Date Issued – 5th June 2025

Preview

This week, market focus sharpened around geopolitical disruptions, macroeconomic fragility, and strategic sector shifts. China’s export restrictions on rare earths are already halting auto production in Europe, spotlighting the global supply chain’s vulnerability. In the U.S., Circle’s IPO above expectations signals rising institutional confidence in stablecoins as regulatory clarity nears. Meanwhile, the Trump administration reignited debate with a sweeping travel ban affecting 12 nations. Soft U.S. data weakened the dollar further, raising expectations for Fed easing, while the IEA projected a 6% drop in global oil investments – marking a notable shift toward LNG as traditional demand forecasts dim.

China’s Rare Earth Curbs Hit Auto Supply

China’s tightening grip on rare earth exports is beginning to disrupt global auto production, with several European supplier plants already offline and Japanese carmakers signaling growing strain. Since early April, Beijing has imposed export restrictions on key materials used in both combustion and electric vehicles, in response to U.S. tariff hikes. With only 25% of export license applications reportedly approved, automakers including BMW and Nissan are scrambling for alternatives. German industry groups warn that output halts are likely unless the situation improves, spotlighting the auto sector’s vulnerability to China’s dominance over 60% of global rare earth production.

Investment Insight:

Geopolitical leverage over rare earths is emerging as a key risk to global industrial output – especially for the EV sector. Investors should watch for supply diversification strategies and alternative material innovations from automakers, while also noting potential long-term tailwinds for non-Chinese rare earth producers and critical minerals ETFs.

Circle IPO Surges, Boosts Crypto Market Confidence

Stablecoin issuer Circle Internet Group priced its IPO at $31 per share – above the expected $27-$28 range – implying a $6.8 billion valuation as it prepares for its NYSE debut under ticker “CRCL.” The offering was upsized to 34 million shares amid strong demand, raising $1.05 billion. Circle is the issuer of USDC, the world’s second-largest stablecoin with a 27% market share. As regulatory headwinds ease under the Trump administration and institutional interest in stablecoins surges, Circle’s listing marks a significant moment for crypto infrastructure firms re-entering public markets, buoyed by renewed investor appetite.

Investment Insight:

Circle’s IPO signals rising institutional confidence in compliant crypto frameworks. As the stablecoin sector anticipates legislative clarity and exponential growth, Circle’s early regulatory advantage and pure-play exposure position it as a strategic asset in portfolios betting on blockchain integration in global finance.

Trump Administration Reinstates Travel Ban Covering 12 Nations

The Trump administration has issued a new proclamation barring entry to citizens from 12 countries, including Afghanistan, Iran, and Somalia, citing national security concerns. The order, effective Monday, also imposes partial restrictions on nationals from seven additional nations. The ban targets countries deemed to lack sufficient screening and information-sharing protocols. This policy echoes Trump’s 2017 travel ban, which was upheld by the Supreme Court before being revoked by President Biden. While some groups – such as permanent residents and family members with verified relationships – are exempt, the move has reignited political opposition and raised questions over its economic and diplomatic ramifications.

Investment Insight:

The travel ban may heighten geopolitical tension and immigration policy uncertainty, particularly in industries reliant on international talent or global mobility. Investors should watch for potential ripple effects in sectors like higher education, tech, and airlines, as well as signals from markets sensitive to rising policy-driven instability.

Dollar Slips on Weak Data, Trade Fears

The U.S. dollar weakened further Thursday amid soft economic data and growing uncertainty over global trade. May’s contraction in the services sector and slowing labor market conditions raised expectations of Fed rate cuts, with markets now pricing in 56 basis points of easing by year-end. The dollar index has dropped 9% YTD – its worst performance since 2017 – as fiscal concerns and policy unpredictability compound investor unease. With U.S. tariffs fluctuating and key trade negotiations still unresolved, currency markets are cautious ahead of Friday’s non-farm payrolls report and the ECB’s expected 25bps rate cut later today.

Investment Insight:

Dollar softness may persist as macro signals shift dovishly and trade tensions linger. Investors should monitor payroll data and rate commentary for confirmation of easing trajectories. Weakness in the greenback could benefit U.S. multinationals and commodities, while strengthening the relative appeal of European and emerging market currencies.

IEA Sees 6% Drop in Oil Investment

Global oil investment is forecast to decline by 6% in 2025, marking the first non-COVID-era pullback in a decade, according to the IEA’s latest World Energy Investment report. The retreat is driven by lower demand expectations, economic uncertainty, and weakening crude prices – exacerbated by President Trump’s disruptive tariff policies and rising OPEC+ output. U.S. tight oil spending is seeing the sharpest drop, while global refinery investment is set to hit a 10-year low at $30 billion. Natural gas spending will remain flat, but the LNG sector is on track for record capacity expansion between 2026 and 2028.

Investment Insight:

Energy investors should brace for a sectoral shift: traditional upstream oil is weakening, while LNG infrastructure is poised for long-term growth. Capital may increasingly flow toward gas plays and infrastructure-linked opportunities as demand dynamics evolve and decarbonization strategies accelerate globally.

Conclusion:

With supply chains tightening, crypto adoption accelerating and macro policy turning more volatile, investors face a landscape defined by disruption and recalibration. The dollar’s softness, oil’s declining capex, and the geopolitical overhang from trade and travel policy add pressure – but also create opportunity in structurally shifting sectors like LNG and compliant digital finance.

Upcoming Dates to Watch:

- June 6th: U.S. Non-Farm Payrolls, U.S. Unemployment Rate

- June 7th: China Trade Balance

- June 10th: U.K. GDP

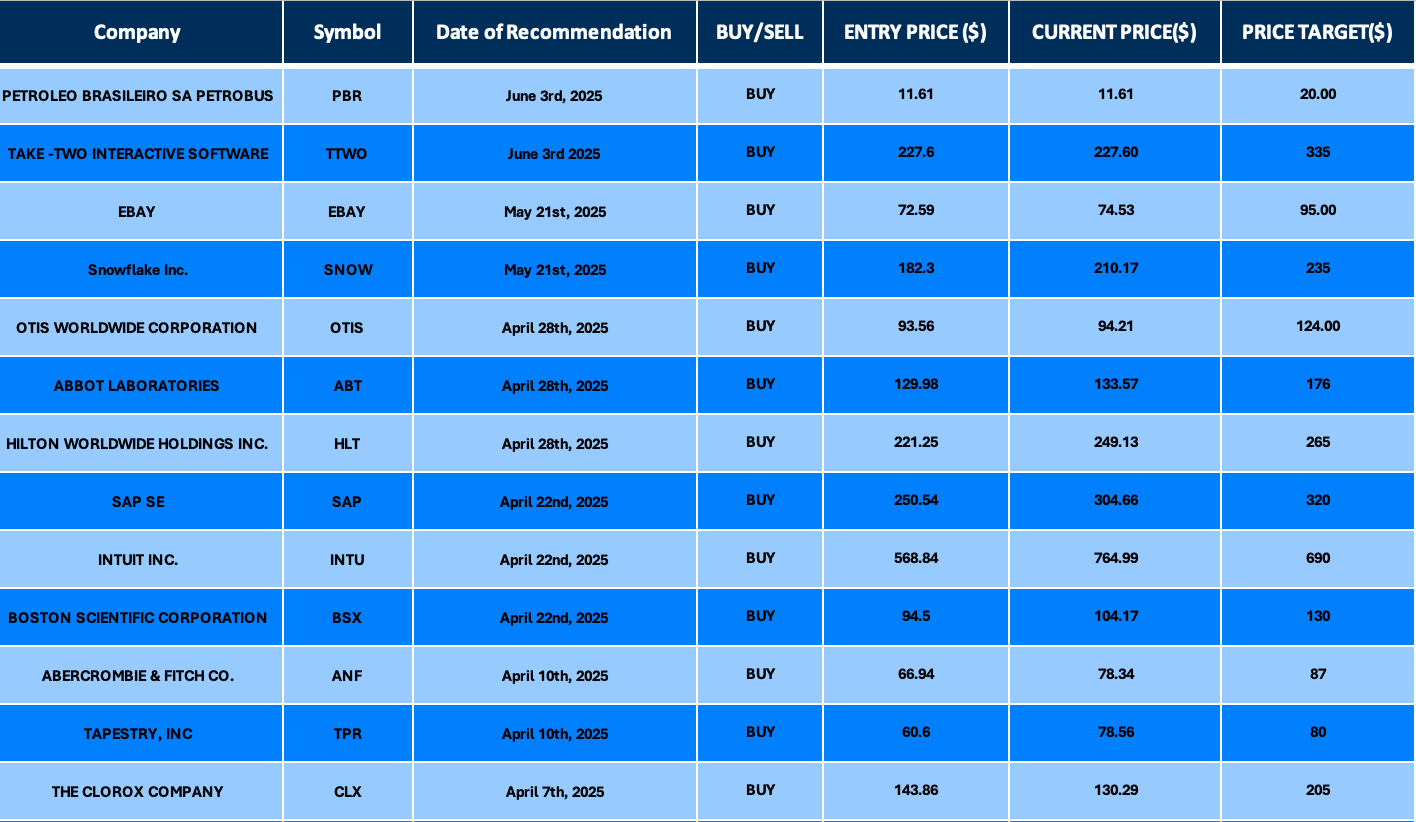

Find below some of our Buy/Sell Recommendations. Balfour Capital Group is a distinguished global boutique investment management firm with $350 million AUM and over 1000 Clients.

Disclaimer: This post provides financial insights for informational purposes only. It does not constitute financial advice or recommendations for investment decisions.