Date Issued – 28th May 2025

Preview

Markets rebounded sharply as easing US-EU trade tensions lifted global equities, with the Dow soaring over 700 points and Germany’s DAX hitting a record high. President Trump’s tariff pause and optimistic tone on negotiations boosted sentiment, while Nvidia and Tesla led tech gains, the latter jumping nearly 7% after Elon Musk reaffirmed his focus on the EV maker. In Asia, Groq warned that AI adoption is outpacing infrastructure capacity, spotlighting risks in data center and power constraints despite heavy investment. Meanwhile, Xiaomi shares rose on record Q1 results, underscoring the firm’s successful pivot to premium products and diversified growth beyond smartphones.

Market Rebounds Sharply as Trump Pauses EU Tariff Hike

U.S. stocks rallied Tuesday, snapping back from last week’s losses as investors cheered a temporary pause on new EU tariffs and a rebound in consumer confidence. The Dow Jones Industrial Average jumped 1.78%, or more than 700 points, while the S&P 500 gained 2.05%, and the Nasdaq Composite surged 2.47%, led by strength in tech shares. Optimism grew after President Trump delayed a planned 50% tariff hike on EU imports to allow time for accelerated trade negotiations. Bond markets also steadied as Treasury yields fell, with the 30-year yield retreating to 4.94% amid indications that Japan will scale back bond sales following recent volatility. Nvidia climbed 3.21% ahead of its earnings, as it unveiled a lower-cost chip for China, further fueling the market’s bullish tone.

Investment Insight: Markets are pricing in relief from escalating trade tensions and a more stable bond environment, suggesting a near-term tactical opportunity in cyclical and tech sectors. However, with key economic data and Fed commentary on deck, investors should maintain a balanced posture, watching for confirmation of sustained consumer strength and policy clarity before extending risk exposure.

Asia Faces Infrastructure Strain Amid AI Acceleration, Groq Warns

AI adoption in Asia is outpacing the region’s data center and power infrastructure, according to Groq Chief Revenue Officer Ian Andrews. Speaking at Singapore’s ATxSummit, Andrews highlighted severe compute bottlenecks as demand for inference—AI decision-making—surges. Despite governments and tech giants ramping up investment, including Taiwan’s $3 billion initiative and OpenAI’s expansion in South Korea, infrastructure remains the limiting factor. As more advanced models debut at a record pace, the gap between AI capability and physical capacity is widening. Groq, which designs chips optimized for inference speed, sees this infrastructure lag as a critical challenge for the region’s AI ambitions.

Investment Insight: Investors should monitor infrastructure buildouts in Asia as a key enabler of AI scalability. While model innovation garners headlines, the long-term value lies in firms positioned to solve compute and energy constraints—data center operators, power providers, and edge hardware firms are set to benefit as AI demand collides with physical limitations.

DAX Hits Record High as US-EU Trade Tensions Ease

Germany’s DAX climbed 0.18% to a record 24,269.47 on Wednesday, extending its rally for a third straight session amid easing transatlantic trade tensions. Optimism surged after President Trump signaled progress in US-EU negotiations, delaying punitive tariffs and suggesting imminent meeting dates. The Euro Stoxx 600 edged up 0.07%, while Wall Street gains from Tuesday echoed across European markets. Defence and banking sectors led the DAX higher, buoyed by Germany’s fiscal stimulus and increased defence spending. Meanwhile, the euro slipped below 1.14 against the dollar, reflecting renewed confidence in the US economic trajectory and risk-on sentiment.

Investment Insight: With trade tensions receding and fiscal tailwinds in play, European equities—particularly German industrials and financials—are positioned for continued outperformance. Investors should watch for follow-through in policy implementation and trade talks, as well as ECB policy stability, to sustain momentum. The rally in defence stocks highlights a structural shift in European spending priorities, offering a longer-term thematic opportunity.

Tesla Surges as Musk Reaffirms Focus, Breaks Out of Key Chart Pattern

Tesla shares soared nearly 7% on Tuesday, closing at their highest level since early February, after CEO Elon Musk reaffirmed his full-time commitment to the EV maker. Musk’s social media post over the weekend signaled a renewed operational focus, helping to ease investor concerns around his prior distractions. The stock, which had fallen sharply earlier this year, has now rallied over 60% from its April lows. Technical traders noted a breakout from a bullish pennant formation, suggesting further upside potential. Key resistance levels lie at $430 and $489, while support sits at $325 and $289, with bullish momentum confirmed by a strong RSI reading.

Investment Insight: Tesla’s technical breakout and leadership clarity offer near-term momentum for bullish investors, but overbought indicators signal heightened risk of pullback. Strategic entries on dips near $325 or $289 may offer more attractive risk-reward, while profit-taking at resistance levels could temper gains. Long-term positioning should balance Musk’s renewed operational focus with execution risks tied to upcoming product launches like the Robotaxi.

Market wrap: Tesla Inc (TSLA): USD 362.89

Xiaomi Shares Rise on Record Q1 Earnings and Diversification Strategy

Xiaomi shares jumped as much as 3.4% in Hong Kong trading Wednesday after the company posted record first-quarter revenue and profit, reflecting strong execution of its pivot toward premium products across smartphones, home appliances, and electric vehicles. The stock pared gains to trade 0.6% higher later in the session. With a market cap now surpassing $171 billion—eclipsing EV giant BYD—Xiaomi is gaining investor favor as a diversified consumer tech and lifestyle brand. Analysts credit the company’s multi-sector strategy for helping it weather China’s intensifying EV price war, though macroeconomic risks and trade tensions remain potential headwinds.

Investment Insight: Xiaomi’s ability to scale across verticals positions it as a defensible growth play in China’s competitive tech landscape. Its premiumization strategy and consumer ecosystem model provide resilience amid sector-specific volatility. Investors may look to Xiaomi as a long-term compounder, though global trade risks and profit margin pressures in its automotive segment warrant close monitoring.

Market price: Xiaomi Corp (HKG: 1810): HKD 51.75

Conclusion

Investor sentiment is turning cautiously optimistic as trade tensions ease, tech leadership stabilizes, and corporate results bolster confidence across regions. Momentum in Tesla and Xiaomi underscores the market’s appetite for innovation-driven growth, while structural shifts in European defense spending and Asia’s AI infrastructure needs signal longer-term themes. However, with key economic data, Fed commentary, and geopolitical developments still ahead, markets remain sensitive to macro signals. For now, risk appetite is returning—but investors would do well to stay selective, balancing opportunity with vigilance as global markets navigate a complex but increasingly constructive landscape.

Upcoming Dates to Watch

- May 28th, 2025: Japan Foreign Bonds Buying, Nvidia earnings

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

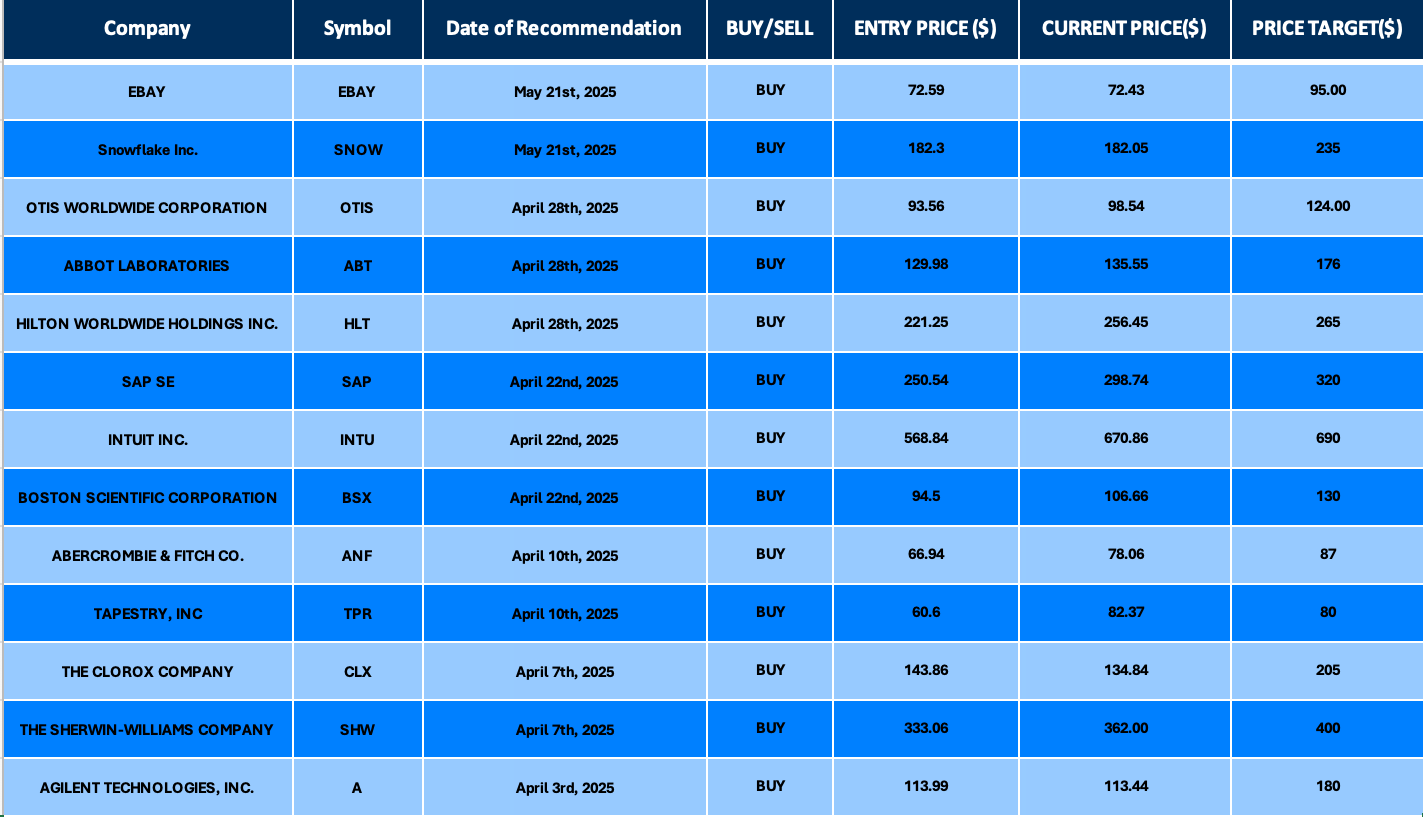

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.