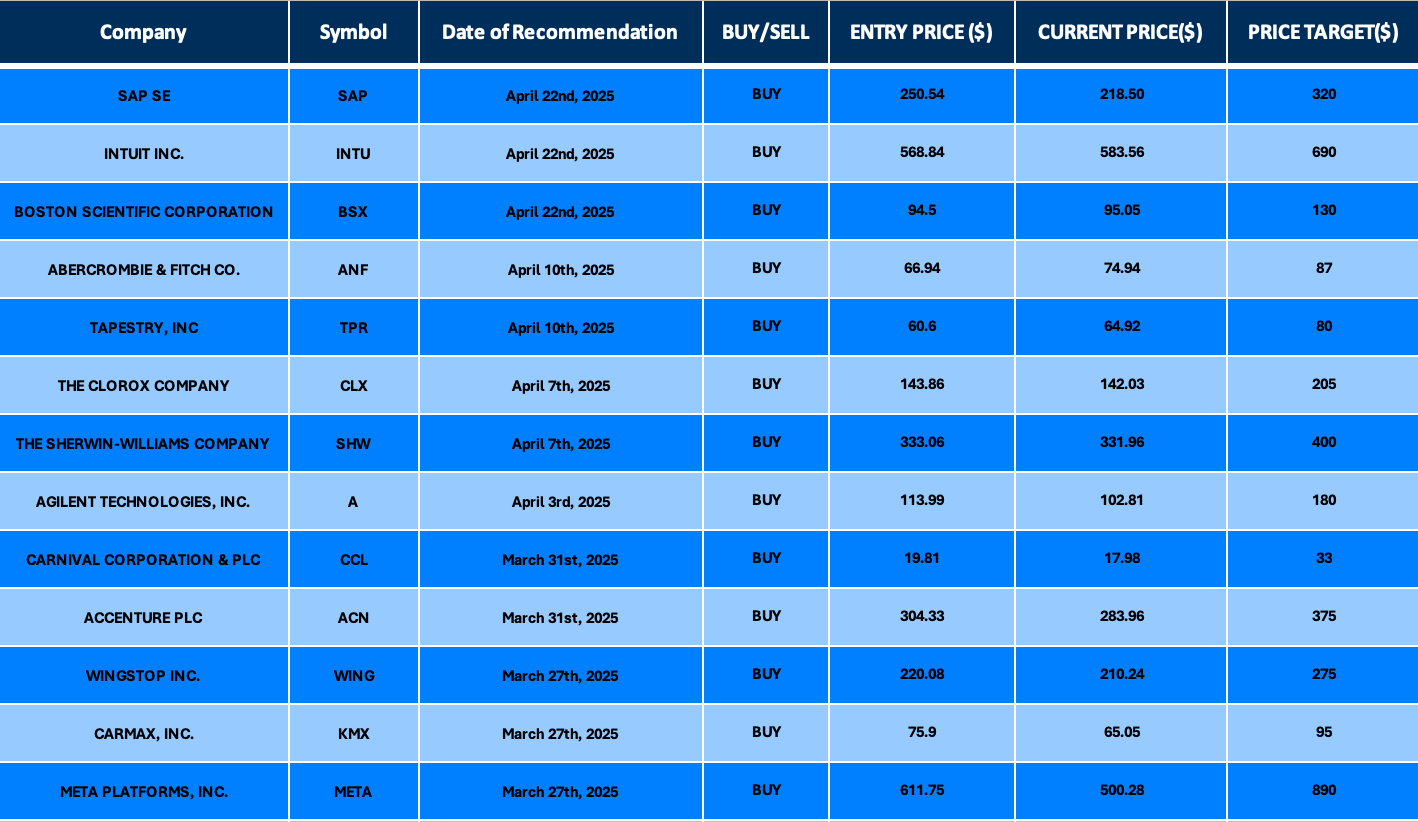

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.