Date Issued – 30th May 2025

Preview

US stock futures dipped as tariff uncertainty returned, with key inflation data due Friday in focus. Boeing surged to a 15-month high after announcing resumed aircraft deliveries to China, while China’s manufacturing PMI hinted at continued contraction amid trade tensions. Gold extended losses ahead of the PCE report but retained its haven appeal as geopolitical risks persist. Meanwhile, Japan’s JERA signaled interest in Alaska’s $44 billion LNG project, underscoring Asia’s appetite for diversified energy supplies. Investors are advised to monitor inflation, trade developments, and technical levels across sectors.

Futures Slip Amid Tariff Uncertainty

US stock futures edged lower following a federal appeals court decision to reinstate tariffs introduced by the Trump administration, reigniting trade policy uncertainty. Dow Jones, S&P 500, and Nasdaq futures dipped 0.1%, 0.2%, and 0.3%, respectively, as investors weighed the potential economic ripple effects. The White House signaled readiness to escalate the legal battle to the Supreme Court, while Wall Street shifted focus to April’s PCE Price Index, the Federal Reserve’s favored inflation gauge, due Friday. Broader markets exhibited resilience earlier in the week, buoyed by optimism over a potential US-EU trade deal and Nvidia’s standout earnings.

Investment Insight

The reinstatement of tariffs introduces short-term volatility, but inflationary impacts may be delayed. Investors should monitor upcoming inflation data closely while considering defensive positions in sectors less exposed to trade policy risks, such as healthcare and utilities. Tech stocks, while pressured today, remain a strong long-term growth play following Nvidia’s robust earnings.

Boeing Surges to 15-Month High on China Delivery News

Boeing (BA) shares soared over 3% to close at $208, marking their highest level since February 2024 after the company confirmed plans to resume aircraft deliveries to China next month. Optimism surrounding a potential U.S.-China trade deal and increased production targets for the 737 Max further boosted sentiment. The stock has climbed 62% from its April low and is up 18% year-to-date. Analysts are closely watching technical levels, including support around $199 and $187, and resistance near $234 and $265, as Boeing continues its upward trajectory.

Investment Insight

Boeing’s breakout above a flag pattern signals bullish momentum, but overbought technical indicators suggest potential near-term consolidation. Investors should monitor key support levels for entry opportunities, while resistance zones near $234 and $265 could present profit-taking areas. Long-term prospects remain strong, supported by renewed demand in China and production expansion plans.

Market price: Boeing Co (BA): USD 208.18

China’s Manufacturing Sector Contracts Amid Trade Tensions

China’s manufacturing activity likely contracted for the second consecutive month in May, with the official PMI projected at 49.5, according to a Reuters poll. This marks a slight improvement from April’s 49.0 but remains below the 50-point threshold separating growth from contraction. Ongoing trade tensions with the U.S. and EU, including U.S. tariffs of 145% and EU dumping investigations, are weighing on sentiment as policymakers juggle sluggish domestic demand and deflationary pressures. Analysts anticipate additional monetary and fiscal stimulus to stabilize growth, with Beijing maintaining its 5% annual GDP target despite mounting external headwinds.

Investment Insight

China’s faltering manufacturing sector highlights risks for global supply chains and commodity markets, particularly as trade tensions intensify. Investors should monitor policy stimulus efforts and PMI data for signs of stabilization. Export-dependent industries and commodities may face downside pressure, while sectors tied to domestic consumption and fiscal stimulus, such as infrastructure and renewable energy, could offer growth opportunities.

Gold Slips Ahead of Key US Data Amid Tariff Uncertainty

Gold prices fell 0.8% on Friday, extending weekly losses to nearly 2%, as traders positioned ahead of the US PCE price index release, a key inflation gauge. The metal struggled to break above resistance at $3,328, according to analysts, with technical factors contributing to the pullback. Meanwhile, renewed US-China trade tensions and uncertainties over President Trump’s tariff policies continue to bolster gold’s long-term haven appeal. Spot gold traded at $3,300 per ounce, while the stronger dollar pressured other precious metals, including silver, palladium, and platinum.

Investment Insight

Despite short-term declines, gold remains a critical hedge against inflation and geopolitical uncertainty, particularly as US-China trade tensions persist. Investors should consider using recent dips as buying opportunities for portfolio diversification, focusing on long-term allocations to safe-haven assets. Monitoring inflation data and trade developments will be key to navigating near-term price movements.

Japan’s JERA Eyes LNG Imports From Alaska Amid Trade Talks

Japan’s largest LNG importer, JERA Co., expressed interest in sourcing liquefied natural gas from the $44 billion Alaska LNG export project, a key initiative backed by the Biden administration. While details remain scarce, the move signals progress for the long-delayed project as Japan seeks to strengthen trade ties with the US. The Alaska Sustainable Energy Conference has drawn high-level delegations from Japan, South Korea, and Taiwan, with Asian buyers leveraging the event to align with Washington amid ongoing trade negotiations.

Investment Insight

The Alaska LNG project may gain traction as Asian energy importers seek diversified supply sources and stronger ties with the US. Investors should monitor developments in long-term contracts, which are crucial for advancing the project. LNG demand in Asia remains robust, offering opportunities in energy infrastructure and export-focused ventures tied to US-Asia trade relations.

Conclusion

Markets remain on edge as trade tensions and tariff uncertainties dominate headlines, impacting everything from stock futures to commodity prices. Boeing’s rally underscores the potential for strategic gains amid improving U.S.-China trade prospects, while China’s contracting manufacturing sector highlights risks to global supply chains. Gold’s recent pullback offers a reminder of its enduring role as a hedge against volatility, and Japan’s interest in Alaska LNG signals shifting energy dynamics in Asia. As key inflation data looms, investors should stay vigilant, focusing on defensive strategies and long-term opportunities aligned with evolving geopolitical and economic trends.

Upcoming Dates to Watch

- May 30th, 2025: German CPI

- May 30th, 2025: Chinese Composite PMI

- May 30th, 2025: Chinese Manufacturing PMI

- May 30th, 2025: PCE Index

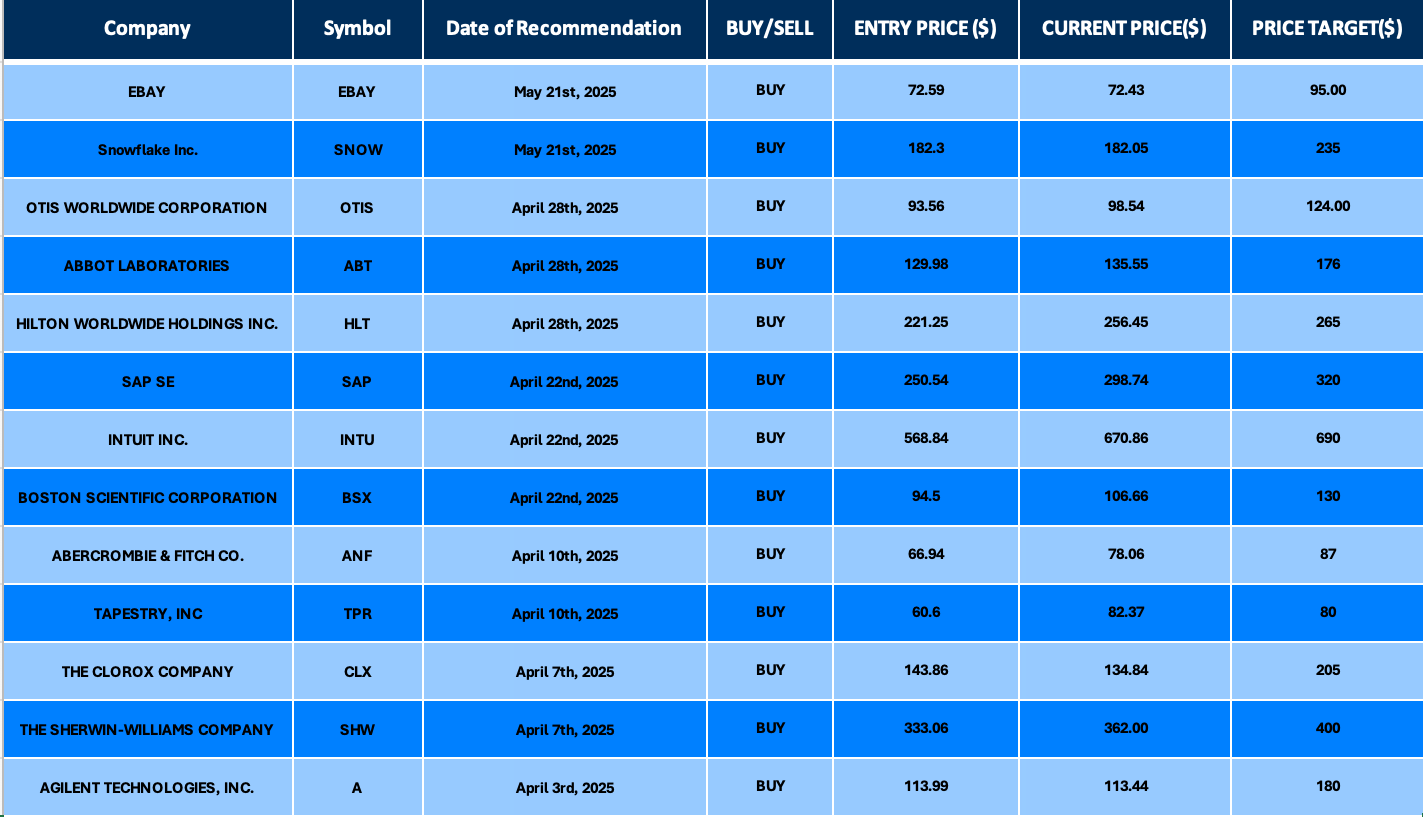

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.