Date Issued – 29th May 2025

Global markets rallied after a U.S. court ruled against Trump-era tariffs

Global markets rallied after a U.S. court ruled against Trump-era tariffs, lifting trade-sensitive stocks and sending the S&P 500 futures up 1.6%. Nvidia surged nearly 5% in after-hours trading as earnings beat expectations despite an $8 billion hit from China export curbs, pushing it past Microsoft and Apple in market cap. Elon Musk exited his White House advisory role, refocusing on Tesla and SpaceX, a shift welcomed by investors. Meanwhile, Bitcoin ETFs pulled in $9 billion in recent weeks as investors rotated out of gold, signaling growing institutional confidence in digital assets amid U.S. fiscal concerns. Salesforce also impressed, raising its full-year outlook after AI-fueled revenue topped $9.8 billion in Q1 and announcing an $8 billion acquisition of Informatica to expand its data cloud capabilities.

Court Ruling on Tariffs Sparks Global Market Rally

Stocks across global markets advanced after a U.S. federal court ruled that former President Donald Trump exceeded his authority in imposing widespread tariffs under the 1977 International Emergency Economic Powers Act. The decision casts doubt on the legality of key trade policies that have weighed on global sentiment and inflation expectations. Futures on the S&P 500 rose 1.6%, while the Dow gained 1.2%.

In Asia, Japan’s Nikkei 225 led with a 1.5% jump, aided by relief over potential tariff rollbacks. South Korea’s Kospi climbed 1.4% after a surprise interest rate cut by the Bank of Korea, while Australia’s ASX 200 edged 0.3% higher. The dollar strengthened sharply against the yen, hitting 146.06. Meanwhile, U.S. Treasury yields ticked up, with the 10-year rising to 4.47%, and oil prices made modest gains. Investor focus now shifts to Nvidia’s earnings, which lifted the stock 4.9% in after-hours trading.

Investment Insight

The court’s tariff ruling injects near-term optimism into equity markets, particularly for export-reliant economies and multinational firms. While policy uncertainty remains pending appeal, investors may find opportunity in sectors poised to benefit from reduced trade friction, such as industrials and autos. However, the limited bond market reaction and Fed’s cautious stance suggest inflation and policy risk still loom large—underscoring the need for selective positioning.

Nvidia Surges After Earnings, Shrugging Off China Export Blow

Nvidia shares rallied nearly 5% in after-hours trading after the chipmaker delivered better-than-expected first-quarter earnings and a bullish outlook, despite an $8 billion revenue hit from U.S. export restrictions to China. The company’s data center revenue soared 73% year-on-year to $39.1 billion, fueling total revenue growth of 69% to $44.1 billion. Earnings per share reached $0.96, topping estimates, as global AI demand remained firmly intact.

Nvidia’s outlook for the current quarter—$45 billion in revenue and a 72% non-GAAP gross margin—reassured investors, even as China-related write-downs dragged Q1 gross margin down to 61%. Nvidia now holds the top spot in global market capitalization, surpassing Microsoft and Apple, as its AI dominance deepens through new ventures, including U.S. factory expansions and a strategic partnership in Saudi Arabia.

Investment Insight

Nvidia’s earnings reaffirm its central role in the AI infrastructure boom, with resilience in the face of geopolitical headwinds. While China’s market is effectively off-limits, diversification into the Middle East and continued strength from global hyperscalers mitigate regional risk. For investors, Nvidia’s margin guidance and forward momentum suggest AI tailwinds are far from peaking—supporting a long-term overweight stance despite near-term policy volatility.

Market price: NVIDIA Corp (NVDA): USD 134.81

Elon Musk Exits White House Role, Refocuses on Business Amid Political Shift

Elon Musk announced his departure from the Trump administration’s DOGE office, signaling the end of his tenure as a special government employee tasked with reducing federal spending. The Tesla and SpaceX CEO thanked President Trump for the opportunity but criticized a recent budget bill for undermining cost-cutting efforts.

Musk’s decision to step back from Washington and reduce political spending follows months of backlash over his government role—an involvement that had weighed on Tesla’s public image. With Musk now refocusing on his companies, Tesla shares have rebounded, supported by investor relief as the billionaire returns to full-time leadership. A White House official confirmed Musk’s offboarding has begun.

Investment Insight

Musk’s return to hands-on operational leadership at Tesla and SpaceX may ease investor concerns over executive distraction and reputational risk. His withdrawal from the political spotlight could reduce headline volatility for Tesla, potentially restoring focus on fundamentals amid a competitive EV landscape. Investors may view this as a stabilizing pivot that supports medium-term performance, particularly if it coincides with renewed innovation and production milestones.

Bitcoin ETFs Attract $9 Billion as Investors Rotate Out of Gold

U.S. Bitcoin ETFs have raked in over $9 billion in inflows over the past five weeks, led by BlackRock’s iShares Bitcoin Trust (IBIT), as investors pivot away from traditional safe havens. Gold-backed ETFs, by contrast, saw more than $2.8 billion in outflows during the same period, reflecting a notable shift in risk hedging preferences.

Bitcoin recently hit an all-time high of $111,980, buoyed by favorable regulatory signals and growing macroeconomic unease, even as gold pulled back from recent peaks. Analysts highlight Bitcoin’s appeal as a hedge against both private and sovereign risks, especially amid rising fiscal concerns and a downgraded U.S. credit rating. While gold remains the stronger performer year-to-date—with a 25% gain versus Bitcoin’s 15%—Bitcoin’s low recent correlation with traditional assets offers new diversification potential.

Investment Insight

The rotation from gold to Bitcoin ETFs underscores a growing institutional embrace of digital assets as credible hedges in an era of fiscal uncertainty. While volatility remains a concern, Bitcoin’s evolving correlation profile and decentralized nature may offer diversification benefits beyond traditional safe havens. Investors should monitor the regulatory landscape and macro signals closely, as Bitcoin’s role in multi-asset portfolios continues to transition from speculative bet to strategic allocation.

Salesforce Lifts Outlook on Strong AI-Driven Growth, Beats Q1 Estimates

Salesforce raised its full-year revenue guidance after posting better-than-expected fiscal Q1 results, buoyed by accelerating demand for its AI offerings. Adjusted earnings per share came in at $2.58, topping the $2.55 consensus, while revenue rose 8% year-over-year to $9.83 billion, outpacing both company and Wall Street forecasts.

The enterprise software firm now expects FY26 revenue of $41.0–$41.3 billion, up from prior guidance of $40.5–$40.9 billion, and guided Q2 earnings and sales above estimates. AI remains the primary growth engine, with annual recurring revenue from its data cloud and Agentforce platform more than doubling to $1 billion. Shares rose 1.8% in after-hours trading following the upbeat report. Salesforce also announced an $8 billion acquisition of Informatica to strengthen its AI capabilities, though the deal won’t impact current-year results.

Investment Insight

Salesforce’s results highlight accelerating enterprise demand for AI-integrated solutions, validating its pivot around Agentforce. The raised outlook and strong subscription momentum signal durable topline growth, even as broader IT budgets remain mixed. The Informatica acquisition reinforces the company’s multi-year AI strategy and could further entrench Salesforce in data-driven enterprise workflows. Investors may view the stock favorably as it combines margin discipline with AI-led growth, positioning it as a core holding in the evolving software landscape.

Market price: Salesforce Inc (CRM): 276.03

Conclusion

This week’s developments underscore a shifting investment landscape defined by AI-driven performance, evolving macro risks, and deepening market recalibrations. From Nvidia’s dominance to Salesforce’s strategic expansion, tech remains the engine of growth. Meanwhile, Bitcoin’s ascent as an institutional hedge and the rollback of tariff pressures point to a broader rebalancing of risk and opportunity. Elon Musk’s retreat from politics adds clarity to Tesla’s leadership narrative, while central banks and fiscal policy remain key watchpoints. As volatility persists, investors appear increasingly selective—favoring innovation, clarity, and resilience in a market still navigating structural change and geopolitical complexity.

Upcoming Dates to Watch

- May 29th, 2025: US GDP, US Jobless claims, South Korea Industrial Production, Japan Unemployment rate

- May 30th, 2025: German CPI, Chinese Composite PMI, Chinese Manufacturing PMI, PCE Index

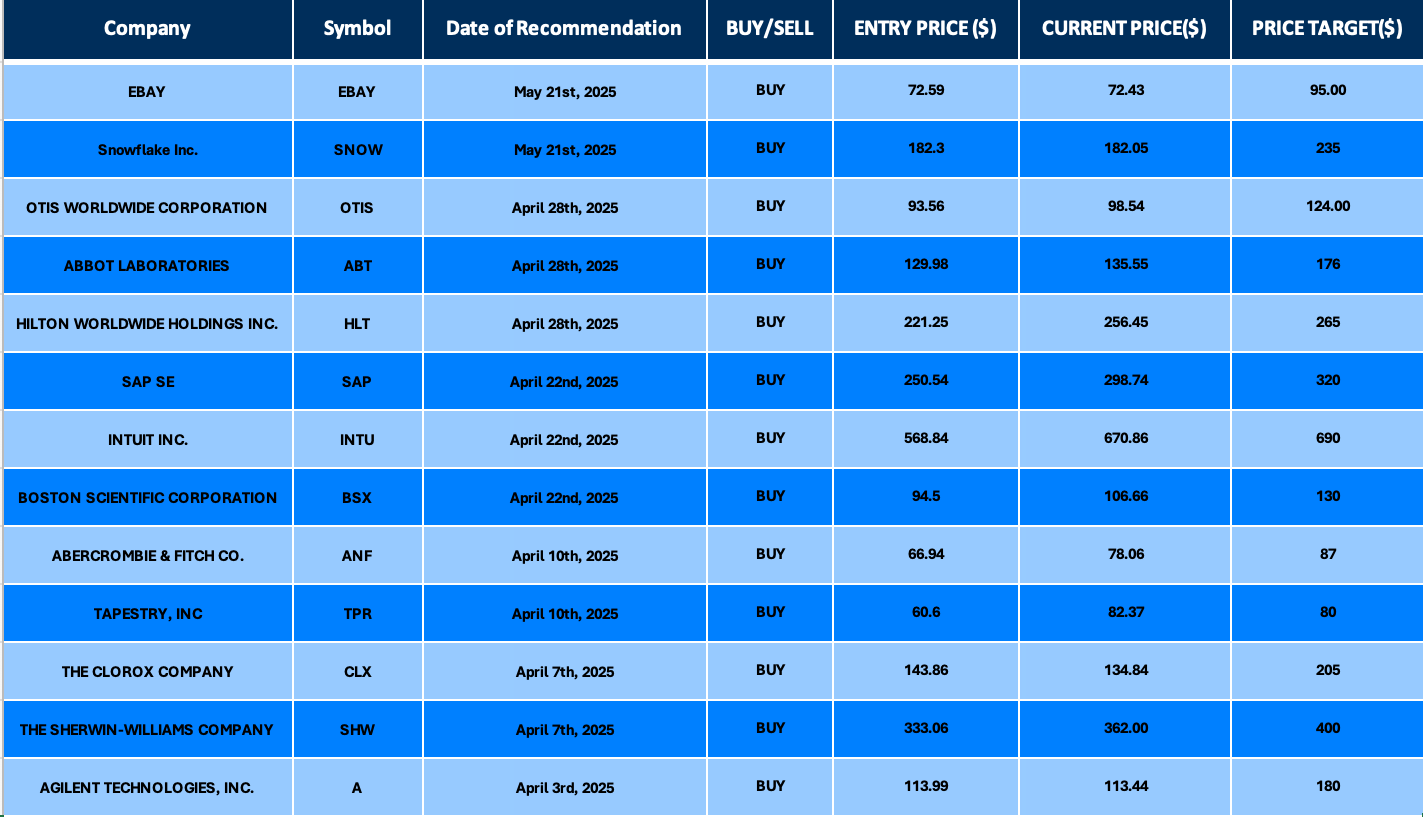

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.