Date Issued – 27th May 2025

Preview

Markets are reacting to President Trump’s tariff delay, with European stocks and U.S. futures rebounding while the dollar hovers near a two-year low. Nvidia’s earnings report on Wednesday could shape sentiment, as investors watch for AI spending trends and China sales updates. Meanwhile, Australian wheat faces pressure from weak Chinese demand and Russian competition, risking a fire sale that could further depress prices. In energy, U.S. offshore oil production is set for long-term growth, with Gulf output projected to rise by 33% by 2027, even as shale activity slows. Tesla continues to struggle in Europe, with April sales halving amid growing competition and a Musk-linked boycott.

Stocks Rebound on Tariff Delay; Dollar Nears Two-Year Low

European stocks and US equity futures advanced after President Trump postponed a potential 50% tariff on EU goods to July 9, reversing a prior aggressive stance. The Stoxx Europe 600 erased Friday’s losses, while S&P 500 and Nasdaq 100 futures climbed 1.3% and 1.5%, respectively. Trump’s policy volatility, dubbed the “Trump Pattern,” continues to drive market oscillations, though signs of investor fatigue are emerging. Meanwhile, the dollar weakened, with Bloomberg’s dollar spot index nearing its lowest since July 2023, as traders remain bearish on the currency. Nvidia’s earnings and key US inflation data later this week could further shape sentiment amid ongoing macro and trade uncertainties.

Investment Insight: The “Trump Pattern” of trade threats followed by concessions creates tactical opportunities for short-term gains, but declining rebound strength signals potential erosion of risk appetite. Investors should remain cautious, focusing on defensive sectors and companies with limited exposure to unresolved trade tensions. Monitoring Nvidia’s outlook and inflation data this week will be critical for gauging market resilience.

Australian Wheat Faces Price Pressure Amid Weak Chinese Demand and Russian Competition

Australian wheat stockpiles are set to climb significantly by the end of the season due to a collapse in Chinese imports and stiff competition from Russian exports. Shipments to China from October to March fell 81% year-over-year, as Russian grain continues to flow at competitive prices. Analysts warn that mounting inventories, projected at 5-6 million tons of carryover, could force a fire sale to clear storage ahead of the next harvest, driving prices lower. Benchmark wheat futures are already near five-year lows amid abundant global supply, with Australian wheat prices potentially dropping to A$300 per ton from current levels of A$325-A$350.

Investment Insight: Oversupply dynamics and diminishing demand from key markets signal continued downward pressure on wheat prices, making near-term recovery unlikely. Investors should anticipate headwinds for Australian agricultural exporters while monitoring potential opportunities in alternative grains or geographic markets. Diversification into sectors less exposed to commodity price swings may offer defensive positioning as the global grain surplus persists.

U.S. Offshore Oil Production Poised for Major Growth

Offshore oil production in the U.S. is set to surge, with Gulf of Mexico output projected to rise from 1.8 million bpd to 2.4 million bpd by 2027, driven by streamlined permitting, technological advancements, and increased investment. The sector offers a reliable, high-volume production profile as shale growth plateaus and onshore rig activity declines. In 2024, offshore areas accounted for 14% of U.S. crude production, with federal leases generating $7 billion in revenue. However, global dynamics, including OPEC+ production hikes and soft oil prices, may weigh on the broader U.S. energy outlook.

Investment Insight: Offshore drilling’s long-term, steady output profile is becoming a key growth driver as the shale boom matures. Investors should focus on companies leveraging deepwater technologies and AI-driven efficiencies, which enhance productivity and reduce costs. While regulatory and geopolitical risks remain, the Gulf of Mexico’s expanding role in U.S. energy production positions it as a cornerstone for future oil market stability and investment opportunities.

Nvidia Earnings in Focus: Key Price Levels to Watch

Nvidia shares are consolidating ahead of its earnings report on Wednesday, with technical indicators signaling potential bullish momentum. Recent price action has formed a flag pattern, suggesting a continuation of the stock’s uptrend. Key resistance levels to monitor are $143, near February’s swing high, and $150, a zone tied to prior peaks from late 2024. On the downside, support levels at $121 and $115 align with critical trendlines and moving averages. Nvidia’s performance will hinge on AI infrastructure demand and updates on its China sales, under pressure from U.S. export restrictions.

Investment Insight: Nvidia’s technical setup offers traders actionable entry and exit points, with resistance at $143 and $150 presenting profit-taking opportunities. Long-term investors should monitor fundamental drivers, including AI spending trends and geopolitical risks tied to export controls. While volatility may spike around earnings, the stock’s resilience and growth prospects in AI make it a compelling play for tech-focused portfolios.

Market wrap: NVIDIA Corp (NVDA): USD 131.29

Tesla Europe Sales Plunge Amid Competition and Musk Boycott

Tesla’s European sales fell 49% year-over-year in April to 7,261 units, with market share dropping to 0.7% from 1.3%, according to ACEA data. This decline contrasts with a 34.1% growth in overall EV sales in the region, as competition from European automakers and Chinese EVs, including BYD, intensifies. Tesla’s aging lineup and a regional boycott linked to CEO Elon Musk’s political affiliations have compounded challenges, despite plans to update key models like the Model Y. While Tesla reports recovery in other markets, it faces mounting pressure in Europe and China amid rising competition and price wars.

Investment Insight: Tesla’s waning dominance in Europe highlights the risks of relying on an aging product lineup amid intensifying competition. Investors should monitor Tesla’s ability to execute model updates and maintain pricing power in key markets. Diversifying EV exposure into competitors with growing European market shares, such as BYD or hybrid-focused automakers, may offer a hedge against Tesla’s regional struggles.

Conclusion

Markets are navigating a mix of opportunities and challenges, from geopolitical uncertainty driving tariff-induced volatility to sector-specific pressures in energy, agriculture, and tech. Nvidia’s earnings and U.S. inflation data this week will be closely watched for signals on AI demand and broader economic trends. Meanwhile, Tesla’s struggles in Europe and Australia’s wheat oversupply highlight the competitive and dynamic nature of global markets. As offshore oil production gains momentum and key price levels emerge across industries, investors should adopt a strategic approach, balancing short-term opportunities with the need to manage risks in an evolving macroeconomic landscape.

Upcoming Dates to Watch

- May 27th, 2025: Japan BoJ Core CPI

- May 28th, 2025: Japan Foreign Bonds Buying, Nvidia earnings

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

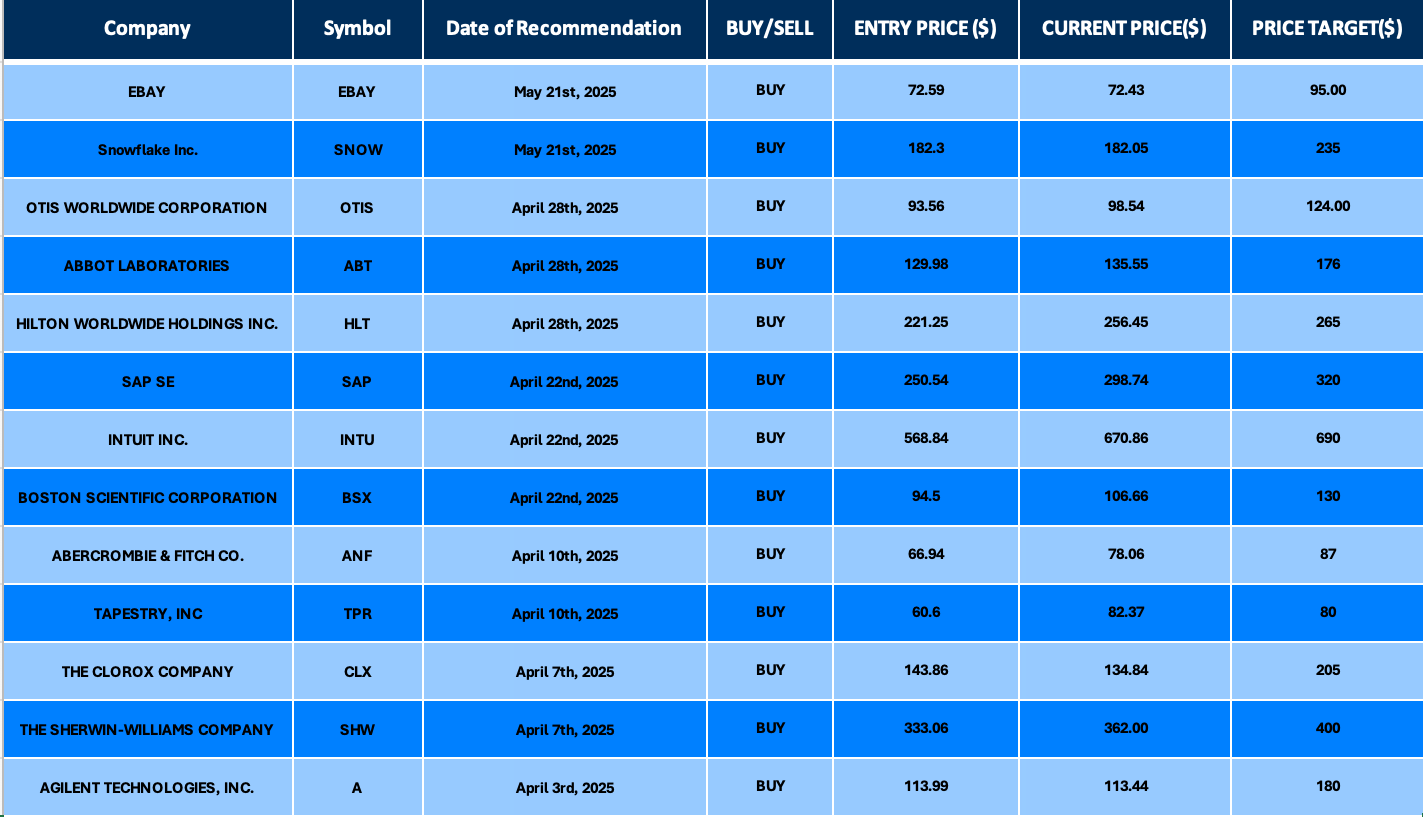

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.