Date Issued – 28th April 2025

Preview

Markets are navigating cautiously this week as investors eye US-China trade negotiations, Chinese stimulus measures, and major tech earnings from Apple, Microsoft, Meta, and Amazon

Asian equities edged higher, but S&P 500 futures signal a pause in the US rally, and gold slid 6.5% from record highs amid improving risk sentiment. Beijing remains committed to a 5% GDP growth target despite US tariffs, unveiling measures to boost domestic demand and stabilize employment. Apple’s earnings will test its resilience against tariff pressures, while Toyota Industries surged 23% on buyout speculation by Toyota Motor, signaling potential shifts in Japan’s corporate landscape. Investors remain defensive, focusing on domestic equities and sectors poised to benefit from stimulus and easing trade tensions.

Cautious Markets Amid Earnings and Trade Tensions

Asian markets began the week with restrained gains as investors awaited clarity on US-China trade negotiations and potential Chinese stimulus measures. The MSCI Asia Pacific Index edged up 0.6%, while S&P 500 futures fell 0.6%, signaling a potential pause in the recent US equity rally. European stock futures remained flat. Gold prices slid 1.6% as traders reassessed its recent rally, and 10-year US Treasury yields inched higher by 1 basis point. Key economic events, including the Bank of Japan’s rate decision and US GDP and jobs data, loom large, while earnings from major US tech players—Microsoft, Apple, Meta, and Amazon—are set to drive sentiment. Despite hopes of an earlier Federal Reserve rate cut, fund managers remain cautious, emphasizing defensive, domestic-focused strategies amid ongoing tariff and geopolitical uncertainties.

Investment Insight

With market volatility persisting, investors should prioritize defensive sectors and quality domestic equities over high-risk international plays. Earnings from tech giants this week may shape near-term sentiment, but trade tensions and economic uncertainties warrant a measured approach. Diversification across stable dividend-paying stocks and cash-rich companies can provide resilience against potential downside risks.

Gold’s Rally Pauses Amid Trade War Optimism

Gold prices have dropped 6.5% from their record highs last week as easing US-China trade tensions spurred a global stock market rally, reducing haven demand. Hedge funds have sharply cut net long positions, signaling diminished bullish sentiment. The euro’s strength against the dollar, a key factor in gold’s earlier surge, has also softened as risk appetite improves. Analysts warn of downside risks, citing technical overbought signals, slowing central bank purchases, and tightened liquidity conditions. However, lingering uncertainties and inflation risks may still provide support for gold as a haven asset in the medium term.

Investment Insight

Gold’s correction reflects a recalibration of overextended positions as risk appetite returns. Investors should remain cautious, avoiding aggressive exposure to gold until technical levels stabilize. Diversifying into equities poised to benefit from easing trade tensions or hedging with broader commodity exposure may offer better near-term opportunities. For long-term holders, gold remains a viable hedge against geopolitical risks and inflation, but a measured allocation is prudent amidst current volatility.

China Asserts Resilience Amid Escalating US Tariffs

China’s leadership has sought to reassure markets and citizens of its ability to counter the economic impact of the US trade war, emphasizing robust policy tools to protect jobs and stabilize growth. Amid combined US tariffs of up to 145% on Chinese imports, Beijing announced measures including easier lending conditions, corporate support, and incentives for domestic demand, such as rebates on consumer and industrial upgrades. Officials dismissed US tariff policies as “bullying” while downplaying reliance on US imports, particularly in energy and agriculture. Despite these challenges, China remains committed to its 5% GDP growth target, leveraging urbanization and increased domestic consumption as key growth drivers. Uncertainty persists, however, as trade negotiations remain stalled.

Investment Insight

China’s proactive stance to bolster domestic demand and stabilize employment underscores its resilience, but prolonged uncertainty around US-China trade tensions adds risks to global supply chains and market sentiment. Investors should consider exposure to sectors benefiting from China’s domestic stimulus, such as infrastructure, renewables, and consumer goods. However, caution is advised regarding industries directly tied to global trade, as tariff escalation could weigh further on exports and corporate earnings.

Apple Earnings Loom Amid Tariff Concerns and Technical Signals

Apple shares are under scrutiny ahead of its fiscal Q2 earnings report on Thursday, as Wall Street assesses the impact of tariffs and price adjustments on consumer demand. The tech giant’s broader strategy, including plans to shift significant iPhone production to India by 2026, will also be closely watched. Year-to-date, Apple’s stock is down 16% but has rebounded 25% from this month’s lows. Technical indicators suggest muted momentum, with the RSI hovering below 50. Key support levels to watch include $169 and $157, while resistance zones near $220 and $237 could attract selling pressure in the event of a rally.

Investment Insight

Apple’s earnings and guidance will be pivotal for short-term stock performance, particularly in the context of tariffs and production realignment. For investors, $169 represents a critical support level for potential entry, while profit-taking opportunities might arise near $220 or $237. Long-term buyers should focus on Apple’s ability to diversify its supply chain and sustain demand amid economic pressures, positioning the stock as a strategic hold despite near-term volatility.

Market price: Apple Inc (AAPL): USD 161.47

Toyota Industries Soars on Buyout Speculation

Shares of Toyota Industries surged by their daily limit of 23% on Monday, poised for their largest one-day gain in over four decades, following Toyota Motor’s announcement of a potential buyout. The automaker is reportedly considering a deal worth as much as 6 trillion yen ($41 billion), according to Bloomberg. Toyota Industries, a key supplier and parts manufacturer, confirmed receiving proposals to go private but denied any formal offer from Toyota or its chairman, Akio Toyoda.

Analysts see the potential sale of Toyota Industries’ stake in Toyota Motor as a strong catalyst, with the buyout potentially enabling Toyota to acquire its supplier’s high-growth materials handling business at minimal cost. Cross-shareholding pressures and Japan’s corporate reform agenda are further driving the speculation.

Investment Insight

Toyota Industries’ possible privatisation signals a strategic shift in Japan’s corporate landscape, with increased focus on streamlining cross-shareholdings and unlocking shareholder value. Investors should monitor developments closely, as a buyout could significantly enhance Toyota’s vertical integration, particularly in materials handling and EV components. For shareholders of Toyota Industries, the potential premium offers a profitable exit, while Toyota Motor investors should weigh the long-term synergies against near-term financial outlay.

Market price: Toyota Industries Corp (TYO: 6201): JPY 16,225.0

Conclusion

This week’s market dynamics highlight the delicate balance between cautious optimism and persistent economic uncertainties. Key earnings from tech giants, developments in US-China trade negotiations, and central bank decisions will shape sentiment in the days ahead. While Apple and Toyota Industries dominate headlines with pivotal corporate moves, gold’s retreat signals shifting risk appetites. China’s proactive policy measures underscore resilience, but global investors remain defensive, prioritizing stability amid volatility.

As markets navigate these crosscurrents, strategic focus on quality assets, domestic plays, and diversification will be essential to weather potential disruptions and capitalize on emerging opportunities.

Upcoming Dates to Watch

April 29th, 2025: EU Consumer Confidence, South Korea industrial production

April 30th, 2025: EU GDP, US GDP

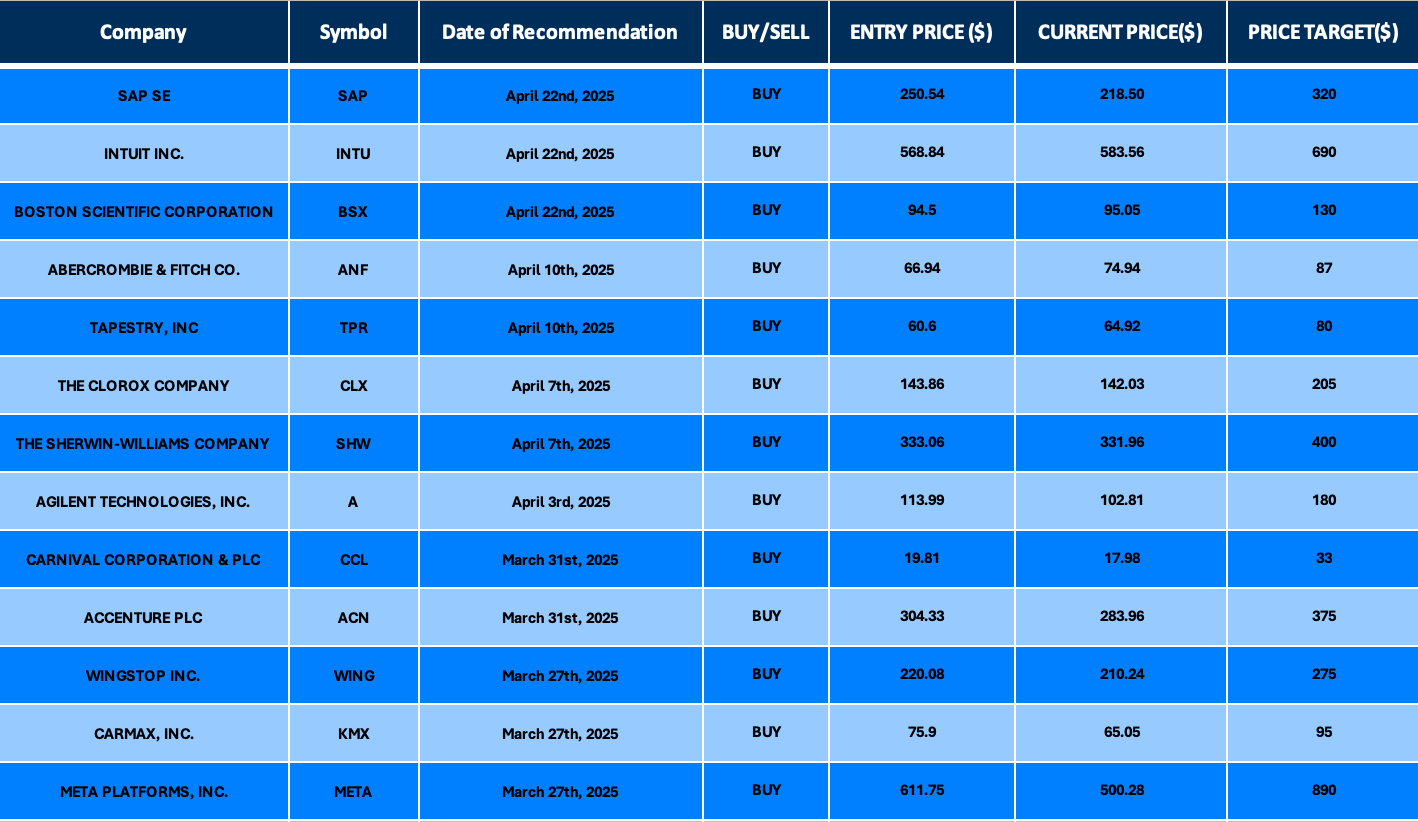

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.