Date Issued – 26th May 2025

Preview

Global markets face a critical week as investors digest US President Trump’s delayed EU tariffs, Nvidia’s earnings, and key inflation data. European equities are rebounding after the tariff extension to July 9, while US indices remain pressured by rising Treasury yields, which hit multi-year highs. Nvidia’s results on Wednesday could steer tech sentiment as demand for AI chips faces scrutiny. In Asia, Chinese EV stocks slumped as BYD’s aggressive price cuts raised fears of a prolonged margin squeeze, despite robust sales momentum. Meanwhile, VietJet’s $20 billion Airbus order highlights Vietnam’s aviation growth amid geopolitical trade talks. Oil prices steadied near $65 as traders eye OPEC+ decisions on production and potential supply risks from US-Iran negotiations. Investors remain cautious amid ongoing volatility tied to trade policies, fiscal concerns, and supply dynamics.

Tariffs, Treasury Yields, and Nvidia Earnings Take Center Stage

Markets stumbled last week as concerns over President Trump’s escalating tariff threats and a surging fiscal deficit kept investors on edge. The Nasdaq and S&P 500 each fell over 2%, while the Russell 2000 slumped nearly 4%, reflecting heightened sensitivity to rising Treasury yields. The 10-year yield briefly crossed 4.6%, its highest since February, before retreating slightly. Nvidia’s upcoming earnings report on Wednesday is set to dominate investor focus, with expectations of robust AI-chip demand amid growing tech sector volatility. Meanwhile, the Federal Reserve’s preferred inflation gauge, the PCE index, due Friday, will offer critical insights into price stability following renewed tariff concerns.

Investment Insight: With trade tensions reigniting and bond yields testing multi-year highs, investors should brace for continued volatility. Defensive positioning in sectors less sensitive to interest rate swings, such as healthcare or consumer staples, may provide a buffer. Nvidia’s results could sway broader tech sentiment—watch for guidance on AI demand to assess the sector’s resilience. Additionally, inflation data on Friday will be pivotal in shaping expectations for the Fed’s future policy trajectory.

Chinese EV Stocks Slide as BYD Sparks Price War

Shares of Chinese electric vehicle makers fell sharply on Monday, with BYD tumbling up to 8.3% in Hong Kong following aggressive price cuts of up to 35% across 22 models. Rivals Li Auto, Great Wall Motor, and Geely also dropped over 5% as the announcement intensified concerns of a prolonged price war pressuring margins. While BYD’s cuts aim to revive sluggish consumer demand amid China’s economic slowdown, dealership inventories remain high, hitting their steepest levels since late 2023. Analysts warn that the move could trigger further discounts among peers, straining profitability and accelerating industry consolidation. Despite the challenges, BYD’s May sales volumes may continue to climb, supported by strong overseas growth, including its recent lead over Tesla in Europe.

Investment Insight: BYD’s aggressive pricing underscores the competitive challenges in China’s EV market, where price wars could erode earnings across the sector. Investors should remain cautious of automakers with high inventory levels and limited pricing flexibility. However, BYD’s overseas expansion and record-breaking sales momentum position it better to weather margin pressures. Long-term investors may find opportunities in globally diversified EV leaders with strong brand loyalty and innovation pipelines.

Market price: BYD Ord Shares H (HKG: 1211) HKD 423.20

VietJet Expands Airbus Fleet with New A330neo Order

Vietnamese budget carrier VietJet has bolstered its fleet expansion strategy by ordering 20 additional Airbus A330neo wide-body jets, coinciding with French President Emmanuel Macron’s visit to Hanoi. This latest agreement, signed by VietJet’s chairwoman Nguyen Thi Phuong Thao and Airbus senior executive Wouter van Wersch, brings the total A330neo orders from VietJet to 40. The airline aims to leverage the aircraft for ambitious growth across the Asia-Pacific region and potential long-haul routes to Europe. While the deal underscores VietJet’s alignment with Airbus, the carrier also maintains a longstanding but delayed commitment to Boeing, having agreed to purchase 200 Boeing 737 MAX planes since 2016. The announcement highlights Vietnam’s strategic aviation growth amid ongoing trade negotiations with the U.S. to address tariff concerns.

Investment Insight: VietJet’s strategic fleet expansion signals confidence in long-term growth in Asia-Pacific aviation demand, driven by rising middle-class travel. The focus on A330neo wide-body jets positions the airline to tap into lucrative international routes, potentially enhancing profitability. Investors in Airbus benefit from the strengthening of its foothold in emerging markets like Vietnam, while Boeing faces challenges with delayed deliveries. For aviation investors, monitoring VietJet’s ability to execute its expansion plans and navigate geopolitical trade dynamics will be key.

Market price: Airbus SE (AIR): EUR 157.30

European Markets Rebound as Trump Delays EU Tariffs

European stock markets are poised to recover on Monday after US President Trump announced a delay in implementing 50% tariffs on EU imports until July 9. The move, following discussions with European Commission President Ursula von der Leyen, eased fears of escalating trade tensions that had pressured global equities last week. Futures on the Euro Stoxx 600 and Germany’s DAX rose 1.54% and 1.35%, respectively, alongside US futures gains. Meanwhile, the euro hit a one-month high against the dollar, which weakened amid mounting concerns over US fiscal challenges and Moody’s recent credit rating downgrade. Analysts suggest optimism around a potential trade resolution is driving the rally, though market sentiment remains fragile given unresolved trade disputes.

Investment Insight: The temporary reprieve in US-EU trade tensions offers a window for investors to capitalize on a rebound in European equities, particularly in export-heavy sectors like autos and industrials. However, with tariff risks merely postponed, caution is warranted. Diversifying into defensive European plays or sectors less exposed to US trade policy could hedge against future volatility. Currency investors should also monitor the weakening dollar, which may signal further pressure on US assets amid fiscal uncertainty.

Oil Prices Hold Steady Amid Tariff Extension and OPEC+ Focus

Oil markets stabilized on Monday as traders assessed President Trump’s decision to delay the implementation of 50% tariffs on EU goods until July 9, offering a temporary reprieve from trade-related demand concerns. Brent crude hovered near $65 per barrel, while West Texas Intermediate remained below $62. The market’s near-term focus now shifts to the upcoming OPEC+ meeting, where the group is expected to announce a substantial production increase, potentially adding to bearish pressures. Additionally, optimism surrounding US-Iran nuclear talks has introduced a potential wildcard for global supply dynamics, with discussions hinting at progress toward an agreement.

Investment Insight: Oil markets face a precarious balance as trade tensions ease but oversupply risks mount. Investors should monitor OPEC+ production decisions closely, as further output increases could weigh on prices in the second half of the year. For those in energy equities, focusing on companies with low break-even costs and robust cash flows may mitigate downside risks from prolonged price weakness. Additionally, any breakthrough in US-Iran talks could alter supply expectations, warranting a cautious approach to oil-linked investments.

Conclusion

This week’s market narrative centers on the intersection of trade tensions, monetary policy, and corporate performance. Trump’s tariff maneuvers provide temporary relief in Europe but prolong uncertainty globally, keeping investors on edge. Nvidia’s earnings and the Fed’s inflation gauge will serve as pivotal indicators for tech and macroeconomic sentiment, while OPEC+ decisions could shape the energy market’s direction. In Asia, BYD’s price war underscores competitive pressures in China’s EV sector, even as VietJet’s Airbus order signals optimism in aviation growth. With volatility expected to persist, strategic positioning in resilient sectors and close monitoring of geopolitical developments remain essential for investors.

Upcoming Dates to Watch

- May 27th, 2025: Japan BoJ Core CPI

- May 28th, 2025: Japan Foreign Bonds Buying, Nvidia earnings

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

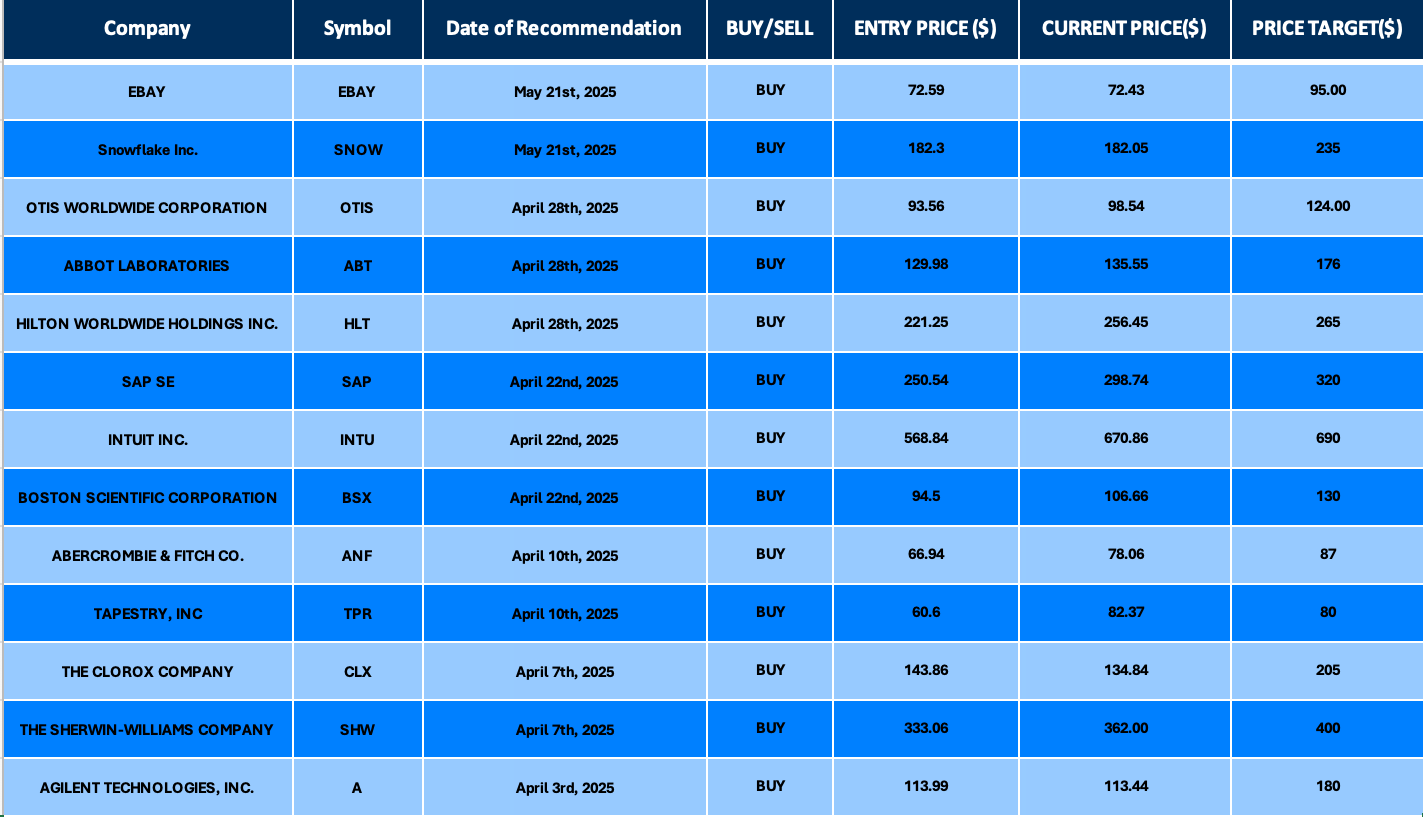

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.