Date Issued – 2nd June 2025

Preview

Markets opened June on a cautious note following a strong May rally, with U.S. equity futures slipping as investors weigh escalating U.S.-China trade tensions and a critical week of economic data. Swiss GDP surprised to the upside, driven by pre-tariff export front-loading to the U.S., while Goldman Sachs expects OPEC+ to raise oil output again in August amid resilient demand. Gold surged on haven flows as trade friction intensified, aided by a weaker dollar and dovish Fed commentary. Bitcoin stabilized near $105,000 after a weekend drop tied to risk-off sentiment and institutional outflows. As geopolitical risk and tariff uncertainty grow, investors are recalibrating exposure across commodities, crypto, and equities ahead of key macro catalysts.

Wall Street Pauses After May Rally Amid Trade Tensions and Data Watch

US equity futures slipped early Monday as markets entered June with caution following a robust May rally. Futures tied to the S&P 500, Dow, and Nasdaq fell between 0.5% and 0.7%, signaling a tentative open after the S&P posted its strongest May in over three decades. Tech stocks, buoyed by AI enthusiasm and steady economic indicators, drove the gains last month, with the Nasdaq up 9%. However, renewed trade uncertainty — including legal back-and-forth over Trump-era tariffs and escalating rhetoric with China — has reintroduced volatility. Investors are also bracing for key economic data this week, including Friday’s nonfarm payrolls report, which could shape expectations for Federal Reserve policy heading into the summer.

Investment Insight: After a historically strong May, markets may face near-term consolidation as geopolitical tensions and policy ambiguity resurface. Investors should watch labor data closely for signs of economic resilience or softness, which could recalibrate rate expectations. With earnings season winding down, positioning around macro catalysts may drive the next leg of equity moves — suggesting a more selective, fundamentals-driven approach is warranted.

Swiss GDP Accelerates as Exporters Race Against U.S. Tariff Clock

Switzerland’s economy expanded by 0.8% in Q1 2025, outperforming expectations as firms rushed to front-load shipments ahead of newly imposed U.S. tariffs. The quarterly growth, adjusted for major sporting events, exceeded both the previous quarter’s 0.6% and the long-term average of 0.4%. A sharp 17.4% jump in exports to the U.S. — far outpacing the 3.6% growth in overall exports — was a key driver, underscoring how policy uncertainty is reshaping global trade flows. The acceleration came just before President Trump’s administration enacted a 31% tariff on Swiss goods in April, a figure since dialed back to 10% pending further negotiations.

Investment Insight: The stronger-than-expected Swiss GDP print highlights how front-loaded trade activity can create short-term tailwinds in export-driven economies amid tariff uncertainty. Investors should be mindful that such gains may reverse as temporary demand fades and trade policies solidify. For now, export-heavy sectors may benefit, but the outlook hinges on the durability of U.S.-Swiss negotiations and the broader trajectory of global trade tensions.

Goldman Projects Modest OPEC+ Output Hike Amid Resilient Demand

Goldman Sachs expects OPEC+ to raise oil production by 0.41 million barrels per day in August, marking a third consecutive monthly increase as the group seeks to reclaim market share and enforce internal discipline. The bank cited firm spot market fundamentals, stronger-than-expected global activity data, and seasonal demand tailwinds as justification for continued output hikes. Oil prices edged higher in early Asian trading, reflecting market alignment with OPEC+’s July production increase. Goldman anticipates production will plateau from September, with rising non-OPEC supply and a projected slowdown in global growth rebalancing the market. Despite the output increases, Goldman maintained a cautious price outlook, forecasting Brent at $60 and WTI at $56 for the rest of 2025.

Investment Insight: OPEC+’s measured production increases reflect a strategic pivot toward market normalization rather than aggressive price targeting. While short-term fundamentals support higher output, investors should monitor the ramp-up in non-OPEC supply and potential demand softening later in 2025. Energy sector allocations may benefit from tactical positioning around summer demand strength, but longer-term caution is warranted amid projected surpluses and subdued price forecasts.

Gold Surges as Trade Tensions and Tariff Fears Stoke Safe-Haven Demand

Gold prices climbed sharply in early Monday trading, buoyed by escalating U.S.-China trade tensions and growing uncertainty over President Trump’s tariff policy. Spot gold rose 0.8% to $3,315.68/oz, while futures gained 0.7%, extending haven inflows amid deteriorating hopes for a lasting trade agreement. China’s rejection of Trump’s recent accusations and the threat of higher tariffs on commodities—including a proposed hike on steel and aluminum imports—rattled investor sentiment. A weaker dollar, following dovish comments from Fed Governor Christopher Waller, further supported metals broadly. Copper and silver prices also advanced, while platinum lagged, reflecting mixed demand signals across the commodity complex.

Investment Insight: The renewed bid for gold underscores market sensitivity to geopolitical friction and policy unpredictability. With trade talks stalling and tariff rhetoric intensifying, gold’s appeal as a hedge is likely to remain intact. Investors should consider maintaining exposure to precious metals as macro risks persist and rate cut expectations firm up. However, gains may face resistance if trade negotiations stabilize or dollar strength returns.

Bitcoin Stabilizes Near $105K After Weekend Selloff on Trade Tensions

Bitcoin held steady around $104,640 early Monday, pausing after a sharp weekend decline driven by escalating U.S.-China trade tensions and renewed risk aversion. The cryptocurrency fell from record highs above $111,000 as profit-taking intensified and ETF flow data pointed to institutional outflows late last week. Market sentiment was further weighed down by President Trump’s threat to double tariffs on steel and aluminum and the stalling of trade negotiations with Beijing. Despite limited direct exposure to tariffs, crypto assets mirrored broader risk-off moves, particularly in tech-linked markets. Altcoins followed suit, with Ether, XRP, and Polygon posting modest declines.

Investment Insight: Bitcoin’s recent retreat highlights its increasing correlation with macroeconomic sentiment and equity markets. While regulatory optimism fueled May’s rally, mounting geopolitical risks and institutional de-risking may cap near-term upside. Investors should monitor ETF flows and policy signals closely, as crypto remains vulnerable to shifts in global risk appetite. Strategic allocations may benefit from a more cautious stance amid elevated volatility.

Conclusion

Markets are entering June with renewed caution as geopolitical tensions and trade policy uncertainty cloud the outlook across asset classes. While May delivered outsized gains—particularly in tech and crypto—investors are now navigating a more complex environment marked by shifting central bank signals, tariff volatility, and signs of decelerating global growth. Defensive positioning is reemerging, with flows favoring havens like gold and selective commodity exposure. As key economic data and policy decisions loom, near-term market direction will hinge on clarity from Washington, Beijing, and the Fed. Strategic flexibility and disciplined risk management remain essential in this increasingly reactive market landscape.

Upcoming Dates to Watch

- June 2nd, 2025: Swiss GDP, HK Retail Sales, US S&P Global Manufacturing PMI, South Korea CPI

- June 3rd, 2025: Swiss CPI, South Korea GDP, Australia GDP

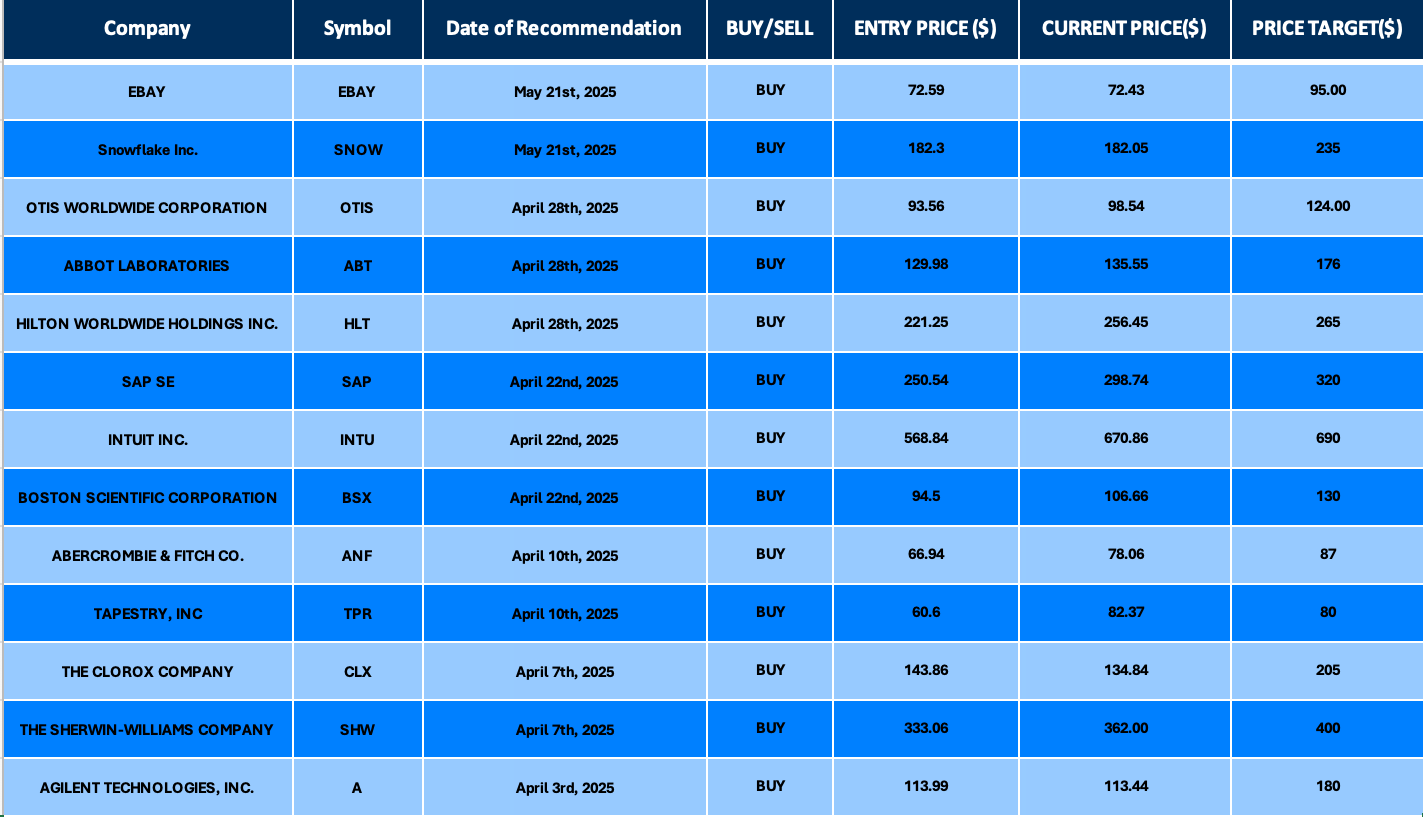

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.